Trump at Economic Club of Chicago: Thoughts on Autos

We detail the import lines and Mexico trade flows and consider Trump’s threat to the auto sector as covered in his recent Bloomberg Q&A.

A cartoon moment on tariffs and economics is worth watching in full…

We frame up some objective numbers and trade data to reiterate the fact that tariffs are simple multiplication, paid by the buyer, and any policy position questioning that basic fact is “Looney Tunes.”

Despite Trump’s false statements, tariffs are tied to imports with the amount the “buyer pays” based on an up-front % charge (whether you call it a tax or not). That then creates an economic debate on “who eats that cost” whether it be the buyer at the border or the consumer in the end or any combination between profit margin pressure or price increases to the end market customer.

The Trump factual gaffs in the Economic Club Q&A (where facts were used at all) and the rambling “weave” is nothing new, but the trade partner attacks by Trump on NAFTA/USMCA nations and EU trade hostility are signaling very high risks of trade wars with the top 4 trading partners. That promises massive damage to cost structures and import/export volumes and notably in the auto sector.

The difference between not liking Harris economic plans and framing Trump economic “policies” is that there will be Congressional checks on Harris while the tariff game plan by Trump is effectively his own executive branch “tariff policy dictatorship” free of checks and balances.

Autos as a critical industry and economic driver will pay dearly after the US auto sector has spent decades overhauling global supplier chains to embrace lean manufacturing on a global scale (with a heavy North American emphasis tied to Mexico).

For autos, unit cost pressures from tariffs will need to be recovered through higher prices that will reduce customer affordability and hit volumes. That volume pressure will also throw off the supply-demand balance (less imports from Mexico, Asia, or EU), and that means higher prices in the US. Supply and demand effects on autos was very much in evidence in 2022 (see Automotive Inflation: More than Meets the Eye10-17-22). Worsening trade clashes and supplier chain disruptions with China would undermine production again.

We recommend everyone kick back and watch the Bloomberg interview of Donald Trump from Wednesday’s journey into “the weave” at the Economic Club of Chicago. Anyone who watches it can decide for themselves on the relative factual and conceptual grasp Trump has on the topics and notably in the area of tariffs and trade.

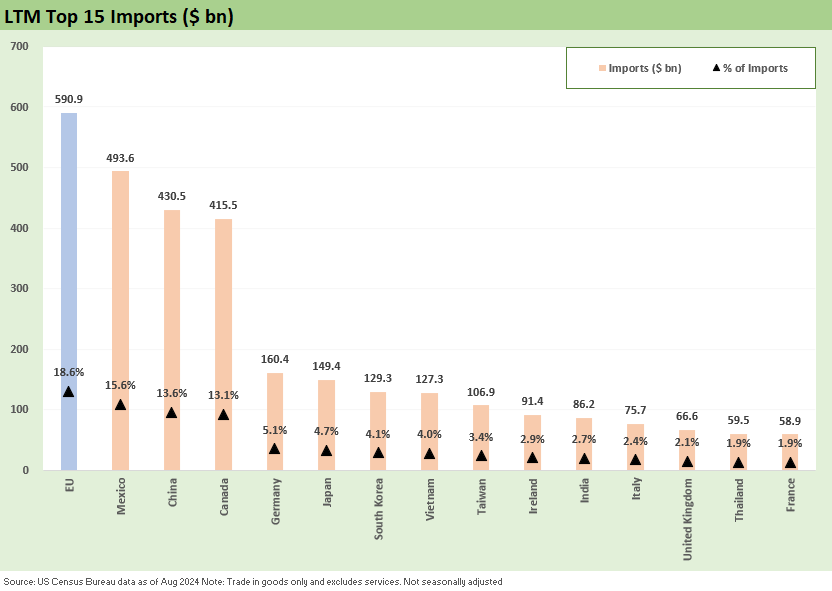

When listening to the Q&A, remember the two lines we plot in the above chart. The higher line (imports) will face a wide range of tariffs. These tariffs are percentages of the border price tag assigned depending on what country those goods come from. There are a whole raft of WTO rules that make the issues very complicated as most favored nation rules of bygone years and exceptions for countries and products tied to trade laws see an army of trade lawyers at work on this black hole topic.

Tariffs are taxes…the GOP said so in 2017.

Under the rule of “keep it simple” the tariff is a border tax. For those who recall the House “BAT tax bill” in 2017 proposed by Ryan and Brady, they basically called that proposal a tax. The BAT tax was designed to replace income taxes with a 20% BAT tax on imports. The Senate laughed it out of the process and did not even consider it. Times change. Trump’s plan is a variation on that ill-fated BAT tax scheme. The word TAX was there for a reason.

