Footnotes & Flashbacks: Asset Returns 4-6-25

We frame a brutal week across debt and equity returns as the market gears up for a lot more questions needing answers.

House of Tariffs. More pain to play…

We already posted a detailed rant on the state of affairs in the world of dysfunctional, ill-conceived tariff rollouts and ensuing pain in our not-so-mini Mini Market Lookback: A Week for the History Books (4-5-25). We will thus be brief in this note, and we refer you to that commentary for more on tariff issues and the lasting damage being done.

A big difference this week in asset returns was the very ugly spike in credit spreads at +98 bps. Over 1-month, gross spreads rose and quality spread decompression hit the markets sharply with HY at +157 bps wider with the CCC tier wider by +325 bps, the B tier at +180 bps and BB tier at +114 bps.

The low quality and embarrassing lack of analytical depth in the reciprocal tariff process was also a major sentiment shaper even if the breadth and numerical scale of the tariffs are the main event. We would note that every nation with a trade pulse got hit…ex-Russia and ex-Belarus of course (see Reciprocal Tariff Math: Hocus Pocus 4-3-25, Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25). The sentiment was basically “if they were this light on rigor and research, you just can’t trust the process or the people.”

The Trump Tariff cost impacts will translate into reverberating economic effects including higher costs, cost reduction strategies (including layoffs) to mitigate the pain (already seeing them on screen), higher prices and lower volumes (side order of elasticity anyone?).

Meanwhile, we have a raft of major product group tariffs under review across pharma, semis, lumber and copper among those that are major trade lines (especially Pharma with the EU). Those will be in a rolling process of headlines on tariffs and will bring more retaliation.

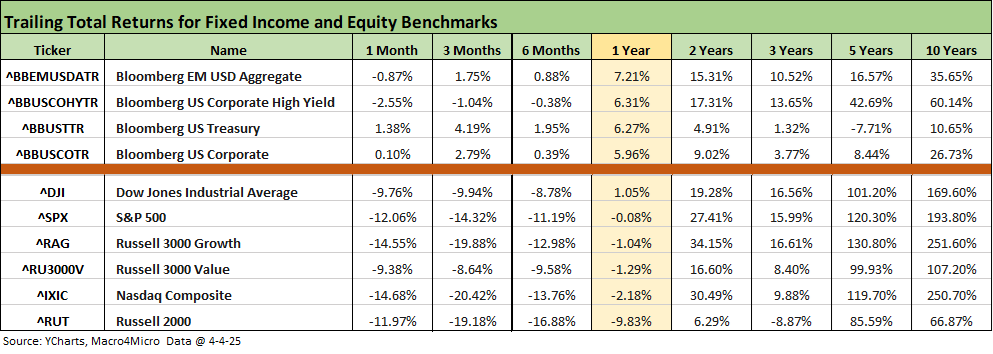

The above table updates the running time horizon returns for the higher-level debt and equity benchmarks we monitor. The short form is as follows: duration won, fundamental risk pricing and valuation lost.

The UST curve story for FY 2025 is more complex than the odds-on handicapping of 5-6 cuts showing up on the screens. The flow-through impact on prices and stagflation scenarios could complicate that theme. More asset allocators will be scrambling to go back and review the Volcker stagflation thought process after the Burns/Miller whiff and what happened when they failed at “finishing off” inflation.

As we covered in our commentary yesterday, the Powell presentation was looking at good jobs numbers and inflation well above target. So he is not doing anything for now and especially with a mildly adverse move in Core PCE in the recent release (see PCE Feb 2025: Inflation, Income, Outlays 3-28-25). Trump will keep hammering him, but this problem is on Trump trade and fiscal policy. The FOMC will stick with its mandate and the data – as it should. Trump should be singing “Rescue Me” in the middle of 5th Avenue rather than insulting Powell.

