Housing Starts Nov 2024: YoY Fade in Single Family, Solid Sequentially

Single family posts decent sequential total starts but all regions were soft YoY. Multifamily again the weakest.

Which road leads to inflation, labor worries, supplier chain problems, and tight credit?

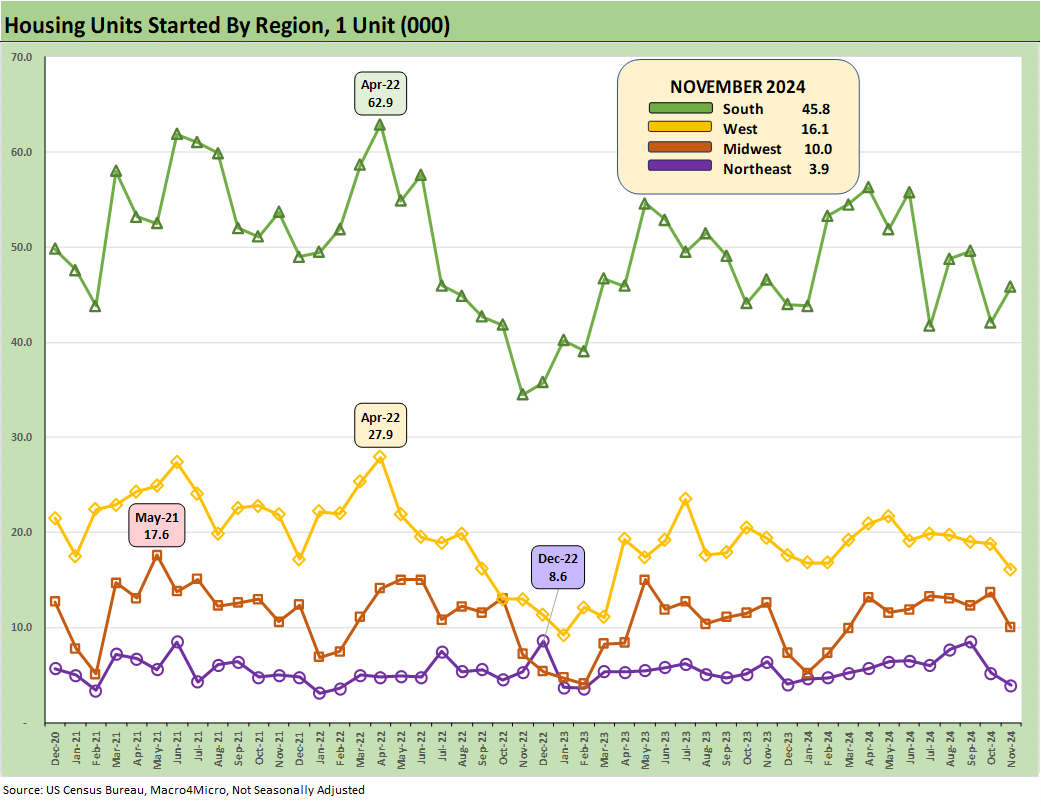

Nov 2024 shows an uptick from Oct in single family MoM (+6.4%) but material declines YoY for 3 of 4 regions. The critical South region was only slightly lower YoY with a major sequential rise of over 18%.

The homebuilders will continue to manage their working capital prudently, which for the most part means balancing sales and starts and planning at the regional and community level.

