Return Quilts: Resilience from the Bottom Up

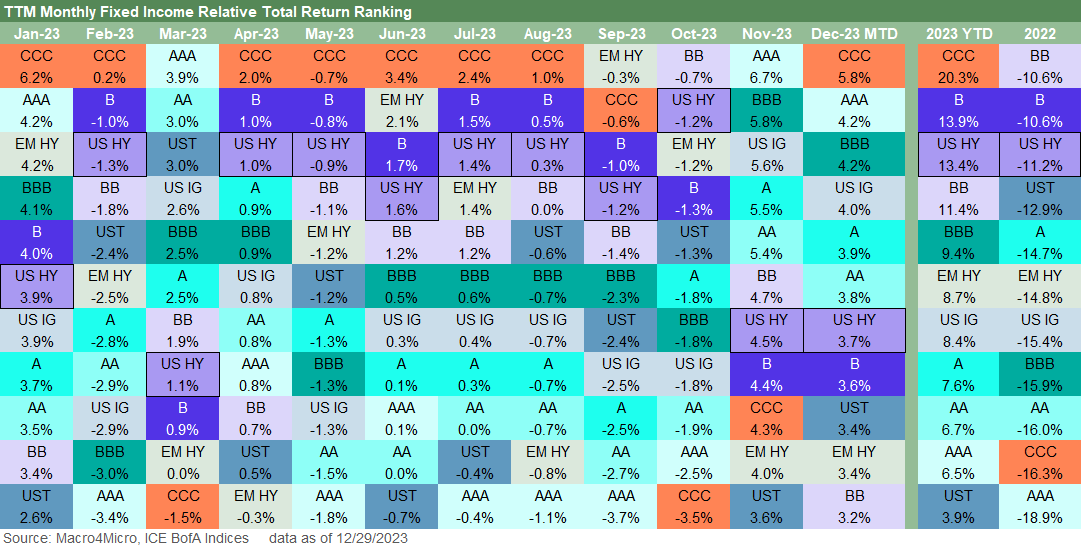

We look at the total and excess return quilt showing the monthly swings across the credit tiers on the way to a CCC win for 2023.

With the UST curve and spreads narrowing impressively from the end of 2022, the end result was a banner year for all bond credit sectors whether heavier on duration or credit risk.

With IG north of 8% in total return and HY above 13%, riskier credit assets had a good time, but so did those investors who were long duration in recent weeks with the BBB tier wrapping the year at +9.4% or slightly below the long-term returns on equities.

The BB heavy HY sector won the war on multiple fronts with quality spreads running materially tighter in the home stretch and getting its share of the duration winnings for an 11+% handle in BB total returns with less volatility than those issuers with exponentially higher default risk at the bottom of the risk tiers in CCCs.

There is still no denying the CCC tier total return and excess return win for calendar 2023 after a history since the late 1990s where the CCC tier almost always comes in first or last place in excess returns.

In this commentary, we recap a very strong year for credit assets that saw inflation make great progress while employment and the consumer’s propensity to spend pushed back hard on recession probabilities. In multiple areas of policy and politics, the opportunities were on the table for self-destruction from the UST to the bank system.

Fortunately, disaster was averted whether in domestic politics (UST default risk sidestepped - for now), geopolitics (lack of Iran escalation with major oil price fallout – for now), and Fed policy (regional bank support sidestepped a very unexpected “push-button run” on the regional banks). There is still a long way to go for a government budget with the potential fallout into numerous sectors.

Many of the same worries remain, but at least UST default risk does not come up again until early 2025. The Middle East will remain a focus for its logistical choke points (Red Sea, Strait of Hormuz) and potential for escalation. Oil is notoriously volatile and unpredictable and will remain on shaky ground if Israel-Gaza escalates (notably into Lebanon). We could just as easily see a Saudi oil price war as an Iran conflict. The market seems inclined to cross that nightmare when and if they come to it. At least a Saudi market share war and oil price collapse would be an economic tax cut for most.

Oil and gas are each at record production volumes in the US with record exports of oil and LNG, so there is room to maneuver if it comes to a massive energy market disruption scenario. On the other hand, that would fall hard on Europe and China and global growth. There could easily be a fresh look at Russia policy in Europe by some countries at that point. We don’t want to fall into that rabbit hole of macro handicapping. Reading foreign policy trade rags is a leading cause of bear syndrome.

UST migration and shapeshifting and spread compression tell the total return story…

As we detail in the total return quilt, the CCC tier led the way across the post-2022 tightening cycle in a year that saw the Fed moderately tighter over 2023 after a brutal 2022, but credit spreads were much tighter across 2023. That came after a 2022 when HY OAS had just missed +600 bps in the summer and crossed the +500 bps line in the summer and early fall. HY OAS ended 2023 by crossing below the June 2014 lows this past week at +334 bps (vs. +335 bps 6-23-14) and will open 2024 only one good month from hitting the early Oct 2018 lows (+316 bps 10-3-18).

The total return chart above shows the CCC tier taking the #1 spot in 7 of the first 8 months (just missed 8 of 9) as short duration, higher coupons, and higher starting spreads coming out of 2022 carried the day. Spreads were tightening after the HY index ended 2022 at +481 bps and the CCC tier at +1170 bps. All in yields for the HY index were materially lower in 2014 and 2018.

Late 2023 gyrations…

We see how the last handful of months were bouncing around with the UST shifts and spread volatility. Both spreads and UST wrapped Nov-Dec in dramatically impressive fashion with over 100 bps of tightening in HY over the two months, but the long duration BBB tier were also rallying materially in Nov-Dec as the speculative grade divide risk narrowed. That was after negative returns in the months of Sept-Oct.