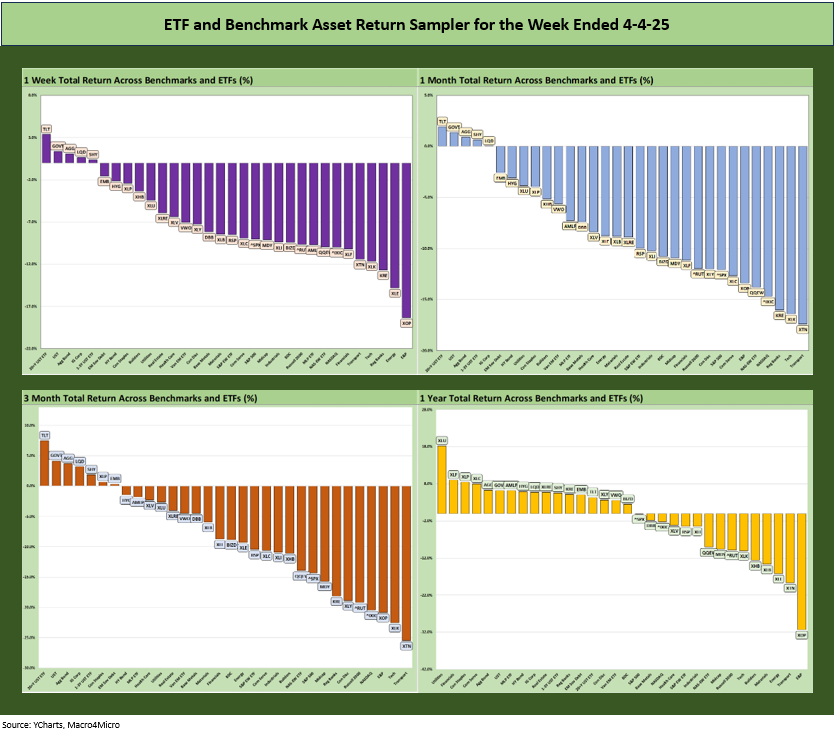

The rolling return visual

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of the trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