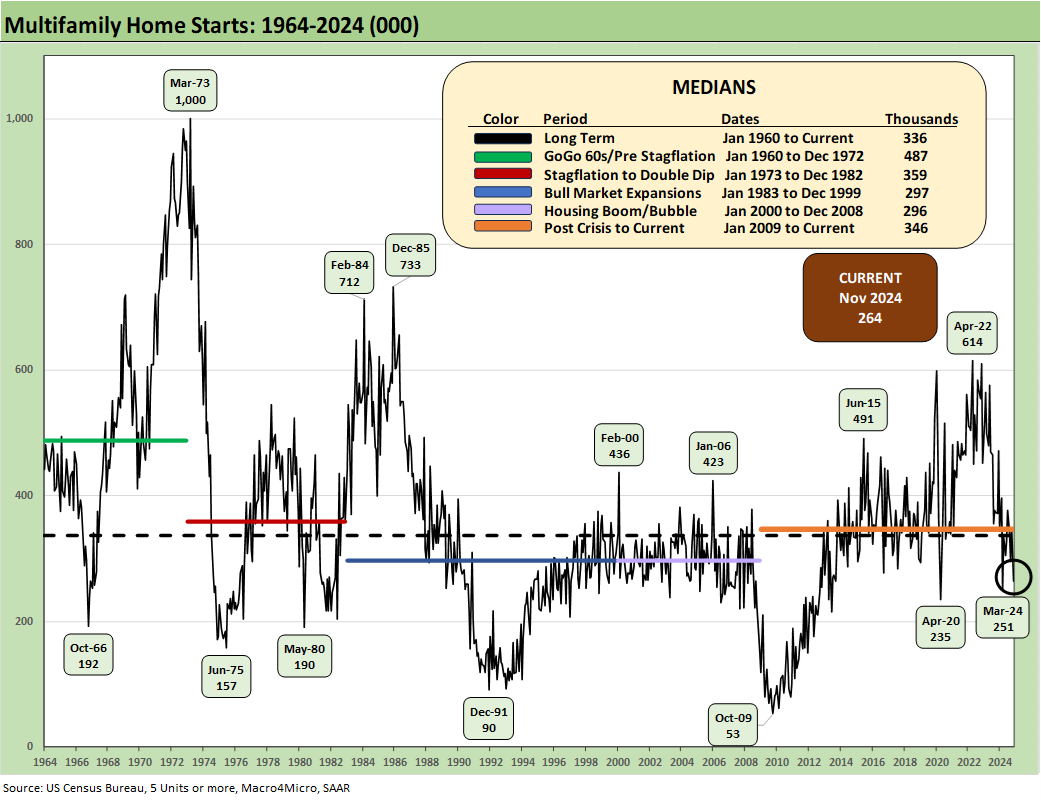

Multifamily starts are down hard YoY and MoM yet again.

The homebuilders have been very resilient across the tightening cycle even with mortgage rates rising since the Sept and early Oct lows. The Freddie Mac 30Y has moved in the wrong direction after dipping below +6.1% at the lows. There is still more than a little uncertainty on where the longer end of the UST curve is headed. Away from the Freddie benchmark 30Y rate, the broader universe is now closer to 7% with 6.9% handles in some of the daily trade rags. With the FOMC news today and Powell Q&A, the UST 10Y is up over +10 bps and the 2Y up over +11 bps.

