US Debt % GDP: Raiders of the Lost Treasury

We look at some of the facts and fiction across 50 years of history for US Debt as a % of GDP.

"This shouldn't be a problem with Congress."

With a debt ceiling deal hopefully to be passed by Congress, we frame the time series on Federal Debt as a % of GDP that reinforces bipartisan accountability for where systemic debt stands as of now.

The recent discussions of Federal Debt as a % of GDP in the debt ceiling process gave more attention to the Debt % GDP metric, a ratio that often gets cherry picked for political spin.

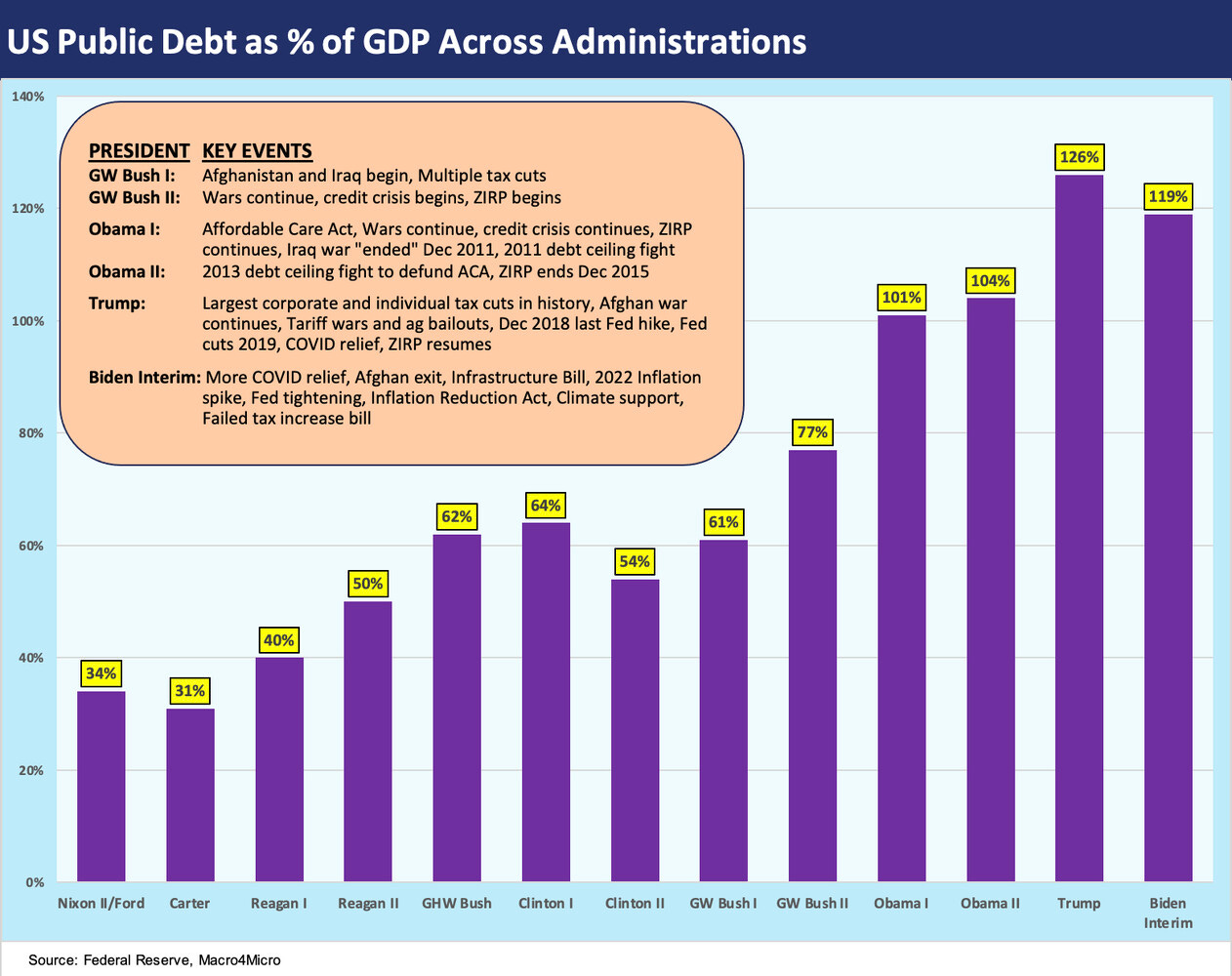

We plot a factual timeline of how we got here on Debt % GDP and break out the changes in each administration from “Nixon/Ford” through the interim Biden numbers.