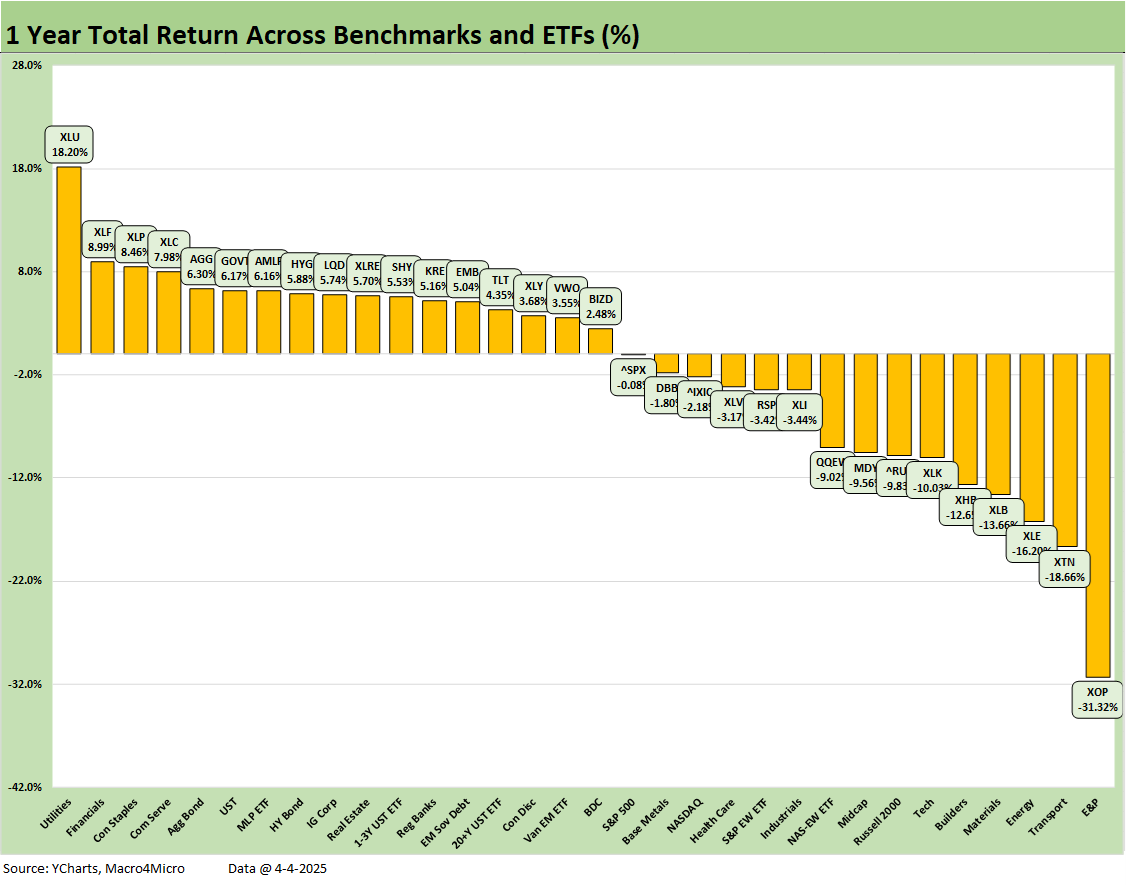

The shift in the symmetry is easily seen relative to past weeks with the 1-year timeline finally moving sharply to the right with a 17-15 score from the 30+ positive a short time ago.

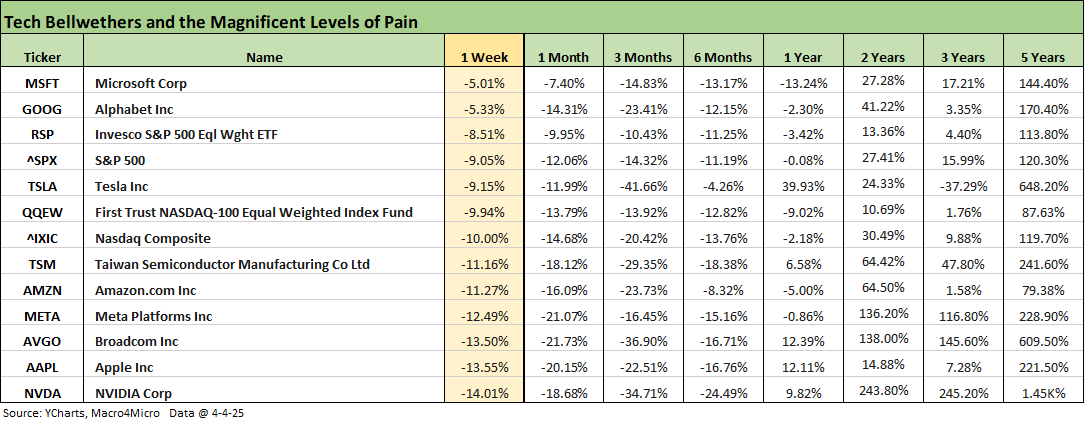

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

We looked at this chart in yesterday’s commentary, and there is very little mystery in the results plastered all over the screen and headlines this week for the tech meltdown. As a reminder, the company stocks and benchmarks are lined up in descending order of total returns for the week. All negative returns for 1-week, 1-month, 3-months, and 6-months make a statement. We also see a mixed bag for 1-year with Mag 7 names showing 4 of 7 negative. We’ve already seen some wags renaming the Mag 7 the “Maleficent 7.” The names will get worse from there.