Trump is very “creative” in his use of words, but there is no hiding from the use of the word tax in the House 2017 border tax plan. The Democrats chose to use the word “sales tax” on the current Trump tariff plan, but now the application of that word is vehemently denied by the GOP. The Trump tariff plan is worse than a sales tax in our view since that tariff is applied before the sale and is added to the cost of what is “on the shelf” or literally “in the parking lot.”

As we detail below, the main targets are the leading trade partners that comprise almost 61% of US imports. Three are US allies (ex-China) and two of them (Mexico, Canada) are part of a free trade deal that is in imminent jeopardy in 2025 even ahead of the scheduled mid-2026 review by the three countries.

In a world of stressed geopolitics, trade clashes can only make life more challenging. If we add Trump’s attachment to Putin and antagonism toward Ukraine to an EU trade clash, there is room for more damage and a more aggressive response from both sides. EU operates as a bloc and not nation by nation, and they are the #1 trade partner. Trump appears determined to toxify the EU relationship other than Orban in Hungary. We note that Hungary is a negligible US trade partners in total volume with a US-Hungary trade deficit a multiple of the exports to Hungary. His appeal to Trump lies elsewhere.

Tension with China feeds into the historical flash point of Taiwan. We view China as almost a “systemic threat to the cost of sales” line of US manufacturers, service companies and certainly retailers. We update the China import lines in a separate commentary (see Facts Matter: China Syndrome on Trade 9-10-24). For tariff exposure, just look at the import lines in the charts herein and tack on a tariff to come.

For many, the Bloomberg interview at the Economic Club of Chicago was a painful case study on a lack of homework (or basic grasp of facts) on a topic that has been on Trump’s front burner of policy ambitions for almost a decade.

As we heard in the Q&A, we are still at the point where Trump is claiming he collected “hundreds of billions” from China in tariffs. He actually collected zero “from” China. Buyer pays. Some of the fallout from the Bloomberg Q&A session was obscured over the last two days by all the attention to the bizarre 39-minute sway and dance Town Hall Meeting that captured the airwaves. It is better to watch the Bloomberg Q&A for the full effect. You make the call.

The Trump performance should be a worry to anyone with close economic ties to the auto industry beyond the manufacturing chain since the economic effects flow into the services world of auto retail, freight/logistics, finance, and insurance. The array of economic multiplier effects tied to auto volumes and manufacturing is impressive in scale.

In such an emotionally charged, polarized political environment and a misinformation-filled round of economic debates, sometimes the increasingly obvious gets obscured. That is why some objective import and export lists with numbers can often cut through the BS (that is not “balance sheet”).

Autos lead the import ranks, so this is a major risk factor…

As we see in the chart below, Autos rank at #1 for imports into the US based on “trade with the world” just ahead of Pharma & Medicines. The realities of luxury imports (EU and Japan) and Canadian imports in the auto chain are also a big part of the story, but we will narrow in on Mexico for today. We are not looking to make the world safe for Land Rover customers and “Beamer Buyers”. The biggest worry is the North American flows of vehicles and supplier chain activities and the disproportionately high level of China supplier chain risks.

From our standpoint, the biggest threat is against autos produced within the USCMA and how Trump’s plan could end up as a global supplier chain assault that will derail Tier 1,2, and 3 suppliers. That plan could squeeze profitability of US-based OEMs and US based suppliers who rely on non-US suppliers for unit cost management.

“Suppliers to the suppliers” (the Tier 2, 3 suppliers) could face tariffs, and that needs to get passed on to Tier 1 suppliers and OEMs. In that scenario, OEMs have a long history of saying to the supplier “that’s your problem” and then the supplier gets crushed by OEM inflexibility, tariffs, and supplier chain breakdowns or supplier financial stress (or collapse). We have seen it before. That risk is more acute in a cyclical downturn.

Discussions of tariffs used to be a simple and obvious economic analysis. The topic now generates so much bile and discord given their importance to Trump that it drives many extreme elements into willful ignorance of basic economic facts. We can probably expect bumper stickers that say, “Jesus loves tariffs.” (I wish I was kidding). Just look at the import lines above and mark them higher as a cost with tariffs.

Remember, Trump has even discussed across-the-board tariffs on every import. The more worrisome idea is he uses exceptions/exemptions as patronage in a Putin-esque process of demanding support. We saw that on a small scale in his last term. All of these decisions will be controlled by the executive branch. It also offers a means to influence the behavior of House Reps and Senators.

