Footnotes & Flashbacks: Asset Returns for 2024

We wrap asset returns for 2024 and add some 2-year time horizons to mark an extraordinary moment not seen since Clinton.

Will tariffs and mass deportation be able to keep ringing the asset return bell?

We have been running a range of lookback commentaries on asset returns and credit market histories since the holiday slowdown with equities wrapping an exceptional 2-year run, HY excess returns modestly better than the median since the late 90s TMT cycle, and IG total returns held back by duration (see Annual and Monthly Asset Return Quilt 12-27-24, Credit Returns: 2024 Monthly Return Quilt 12-26-24).

The Mag 7 started to post widely divergent results later in the year and market breadth reversed from earlier bragging rights as anxiety over lofty valuations and too much multiple expansion crept into more industries and large cap names.

Even with sound earnings growth still the base case into 2025, the second guessing of multiples is getting a hard look while the UST handicapping battle is not making life easy for bonds or growth stocks.

With HY credit spreads looking more like June 2007, the ability to run three straight years of strong excess returns has been a very high bar historically and especially with a starting point of very tight spreads and the tendency of the credit markets to face the reality of “life happens” moments (1989, 2000, 2007).

We are rolling into 2025 with noise from tariffs, mass deportation, trade partner tension, and an apparent inclination toward a new imperialism (Panama, Greenland, G7 member Canada as a 51st state with only 2 Senators).

The above chart updates the 12-31-24 numbers across various time horizons for the high-level equity and debt benchmarks we like to watch. The 2-year numbers in equities jump off the page with performance not seen since the TMT years under Clinton where markets were rolling alongside GDP Growth (see Presidential GDP Dance Off: Clinton vs. Trump 7-27-24). Even Reagan’s bull market did not pull off the back-to-back 20% handle performance on the S&P 500 (see Presidential GDP Dance Off: Reagan vs. Trump 7-27-24).

The +87% handle for the Russell 3000 Growth and the NASDAQ makes a statement. Those looking to rain on that parade can point at the +86% return on the NASDAQ in the single year of 1999 that soon gave way to 3 years of hell and a major default cycle in 2000-2002. This is a very different cycle with very different financial profiles of the Mag 7 drivers, but multiple expansion to such lofty levels can promote trigger-happy reactions if bad news surfaces. Tempting fate, the inflation gods, UST curve reactions or risking earnings growth setbacks on radical shifts in policy will be at the very least second-guessed as the year unfolds.

We see how duration undercut total returns for debt this past month with the 1-month time horizon for credit and UST all in negative for the month. Looking back across the year, we see the UST benchmark as barely positive with lower duration, higher coupons and spread compression allowing HY to pull out an 8% handle total return but with IG at only 2.1%. The HY return is just below the long-term return on equities and was helped by steady risk appetites, solid credit fundamentals, the start of an easing cycle and the usual correlation effects when equities are hitting records. History shows the credit markets turn first, so HY will remain on the short list of focal points.