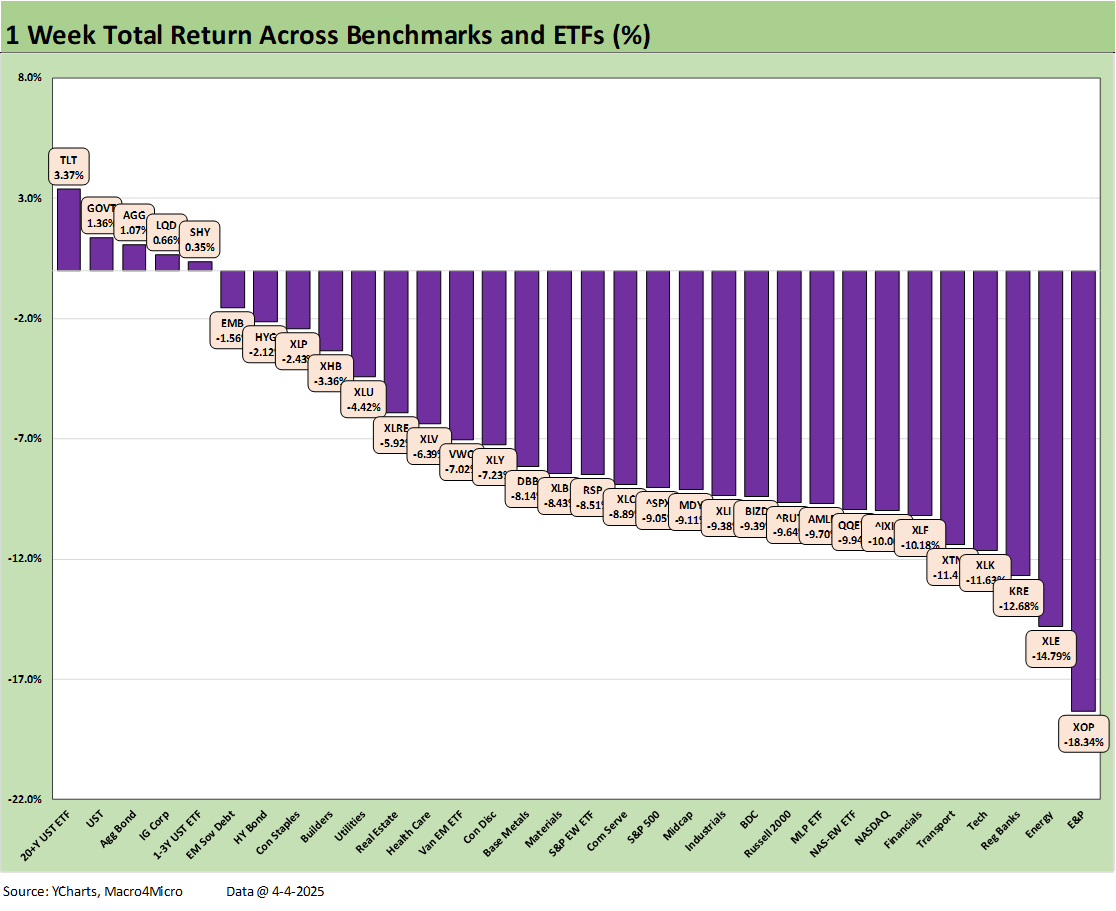

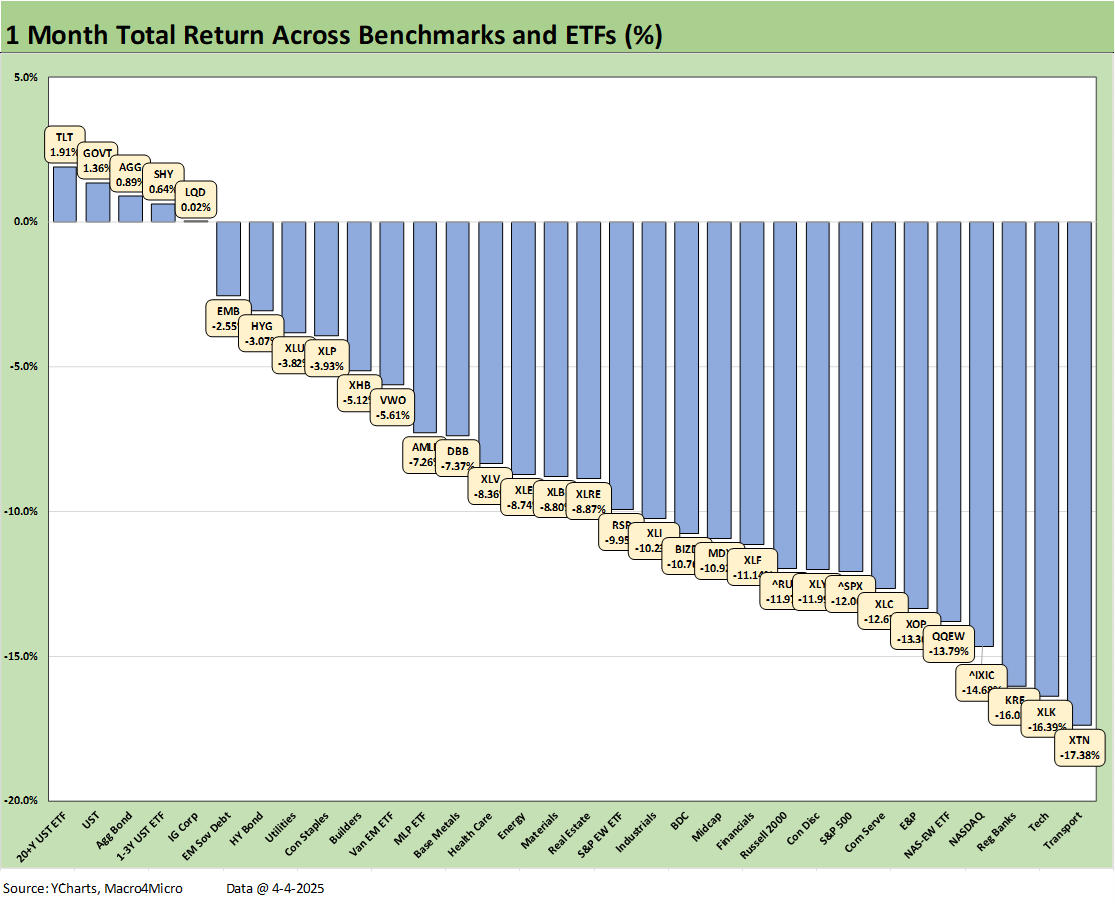

We looked at the 1-week numbers already in Mini Market Lookback: A Week for the History Books. The Hi-Lo range for the week from #1 to #32 was almost 22 points. The median return across the 32 for the week was around -8.5%. The bottom quartile saw 7 of 8 in double-digit negative range.

The 1-month score is 5-27 with the only positive returns in bond ETFs and the long duration UST ETF (TLT) at #1. The 7 bond ETFs hold the top 7 spots with only Utilities (XLU) making the bottom of the top tier. The entire bottom tier posted double-digit negative returns. We see 6 of 8 in the third quartile in double-digit negative range.

