HY OAS Lows Memory Lane: 2024, 2007, and 1997

We look back at 2007 and 1997 for the last round of credit cycle peaks with HY OAS below 300 bps and seek any parallels to 2024.

Careful with that thread. That one is 2025…

We go through a “those were the days” moment after HY OAS dipped to +289 bps on Friday before the Monday widening to +295 bps as credit spreads for now are hovering in the high 200s to low 300s. 1997 and 2007 offer a reminder of how low HY spreads can go with a reminder of the mixed durability of such lows.

The lookback exercise highlights that the June 2007 lows were living on highly leveraged and borrowed time while the 1997 lows left ample room for the credit cycle to run (and the economic expansion to run even longer) despite Oct 1997 marking the lows for HY spreads after a long stretch below 300 bps for most of 1997.

The global noise that hit 1998 in global emerging markets (Russia default, sustained Asia crisis) and domestic markets (LTCM offered the first dose of what overleveraged counterparties could mean), saw the Fed ride to the rescue in the fall and set the table for a +86% NASDAQ year in 1999.

2024 has sound economic fundamentals and a healthier bank system and largely extinct securities sector compared to 2007 and 1997. The current contingent threats are more about elections and domestic policy risk (massive deficits, domestic social divisions, election denial, religious support of violence), but there is also hot war risk overlapping with Cold War legacy with Iran escalation on the front burner and China/Taiwan looming on the back.

The above chart frames the timeline for HY spreads for calendar years 1997 and 2007 and YTD 2024. We thought the running timelines offered food for thought and some historical perspective. Since we crossed the 300 bps HY OAS threshold on Friday (10-4-24), the comparison became more relevant.

The 1997 and 2007 years played out as the world of leveraged investing (hedge funds) and an excess of derivatives were hallmarks as those in turn brought high counterparty risk along with their growth. The 1990s credit cycle experience included LTCM and some subprime mortgage mishaps as the original red flags on what unwinding positions could mean in counterparty exposure. Given what followed in mortgages and with AIG in 2008, the lessons were not learned.

The chart shows HY OAS lows of +244 bps in Oct 1997 (IG had hit +53 bps) with a high +280 bps range in Dec 1997 just as we saw +289 bps this past Friday (10-4-2024). For June 2007, we saw a bounce in HY OAS from +241 bps on June 1, 2007 (and June 5) and then into the 280s bps range later in the month (closed June at +298 bps). The 1997 and mid 2007 experiences were very different despite some common spread lows, and the 2024 experience will be quite distinctive as well.

Each of these credit cycles have their own differentiated cyclical dynamics, monetary and regulatory backdrops, industry risk, and market structure evolution. We are not revisiting all those topics here, but we have plenty of links covering histories at the bottom of the commentary. We also look at the histories of credit spreads and quality differentials in our weekly Footnotes publication on Credit Markets (see Footnotes & Flashbacks: Credit Markets 10-7-24).

The TMT bubble cycle and credit crisis years always offer useful frames of reference…

The goal of the spread chart is for a memory jogger on how the HY credit cycle peaks of the post-Glass Steagall world framed up (i.e. after the 1980s credit cycle) in terms of “how low” and for “how long.” We also see in the case of 2007 how quickly the market deteriorated. The short form version for the 1997 peak was that it still had two more years of credit cycle expansion to go while 2007 would soon mark the start of a recession with a ticking bomb for the securities business. That bomb would explode in 2008.

The 1990s underwriting party in debt and equities…

First up was the 1990s and how that played out with the commercial banking, underwriting, and capital markets business lines converging across the decade. US, European, and Asian banks were in a mad dash to book business in the US and capture share in the lucrative derivatives business (notably securitization and CDS).

The coming arrival of the Eurozone to start 1999 also set off a global scramble for share. Such transition periods unsurprisingly brought excess capital and risk taking and especially in the underwriting and counterparty side of the ledger. The mortgage boom grew in fits and starts (1994 and late 1990s brought some fits). Myriad iterations of ABS were hatched including more types of asset backed commercial paper that finally blew itself up in the 2007 mortgage and structured finance bubble.

The 1997 bull market for credit started the year in the low 300s for HY OAS but dipped below 300 bps in Feb 1997 and stayed below the line through the end of the year. The Oct 1997 low of +244 bps also came with the all-time IG lows in high grade spreads at +53 bps. The year ended in +200 bps handles at +296 bps.

During 1998, the materially lower UST curve from 1996 and 1997 kept the risk appetite beat going and sub-300 HY OAS levels held in well into spring (May crossed back above +300 bps). This was during a period of stress in Yankee bonds (notably Asian dollar bonds), but the US credit sectors held in well until the Aug 1998 Russia default sent the world into a bout of volatility that only calmed down after LTCM was “closet bailed out” and the Fed shifted its bias toward easing starting in Sept 1998. That period of volatility saw HY spreads head north of the +600 bps line in Oct 1998. After the Fed eased, HY migrated back into the 500 handle OAS range by Nov 1998.

