Industrial Production Feb 2025: Capacity Utilization

The manufacturing sector posted some favorable sequential numbers ahead of the tariff dislocations on the horizon.

Is motive power belching or blinking?

Capacity utilization ticked higher at the headline level during Feb 2025 and posted favorable sequential moves for total industry, total manufacturing, durables, and nondurables.

Motor vehicles posted the best sequential move among major industry lines. Unfortunately, tariffs heighten disruption risk as the year proceeds. The auto supplier-to-OEM chain will be subject to supplier chain financial stress, trade partner retaliation, strike risk (irate assembly line workers) and potentially semiconductor shortages tied to Trump policies.

In the interest of long-term plans to encourage investment in US manufacturing, the passport to paradise involves crippling some supplier chains and ignoring the views of manufacturers based on the theories of some B Team economists.

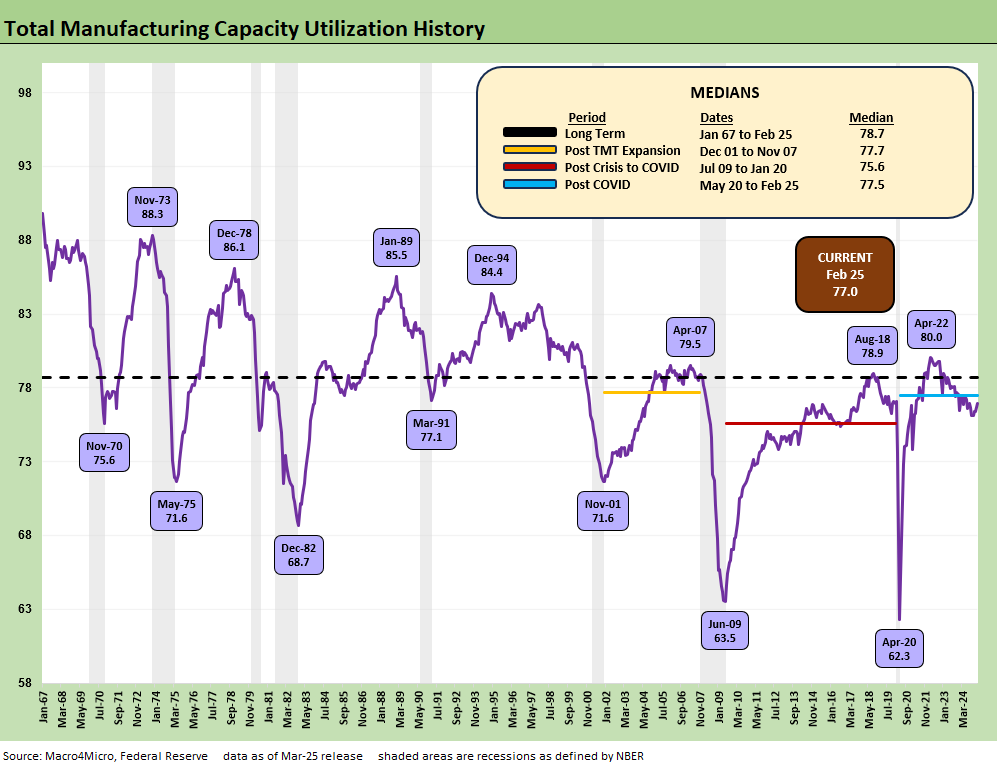

The above chart updates the time series for total manufacturing capacity utilization. We see a sequential uptick from 76.4% in Jan 2025 to 77.0%, which is still well below the long-term average of 78.2%. The 77.0% rate frames up well vs. 2H24 numbers. The peak utilization was seen in spring 2022 ahead of the tightening cycle impacts.

The higher-level buckets in the Total Industry mix are detailed above. It offers a reminder that we had a steady but unimpressive set of manufacturing metrics in 2024. They are holding for now. We break out the deltas for MoM on the right. The MoM numbers show positive sequential variances with the exception of Utilities. Durables performed well MoM.

