Mini Market Lookback: A Week for the History Books 4-5-25

This week will be one of those “live in infamy” moments, and history will not be kind. Neither was the market.

I’m not gonna hurt ya, I’m just going to bash the economy!

The pain from tariffs has been excruciating for markets with the foundation of the Trump Tariff program immediately rejected by equity and credit markets, and for good reason. The “tariff pitch” from Trump ignores the reality that the “buyer pays” and someone at some point has to bear the cost along the chain of events from seller to supplier to retailer to customer. So it is flawed from the start.

The sad part to come is the actual transaction level reality that will bring higher prices, higher costs (from raw materials to inventory), diverse strategies to address higher costs via layoffs, and operational restructurings to offset the tariff damage – if possible.

For bankers, IPOs will get paused and M&A faces strong headwinds as deals get revisited while valuation variables get reworked. With markets awaiting more retaliation and new tariffs in process, there are some big unknowns (semis, pharma, copper, lumber, etc.).

Selling an ideology and generating political support from emotional attachments by fostering hatred and bigotry has plenty of history across nations, but the dismal science of economics is not easily swayed and the stark, unforgiving discipline of double-entry accounting will record the costs and the price changes.

The worst is ahead at the transaction level as more tariffs roll in and the policies show up in sea level purchases, the buyer pays the tariff on the sellers’ price (some may be partially absorbed by sellers), and then the market will see how the tariffs flow along the transaction chain from there. Real dollars and real events and not White House selling points will rule at that point. The facts will matter as much as some parties will seek to deny and distract.

