Credit Crib Note: Herc Rentals (HRI)

We look at the operating fundamentals, financial risk, and credit profile of Herc Rentals as the #3 equipment rental player in the US.

CREDIT TREND: Stable

Herc Rentals (HRI) has seen a slow and steady improvement in its credit quality over the past decade from the single B tier 2L bond days of 2016 after the Hertz spinoff and then eventually across a steady climb in its earning asset base after COVID. The company has been a success story after starting as a stand-alone with a lot of work that had to be done after too many years under the Hertz umbrella.

We had an outperform recommendation on the B+/B3 2L bonds long ago at spinoff date and the company delivered slowly but surely in the growth of the business from $3.5 bn in assets at 4Q16 to $8.2 bn at 3Q24 with a very different operating profile. EBITDA margins have expanded from mid-30% handles ahead of the spinoff to mid-to-high 40% range in recent periods. Sitting in the mid-to-lower tier of the BB HY index composite with ready access to the BB unsecured bond market is a long way from the spinoff days.

We have watched HRI since the separation of the Hertz car rental business from the Herc equipment operations back after 2Q16. For too many years before that time period, Herc had to ride along with the volatile cycles of the car rental business across an array of ownership structures, troubled M&A deals (e.g. Thrifty), LBOs, IPOs, and major bouts of credit turmoil. With the mid-2016 spinoff, Herc Rentals management could breathe a sigh of relief and start on its own path with shareholders aware that the industry had a few model templates that showed the clear line of sight to how shareholders could win big.

The winners in equipment rental were United Rentals (see Credit Crib Note: United Rentals (URI) 11-14-24) and Ashtead (see Credit Crib Note: Ashtead Group plc (AHT) 11-21-24), and HRI could model their strategy along those lines or get taken over by one of them. Their playbook was not a mystery by 2016. HRI could just “copy off the other guy’s homework.”

Since the more ambitious strategy unfolded after the COVID turmoil in 2020, HRI has successfully executed a plan to profitably grow its asset base while reducing overall business risk through the diversification of its fleet mix and broadening exposure across industry verticals and regions. At the same time, profit margins soared and leverage materially declined since the spinoff from 4.0x at 4Q16 to 2.7x within a target range 2x to 3x for net debt/EBITDA.

To be clear on the nature of the Hertz and Herc Rentals spinoff and “parent” status of the car rental operation (detailed in the “History and Highlights” section at the bottom of this commentary), Herc Holdings is the legacy legal entity even though the transaction was accounted for at Hertz as a spinoff of Herc for accounting purposes.

OPERATING PROFILE

We see the HRI equity market performance detailed in the above chart since the mid-2016 spinoff transaction when Herc and Hertz Car Rental went separate ways. The chart tells a story. The equipment rental stocks really hit the accelerator later in the post-COVID capex cycle, and the attention that United Rentals has received opened up eyes to other growth opportunities such as Herc Rentals as equipment demand was fueled by all the megaprojects and infrastructure activity from energy and LNG to EVs.

Capex levels in nonresidential construction and industrial/manufacturing investment took off on the back of the megaproject expansion driven by various major legislative initiatives (Infrastructure, CHIPS, IRA, LNG, etc.). The themes at HRI are consistent with the operating strategies we hear about from United Rentals (URI) and Ashtead (ASHTF) with fleet expansion, growth in higher margin specialty equipment, cross-selling, and mixing in acquisitions with greenfield investment.

The template for rapid industry expansion has been set by URI and Ashtead, and in many ways the acquisition strategy has been derisked and is well recognized at banks and in the capital markets as “low execution risk.” Equipment rental is one of those sectors where roll-ups and consolidation is seen as a good strategy as in some other industries (e.g. waste management) but not in some others (e.g. steel service centers).

The fragmented nature of the equipment rental sector still offers a lot of opportunity to keep rolling up smaller players and continuing the consolidation game plan. The complexities of the industry should not be underestimated, but HRI has shown that it can do the job as it marched from mid-30% EBITDA margins after the 2016 spinoff to high 40% handle margins now. As we detail in the cash flow charts below, the acquisition pace has picked up for HRI.

For Herc, the next leg of the strategy goes under the heading of “better late than never” as it has commenced a stream of bolt-on deals and consistent pattern of growth capex. The expansion strategy runs through fleet size and mix and has allowed HRI to increase revenue and earnings as we detail below. The total asset line is up by almost 90% from the end of 2020 to 3Q24 and almost 2.5-fold since 2016. Materially higher capex and stepped-up acquisition activity has driven the growth in operating cash flow for reinvestment in replacement and expansion while freeing up cash flow for dividends and buybacks.