The flow of light vehicles (LVs) tie into regional production, narrow US production, and imports. The US sales mix YTD through 9 months (Source: Auto News) shows around 75% of sales from domestic volumes (including domestically produced non-US nameplates from the transplants) and 25% imports. The volumes feed auto retailers (including parts and services), who as an industry group employ more than auto manufacturing.

The effects flow into such subsectors as financial services, freight and logistics providers, auto insurance operations, construction (think EV assembly and battery plants in this market), mining (think lithium and other metals), and steelmakers (think higher quality flat rolled steel for use in the US, Mexico, and Canada) among others. Autos is a major economic subsector to be applying radical economic distortions with so much embedded investment and financial stakes including millions of employees directly and indirectly impacted.

Mexico as the #1 importing nation…

We had already reviewed the trade partner risks and the basic issues at stake in other recent commentaries (see Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24, Facts Matter: China Syndrome on Trade 9-10-24, The Debate: The China Deficits and Who Pays the Tariff? 6-29-24).

We are not relitigating whether trade deficits are good or bad or whether Trump even understands the basic concepts (he does not). We have addressed those in the past. We are updating some lists and posing some questions to consider. The importance of autos and tariffs are intuitive just given the trade ranking of autos and multiplier effects of auto manufacturing cycles.

The trade partner concentration always comes back to Mexico and Canada as the legacy NAFTA partners (now USMCA), the EU as the #1 bloc in both imports and exports, and China as the #2 importing nation behind Mexico. As a trade partner, Mexico has taken over the #1 spot as a nation (treating EU nations on a stand-alone basis).

With a 6-year review of the USMCA slated for a mid-2026 timeline and Trump already threatening to withdraw from the deal, there will be a lot of economic reality that could come home to roost during 2025. How the market will factor those risks into pricing will get closer to being handicapped subject to election outcomes in the White House, Senate and House. The issue on tariffs is that all Trump needs is the White House. Harris needs Congress for her agenda.

The commentary we have heard in the past and in more disjointed form during the Chicago Economic Club session was in line with the usually glaring factual inaccuracies. What was again in evidence was Trump’s clear ignorance of how the industry has evolved after hundreds of billions in capex and realignment of global supplier chains across the decades.

If we asked him if he read The Machine That Changed the World, he would likely say “Sure, my autobiographies.” In fact, the supplier chains cannot be erased quickly without cataclysmic fallout for many companies along the supplier-to-OEM value chain. With COVID, we have recently seen what broken and damaged supplier chains can cause – pricing distortions and inflation.

Mexico back in Trump’s crosshairs…

In the next chart we add some details in what gets produced in Mexico. We lift the information from Automotive News. At the very least, it demystifies the automakers involved, their relative share of production, and what they produce there.

The main point is the legacy “Big 5” of Mexico are there in scale. That big 5 of Mexico in production has been comprised of GM, Nissan, VW, Chrysler (rolled into Stellantis), and Ford. We also see other Japanese OEMs (Toyota, Honda, Mazda) and Korean transplants (Hyundai/Kia) with a smaller European presence (BMW, Daimler).

The chart frames YTD Mexico production through August for those players.

When looking at this lineup, we can consider the many subsectors (dealers, finance & insurance, freight/logistics, suppliers, etc.) that are touched by this production base in Mexico. As noted, that volume YTD on Mexico is almost triple that of Canada. The legacy US players are a major factor in Mexico with GM sitting at #1, Ram/Jeep at #4, and Ford at #5.

The economics of labor costs (wages and benefits) have always been the critical driver of the cross-border dynamics. That “labor arb” is why migration of NA capacity to Mexico by the UAW based US players has always been so contentious with the progressive wing of the Democratic party (think Sanders).

Now the growing base of more nativist, isolationist, and anti-immigration segment of the GOP (think Trump) has piled on as well. The fact that 2 out of 3 of the Detroit 3 had to file Chapter 11 does not come up much since it is bad politics. The result over the decades was a massive downsizing of UAW-based capacity and capacity growth in Mexico.