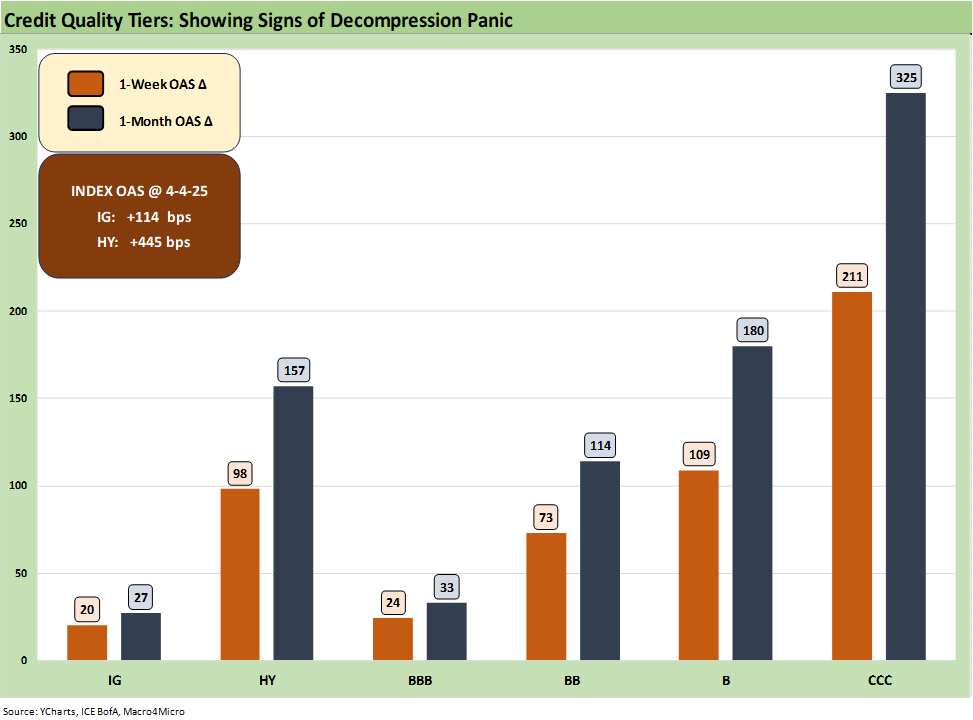

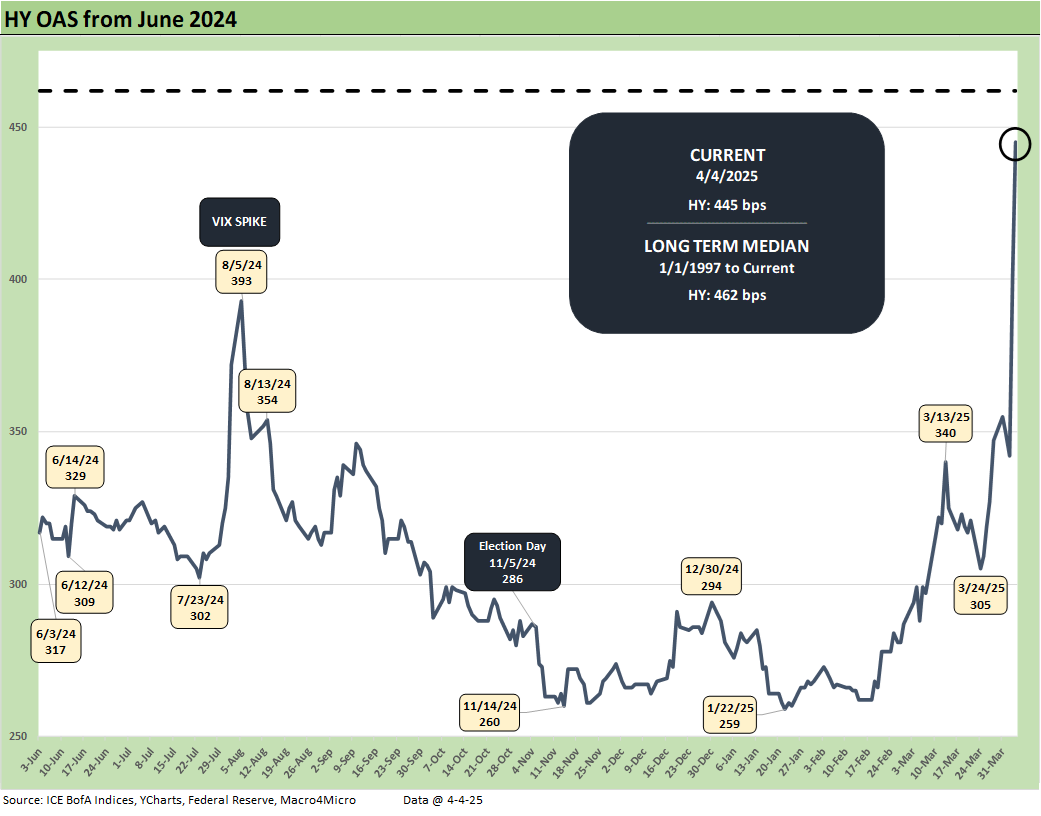

The above chart shows the spread deltas of the past week and past 1-month timeline. HY OAS has blown out by +157 bps over the last month and at +445 bps is just under the +462 bps long-term median. That is a sharp contrast with HY OAS being in the June 2007 spread bubble band less than a month ago (Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25).

The risk pricing moves make a clear statement that the equity market worries have now infected the less volatile credit markets as Trump took speculation and turned that into objective policy decisions. Even if the final form and exact numbers are still being formulated, it only gets worse from here with more product group tariffs and more retaliation.

We see materially wider credit spreads and proportionately higher pricing decompression along the credit tiers with the CCC tier now well into the equity return range at just under 15% yields when we roll CCC spreads up with a rallied yield curve. The spread wave has started to infect IG as well.

Credit sending signals to equities…

For the “buy the dip” crowd in equities, there are plenty of reasons to be worried given the scale of the attack on global trade, product pricing, and uncertain demand fundamentals after the “buyer pays” (Trump still says the seller pays). Supplier chains and consumer product heavy markets will get pummeled. The major OEMs at the end of many durable goods product chains will have expenses to eat, offset, or pass on and important decisions to make.

Non-public small business entities did not get as much airtime as they deserved since it was easier to point at the Russell 2000 with its return just below -10%. The small private companies are the type that get hit with credit contraction. They are also major employers across the country. They have supplier chains also and are in harm’s way. Small retailers will see the “cost of sales” line soar if they had low cost purchasing practices (like most rational, well-run operations).