HRI is using a strategy that has worked quite well for URI and ASHTF. The plan entails growing the base of cash flow generating assets (equipment), diversifying by end market vertical and geographic region in North America, increasing penetration of major customers and megaprojects during the post-COVID capex boom, and upgrading the array of service offerings including higher margin specialty equipment. Herc has come a long way since the days of 2016 when it was overexposed to the upstream E&P sector (19% of revenues during 1Q16 when the oil markets bottomed) at a time when energy capex was plunging and bankruptcies were soaring in energy. The deal volume is picking up as we see in bolt-ons and capex levels in the tables below.

We included the long-term stock chart from mid-2016 earlier to tell the longer-term story of how HRI fought its way into the top tier with the other material outperformers from equipment rental. Below we shorten up the timeline to the more relevant expansion period as HRI stepped up its acquisition game and the company and industry alike has seen more focus from major Wall Street firms in equity coverage. It is a sign of the industry “going mainstream” in the capital markets with bellwether large cap names such as United Rentals and Ashtead opening up more potential for Herc Rentals as well.

FINANCIAL TRENDS

High margins and sustained, prudent management of cash flow has driven very favorable equity performance in the equipment rental names. The industry leaders have reached a cruising altitude in cash flow where they can fund growth capex, replacement capex, some acquisitions, and have enough left over for buybacks and dividends. HRI is close to the point where that playbook can be more routine and consistent in filling in all those lines each year (capex, M&A, buybacks, dividends). Major acquisitions can tap the brakes on buybacks as we see with URI.

Life as a BB tier unsecured issuer is how URI and ASHTF have prospered. URI grew so quickly and on such a massive scale across the 2010 to 2020 period and in the post-COVID period that URI started to layer in 1L and 2L bonds to broaden its investor base. In contrast, Ashtead spent its formative years as a 2L issuer in the BB range before moving to an IG unsecured bond issuer. Getting below 2x leverage for HRI is a high bar that they are unlikely to clear in 2025 which in turn will keep them from making a push for IG ratings. They are playing catch-up on growth.

The above chart frames the timeline of revenue growth with the primary focus on Equipment Rental revenue. We include EBITDA margins for total revenue and rental only EBITDA (“REBITDA”) as provided in the company’s quarterly presentations.

The total EBITDA margins of 43.8% for YTD 3Q24 and 45.4% for REBITDA underscores how HRI had closed the gap with the equipment rental industry leaders although there is still a modest shortfall in total EBITDA margins vs. URI and ASHTF, who are in the 45% to 46% area for total EBITDA margins.

REBITDA margins of over 45% compare favorably to sub-40% annual REBITDA margins as recently as 2018 and sub-43% in FY 2019 before COVID.

Double-digit net margins are impressive and have set the stage for the equity market to chase the lower multiple that had been assigned to HRI before the latest rally evident in the stock chart posted earlier in this note.

The 2024 performance has been favorable in terms of volume and rates with 3Q24 pricing up by 2.3% YoY while YTD pricing was +3.5%. The pace of pricing improvement is slowing after some strong growth in 2023 (+6.9%) and 2022 (+5.8%). The “OEC fleet on rent” grew by +10.7%

Rental revenue guidance provided during 3Q24 earnings season brought an upward revision in equipment rental revenue for FY 2024 to +9.5% to +11% growth from the prior guidance of +7% to +10%. Record rental revenue is projected for 4Q24, and the “record” is not a surprise given the rate of investment in growth capex and acquisitions. Based on guidance, rental margins should be higher.

HRI detailed some of the macro data services and surveys that it uses with industrial spending expected to be the highest level on record even above the records of 2023 that came with a 17% spike as so many megaprojects were ramping up. Nonresidential starts are expected to rise from 2023 even if still below 2022 levels.

The above chart highlights the steady growth in the asset base and OEC since 2019 with leverage staying within the 2x to 3X range.

The current leverage is inside the current 2.0x to 3.0x target range. Back when the spinoff was executed in 2016, the range had been 2.5x to 3.5x range over the course of the cycle with an initial pro forma leverage target of 3.75x. Nonetheless, HRI hit 4.0x handles to end 2016 and stayed higher than its target range into early 2017 before getting inside the range during 2018.

HRI has demonstrated its financial flexibility with two oversubscribed unsecured bond issues that were increased in the launch process with the two deals totaling $2 bn ($1.2 bn 2027 maturity, $800 mn 2029 maturity). The more favorable capital structure since HRI’s single B tier days supports asset protection and financial flexibility through the use of ABL lines as it consolidates more acquisitions.

As of 3Q24, HRI had a $3.5 bn ABL line (extended during 2022 to 2027) with $1.73 bn utilized and $1.73 bn available. The separate AR facility of $400 mn had $390 mn utilized and $10 mn available at 3Q24.

