Tariff: Target Updates – Canada

We update imports and exports from Canada as a reminder of what imports might see tariffs and what US exports could be retaliation targets.

Nicest people in the world, but Canadians know how to drop the gloves…

The 25% tariff threat against Canada is perhaps the hardest to explain since Trump’s use of the word “ALL” in his usual all caps social media habit is often materially discounted.

Downplaying the tariff threats comes with risk given the basic game theory. If the market does not take him seriously, why would the trade partners? (hint: since Trump has shown a ready willingness to pull the trigger).

Canada presents a massive import line into the US and notably in heavy crudes for higher-tech refineries (notably in the Gulf) who have invested billions in the ability to process heavy crudes with their price discounts and favorable input cost economics.

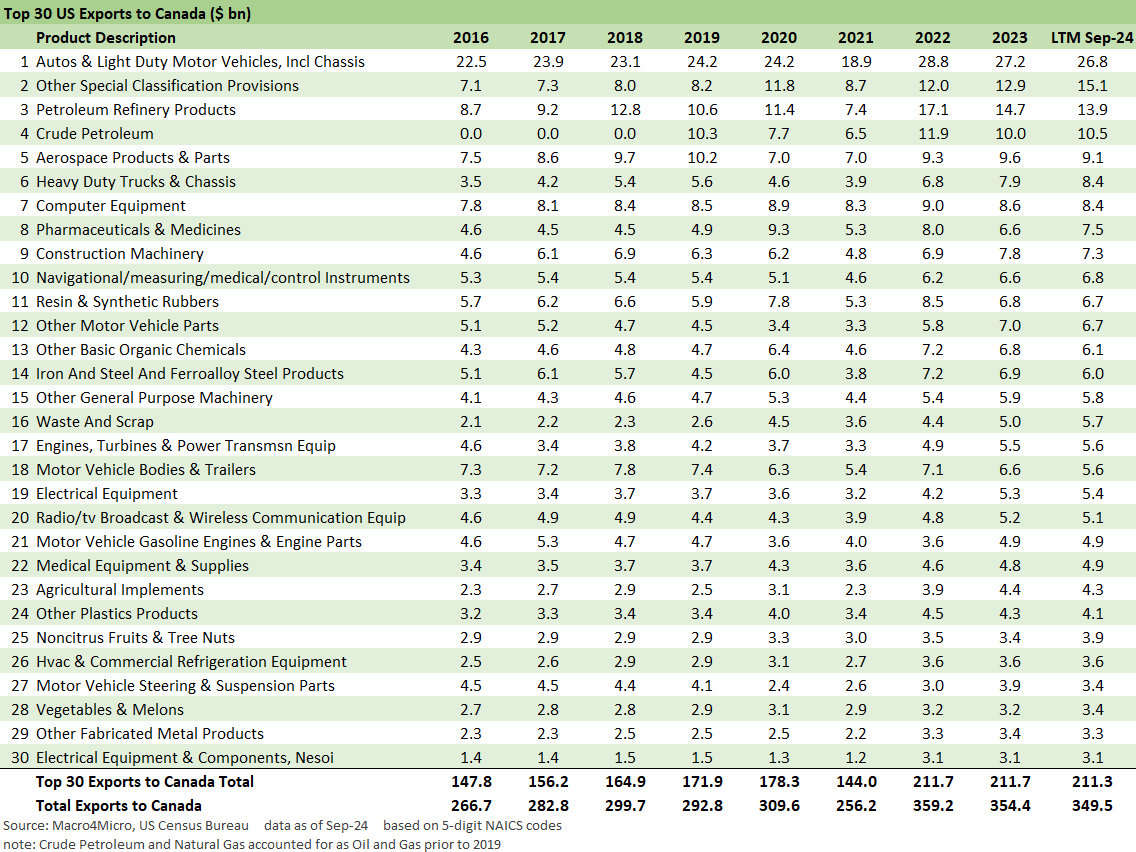

The exports from the US to Canada is a very high value-added mix with our #2 trade partner (behind Mexico) where retaliation would be felt in the US economy.

While there are some loopholes for national security in the new NAFTA/USMCA, the action is likely a violation of the agreement as well as WTO rules (we hear the “Who cares?” in everyone’s thoughts).