The return ranking shows how risk maximization was the eventual winner in total and excess returns alike. The same was the case for betting on duration later in the year as earlier UST curve damage was retraced in the wild finish for the UST curve. A bigger bet on duration was the winner later in the year. Those that question the ability of the curve to avoid some steepening along the way have the borrowing demands and investor base depth as a major wildcard (including us). Being optimistic on fundamentals (we have been) is hard to reconcile with the Fed, Powell et al avoiding the mid-1970s errors of easing too early.

The total return quilt breaks out the return rankings monthly, and then on the right we give the full year results for 2023 with 2022 results listed alongside. We see CCC at #1 in 2023 and almost last in 2022 but with AAA taking last place in 2022 on the fact it is the longest duration credit tier at 9.4 vs. 6.8 for IG and 3.2 for HY.

As the year 2023 wore on, the “steepening toward flattening” dynamic in the UST market was gradually whittling away at the inversion out the curve. That meant duration would be a major headwind for returns. The period showed more than a little duration pain still in place well into October as we see in the monthly total returns. The slew of negative asset subsector return numbers in Aug, Sept, and Oct tell the story on duration, but all risky assets were feeling their share of setbacks as we covered in our asset return Footnotes publications (see Footnotes & Flashbacks: Asset Returns 10-22-23).

Then came the mother of all UST rallies in Nov-Dec even in the face of constructive macro metrics. Goldilocks fans were good at marketing how the moving parts can stay in balanced harmony easing without a recession, but the Fed Chair Powell was even better at bolstering confidence by just sending bluntly positive, dovish signals in the recent FOMC meeting. The dot plot also piled on. The street and some major brand name investors are calling for UST declines that outpace the dot plot and run as high as more than 200 bps along segments of the UST curve.

Spreads and HY compression…

We have looked at the credit spread action in earlier commentaries (see links at bottom). We also update yield and spread trends weekly in our Footnotes yield publication (we will post that later this weekend (see Footnotes & Flashbacks: State of Yields 12-23-23). The fact remains that HY spreads are tight in absolute terms across the cycles and even tighter when framed in the context of comparative yield pickup vs. UST or IG yields.

Many asset allocators will justifiably see a 7.7% HY index yield as attractive even after the rally. Even if the theme is picking your spots or holding onto what you have and waiting for the refi cycle, HY investors tend to be tough to rattle. The opportunity in a HY refi cycle to flip into current coupons will also support HY demand as funds reinvest in the refi (see HY Refi Risk: The Maturity challenge 12-20-23) and bolster portfolio cash flow with new issue income flows.

Betting the ranch on CCCs is a risky gambit, but refinancing would be its own reward for some CCC issuers. Perhaps it is “no guts, no glory,” but we have found the BB heavy strategy has held up better across cycles on a risk adjusted basis. The array of outliers and geopolitical tail risks and political event risks do not help confidence when spreads are tight.

Excess returns touch an old CCC tier theme as usually being first or last…

The above chart captures the “excess returns” (excess above the duration-matched, risk-free return) and is supposed to capture what the investor got paid for taking credit risk. In a perfectly efficient world operating perfectly across each calendar year (never met that perfect world), the numbers should always be positive for a higher risk asset vs. a lower risk asset. After all, a higher risk demands higher returns. That of course is often not the case.

The excess return differentials can be viewed as a means of framing relative compensation for credit risk in any given period. For any given excess return differential, that number then needs to be held up against what an investor sees as the risk profile of the market whether at the asset class level or across tiers and subsectors. That is the “value” equation vs. the best nominal total return question.

Our take on this past year is that it presented an above median risk at below median spreads, but the value to the investor of materially higher all-in yields after 15 years of income starvation remained the focus. That yield starvation period included a refi wave financed by low new issue coupons (see Coupon Climb: Phasing into Reality 12-12-23). The HY index entered 2020 at par plus levels ready for refinancing, and the Fed policy and legislative support during COVID set off such a wave that lowered coupons and extended maturities.

That refinancing challenge is again on the front burner in 2024-2025. As we all know at this point, a very dovish FOMC meeting fueled a growing market consensus on fed funds cuts “early and often” in 2024 that would include a full curve downward migration. The aftermath of that FOMC meeting saw equity and credit rallies while bond math took its course in supporting total returns for UST and IG bonds.

While it is a topic for other pieces, handicapping so many moving parts of risk to all work out perfectly again is not easy in light of history. This market has so many moving parts in central bank policy, macro variables globally, geopolitics, and an almost $2 trillion in UST funding needs for a record deficit that is a sticking point for so many.

The UST funding problem is about more than supply and demand for UST along the curve. The challenge includes the wildcards inherent in an unstable Washington (unstable in every sense of the word, including some of the people). For now, the consumer and the Fed are running the show with an assist from fixed investment and government spending.

If the Fed starts easing early and often in 2024, you can imagine the accusations (politicization of Fed and a verminous deep state of economists) on the way to an election. If Biden gets the easing benefits, it would mirror what Trump got in 2019 when the economy faltered. The Fed policy is also colored by the fact that one of the likely candidates will be someone who had been seeking to fire Powell for not taking fed funds into negative range. That should make for interesting handicapping as the year goes on.

See also:

Coupon Climb: Phasing into Reality 12-12-23

HY vs. IG Excess and Total Returns Across Cycles: The UST Kicker 12-11-23

HY Multicycle Spreads, Excess Returns, Total Returns 12-5-23

HY Credit Spreads, Migration, Medians, and Misdirection 11-6-23

Quality Spread Trends: Treacherous Path, Watch Your Footing 10-25-23