Retail Sales Nov24: Gift of No Surprises

A fifth consecutive positive month for retail sales is a passing grade for the consumer that leaves policy path flexibility for the FOMC beyond tomorrow’s expected cut.

Headline retail sales increased this month to the tune of 0.7% as consumers signal resilience during the holiday shopping season.

A continued shift towards online shopping experiences helped drive a positive Core Retail print of 0.4% on the month and some evidence of budget reallocation to Autos spending.

Another uneventful economic print joins relatively low-shock factor CPI and payrolls releases this month gives much-needed time to investors to focus on the torrent of policy actions in the upcoming year.

The UST curve reaction was a relative yawn on the day as we go to print with the 10Y UST posting a negligible move, hanging around 4.39%, well above the Sept lows of 3.6%.

The recent history of retail sales shows continued growth after concerns around consumer resilience and financial health was in full swing with the economic cycle debate. After the 0.7% MoM headline Retail Sales print this morning, 2024 YTD sits at just over 3% and core retail is slightly stronger at 3.2% YTD. This year is another reminder of how hard it is to decelerate spending without an unemployment spike as money still flows and the moderate growth story takes a worry off the Fed’s list. We also see a stream of new entrants into the work force and many staying on and working longer.

Despite being in good shape now, consumer fundamentals are deteriorating as delinquency rates increase back towards normal pre-pandemic levels, revolving credit usage is expanding, and current savings rates do not leave much room for error.

Major consumer-facing brands across the board are realigning around value propositions, and some more value-centric brands like Walmart noted higher-income shoppers searching for more affordability. This does not bode well for durability considering the inflation threat from trade, tariff, and deportation policies looming. Those threats will make for tough Fed policy calculus since labor force disruptions could shift the wage inflation trend but also could undermine PCE growth.

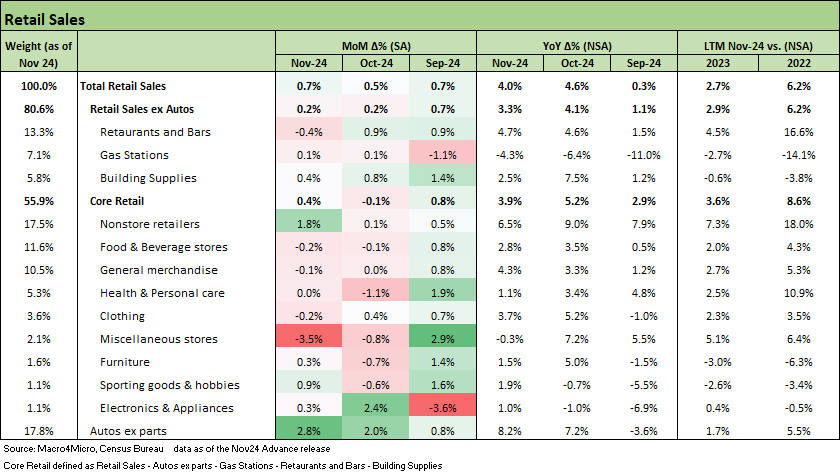

The table above covers key line items and subcategories that show a mixed set of underlying data to the relatively strong print. Today’s print sees both Nonstore Retailers and Autos ex-parts as the largest line items with 1.8% and 2.8% growth, respectively. Miscellaneous stores and restaurants and bars contracted the most on the month but in the context of a strong holiday spend month, is likely related to trade-offs of discretionary spends.

Aside from just trade-offs to the discretionary spending line, the large increase in autos of late may also crowds out some purchases in consumer budgets by leaving less flexibility. Autos will see immediate impact under trade policy changes in 2025 with supplier chains and cost structures that will see further disruption.

The November retail sales report delivers a steady, positive signal on consumer demand. However, it also masks growing vulnerabilities of rising reliance on credit and deteriorating savings buffers in consumer resilience which looming inflation risks will test in 2025.

Kevin Chun, CFA kevin@macro4micro.com

Glenn Reynolds, CFA glenn@macro4micro.com

See also:

Footnotes & Flashbacks: State of Yields 12-15-24

Footnotes & Flashbacks: Asset Returns 12-15-24

Mini Market Lookback: Macro Grab Bag 12-14-24

Toll Brothers: Rich Get Richer 12-12-24

CPI Nov 2024: Steady, Not Helpful 12-11-24

Mini Market Lookback: Decoupling at Bat, Entropy on Deck? 12-7-24

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Payroll Nov 2024: So Much for the Depression 12-6-24

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

JOLTS Oct 2024: Strong Starting Point for New Team in Job Openings 12-3-24

Mini Market Lookback: Tariff Wishbones, Policy Turduckens 11-30-24

PCE Inflation Oct 2024: Personal Income & Outlays 11-27-24

3Q24 GDP Second Estimate: PCE Trim, GPDI Bump 11-27-24

New Home Sales Oct 2024: Weather Fates, Whither Rates 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Mini Market Lookback: Market Delinks from Appointment Chaos… For Now 11-23-24

Credit Crib Note: Ashtead Group 11-21-24

Existing Home Sales Oct 2024: Limited Broker Relief 11-21-24

Housing Starts Oct 2024: Economics Rule 11-19-24

Mini Market Lookback: Reality Checks 11-16-24

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

Mini Market Lookback: Extrapolation Time? 11-9-24

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24