We have been watching the tariff issue closely for a long time. We read the original long ago that Clinton legislated in 1993 after Bush struck an agreement in 1992. (reminder: NAFTA was a GOP effort that attracted some bipartisan support including Clinton’s White House). Tariffs and NAFTA/USMCA is a topic that will never go away including waves of activity after the 2016 election and the Trump rework of NAFTA back in 2018 (effective mid-2020). We refer you to the most recent update on Canadian trade after Trump campaigned on a fresh do-over (see Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24).

In this commentary, we just update the import and export lists for Sept (most recent) and pose some questions. The markets get used to saber rattling and shooting in the air by Trump, but the 2018-2019 experience was not favorable with a massive farm sector bailout (dwarfed auto bailout costs), a slide in corporate investment, and a wave of cost increases across steel and metals and components.

If you listen to some channels (Fox this morning) we hear the tariff experience was a great one back in Trump 1.0. It was not (see Histories: Asset Return Journey from 2016 to 2023 1-21-24). The 2018 markets were pummeled and 2019 required Fed easing on weak exports and weak investment (the FOMC said so).

We have simple ambitions in this note since we have plenty of links below for topical material. For now, some obvious questions are in order:

The “conditions” to avoid the tariffs…

The partisans can say “he is protecting us from migration waves and fentanyl” but the natural question is how does anyone stop the fentanyl traffic? (there is not an advertised freight and logistics label on trucks and containers or mules with orange vests with “drugs” emblazoned on the front and back!)

The upcoming deportation program also has more aggressive tariffs attached, so how does Mexico in particular (or Canada) escape tariffs for this first wave of threats or more in the future?

Is the only political recourse for Canada and Mexico to retaliate and challenge Trump to detail the traffic in fentanyl from their countries? The same with China? (after all, if they knew where the fentanyl was coming from, they would stop it). It is a challenge without a means of establishing performance.

The history of drug trafficking and opioids (synthetic from China or the old -fashioned kind from warlord allies in Afghanistan) is a mixed one, so are tariff targets and related demands doomed to fail?

The trade questions…

Will Canada retaliate when Trump warns them not to retaliate (he warned everyone last time) ahead of a Canadian election year? (Canada will retaliate).

Will this 25% tariff apply to crude oil with Canada, who is always by far the biggest oil importer into the US with very attractive economics for US refiners?

What would a tariff on Canadian crude mean for energy inflation given the sheer volumes involved and supply-demand dynamics?

Will Trump pull out the National Security Section 232 angle again for these tariffs since it might allow him to skirt the risk of violating USMCA while allowing him to operate unencumbered with a spineless Congress?

Will this be the “end of the beginning” for the death knell of the WTO?

What will this mean for the ag sector and the inevitable clash of the dairy and cheese interests on both sides of the border?

How badly will the auto chain get hurt across the US-Canadian moving parts with the Detroit 3 and Japan operations in Canada?

What will this mean for US steel and aluminum prices and cost pressures for manufacturers and current order books?

Will the fallout spread to Boeing order books and/or unsettle defense and aero supplier chains?

Will such a threat by Trump discourage future investment in energy in the US and Canada for transport of Canadian crudes after so many setbacks over the years and erratic political behavior? Who would commit capital against that backdrop and history?

The above import list hammers home the massive role played by energy and autos and commodity inputs across chemicals, steel and nonferrous among other more commodity-like categories. The auto round trip supplier chain is especially unsettling when one considers how badly the Mexico auto OEM and supplier chain will get hammered.

To the extent there are ambitions to make the US a dominant energy exporter, a good working relationship with Canada could be crucial as Canadian crude could increase into the US while US crude expands its global market penetration. Canadian crude is severely limited (even if better than past cycles) in its access to tidewater for exports. Team Trump could throw the crude export market wide open with its “climate be damned’ ideology.

“Fortress North America” is a better strategy to close off Mideast oil price risk and insulate from geopolitics (Iran, Strait of Hormuz, etc.) than “Fortress US.” On a side note, Canada is our NORAD partner and part of the chain of command in a scary nuclear age, so maybe someone should slip a large font index card to Trump that says “Canada is our nuclear defense ally!”

The above export list is target rich with a higher value-added product profile not mirrored in trade with Mexico. The US has a lot to lose in retaliation. Manufactured goods and technology heavy products are featured in the top 10, but there is also a lot of two-way traffic in food and ag products that threatens inflation. It is just math.

Let’s see if we can get someone on Team Trump to use the magic words “Buyer pays!” Don’t hold your breath.

We will follow up as more info dribbles out.

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com

See also:

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23

Midyear Trade Flows: That Other Deficit 8-10-23

State of Trade: The Big Picture Flows 12-18-22