The numbers tell the story even if selectivity of facts is a practice these days when you want your audience to accept only the facts you like and omit or impugn the facts you don’t.

In this commentary, we focus on a few factual charts that tell a story of the rise in US government debt. The debt ceiling agreement reached on the weekend faces some key votes this week. The right and left are already making noise, but the deal would avert disaster after a lot of back and forth on the state of US sovereign health.

This is a narrow ambition note that wants to clarify the metrics and highlight the changes across Presidential administrations. Speaker McCarthy invoked a lot of “% of GDP metrics” in his media push over the past two weeks, so the ratio is very topical. Detailing the direction of systemic leverage requires an embrace of facts, and these days this is more about hope than a high probability outcome. We look at three charts in this piece to provide some food for thought or at least some reason not to get misled by some of the debt ceiling rhetoric.

Plenty of blame to go around…the numbers are what they are…

In the chart above, we plot the growth of “Total Federal Public Debt” (the Fed’s term) as a % of Gross Domestic Product. Each Presidential term from 1973-1977 gets its own bar in the chart, and we frame Debt % GDP for the period near the end of that term (closer to inauguration than Election Day). We use the data from the Fed (FRED) and round the numbers.

We chose purple as the color for a reason and skipped the choice of red and blue labels. The governments were often divided, and the soaring debt levels can clearly be seen as a bipartisan “effort.” There were only two declines across the timeline of full terms (Carter, Clinton II). Biden’s systemic numbers are lower than Trump’s, but Biden has not hit a full term yet.

The most successful US balance sheet repair (Clinton II) came with a divided government that also saw a few years of budget surpluses. Over Clinton’s two terms, Debt % GDP declined by 8 points including 10 points in Clinton II. The economy was also in impressive growth mode in the 1990s and even more impressive in the 1980s as Reagan ramped up deficit spending (his two terms added 19 points to Debt % GDP).

