CPI Nov 2024: Steady, Not Helpful

A consensus CPI read does not help optimists but does not reward pessimists on FOMC handicapping.

Been a demanding year for the curve. Could use a few more consensus reports.

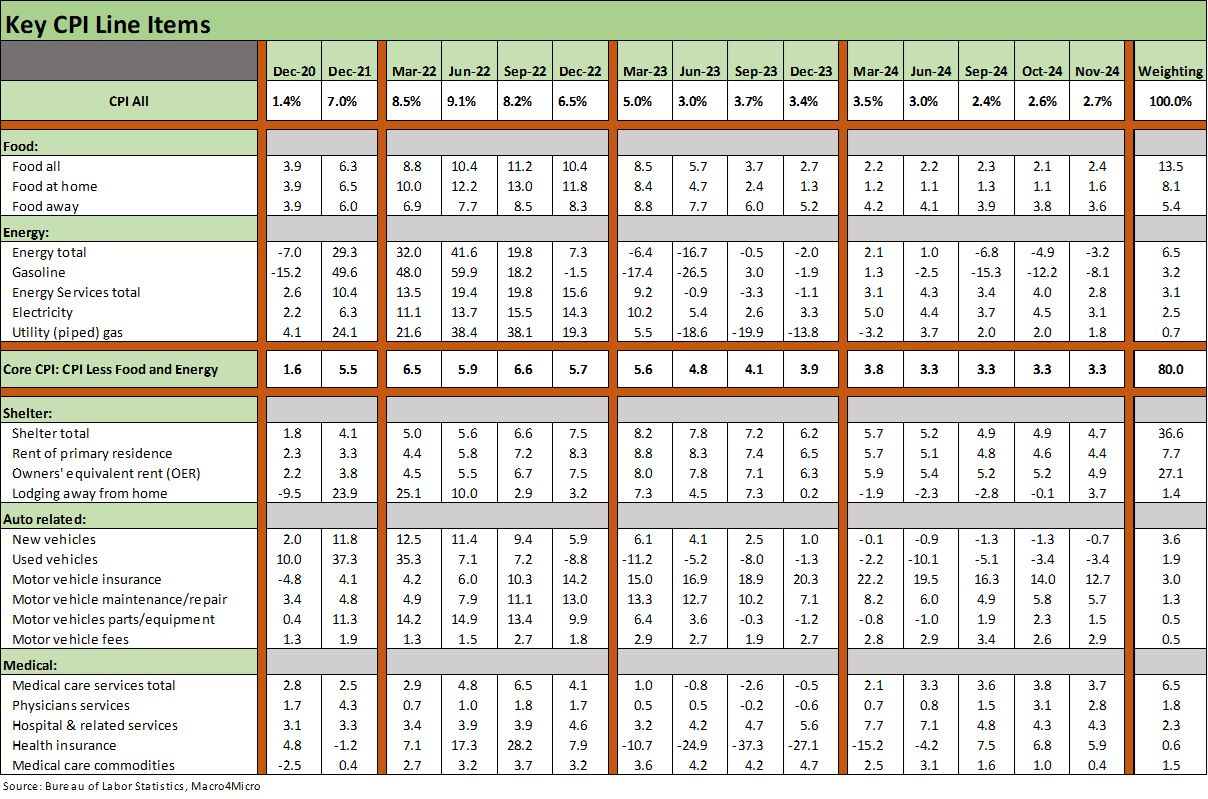

Nov 2024 put up another consensus CPI (more or less) in Nov as we saw in Oct with Food line items showing some pressure, total Services still at 4.5% (64.5% weighting) even if that total services line improved MoM from +0.4% to +0.3%.

“All items less shelter” is still soothing at +1.6% YoY with both Durables (-2.0% YoY) and Commodities deflating (-0.2% YoY) but even both of those ticked higher sequentially MoM.

The Shelter line will be very hard to shake with total Shelter at +4.7% and 36.6% of the CPI index and Owners’ Equivalent Rent (OER) at +4.9% and 27.1% of the CPI index.

We get the PCE price index next week in the holiday-compressed release schedules.

The above chart frames some of the Special Aggregate indexes we find useful. The “All items less shelter” index is one that helps you sleep at night and allows you to rationalize a solution that could come with a comprehensive housing plan that is realistic. If it existed, such a plan might put a dent in the unfavorable supply-demand imbalances, demographic pressures, and impact of the labor shortages that will get even worse when the fleets of buses start sending skilled and semiskilled construction workers back across the border. The problem is, there is no such comprehensive housing plan.

Builders are not given to overbuilding in this cycle and very prudently manage their working capital and coordinate their starts cadence with sales rates. Meanwhile, we have seen a mild pop in refinancing activity with the latest reads, but the “locked in” backdrop of sub-4% and sub-3% mortgages remain status quo for existing homes. That keeps single family inventory tight even if existing home inventory is well off the lows. Mortgage rates are down from recent highs but still closer to 7% than 6%. Bottom line: the shelter problem is not going away.