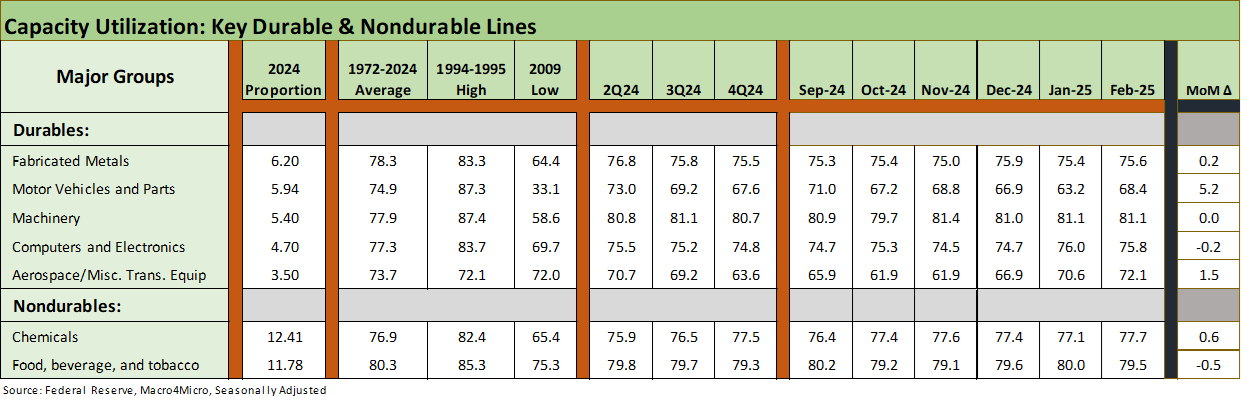

The above chart breaks out the largest of the Durable and Nondurable groups. We see 3 of the 5 durables industries posting positive variances MoM with Machinery flat and Computers and Electronics slightly lower.

The above table updates the capacity utilization history for expansions and recessions. The ability of more companies to generate solid profits at lower capacity utilization in today’s markets is tied in part to automation and in part to the development of low-cost supplier chains. Low-cost supplier chains are now fatally threatened by tariffs.

Those supply chains had comprised the risk mitigating structural advantages of global sourcing that are about to be shredded. The new policies are based on a highly speculative concept of how tariffs will translate into mass investment in the US to reshore and expand while customers scrap their offshore supplier base. That will unfold with the risk of what the policy architects have described as “mild disruptions” and a “little pain” with some backpedaling on recession probabilities (that was not the campaign story line).

The topic of low-cost supplier chains has been a challenge for Trump to grasp the concepts, and his tariff policies will serve to raise breakeven volumes again on higher unit costs. That means the buyer of the supplies will see the cost of sales rise, which in turn requires the “buyer” (who pays the tariffs) to raise prices or take out other costs to preserve margins. We have covered these topics in detail (see The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25 and the Tariff Links at the bottom of this commentary).

The above chart details expansion and recession averages and lines them up by height as a frame of reference. We see the current level on the left. We see current utilization below a number of recession periods. That was acceptable with lower cost supplier chains. For many companies, those days are numbered given the tariff game plan.

See also:

Footnotes & Flashbacks: Credit Markets 3-17-25

Footnotes & Flashbacks: State of Yields 3-16-25

Footnotes & Flashbacks: Asset Returns 3-16-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

Trade: Betty Ford Tariff Wing Open for Business 3-12-25

CPI Feb 2025: Relief Pitcher 3-12-25

JOLTS Jan 2025: Old News, New Risks in the Market 3-11-25

Credit Spreads Join the Party 3-10-25

Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25

Payrolls Feb 2025: Into the Weeds 3-7-25

Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25

Gut Checking Trump GDP Record 3-5-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Asset Returns and UST Update: Pain Matters 3-5-25

Mini Market Lookback: Collision Courses ‘R’ Us 3-2-25

PCE Jan 2025: Prices in Check, Income and Outlays Diverge 2-28-25

Durable Goods Jan25: Waiting Game 2-27-25

GDP 4Q24 Second Estimate: PCE Inflation the Main Event 2-27-25

New Homes Sales Jan 2024: Homebuilders Feeling Cyclical Signals? 2-26-25

Existing Home Sales Jan 2025: Prices High, Volumes Soft, Inventory Up 2-21-25

AutoNation: Retail Resilient, Captive Finance Growth 2-21-25

Toll Brothers 1Q25: Performing with a Net 2-20-25

Herc Rentals: Swinging a Big Bat 2-18-25

UST Yields: Sept 2024 UST in Historical Context 2-17-25

Tariff links:

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24