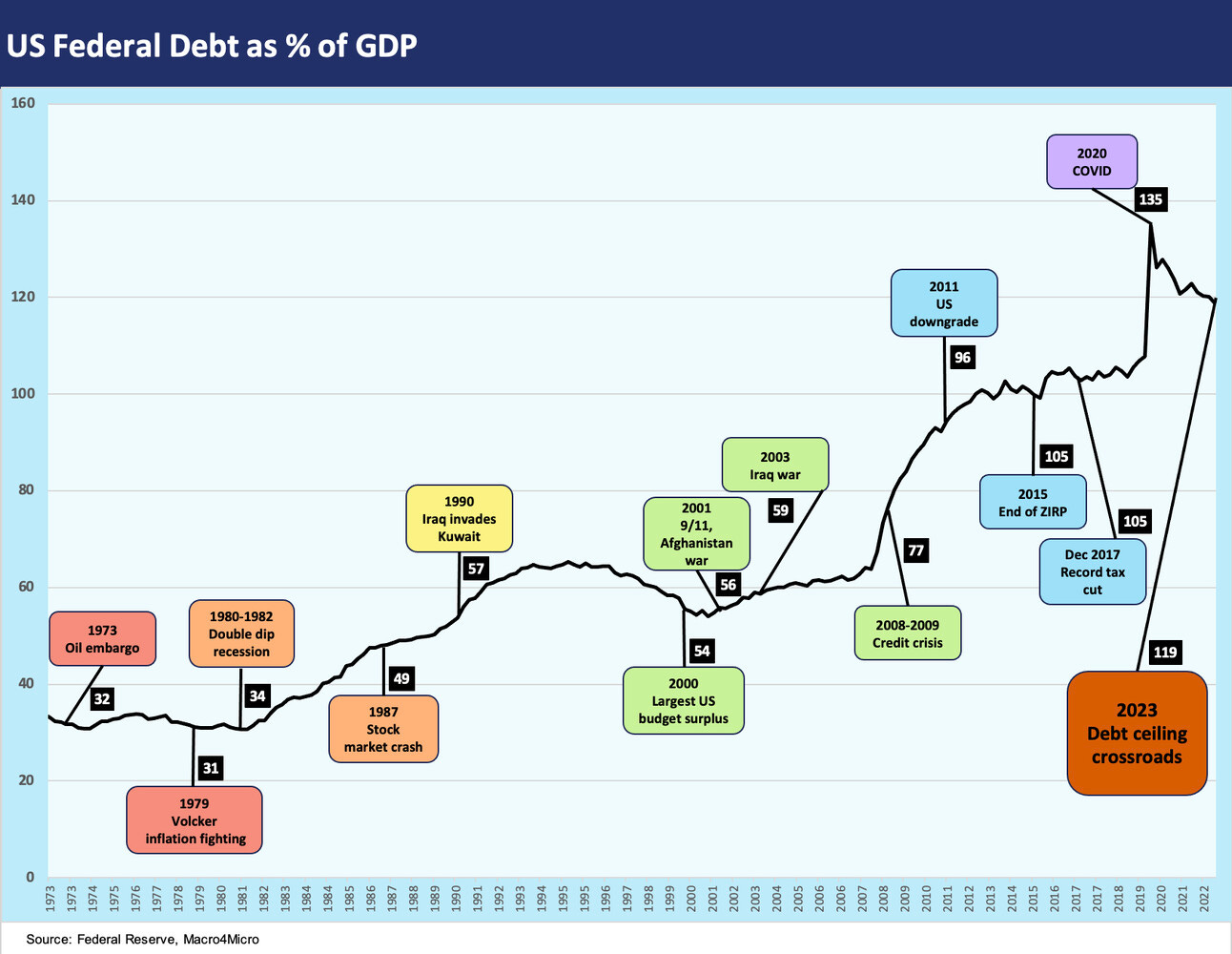

Below we also plot the full time series from 1973 to 2022. The real action in US sovereign balance sheet erosion begins in 2000, and we include some events in the chart above to highlight those post-2000 timelines. As the post-2000 period flies, the post-9/11 support, two wars, a systemic bank crisis, some massive tax cuts, a pandemic, and the allure of a protracted period of ZIRP and low absolute UST rates comprise a case study in borrowing. The balance sheet growth was also part of political polarization that encouraged extreme policy moves when Washington saw periods of single-party control. The idea seemed to be “overdo it while you have control.”

That systemic debt path after 2000 is eye-opening for those that don’t watch this kind of thing. The big jump in Debt % GDP in GW Bush II, Obama I, and the only Trump term were outsized. Those three terms (1 Bush, 1 Obama, 1 Trump) alone drove 62 points of the total 72 points increase from the end of Clinton II through the end of Trump’s single term. Yes, 62 points out of 72. Herbert Hoover is calling… “Fiscal Conservatism on Line 1.”

The only declines across the 50-year timeline were Carter (1977-1980) and Clinton (1993-2000). Biden has only two full years under his belt, but he has a shot at being the third one to post a decline. For all the grief Jimmy Carter took, his budget performance and real GDP growth both look a lot better than Trump’s or Obama’s. That said, those Carter years were ugly periods in the economy using many other frames of reference.

The mixed performances across time are a reminder it is about more than just debt levels and nominal/real GDP. There are a lot of structural change and exogenous shocks that go into the moving parts of recession, inflation, and employment even if the Washington types reduce it to soundbites. In Carter’s case, he also had waves of deregulation and the industry side effects of those challenges. The Iranian oil crisis tipped the scales.

Our three charts cover a long timeline, but we kept it simple to tell a story across two metrics:

The Federal Public Debt % GDP level at the end of each presidential term: Even if across history the “next guy” blames the “last guy” initially, at the end of four years, the numbers were generated on your watch whether that be an inherited credit crisis, the aftereffects of COVID, a Mideast war (or two), an arms race (1980s), an OPEC oil embargo and history of cartel gamesmanship (notably 1970s), or rogue states running amok (Iran in 1979, Russia in 2022). We even had some impeachments (near or actual) along the way (Nixon, Trump) which is not great for bipartisan policy making. We even had a near insurrection and a breakdown in government functionality (now) which makes life harder for the numerators and denominators and certainly precludes changes in tax policy that can influence the direction of debt or fiscal support for growth of the economy (incentives).

Annual Real GDP growth rates from 1973 through 2022: We plot the real GDP growth trends as a factual reminder of the full trend line across the administrations. The selective use of these ratios often mask the reality that the debt numbers have gone off the reservation under both the GOP and Democrats alike since 2000. The real GDP numbers seldom get specifically invoked in looking back across time since the Obama and Trump years were simply mediocre as the icons of the left and right posted up weak GDP numbers annually. They use more adjectives than numbers when discussing these markets.

