Mini Market Lookback: Wild Finish to the Trading Year

A week packed with pre-Christmas releases saw high priority market movers send returns lower.

Seasonal, secular, political, economic, monetary, & valuation headwinds add up…

After a tumultuous year of political noise, misinformation on the economy, improving inflation, and the start of a Fed easing cycle, the past week was like a 2024 microcosm. We saw a brief big swing in the stock market, a case of UST nerves, relatively reassuring inflation numbers, a -25 bps ease, a near government shutdown, legislation by social media, new tariff headlines, and another 3% handle quarterly GDP number.

The best news was a +3.1% 3Q24 GDP growth number since it sets a bar for the handoff to the new GOP Washinton sweep as the US will see a radically new set of policies and regulatory backdrop. The Trump 2.0 team will bring another record supply of UST to go with the record deficit and material tax cuts running alongside a mix of targeted high tariffs against major trade partners potentially combined with a set of blanket tariffs (see Trump Tariffs 2025: Hey EU, Guess What? 12-20-24).

The worst news was not a surprise but looked bad when it was made “official” with forecasted fed funds for 2025 moving +50 bps higher than the Sept dot plot estimate that also featured a lower GDP growth forecast from 2.5% for 2024 to 2.1% for 2025 (see Fed Day: Now That’s a Knife 12-18-24).

The past week saw weak equity performance and wider credit spreads at valuations that still look like past bubble peaks and a UST curve that mixed higher and steeper beyond 2Y UST with steeper and lower on the short end following the FOMC actions and market reaction. HY OAS was +18 bps and IG OAS +4 bps on the week.

A surprise in the debate over the debt ceiling suspension (or repeal) is that few commentators cite the fact that removing the debt ceiling would derail the recurring, politically driven UST default threats that have become normalized but would cause a systemic crisis. It is hard to forget Trump in a CNN Town Hall meeting instructing the GOP House to “do a default” if it did not get everything it wanted. Time for that threat to go away forever.

The market commentators have been highlighting the lack of breadth in recent weeks with tech taking the lead (see Footnotes & Flashbacks: Asset Returns 12-15-24), but the above 1-week return mix shows a different kind of breadth with all 32 of the benchmarks and ETFs we track in the negative range. It is safe to call a 0-32 score a very bad week in the context of a 3% handle GDP growth economy and the post-election optimism that has been on display. It shows a hypersensitivity to headlines at these lofty valuations.

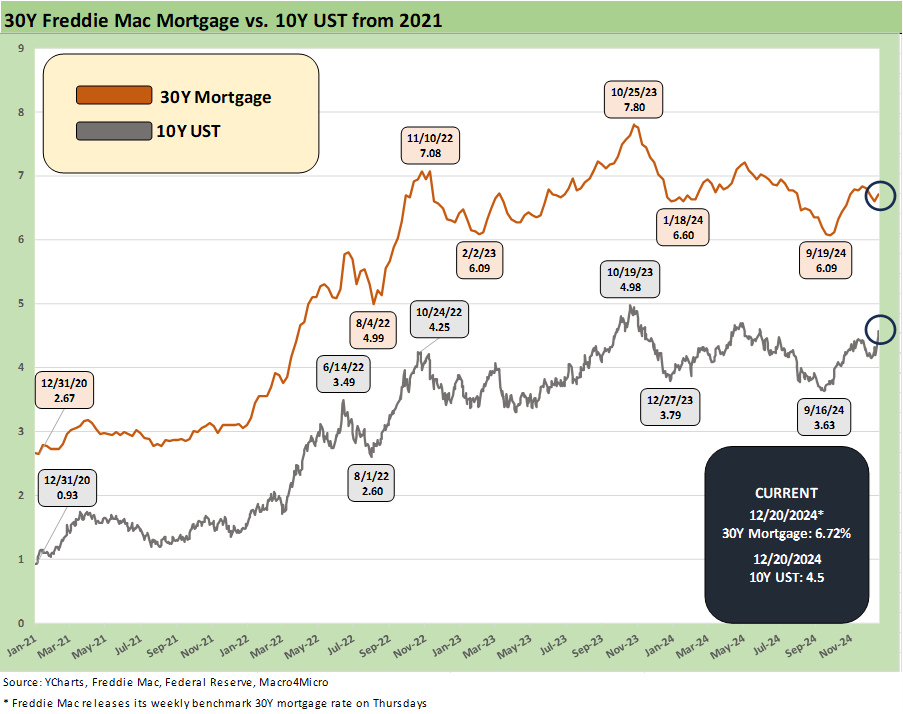

Interest rate sensitive sectors that have been great performers for much of the year (e.g. Homebuilders) have been taking a beating lately after the Sept lows on the 10Y UST around 3.6% before the run to 4.5% this past week. We see the homebuilders sitting in dead last for the week as mortgages are again closer to 7%. Some surveys outside Freddie were already above 7% (e.g. Mortgage News Daily) during the week with Freddie weighing in on Thursday noon (the weekly release) up +12 bps to 6.72% for its mortgage survey.

The above chart updates the tech bellwether group we track each week. High valuations, the dot plot details, and higher rates in longer UST rattled the markets (see Fed Day: Now That’s a Knife 12-18-24). For the week, we see only 3 of the Mag 7 with positive returns (2 barely) despite the Friday rally. With a debt background, we hate the term “long duration stocks” but that selloff does reflect the instinctual reaction to rising discount rates on the valuation of high-octane growth equities.