The UST ride from 1994…

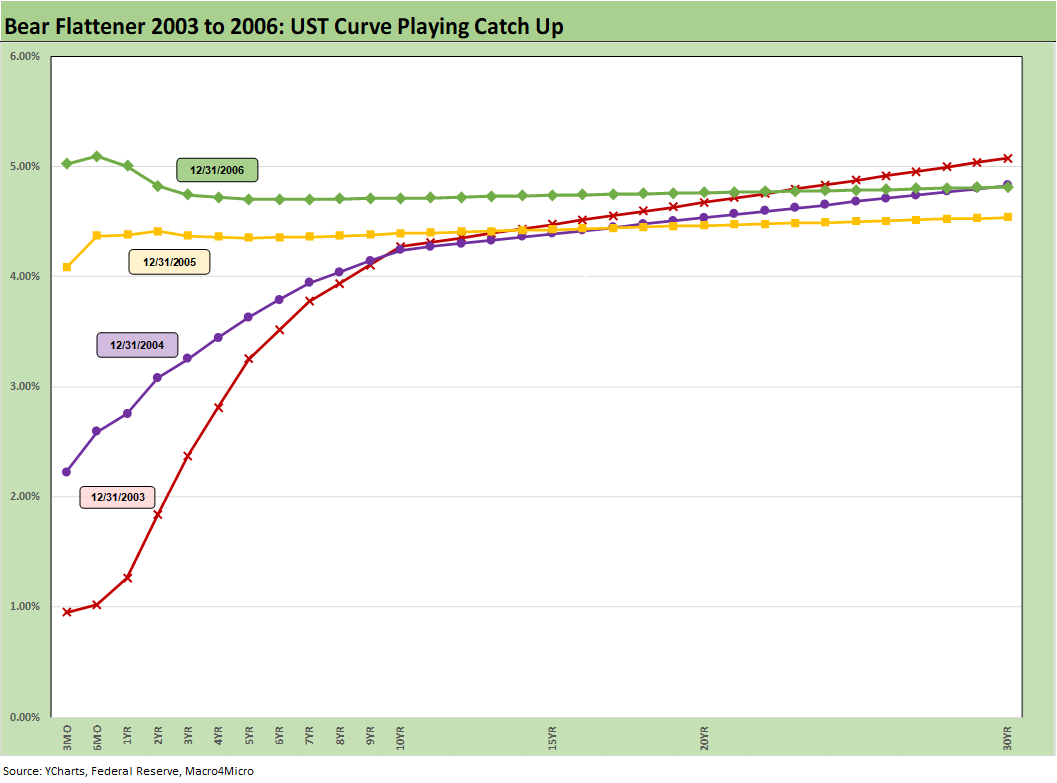

In an open question around how the 1990s might compare to the post-tightening cycle and easing process of 2024-2025, the good news is that the direction of the UST curve has more in common with the 1997 period into 1998 than the June 2007 period that was coming off a multiyear bear flattener of the UST (captured further below).

First, the chart below drives home the UST bull markets of the post-1994 stretch of the 1990s. The economy was rocking in that stretch (see Presidential GDP Dance Off: Clinton vs. Trump 7-27-24). The UST support drove risk appetites from equity to credit.

The post-1994 UST rally drove the best S&P 500 year of the 1990s in 1995 and the bull flattening drove a rally in credit to the 1997 lows. The bull flattening from 1996 into 1997 and 1998 is worth looking back at for some compare and contrast in today’s trend in risk whether equities or credit (see Bear Flattener: Today vs. 1994 and Aftermath 10-18-22, HY vs. IG Excess and Total Returns Across Cycles: The UST Kicker 12-11-23).

The rally in the UST curve from the 1994 tightening ambush by the Fed set off a wave of bullish sentiment that ended up going over the top and creating the TMT bubble and a boom in LBOs and HY new issue. The pressure to drive deal flow was high on Wall Street. Drive they did.

For 2024, the risky credit market is much further along in its evolution after the TMT and credit crisis experience, and there are other places to go for a turbocharged and highly leveraged deal flow in private credit.

If there is a pocket of funds that would be more inclined to engage in excess, the private credit space would be the more likely place. Track record will matter, and some of the best people in the industry are in it with both feet. HY bonds are showing low default rate expectations and less of the leveraged private deals that characterized the late 1990s and mid-2000s. The 1990s TMT years were also unusual as a capex-intensive emerging growth sector with a lot of cash flow bleeders.

One of the more notable parallels in the comparison of 1997 to 2024 is the sharp downshift from peak UST levels and the downward shift in longer rates. However, the current inversion from 3M to 5Y sticks out as a stark anomaly. The 1994 tightening was on fear of inflation rather than actual inflation. The Fed soon reversed itself and followed the market. The year 2025 will face a big test with tariffs and mass deportation ambitions given its interplay with labor costs. If you wanted to pick two policies to drive stagflation, those two would be on the short list.