Time series for Federal Public Debt % GDP…

There is a lot of American history in this timeline from the end of Vietnam (last regular ground troops left in 1972, Saigon fell 1975) to multiple Mideast wars and a proxy war unfolding in Ukraine (Russia was a massive supplier to Vietnam during the Vietnam proxy war). We have looked at the crazy events of these decades in earlier commentaries (see Inflation: Events ‘R’ Us Timeline 10-6-22, Expansion Checklist: Recoveries Lined Up by Height 10-10-22, Business Cycles: The Recession Dating Game 10-10-22)

The chart breaks out the Debt % GDP milestones in the black boxes. We see a massive rise in federal borrowing concentrated in the years since 2000 which included 12 years of White House GOP leadership and 10 years under the Democrats. Some major geopolitical events and systemic crises were part of that period as noted.

From the end of Bush II across all of Obama I and most of Obama II we saw ZIRP and low rates. That changed the costs (i.e., interest expense) of going to the debt well. ZIRP ended in Dec 2015, but rates stayed very low on the normalization path that saw the last rate increase in Dec 2018. 2019 saw multiple cuts later in the year as the economy faltered (a reality that seldom shows up in debates). Then ZIRP returned in March 2020 and the demand for more fiscal programs is all recent history.

Finding the fiscal conservatives in that time series is a very challenging game of “Where’s Waldo.” A lot was going on to say the least in those years from 2000 through today. Obama I edges out Trump’s single term for worst increase. The first term for Obama was up +24 points with a systemic credit crisis to deal with along with two wars. He was followed by Trump who pushed Debt % GDP up by another +22 points.

As we show in a separate chart, Trump’s last year (2020) edges out Obama’s first year (2009) for the worst annual real GDP. Pulling up at #3 in worst terms for Debt % GDP is GW Bush I with its combination of two wars and a range of tax cuts. Bush posted a 23-point increase in Debt % GDP over two terms with 16 of that in the second term.

Obama took a shot at some muted tax increases as well as some targeted cuts while Trump passed what he claims was the largest tax cut in history (as a % of GDP, Reagan had by far the larger tax cut). Trump’s tax reform saw major reductions in the statutory tax rates for corporations made permanent (35% to 21%). Further, a change in global tax structure to a territorial approach that year was a major step in reducing US budget tax reach in the corporate sector. Top individual rates were dramatically lowered as well but SALT deductions made some high-income filers face tax increases at the Federal level.

Looking back across time, Reagan had a case to make that his tax cuts drove a lot of growth but at the cost of a spike in debt. That was also a period when the deregulation in financial services drove an explosion in corporate debt issuance. We will be looking at corporate systemic debt in a separate commentary this week.

Bush had a partial case on tax cuts, but the deregulation of banks/brokerage (end of Glass-Steagall) also drove a lot of credit creation for growth. Objectively speaking by the number, the Trump cuts did more at the micro level for taxed entities than at the macro level for growth. The net effect was his policies were part of piling on a lot more systemic UST leverage. Obama gets no bragging rights on economic growth, but he matched Trumps below-median growth.

Real GDP growth across time…

The chart above should be one they hand out in Presidential debates. The questions could be as follows:

· Is 3% higher than 2%?

· Is 4% higher than 3%?

· Is 5% higher than 4%?

The goal could be to get a yes or no answer in under a 2-minute time limit. We could focus on the first question (Is 3% higher than 2%?) with extra time allowed in exchange for a direct answer.

The potential for material real GDP growth after the new millennium was more challenging after two decades of explosive growth and secular change in the 1980s and 1990s, but that does not change the numbers. The year 1984 was a dazzling 7% handle. Anyone who cares about facts, reality, or the truth (a shrinking base of the electorate and a minority in Congress) should always expect more than a heavy dose of adjectives and self-congratulation using a small subset of metrics that help their case.

For the annual real GDP numbers that we post above, just glance at the left side of the chart, the center, and then the right side. Which sides in the chart were higher? Left, Center, or Right? Which side of the chart saw more bipartisan cooperation?

Then ask the simple questions:

Does partisan division increase individual power or generate better economic numbers?

