Tariffs: The EU Meets the New World…Again…Maybe

We look at the export and import flows between the US and EU as our #1 trade partner gets set for a dose of bizarro economics and reality denial.

20% to 50%… Full Mental Tariffs…

We run through the exports, imports, and trade deficits for the US-EU trade relationship. We look at the line items for signals on what would get tagged in a blanket tariff program and what the retaliation target list looks like for US exports to the EU.

Among the few guarantees in life is that the EU bureaucracy will respond in kind and in proportionate fashion to any US tariffs. The EU will more often than not act in accordance with WTO Rules. That raises the question of whether the coming battles doom the WTO to irrelevance in fact rather than the current situation, which is partial relevance in substance.

With the EU as #1 trade partner and #1 in both imports and exports as a trade bloc (vs. the nation level), a tariff battle will be intrinsically inflationary or earnings dilutive via costs. Meanwhile, retaliation is inherently dilutive to US export volumes and to the revenues and earnings of exporters. That means bad news. The basic laws of economics and double-entry accounting will insist.

The geopolitical and nationalistic overtones for NATO and for Ukraine support will only compound the domestic political pressure, intra-EU tension, and ill will that can complicate the dynamics.

The above chart updates the timeline for EU imports to the US and for US exports to the EU. In technical parlance, that is a whole “s***load” of economic activity with multiplier effects on both sides of the border even if this stat only captures a limited line item at the border. Playing “lab rat” with the largest trade partner on theories that have been disproven as recently as 2018-2019 does not strike us as a low risk policy priority.

We have been putting out data and commentary around the trade flows and related risk lately with a look at Mexico (see Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24), Canada (see Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24), and China (see Facts Matter: China Syndrome on Trade 9-10-24).

The links at the bottom revisit a range of topics, but the main theme is that tariffs are paid by the buyer, which is a fact that is directly opposite to what Trump claims. “Buyer pays” is something most everyone knows except for those wearing funny red hats. Trump put out on a social media post last week that stated the “country pays” (China, EU etc.). We could soon see yet again whether 2+2=4 as Trump puts his “country pays” theory to the test.

The above chart is the starting point for tension given the Trump fixation on trade deficits. As the largest and strongest consumer economy on the planet with an abundance of global supplier chains, the US has been a chronic trade deficit generator in goods with a surplus in services. That mix of price and volume in the US goods picture and lower unit costs flows into strong earnings and cash flow, record stock markets, hiring, and reinvestment.

The top 3 line items on the EU import list is Pharma, Autos, and Aerospace, so the high end of the value-added chain leads the list. Going the other way, the US exports have Pharma at #1, Oil and Natural Gas at #2 and Aerospace at #3.

The situation varies by major trade partner, and the EU is a tricky one for a range of reasons that make it different than Mexico with the “labor cost arb” and the large base of US-owned operations there (notably in autos). China is all about low costs but across a wide range of industries. In contrast, the EU has high labor costs and a very high value-added base of imports into the US mirrored in a high value-added base of exports from the US to the EU.

The US also has a growing base of energy exports that could keep on growing given the events in Russia. Ironically (given Trump’s pro-Putin stance), Russia back in the EU market could undermine US export energy share and thus grow the US-EU trade deficit.

The above chart details the trajectory of EU imports. Someone on this side of the Atlantic must be doing OK to be busy buying that much product from Europe. Someone might suspect that it is a sign of a strong US economy. It would be a challenge to get such a cause-and-effect admission on that from Trump.

In a growing US and EU economy (even if slower growth than the 1980s and 1990s), the post-eurozone economic evolution should not be a surprise. Cross-border M&A, technology investment, and steady US PCE growth make for a ripe target to grow global revenues. We highlight below that exports from the US to the EU also trended higher to near records.

The import volume is also a sign of the growing role of European multinationals in the US economy that integrates operations “here and there.” German auto OEMs and commercial vehicle makers are among the obvious examples, and their operations are substantial in “red states” and the transplant belt. Daimler (Freightliner in North America) and Volvo are major factors in US commercial truck market. We also see Airbus making planes here. The multiplier effects there run the gamut across supplier chains, services infrastructure (freight/logistics, finance, etc.), real estate, construction, the local and national tax base benefits, and on and on.

The above chart shows the US to EU export side of the equation. Two economic leaders seeing growth in activity rise even if just not fast enough for a range of other reasons. It is safe to say that “there is a pattern here” and it is higher economic activity via higher imports and higher exports. The better and faster growing economy tends to see more consumption and thus deficits. That is the US.

How to foster more investment to meet that internal US demand is part of the challenge. “They” (a floating constituency label) just can’t whine “race to the bottom” in the case of the EU. That labor arb complaint works for China and Mexico but not the EU. We have a goods trade surplus ex-oil with Canada. Pursuing actions that reduce economic activity broadly and imports and exports directly can get you a grade of “D” in intro economics class.

The above chart is the list of targets among the Top 30 imports from the EU. For a blanket tariff program, they are all on the list. Some can lobby to come off those lists in one of those “cross my palm with silver” moments for which Washington has become famous. Since tariff programs are run out of the White House with limited input from favored political constituencies in Congress, the ethical discoloration does not need a picture drawn.