Mexico trade with US in intertwined with US auto chain…

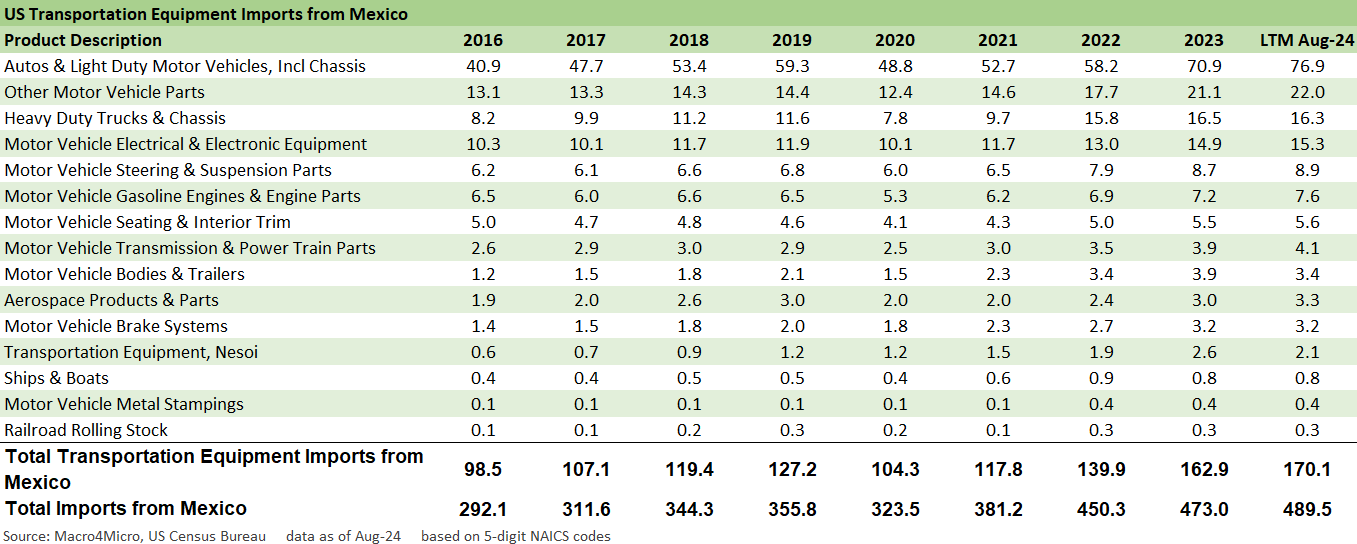

Below we include the latest total import checklist for Mexico showing automotive vehicles and chassis at #1 by a multiple. The two-way traffic (imports and exports) of line items related to vehicles goes well beyond the #1 line and cuts across product groups from materials (chemicals, metals, steel) to a range of supplier products.

That all means the stakes in how tariff policy plays out from here are high. With such economic risks, a President should not be light on facts and anorexic on concepts. For starters, he should know the “buyer pays.” Most journalists who speak with him fear asking the direction question: Who pays? The buyer or seller? That is the equivalent of “Does 2+2=4?” The impact of the tariff is separate and more a judgement call. Who pays is a fact.

He should know that higher costs mean less profits or higher prices. If capacity gets downsized in Mexico and less capacity is destined for the US, then a stable base of demand in the US (or higher demand) means higher vehicle prices. It is not rocket science, and we have recent examples in 2022. It does not take a dazzling memory to think back to 2022 vehicle inflation – new and used.

A glance at the total imports from Mexico above shows a heavy weighting of motor vehicles lines (4 of the top 6) and more as you move down the across the Top 30.

A narrower mix of transportation product flow…

The list further below shows how high components are on the list across multiple lines. We can see how obvious it is that unit costs for a wide range of US OEMs across the legacy Detroit 3 (Stellantis as Chrysler stand-in) and the transplant belt will feel the economic impact.

The chart below breaks the imports from Mexico into more narrow product lines for transportation related imports. These are not small numbers if Trump starts tacking on tariffs. Trump is still not quite waking up to the fact that buyers of these products on this side of the border pay the tariff – not Mexico. That means the Tier 1 supplier (if buying from Tier 2 or Tier 3 in Mexico) is getting pressured on costs and needs to eat the cost or pass it along in prices.

Below we frame the more narrowly defined product lines tied to transportation that are worth considering in context.

The above chart covers the imports in the transportation related sector and the chart below looks at exports to Mexico in transportation equipment. Once again, we see the same theme of back and forth that we also see with Canada (another country for another day on our northern neighbors).

We see auto parts right at the top as the US sends part south to exploit the “labor arb” when south of the border has an abundance of labor that will work at hourly rates in the low to mid-single digits per hour. Again, this gets back to an all-new cost structure for the supplier-to-OEM chain.