Does partisan division generate more economic benefits or just more proceeds from political fund raising?

How many times did GDP growth have a number higher than a 2% handle since 2000? Who was in office?

Who posted the most annual GDP rates with a 3% or higher handle? Who posted the least? Who posted zero? (Hint: two Presidents, see the right side of chart).

Which Presidents were in the most hostile divided governments (Hint: both of the ones who failed to beat a 2% handle Annual GDP range even once). Who will take responsibility for that (Hint: zero).

There may be a pattern forming here.

The inflation X-factor in interpreting the Debt % GDP trends…

The path of both real and nominal GDP growth and cycles matter across the timeline and need to be interpreted in a sound and consistent manner. The distortions from inflation on nominal GDP rates get some play in the to-and-fro debates on what constitutes progress in Debt/GDP trends. We saw one conservative think tank saying, “the only reason Biden Debt % GDP declined is because of inflation.” That is the intellectual equivalent of saying “He is only taller because he has longer bones.”

The fact is you pay back debt and interest out of current dollars – not inflation adjusted dollars. You can respond with something equally dumb like saying, “We are not paying back that formerly long bond with 1993 dollars.” That said, inflation is intuitively bad on many fronts and is not a source of economic policy bragging rights. Biden will run on jobs, the fact he had more votes, and try to make higher-wage lemonade out of inflation lemons. He will not run on the worst inflation in over 40 years. Trump will run on building the greatest economy ever – perhaps in the world – as he indicated in the town hall meeting. The only problem is his actual GDP numbers. That and the fact that he collected zero in tariffs from China (buyer pays).

For Biden, with 2021 as the best real GDP year since Reagan I, it is safe to say that 5.9% is not something he can campaign on very legitimately since it was a reflection of the rebound off the COVID collapse as companies scrambled to meet pent-up demand. Of course, whoever ends up running against Biden from the GOP will not highlight the massive supply-demand imbalances and supplier chain stress that drove a flow-through of soaring costs from excess demand along that Goods and Services chain. They will want to say that Biden caused all the inflation with his COVID relief. The inflation is about a lot more than the Biden COVID relief bill (see Inflation Rorschach Test: Looking at Relief and Stimulus 2-7-23). Soaring payroll also contributed to inflation, but you can run for office on payroll trends. Energy prices and Russia sure did not help.

In the end, you don’t get to pick and choose your metrics and temporarily erase concepts when they do not work for your story line (“Biden Debt % GDP only went down because of inflation”). There is a range of other factors to put on the menu (e.g., inflation performance and related causes), but you don’t get to change the rules to meet the needs of the moment on what is progress and what is not. The fact is that Debt % GDP is down around 7 points from Trump, but it is also 15 points above Obama II, who tacked on 27 points over two terms before Trump layered on 22 more points.

Facts, damned facts, and ideologues…

We recognize that facts can be interpreted in different ways and the conceptual frameworks on analytical inputs can vary. One of the problems in “pitching” policy ambitions is around what “facts” are in any given areas such as debt sustainability and what taxation and budgets seek to achieve. It is well known that budgets are not just a matter of how much you spend after you borrow, but where you spend and why. That part of the debate never goes away. The Debt to GDP ratio is simply a factual output. Again, facts matter.

The inability to embrace the factual is sometime seen as a form of mental impairment except that it is too often riddled with intent to deceive those that are flat out dumb or perhaps willfully ignorant. Even if too many people have taken up residence in the conceptual infirmary for whatever reason, facts still play a role in securities analysis.

People should at least admit to a bias of ideology or a value system and keep making their case. But don’t ignore the facts. Sovereign UST debt is out of control (opinion), but the Debt % GDP numbers have climbed dramatically since 2000 with three Presidents as the main drivers (Bush 23 points higher in two terms, Obama 27 points in two terms, and Trump 22 points in one term). Those three collectively added 72 points to the total since Clinton II before a modest decline (so far) under Biden.

An important issue in the US sovereign debt picture that some do not prioritize is the recurring need for a deep investor base. Supply-demand still applies to UST bonds. As an example, Japan’s Debt % GDP is dramatically higher with a number reported in the 260% range. Japan can place the overwhelming majority of its paper domestically. The US cannot place its debt domestically now, so threatening default is not a good international demand enhancer. Let’s hope the US clears this coming week without that default threat stain soaking too deeply into the natural base of buyers.