We include the list as food for thought. Whether contracts are in place now (Airbus) or US dependence on EU suppliers at assembly operations, or businesses near the customer (think auto dealers and truck dealers), the risks are intrinsic for the traditional buyers along a list of high value-added products detailed above. The topic will be getting revisited as we get to the other side of the election and the wheels turn some more.

We will look at Germany in a separate commentary since that major EU exporter was always one of the main targets of Trump (and Navarro). Germany imports are near records LTM and US exports to Germany are just below an LTM high. The net effect is the US-Germany trade deficit is also around a high. With the US economy doing better than the EU and Germany, that make more intuitive sense than not.

Germany is the leading EU national economy. The largest imports from Germany to the US are Autos, Pharma, Navigational/Measuring/Medical/Control Instruments, and Aerospace Products and Parts. For US exports to Germany, we see Aerospace at #1, Pharma at #2, and Autos #3. The fact that a lot of German cars get made in the US and exported and some of those cars need imported supplies to the US might require a large block print flashcard for Trump from some economic advisors (Good luck with that. He won’t read it). The largest importer of light vehicles to China had been US-made “German” cars. That is about brand power and quality for cars made in red states in the transplant belt.

The above chart runs through the largest exports from the US to the EU. Unfortunately, that list these days doubles as a “retaliation target list.” Blanket tariffs would hit all the manufacturers of those goods. Airbus is winning the battle of the commercial airplane producers vs. Boeing. Tagging Airbus with tariffs is a retaliation headache that Boeing does not need right now.

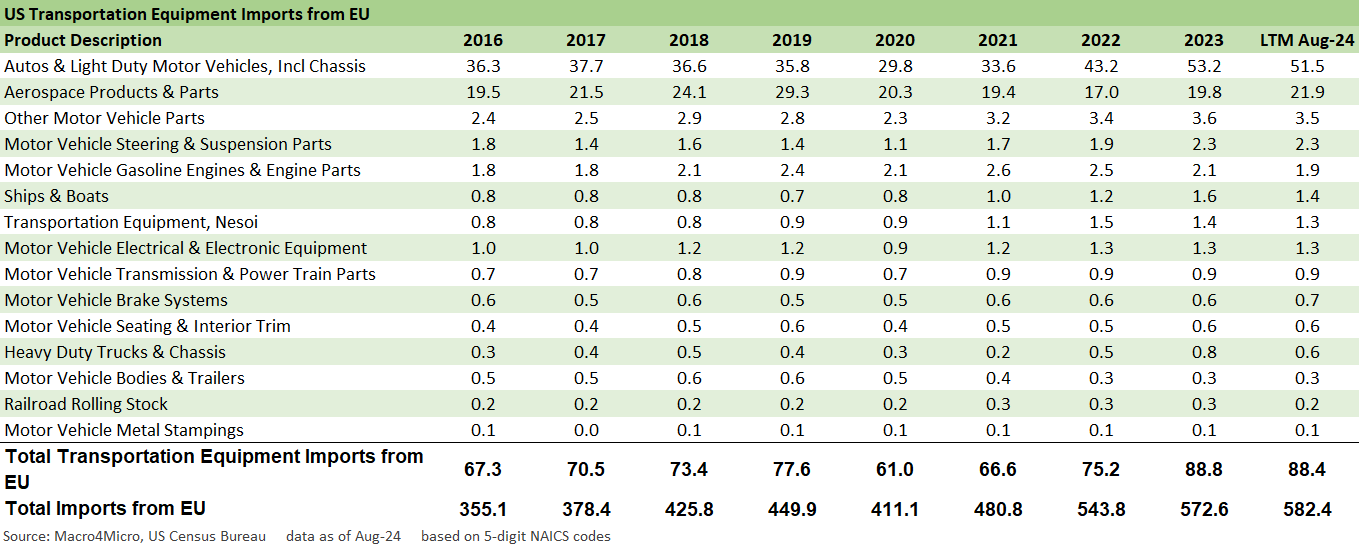

The above chart narrows the list to Transportation related imports from the EU with the export mix in the next chart. There is no question EU vehicles sell well in the US. You can check them off in the regularly reported auto trade stats. Trump constantly cites the fact that the EU does not buy US vehicles. He seems to have missed the many decades when GM and Ford had major market share and manufacturing presence in the EU but lost billions and had to retrench and sell assets. High price consumer durables compete on quality and price. The US players lost. Fair and square.

Now many auto and truck international players are major job providers in the US with multiplier effects galore. Trump tends to delicately dance around the fact that many Michigan and Wisconsin (and Ohio) auto jobs are now in the US transplant belt running from Texas across Mississippi to Georgia/Alabama and north across Kentucky into Ohio and Indiana (and Canada).

The above chart shows the Transportation exports to the EU with the main line item being Aerospace. We do not have the data on what auto models/products are in the mix of EU exports for this piece, but it is safe to assume US-made German and Japanese cars are prominently featured along with Tesla (who also imports from China to EU). Western Europe is not a large pickup truck market, and that is a market the US dominates. Turning left or right or making it down the street can be a problem for many trucks in various “old Europe” urban centers. The models must fit the market (and the parking spot!).

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com

See also:

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23

Midyear Trade Flows: That Other Deficit 8-10-23

State of Trade: The Big Picture Flows 12-18-22