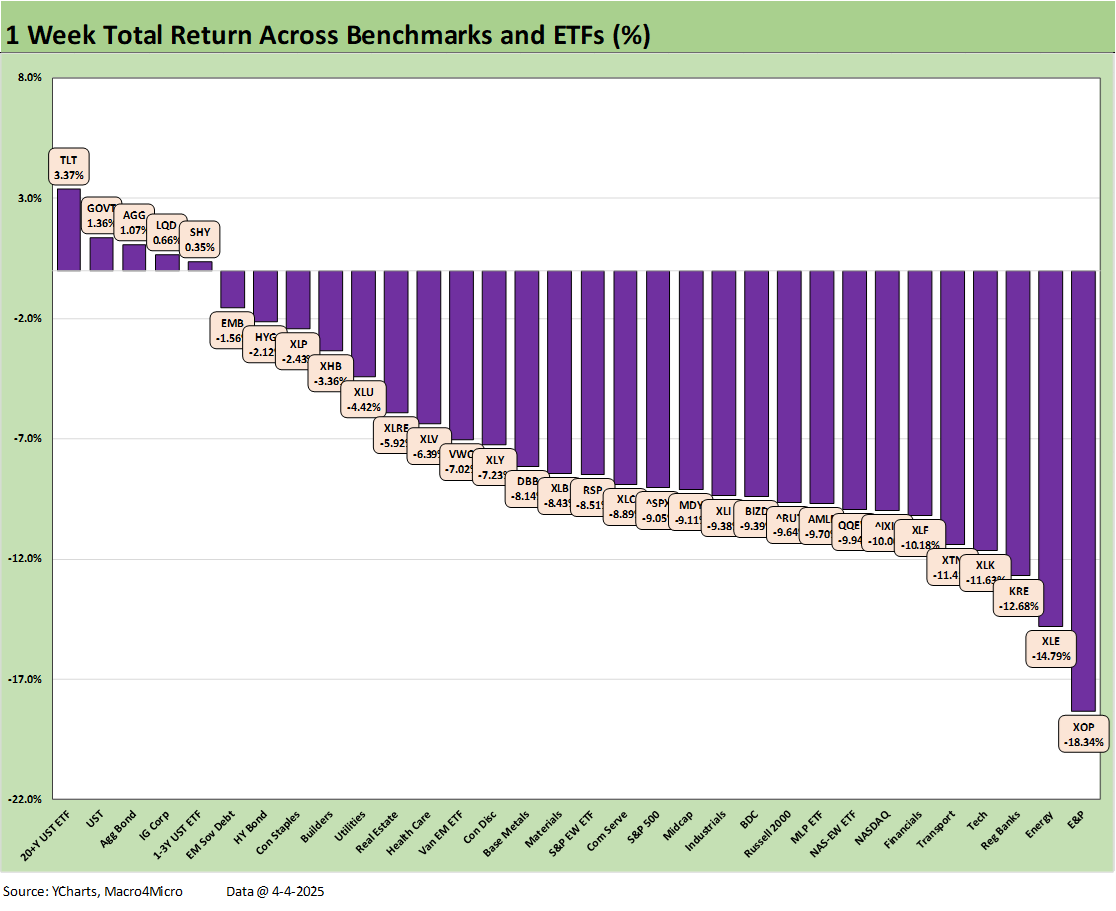

What the “buy the dip” theme music will not have is the frequent add-on of “credit is fine, so we are good.” IG index spreads at +114 bps are still inside the long-term median of around +130 bps, but it is moving wider quickly. Meanwhile, bank equities and private equity asset managers (alternatives, credit, etc.) are getting slammed. We see the broad Financials ETF (XLF) in the bottom quartile in the group of 32 benchmarks and ETFs we watch and down by -10% this past week. Regional Banks (KRE) were also in the bottom quartile at -12.7% for the week.

Financials of all stripes will need to be watched for more signals of credit contraction, actions that narrow refinancing alternatives for borrowers, asset class fund outflows (notably HY bonds), or asset allocation defensiveness. Deregulation had the bank securities markets (notably equities) all pumped up, but forward-looking markets need to factor in potential trouble ahead in asset quality from SMid lending to consumer finance. The same is the case in covenant relief economics and signs of risk aversion. Potential debt exchanges will be rising just as private credit was seeing explosive growth.