The retaliation topic also lurks. When Trump tariff policy throws this many Mexican workers under the bus, the response from Mexico will be tied to domestic sentiment. Anger will rise, and there will be economic pain for many on both sides. The mass deportation demands will inflame the situation, and there is every reason to see a rising probability of the USMCA review breaking down entirely. That uncertainty affects capex planning. We saw that in 2018-2019. This time will be worse.

The export side of the equation for transportation equipment tells a simple story. There are a lot of jobs and economic interests on the line in the mix of products crossing the border in both directions. Many of those exports end up in vehicles that come back north.

Here are a few questions for those researching the policies and for Trump to ponder (which he clearly never has):

If you scale back – or shut down – some of these plants in Mexico, the lead time to replace with US capacity will be quite lengthy (if it happens at all, hold that thought).

With less vehicles for a given demographic demand, what happens to the price of cars when you reduce the supply of vehicles? (Hint: prices rise, see auto inflation in 2022).

Will the tariffs help or hurt the US companies that own suppliers that sell to those plants in Mexico or have subsidiary operations in Mexico? (Hint: it will hurt).

Since many of the more sophisticated tech-intensive systems that involve round trips of imports and exports back and forth across the US and Mexico border, will tariffs on the journey of those parts increase costs or decrease costs? (Hint: it will increase costs).

If those same component systems also include flows of products from China to the US, will the tariffs on China combined with the tariff on Mexico increase unit costs (Hint: yes).

With the US steelmakers as major suppliers of flat rolled steel to Mexico auto operations, will less demand in Mexico hurt those steel producers? (Hint: yes, it will hurt them).

Will the attacks on the Mexican auto sector lead to a broader set of actions that set off a trade war with our largest importing nation that borders some critical state economies (TX, NM, AZ, CA). We should highlight 3 of 4 of those border states (ex-CA) were major supporters of NAFTA in Congress back in 1993 legislation.

Total exports to Mexico…

The next chart gets into the total US export picture to Mexico. The relative range and scale of the targets are more limited in what Mexico can aim at relative to the US. Various ag sector lines will be on the list as always. Mexico needs the refined products and natural gas, but as anyone can see in these charts, there is a critical supplier chain and finished goods cycle between the three USMCA partners that will be badly disrupted. We saw what that fallout looks like in the COVID supplier chain disruptions and inflation.

The more limited range of targets is in contrast to the EU, who is #1 for both imports and exports and operates as a bloc. In the case of Canada, which we will cover in a separate piece, the US has a very high value-added mix of exports to Canada that can be targeted.

In fact, the US has a trade surplus with Canada ex-crude oil. We will look at the northern tier of the USMCA in a separate commentary. In the trade war scenarios, countries such as Mexico and China are more about a “systemic impact on the cost of sales line” and the intrinsically disruptive effects on “supply” in a world where such problems have been shown to bring inflation.

The supply of US exports to Mexico tied to the auto chain (notably auto parts, semis, steel, fabricated metals, chemicals, rubber products) will decline as the US puts the squeeze on the Mexico business lines. That will be a self-inflicted decline in exports for the US, but more will drop off in the retaliation process.

It is easy enough above to follow the bouncing ball and pick a damaged party in the likely trade wars. Trump is seeking an unconditional surrender of large swaths of non-US industry that no political leader in other countries (or trade bloc such as the EU) can submit to given domestic political realities. Everyone will lose, but Mexico will lose more. The entire foundation of the USMCA with Canada also starts to change, and certainly Mexico can embrace China where possible (Canada has a bad relationship with China).

The WTO would effectively be “toast” as a functioning entity in such a scenario, so that means chaos reigns (and tariffs pour) with the EU historically more attuned to the WTO. Take those gloves off, and the EU can counter more immediately and aggressively. If the USMCA breaks down, then Trump naturally turns his trade ire on China and the EU, the #1 trade partner with the US on both the imports and exports. Those topics are for another day.

This is a draconian scenario, but Trump’s policy positions offer visibility to such an outcome. He has driven Senators out of office for even questioning tariffs. He continues to insult some of them, and those GOP Senate alums are much smarter about economics than he is.

The stock market is hitting new highs, so that raises a separate debate on what is factored in or not factored in on such a policy mix. I cannot remember hearing anyone say, “I have a trade war and tariff-driven inflation in my forecast.” More likely, the lack of follow through on such tariff threats is in the equity markets and credit spread lows. That entails a leap of faith in Trump’s judgement.

Contributors:

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macr04micro.com

See also:

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23