The rolling return visual

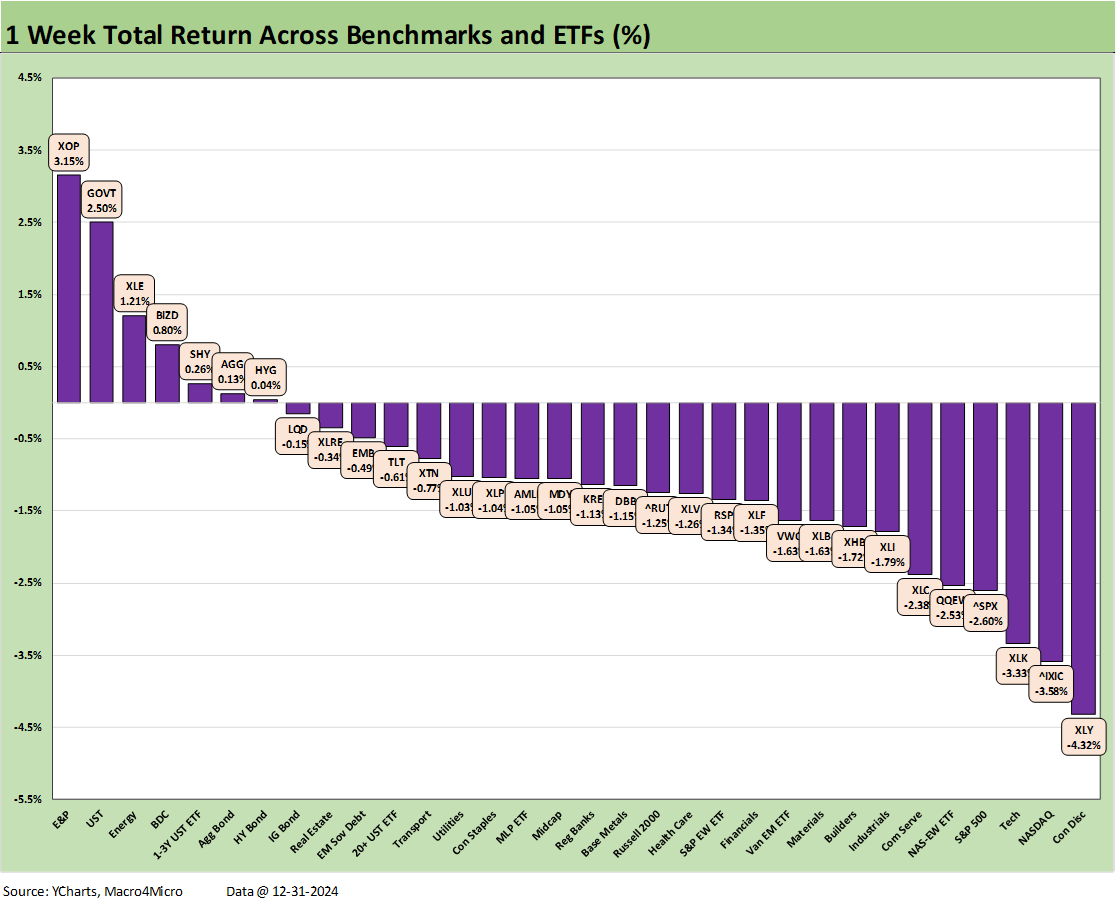

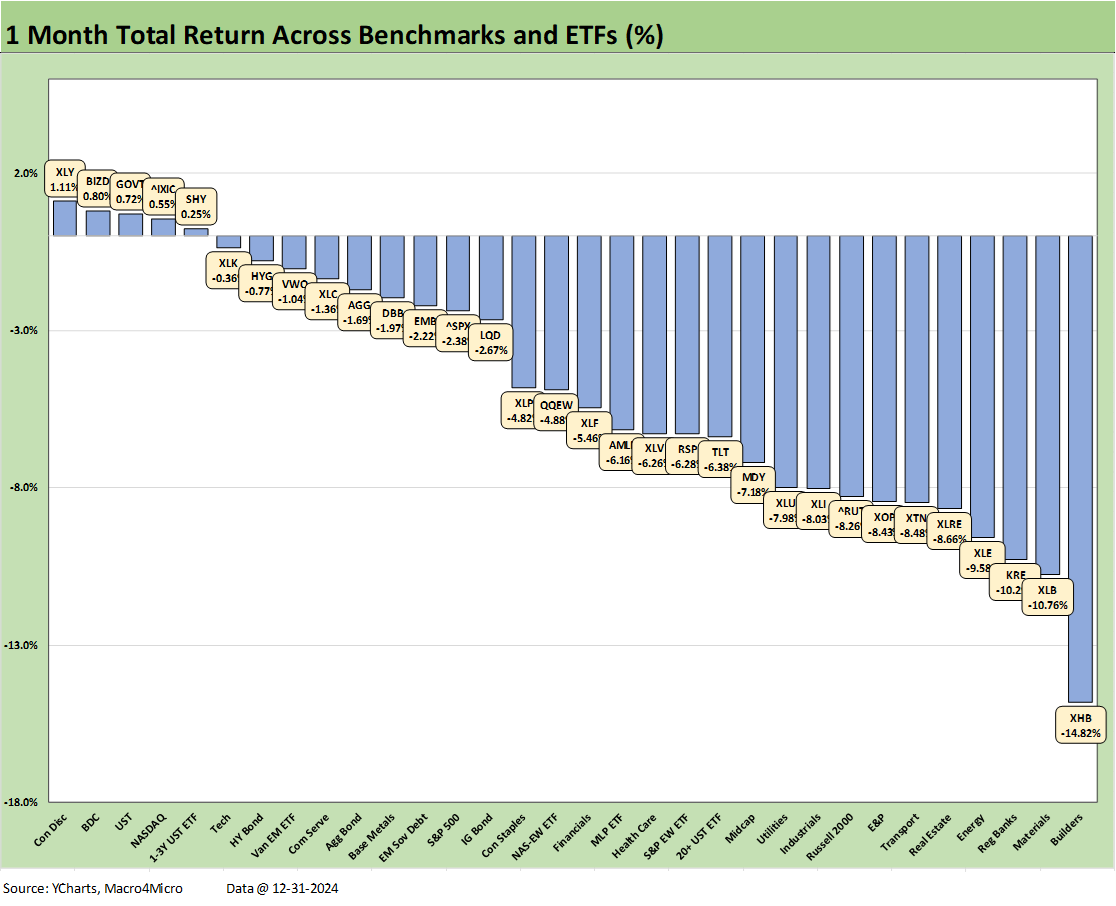

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of the trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes. We also have a YTD version that we include in the broader commentary on the time horizons further below.