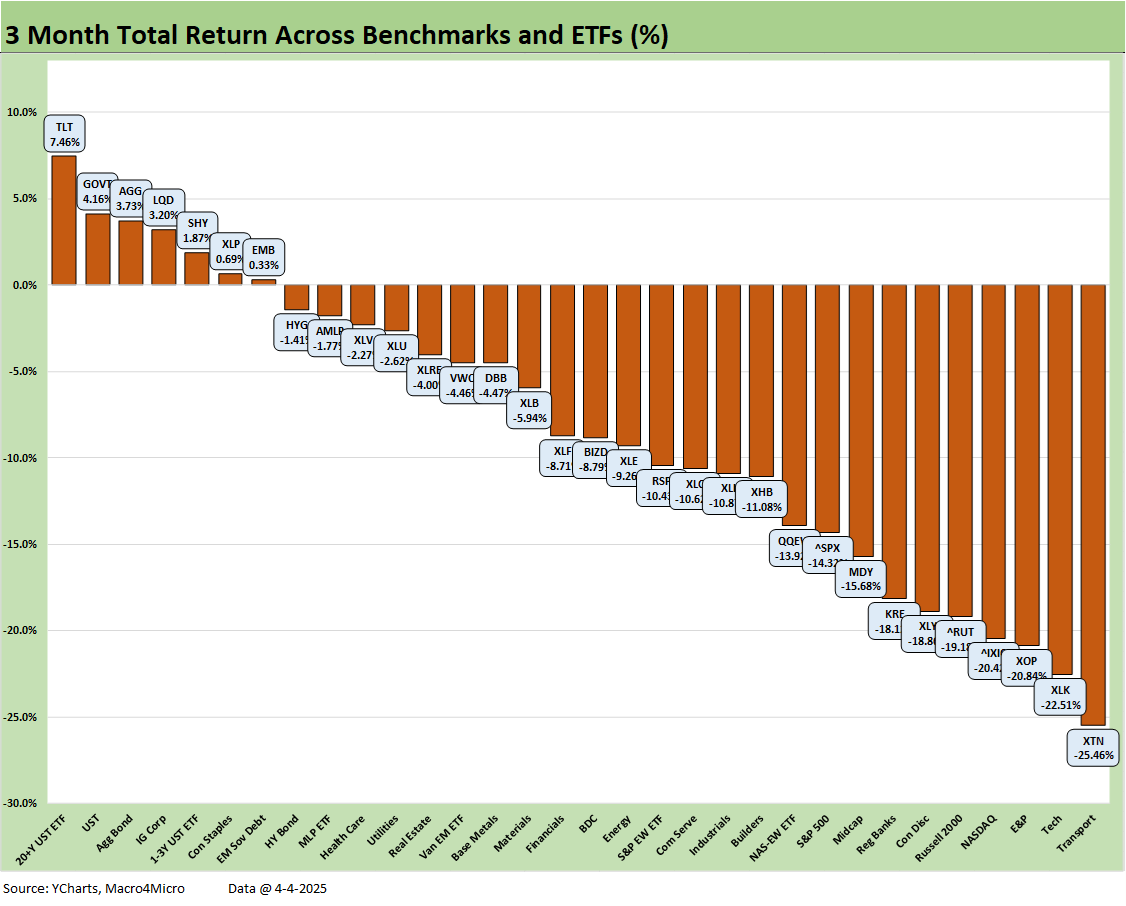

The 3-month returns show 7 of the 8 in the top quartile comprised of bond ETFs and even HY ETF (HYG) despite the spread widening. The UST curve and coupons have ruled in credit. The only equity-based ETF in the top quartile was the defensive Consumer Staples ETF (XLP).

In the bottom quartile, we see the top of that group (Midcaps) at -15.7% and the bottom of the 32 is Transports (XTN) at -25.5%. Given the cyclical nature of XTN constituents, that is grim. Just ahead of XTN is the Tech ETF (XLK) with E&P (XOP) 3 off the bottom, NASDAQ (IXIC) is 4 off the bottom, and the small cap Russell 2000 (RUT) is 5 off the bottom at -19.1%. Regional Banks (KRE) are in the bottom quartile, so that is a very bad sign of low confidence even after all the deregulation buzz had generated a post-election bank rally.

The median returns across the 32 is around -8.7%. NASDAQ, Small Caps and Midcaps are all in the bottom quartile with the S&P 500 sitting on the bottom of the third quartile. With broad benchmarks all in the tank, it is worse than it looks in terms of the breadth of pain.

The magnitude of the weakness in 2025 is showing up in the trailing 1-year returns. It was not long ago we were at 32-0 and numerous weeks of 31-1 and 30-2. The 1-year score is 17-15. The median for the 32 is a meager +3.0%. The major benchmarks are all negative with Russell 2000 and Midcaps in the bottom quartile and NASDAQ and S&P 500 in the third quartile.

The winners in the top quartile are still Utilities (XLU) at #1, Financials at #2 (XLF), Consumer Staples (XLP) #3, Communications Services (XLC) at #4, and then we move into bond ETFs for the rest of the top quartile.

See also:

Mini Market Lookback: A Week for the History Books 4-5-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25