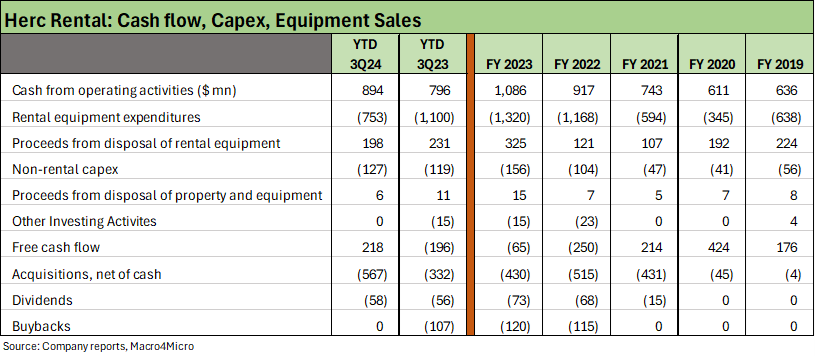

The above chart runs across the main cash flow lines to frame the key drivers of what has been a rapid expansion of both sides of the balance sheet.

As the equipment investment grows, revenues keep growing and higher margins and operating cash flow opens up opportunities for shareholder rewards as seen in the dividends and buyback lines.

The materially higher capex is self-evident in the above table with FY 2023 capex double that of 2019 and almost 4x the levels of the COVID retrenchment.

The higher pace of acquisition activity shows deal totals at over $1.9 bn from FY 2021 through 3Q24 and hitting a peak in 2024. HRI launched its acquisition strategy at the end of 2020, and HRI made its largest acquisition since then during 3Q24 while executing on deals in Florida, Arizona, and California. Net cash acquisitions in 3Q24 totaled $277 million. The acquisitions since 2020 included “51 businesses with 115 locations”.

We have seen Ashtead among the industry leaders also pick up the pace of bolt-on acquisitions in recent years while United Rentals never seems to slow down. As URI saw its stock performance roar ahead, M&A pressures picked up for any equipment rental company that wants to be more attractive in equity markets.

The mix of pressure to acquire and invest will make it harder for HRI to materially improve balance sheet metrics to under 2x, but the next stage of growth for HRI can be executed in the BB tier using cash flow, secured ABL lines, and unsecured bonds.

In the event of a major contraction in construction and industrial markets that we do not see at this point, HRI has the same intrinsic fleet planning flexibility to adjust fleet strategy as needed and defend financial health as we have seen across past cycles in the industry. Those cycles include a systemic financial crisis and a pandemic.

The secular trends that favor rental vs. ownership ease some of the cyclical risk elements, and the higher short end rates have further pressured cost of ownership and support renting vs. buying economics.

Given the history, scale, and financial health of the #1 and #2 players, one could make a case that credit exposure to HRI is a credit risk that is “performing with a net” since it is an asset that could be bought by either one of the major players if the opportunity was there.

The projections for secular growth remain favorable for steady M&A, and a deal for HRI could be easily financed even if it is a bigger bite in total dollar terms than any have taken so far. The numbers could work for URI given pro forma cash flow and some adjustment to buybacks during the integration process.

HISTORY AND HIGHLIGHTS

Herc Rentals is a distant #3 in the equipment rental markets in the US, ranking well behind #1 United Rentals and #2 Ashtead (Sunbelt brand). As of the most recent US market share data, URI holds a 15% US share, ASHTF 11% and HRI 4% with H&E Equipment (HEES) following at a 2% share.

Herc has been in business since 1965, which was long before Ashtead began its rapid growth in the Sunbelt operations in the 1990s and into the new millennium and the same for United Rentals with its 1997 IPO and stunning pace of successful M&A-driven growth.

HRI was embedded within the struggling Hertz Holdings entity that found itself in a constant state of management turmoil (and turnover) up until its de facto financial collapse and bankruptcy during the COVID crisis.

Legally, the car rental business was spun off by Hertz effective 6-30-16 even though the transaction was treated for accounting purposes as a spinoff of HRI at the time. The legacy Hertz parent company is now Herc Holdings (i.e., for old Hertz 10K filings pre-spin, you look under HRI)

We look at the evolution and industry growth of the equipment rental sector in our reports on United Rentals and Ashtead, so we refer the reader to those reports for more in-depth view of industry fundamentals.

Despite being the oldest of the peer group, HRI has been late to the party in the M&A driven growth that has been a feature of the rental sector and notably with URI as the lead consolidator.

The market cap of URI ($56.1 bn) and Ashtead ($35.5 bn) as of 12-6-24 relative to HRI ($6.5 bn) gives a frame of reference of how late HRI is relative to the growth of the industry leaders. That is after two decades of industry organic growth (capex, greenfield locations) and acquisitions (both bolt-ons and billion-dollar deals). But now HRI is in the game.

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com