The symmetry in the above chart collection is showing a sloppy finish to the year anchored by a huge head start flowing out of the late 2023 (Nov-Dec 2023) rally into 2024. The duration bulls were set back in 2024, but the breadth of the stock rally came on strong in enough stretches to set the market up for some key tests ahead. The recent back-to-back 3% handle GDP quarters deliver a strong economy in the handoff. That put the heat on the new White House and GOP controlled Congress to deliver (see GDP 3Q24: Final Number at +3.1% 12-19-24).

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

The tech bellwether chart lines up the names and benchmarks in descending order of total returns for the 1-week time horizon before running returns for a range of timelines in the remaining columns. The fact that the final trading week of the year through 12-31-24 was a case of limping home will keep nerves high as Day 1 clarity on tariffs will be very much anticipated.

That weak finale to the year was clear enough with all negative numbers in the table above for the trailing week ending 12-31-24. We started on the first trading day of 2025 with a sharp rally to open, but that has been fading into the red as we go to print.

The returns over the trailing 2 years tell a dazzling story with 5 of the Mag 7 posting triple digit returns. The two double-digit “laggards” include Apple at almost 95% and Microsoft at almost 79%. You can frame those two against the NASDAQ at +87%, the S&P 500 at 58%, and the Equal Weight NASDAQ 100 ETF (QQEW) at 43% for the same 2-year period.

The 1-week positive vs. negative score was 7-25 for the last week of 2024 through 12-31. The 10Y UST waffled around while the front of the curve eased through last Friday (see Footnotes & Flashbacks: State of Yields 12-29-24). For now, the 3.6% lows of Sept for the 10Y UST seem like a long time ago, but the reality is the marketplace will cast its vote as tariff decisions get made and the effects on CPI/PCE play out. The FOMC can check the short end but the market rules the long end.

For this past week, we see 4 of the 7 positive ETFs and 5 of the 8 lines in the top quartile from the bond ETF side with two energy ETFs (XOP, XLE) and BDCs (BIZD) rounding out the lineup. The IG Corporate ETF (LQD) was negative while ranking at the bottom of the top quartile. The long duration 20+Y UST ETF (TLT) and Sovereign Bond ETF (EMB) were negative and in the second quartile.

The tech-centric and Mag 7 heavy ETFs and benchmarks (including NASDAQ and the S&P 500) were in the bottom quartile and joined by Homebuilders (XHB) and Industrials (XLI) in an unsatisfying finish to the year.

The 1-month time horizon drives home the weak finish to 2024 with 5 positive and 27 negative. The #1 performance for Consumer Discretionary (XLY) only posted a +1.1 return with the 4 remaining members of the 5 in positive range under 1%. The last few lines in the top quartile posted negative returns. That includes the Tech ETF (XLK), HY ETF (HYG), and EM Equities (VWO).

We see some earlier high-fliers seeing double-digit negative returns. That includes Homebuilders (XHB), Materials (XLB), and Regional Banks (KRE). The E&P ETF (XOP) and Energy ETF (XLE) were also weak. We also see the Real Estate ETF (XLRE) feeling some yield curve pain on the month. Bear steepeners flow into income stocks and bring mixed reactions to real estate prospects. Higher rates intrinsically cut into real estate valuations and shorten the commercial real estate cycle broadly.

The 3-month return score is also biased to the positive side of the ledger even if in less dramatic fashion at 13-19. The top performers were heavy on tech exposure and financials (KRE, XLF). Half the Top 10 shows a strong Mag 7 flavor across Consumer Discretionary (XLY) at #1, Communications Services (XLC) at #2, NASDAQ at #5, and just across the line in the second quartile we see the Tech ETF (XLK) at #9 and the S&P 500 at #10.

Regional Banks (KRE) at #3 and Financials (XLF) at #4 are feeling the Trump deregulatory tailwinds, FOMC easing, and sound asset quality despite some soft spots in consumer and SME lending. Interestingly, the BDC ETF (BIZD) has been hanging in the top quartile at a time when there are growing differences of opinion on where private credit and small business asset quality is heading.