The “Services less energy” YoY metric ticked slightly lower sequentially from +4.8% to +4.6 while “Services less medical care” also declined from +4.8% to +4.6%. Energy and Medical Care will both be on the policy front burner in 2025 with the odds mixed in energy and healthcare alike. For energy, the questions are “Will Trump get oil supply higher?” and” Will Trump slap tariffs on the massive base of crude oil from Canada?” In medical care, the questions include “Will Trump repeal the Affordable Care Act with his small majority in the House and Senate? Will he have a plan or just a concept?” The other question in health care revolves around RFK Jr and can best be summarized as “Huh?”

The above chart updates the Big 5 buckets we look at for CPI. These 5 groupings comprise over 75% of CPI. We include a broader automotive group since Autos consume far more of the household budget than many discuss even if we exclude gasoline (see Automotive Inflation: More than Meets the Eye 10-17-22).

For autos, new and used vehicles may be deflating but the financing costs remain brutal relative to pre-inflation UST curve action. The auto lines add up to more than Medical Care and Energy in the CPI index. If we add in gasoline, Autos as a category is bigger than Total Food and is already bigger than Food at Home even without gasoline included.

The grocery store aisle and the gas pump have always been the enemy of those in the White House (Nixon/Ford, Carter, Biden). Trump should be able to handle oil/gasoline as long as he does not blow up Canadian oil imports. He can drive oil prices lower and the US can become a dominant oil exporter if he plays that process intelligently (see Tariff: Target Updates – Canada 11-26-24).

Medical care is the other major threat to inflation outside the 25% tariff threats (Note: if you are an economist that likes to play semantics with “inflation” just insert “household purchasing power.”). The repeal of the ACA is part of an irrational “I hate Obama” impulse that Trump has displayed for years. The household budget pressure tied to Health Care inflation includes threats to premiums. Auto insurance is bad enough right now on the inflation side. More importantly, the loss of medical coverage for many could cripple household budgets and balance sheets. That will be a big topic for 2025 on how the “price of anything” will get impacted by policy actions – in health care and tariffs alike.

The above chart updates some of the line items near and dear to many households. That brings the total of the two CPI index collections above to almost 87% of the CPI index. In the above, we see Recreation Services rising to +3.5% given the robust consumer sector and job market that kept the US out of recession since the tightening cycle and inflation spike of 2022. In the 6 lines above, we see 4 lines move in a negative direction for YoY inflation and 2 lines in a favorable direction.

When we consider tariff threats, the most vulnerable line is apparel. Life could get very complicated for retailers. If Trump does get oil prices driven lower by supply (that is, Trump does not “tariff” Canadian oil) and his tariffs keep driving down other currencies, the airline bookings will stay strong with jet fuel a major driver of fares and exchange rates making goods and services in other countries cheaper in dollar terms.

Inflation Related:

Payroll Nov 2024: So Much for the Depression 12-6-24

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

JOLTS Oct 2024: Strong Starting Point for New Team in Job Openings 12-3-24

PCE Inflation Oct 2024: Personal Income & Outlays 11-27-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

CPI Oct 2024: Calm Before the Confusion 11-13-24

The Inflation Explanation: The Easiest Answer 11-8-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24

JOLTS Sept 2024: Solid but Lower, Signals for Payroll Day? 10-29-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

CPI Sept 2024: Warm Blooded, Not Hot 10-10-24

Inflation Timelines: Cyclical Histories, Key CPI Buckets11-20-23

Automotive Inflation: More than Meets the Eye10-17-22

See also:

Footnotes & Flashbacks: Credit Markets 12-9-24

Footnotes & Flashbacks: State of Yields 12-8-24

Footnotes & Flashbacks: Asset Returns 12-8-24

Mini Market Lookback: Decoupling at Bat, Entropy on Deck? 12-7-24

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Mini Market Lookback: Tariff Wishbones, Policy Turduckens 11-30-24

3Q24 GDP Second Estimate: PCE Trim, GPDI Bump 11-27-24

New Home Sales Oct 2024: Weather Fates, Whither Rates 11-26-24

Mini Market Lookback: Market Delinks from Appointment Chaos… For Now 11-23-24

Credit Crib Note: Ashtead Group 11-21-24

Existing Home Sales Oct 2024: Limited Broker Relief 11-21-24

Housing Starts Oct 2024: Economics Rule 11-19-24

Mini Market Lookback: Reality Checks 11-16-24

Industrial Production: Capacity Utilization Circling Lower 11-15-24

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

Mini Market Lookback: Extrapolation Time? 11-9-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24