The 1997 period was a “credit cycle peak” at a time when the TMT cycle had another few years to run at wider spreads. That market saw a +86% return on the NASDAQ in 1999 on the way to a March 2000 peak. The 1999 conditions in HY credit were already under some duress with HY default rates almost to 6% by 4Q99. As we have covered in past commentaries, Greenspan overreacted and sent fed funds down to 1% by 2004 after the easing frenzy of 2001(see Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22).

The year 2000 also saw the Fed in tightening mode on inflation fears, so that did not help the situation. The Fed was soon delivering a wave of easing in 2001 that eventually saw fed funds at 1% in 2004 and set the table for the housing bubble, blank check counterparty exposure via derivatives, and structured market misbehavior.

That brought us to a tinderbox by the summer of 2007 after a 1H04 to 1H07 credit boom with record LBOs and a stunning amount of undisclosed hedging exposure that would very soon become systemic scale receivables rather than market risk or asset hedges.

2007: spreads spent half the year in sub-300 range…

The bear flattening from the front end from 2003 to 2006 is a major difference from the 1997 experience with its post-1994 bull flattener. 2024 comes on the other side of a crushing tightening cycle that only now is moving into easing mode. That makes it more like the extended credit cycle peak of 1997 to 1999. This time they can skip all the bad underwriting in HY bonds.

The 2006 to 1H07 HY boom was derailed more by mortgages, and that in turn fed bank stress and massive credit contraction. That in turn killed the corporate credit markets and banks. Our old expression of “balance sheets maim, liquidity kills” was the result.

The 2024 experience is less threatening than the late 1990s and 2007…

We spend most of our time on the US credit cycle, and we have been of the view that the credit cycle as it exists today is in very good shape relative to history. As someone who reached working age in the stagflationary 1970s and arrived in NYC for my first job in June 1980 with a record high Misery Index of 22%, this latest inflation bout was minor, exacerbated by COVID, and quickly dealt with successfully by the Fed and offset by the resilience of an economy larger and more diversified than ever.

When we say “less threatening” we are thinking in the context of the strength and diversity of the economy, credit quality mix, bank system health, and regulatory structure (Dodd-Frank behavioral checks had their value). We are not speaking in terms of comparative political risk or fiscal health in the US.

Looking ahead, we see very threatening risks across tariffs, mass deportation fallout, the rule of law generally, routine UST default threats (debt ceiling brinkmanship), religious fanaticism driving violence and theocratic ambitions, authoritarian threats, social unrest, and a “you lie, and I’ll swear to it” culture in Washington broadly.

Even though we were mired in Middle East wars in 2007, one can argue that geopolitical risk is also arguably greater now than 2007 or 1997 with China/Taiwan and trade wars that could escalate into military action, Russian recklessness and nuclear saber-rattling, and Trump’s grudge against Ukraine possibly bringing NATO dissolution under more than a few scenarios.

We always have Iran nukes as a red line, and Israel is unlikely to allow that with a US role an intuitive one. Factoring that into risk pricing is too complicated and would set off spirals that might not be necessary subject to election outcomes. Overall, that is not great symmetry.

Investors do not want to end up as pearl-clutching neurotics, but the world is very unstable on the way into 2025. For those of us who grew up spectating Vietnam or had parents who fought in “no win” hot and cold wars (Korea), lived across the street from the World Trade Center, and all of us who continue to watch the fallout from Oct 7, 2023 in Israel, there is little room to take rational behavior or compromise for granted.

Contributors:

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com

See also:

Footnotes & Flashbacks: Credit Markets 10-7-24

Footnotes & Flashbacks: State of Yields 10-6-24

Footnotes & Flashbacks: Asset Returns 10-6-24

Mini Market Lookback: Cracking the 300 Line in HY 10-5-24

Credit Returns: Sept YTD and Rolling Months 10-1-24

Some market history commentary:

Total Return Quilt: Annual Lookback to 2008 8-13-24

Presidential GDP Dance Off: Clinton vs. Trump 7-27-24

Presidential GDP Dance Off: Reagan vs. Trump 7-27-24

HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24

Credit Cycles: Historical Lightning Round 4-8-24

Credit Markets Across the Decades 4-8-24

HY vs. IG Excess and Total Returns Across Cycles: The UST Kicker 12-11-23

HY Multicycle Spreads, Excess Returns, Total Returns 12-5-23

Fed Funds vs. Credit Spreads and Yields Across the Cycles 6-19-23

Wild Transition Year: The Chaos of 2007 11-1-22

Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22

Bear Flattener: Today vs. 1994 and Aftermath 10-18-22

UST Curve History: Credit Cycle Peaks10-12-22