Over in the bottom tier, we see some major double-digit pain with the Homebuilders (XHB) in dead last at -16% and Materials (XLB) not far behind at -12.2%. The third lowest off the bottom shows a weak performance in the pharma-heavy Health Care ETF (XLV). The weakness in XLV of late offers a reminder that health care investors will need to be vaccinated against RFK Jr or need to see more tangible evidence of life (not the worm) between his ears.

Bond ETFs were spread out across the second, third, and bottom quartile with the long duration UST 20+Y ETF (TLT) just under -10% for 3 months. We see the short duration UST ETF 1Y-3Y in the second quartile with HY (HYG).

The LTM return numbers for calendar 2024 tell a consistent story at a score of 30-2 as we have seen in recent months with TLT falling off the pace at -8.1%. TLT is joined in negative range by E&P (XOP) at just under the line at -1.0%.

We added a two-year time horizon for this edition to mark the moment of such strong back-to-back years in equities. It took 47% to make the top quartile with the BDC ETF (BIZD) and just under 76% to make the top 5. The solid ranking of Midstream Energy (AMLP) and BIZD reminds us high income is a good total return cushion.

The median return across the 32 line items was over 20% with HY (HYG) and EM Equities (EMB) straddling the median line. Looking back over 2 years, TLT is the sole negative even with the strong UST curve rally at the end of 2023.

See also:

HY and IG Returns since 1997: Four Bubbles and Too Many Funerals 12-31-24

Footnotes & Flashbacks: State of Yields 12-29-24

Mini Market Lookback: Last American Hero? Who wins? 12-29-24

Spread Walk: Pace vs. Direction 12-28-24

Annual and Monthly Asset Return Quilt 12-27-24

Credit Returns: 2024 Monthly Return Quilt 12-26-24

New Home Sales: Thanksgiving Delivered, What About Christmas? 12-23-24

Footnotes & Flashbacks: Credit Markets 12-23-24

Footnotes & Flashbacks: State of Yields 12-22-24

Footnotes & Flashbacks: Asset Returns 12-22-24

Mini Market Lookback: Wild Finish to the Trading Year 12-21-24

Trump Tariffs 2025: Hey EU, Guess What? 12-20-24

PCE, Income & Outlays Nov 2024: No Surprise, Little Relief 12-20-24

Existing Home Sales Nov 2024: Mortgage Vice Tightens Again 12-19-24

GDP 3Q24: Final Number at +3.1% 12-19-24

Fed Day: Now That’s a Knife 12-18-24

Credit Crib Note: Iron Mountain 12-18-24

Housing Starts Nov 2024: YoY Fade in Single Family, Solid Sequentially 12-18-24

Industrial Production: Nov 2024 Capacity Utilization 12-17-24

Retail Sales Nov24: Gift of No Surprises 12-17-24

Inflation: The Grocery Price Thing vs. Energy 12-16-24

Toll Brothers: Rich Get Richer 12-12-24

CPI Nov 2024: Steady, Not Helpful 12-11-24

Mini Market Lookback: Decoupling at Bat, Entropy on Deck? 12-7-24

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Payroll Nov 2024: So Much for the Depression 12-6-24

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

JOLTS Oct 2024: Strong Starting Point for New Team in Job Openings 12-3-24

Select Histories:

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24

Credit Returns: Sept YTD and Rolling Months 10-1-24

HY Industry Mix: Damage Report 8-7-24

Volatility and the VIX Vapors: A Lookback from 1997 8-6-24

HY Pain: A 2018 Lookback to Ponder 8-3-24

Presidential GDP Dance Off: Clinton vs. Trump 7-27-24

Presidential GDP Dance Off: Reagan vs. Trump 7-27-24

The B vs. CCC Battle: Tough Neighborhood, Rough Players 7-7-24

HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24

Credit Markets Across the Decades 4-8-24

Credit Cycles: Historical Lightning Round 4-8-24

Histories: Asset Return Journey from 2016 to 2023 1-21-24

Credit Performance: Excess Return Differentials in 2023 1-1-24

Return Quilts: Resilience from the Bottom Up 12-30-23

HY vs. IG Excess and Total Returns Across Cycles: The UST Kicker 12-11-23

HY Multicycle Spreads, Excess Returns, Total Returns 12-5-23

Fed Funds vs. Credit Spreads and Yields Across the Cycles 6-19-23

US Debt % GDP: Raiders of the Lost Treasury 5-29-23

Wild Transition Year: The Chaos of 2007 11-1-22

Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22