Credit Snapshot: Taylor Morrison Home Corp (TMHC) 4-2-25

JOLTS Feb 2025: The Test Starts in 2Q25 4-2-25

Credit Snapshot: United Rentals (URI) 4-1-25

Footnotes & Flashbacks: Credit Markets 3-31-25

Footnotes & Flashbacks: State of Yields 3-30-25

Footnotes & Flashbacks: Asset Returns 3-30-25

Mini Market Lookback: The Next Trade Battle Fast Approaches 3-29-25

PCE Feb 2025: Inflation, Income, Outlays 3-28-25

Auto Tariffs: Questions to Ponder 3-28-25

4Q24 GDP: The Final Cut 3-27-25

Durable Goods February 2025: Preventive Medicine? 3-26-25

New Homes Sales Feb 2025: Consumer Mood Meets Policy Roulette 3-25-25

KB Home 1Q25: The Consumer Theme Piles On 3-25-25

Lennar: Cash Flow and Balance Sheet > Gross Margins 3-24-25

Mini Market Lookback: Fed Gut Check, Tariff Reflux 3-22-25

Existing Homes Sales Feb 2025: Limping into Spring 3-20-25

Fed Action: Very Little Good News for Macro 3-19-25

Industrial Production Feb 2025: Capacity Utilization 3-18-25

Housing Starts Feb 2025: Solid Sequentially, Slightly Soft YoY 3-18-25

Retail Sales Feb 2025: Before the Storm 3-17-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

JOLTS Jan 2025: Old News, New Risks in the Market 3-11-25

Credit Spreads Join the Party 3-10-25

Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25

Payrolls Feb 2025: Into the Weeds 3-7-25

Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25

Gut Checking Trump GDP Record 3-5-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Asset Returns and UST Update: Pain Matters 3-5-25

Mini Market Lookback: Collision Courses ‘R’ Us 3-2-25

Tariff and Trade links:

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Stop Hey What’s That Sound? 4-1-25

Tariffs are like a Box of Chocolates 4-1-25

Auto Tariffs: Questions to Ponder 3-28-25

Fed Gut Check, Tariff Reflux 3-22-25

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23