The biggest hit on the week was to Tesla returns at -5.6%. TSLA is still over +23% for the trailing 1-month period and almost +77% for 3 months. Interestingly, even with that monster rally by TSLA, we see NVDA YTD returns of +172% at more than 2x the TSLA return of +69.5%.

The UST deltas this week are captured above as bonds suffered through another bear steepener with the 2Y to 30Y inflicting pain on bonds/bond ETFs and slamming homebuilders and interest rate sensitive equities as detailed earlier.

The 3Q24 GDP quarter (3.1%) did not get much attention with Musk and Trump sending Washington into Drama Event N+1 (by intent and design). We looked back across the slow growth, post-2000 new millennium GDP growth rates for some context on 3% GDP quarters. For back-to-back quarterly GDP growth rates of 3% or higher, we saw limited examples with 3 of them across two Bush terms. We saw 4 under Obama across two terms. We saw 3 periods of back-to-back 3% or higher growth rates under Trump during Trump 1.0. We saw 4 of those under Biden in 2021, 2023, and this most recent example in 2024.

That is a very constructive economic handoff to the Trump 2.0 team. The inflation dagger was what crushed Biden, but the metrics in real GDP releases cut across the big pieces of PCE, Fixed Investment, and Government consumption and spending. To get to 3% back-to-back, a lot has to be going right. With the election over, perhaps we can now move into a world ruled by facts. That is of course an attempt at sarcasm since it will not happen in policy discourse. We are now in a secular trend of adjectives first and misinformation second, and numbers maybe a distant third. For the markets at least, numbers still matter.

The above chart updates the running 10Y UST and Freddie Mac 30Y mortgage rates. The trend is clear enough looking back, but the UST curve debate around “higher vs. lower” and “flatter vs. steeper” and “bull steepener vs. bear steepener” rages on. The UST curve handicapping has been mired in a vibrant discussion of the moving parts since last year at this time when 6 cuts and a material bull flattening was the consensus for 2024. It took 9 months to get to any cuts and we ended with 4 (4x25). The longer end steepened and moved higher. So, this is no easy task.

The school of thought favoring steeper out the curve in 2024 has been based on the sheer force of supply and record deficits and a solid enough economy. Admitting to a healthy economy would have been impossible for nearly half the country, and economic facts were bound to be ruled out in the most extreme Presidential campaign since 1860. With tariffs now in the equation for trade and goods prices along with deportation and labor economics, the moving parts forecast remains highly politicized.

We see HY wider on the week despite the minor rally on Friday. HY ended wider by +18 bps to +286 bps, which is still down in the June 2007 zone and similar to the late 1997 market. The +464 bps HY OAS long-term median is a very long distance from here.

The HY market had its share of negative influences this week even if just on the equity correlation effects. The fundamental reality is that IG and HY credit trends remain steady and the headline around +3.1% 3Q24 GDP growth was reassuring. The valuation challenge in both equities and credit is still the major focus in the market and notably how to price in the wide range of potential policy outcomes at such tight spreads (see HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24, HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24).

The above chart updates the “HY OAS minus IG OAS” quality spread differential. The +204 bps is +14 bps wider on the week but still consistent with long term cyclical credit cycle peaks as we update in our weekly Credit Markets Footnotes publication (see Footnotes & Flashbacks: Credit Markets 12-16-24). Getting below the +200 bps threshold in that HY-IG differential is very rare across the cycles.

The above chart updates the “BB OAS minus BBB OAS” quality spread differential as it widened over the week despite the Friday HY tightening off the Thursday wides. The +80 bps is still well inside the +135 bps long-term median.

See also:

Trump Tariffs 2025: Hey EU, Guess What? 12-20-24

PCE, Income & Outlays Nov 2024: No Surprise, Little Relief 12-20-24

Existing Home Sales Nov 2024: Mortgage Vice Tightens Again 12-19-24

GDP 3Q24: Final Number at +3.1% 12-19-24

Fed Day: Now That’s a Knife 12-18-24

Housing Starts Nov 2024: YoY Fade in Single Family, Solid Sequentially 12-18-24

Industrial Production: Nov 2024 Capacity Utilization 12-17-24

Retail Sales Nov24: Gift of No Surprises 12-17-24

Inflation: The Grocery Price Thing vs. Energy 12-16-24

Footnotes & Flashbacks: Credit Markets 12-16-24

Footnotes & Flashbacks: State of Yields 12-15-24

Footnotes & Flashbacks: Asset Returns 12-15-24

Mini Market Lookback: Macro Grab Bag 12-14-24

Toll Brothers: Rich Get Richer 12-12-24

CPI Nov 2024: Steady, Not Helpful 12-11-24

Mini Market Lookback: Decoupling at Bat, Entropy on Deck? 12-7-24

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Payroll Nov 2024: So Much for the Depression 12-6-24

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

JOLTS Oct 2024: Strong Starting Point for New Team in Job Openings 12-3-24

Mini Market Lookback: Tariff Wishbones, Policy Turduckens 11-30-24

Tariff: Target Updates – Canada 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24