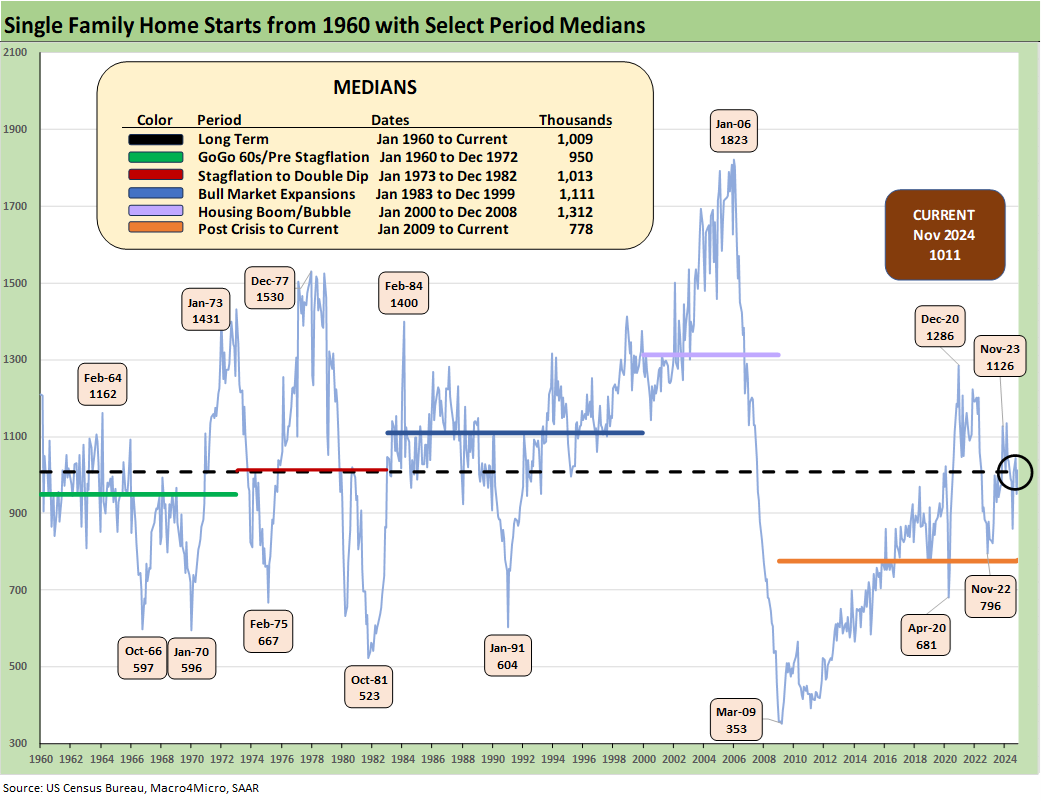

The above time series updates single family starts, and the current 1,011K is slightly above the long-term median of 1,009K noted in the box. The current level is in the zone of the 1980s/1990s bull markets (1,111K), but well below the early 2000s housing bubble boom median (1,312K).

The reality is that demographic demand has never been greater, so the needs of the current adult population might initially not be recognized in the 1.0 million number. The supply vs. demand (and need) side adds up to an acute shortage that keeps home prices high and affordability strained in a market where mortgages remain closer to 7% than 6%.

The above chart plots total permits vs. total starts and for single family alone on a not seasonally adjusted (NSA) basis. On an NSA basis, we see single family up by +7.2% YTD while Permits are +8.0% YTD. Those numbers take some of the anxiety off with respect to what is going on at sea level as NSA is useful as an indicator on what is going on in the trenches.

On a SAAR basis, starts were down sequentially by -1.8% MoM but down -14.6% YoY. Single family was up +6.4% MoM but down by -10.2% YoY. The outlier in the SAAR mix was a favorable MoM move in the South at +18.3% and down by only -1.6% YoY. The South comprised 61% of single family starts in total during Nov 2024 on a SAAR basis and over 56% of total starts (SAAR).

The above chart breaks out the regional starts on a not seasonally adjusted (NSA) basis. We see the sequential uptick in the dominant South region while the West, Midwest, and Northeast all declined.

Multifamily continued its ratcheting moves lower in Nov with a -24.1% MoM decline to 264K. That is the worst multifamily starts month since 251K in March. The YoY declined was -28.8%. The long-term median of 336K cuts across a few major but volatile multifamily cycles as we look back across the decades.

The above time series details multifamily permits with the sequential MoM move at +22.1% and +4.8% YoY. The YTD NSA totals for permits are -19.6%, so the multifamily cycle remains in a downturn with erratic MoM moves.

Housing:

New Home Sales Oct 2024: Weather Fates, Whither Rates 11-26-24

Existing Home Sales Oct 2024: Limited Broker Relief 11-21-24

Housing Starts Oct 2024: Economics Rule 11-19-24

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

Homebuilders:

Toll Brothers: Rich Get Richer 12-12-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

KB Home: Steady Growth, Slower Motion 9-26-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

Homebuilders: Updating Equity Performance and Size Rankings 7-11-24

Credit Crib Note: KB Home 7-9-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24