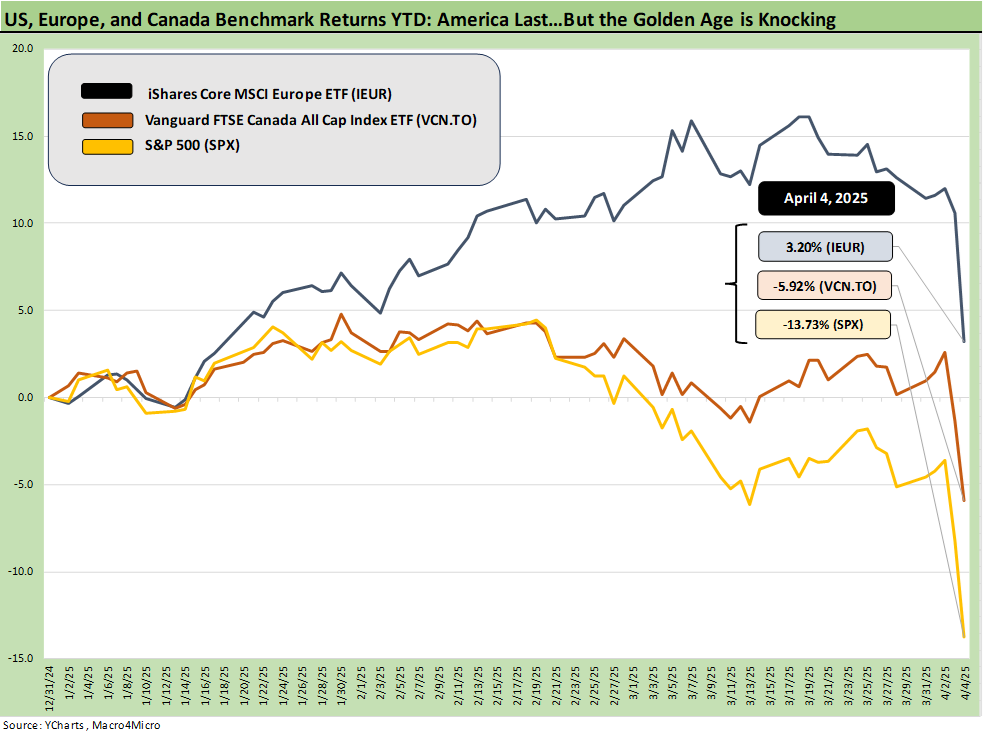

The above plots broad equity benchmarks and market proxy ETFs for the US, Europe, and Canada against one another YTD. If Trump’s plan was to go hard after Europe and Canada – the two that have been drawing his angriest, arguably personal comments for months – then US vs. EU vs. Canada will remain a head-to-head comparison. We will update this one regularly just to keep the thought process running on how the markets see Trump’s game plan working out. So far, not so good….

The ability to inflict pain on third party nations is always available, but there is a reason past Presidents did not attack allies since it comes at a cost and with a retaliation that has teeth. There is no “won and lost” score here since everyone loses despite Bessent absurdly saying “the surplus always loses.” The US with high inflation, lower growth, and higher unemployment has a buzzer in the midterm elections. Then another one in 2026.

Open markets and free trade had been an American cause and had been since after World War I. This crew is using attacks on all trading partners to change that. While Trump always brings up McKinley and reinvents “how great” the late 1800s and early 1900s were, there are a lot of decades of US economic history and global trade evolution that is hard to unwind. It is about stuffing a crowd of genies back in a single bottle.

McKinley is one of his idols, but Trump seldom mentions there were no income taxes in the US when McKinley was doing his thing (16thamendment came later in 1913). The House GOP proposed using tariffs to replace corporate income taxes back in 2017. Who knows what Trump has in mind now in the face of shattering budget deficits and an overleveraged sovereign balance sheet (Trump 1.0 saw a record high for UST debt as a % of GDP. As an aside, he also hit record trade deficits). The use of tariffs as a revenue source are clearly a priority for Trump regardless of the global trade damage.

We assume he may have read examples of how the evolution of the US economy across the Gilded Age on the way to McKinley was riddled with market panics, recessions, and even depressions (before the term was used like it is now). Maybe he read about those also (seriously doubt it) and believes recessions and crashes are just part of the process (his campaign did not run on that premise).

Asset returns across the 32 benchmarks and ETFs

This week’s positive vs. negative score was 5-27 with only bond ETFs positive and all 7 of the bond ETFs at #1 through #7 of the 8 lines in the top quartile. The defensive Consumer Staples ETF (XLP) was at the bottom of the top quartile with a -2.4 % return.

While policy changes can turn on a dime, the probability of Trump backing off on his tariffs are low on human nature alone. The bigger risk is more retaliation from Europe after a respectable bureaucratic lag and more responses from Canada. The Japanese and South Korean trade issues are more complex since they have good reasons to justify commitments to large scale projects in the US while also bringing over more suppliers.

The UAW, which is highly supportive of tariffs, will eventually wake up to the fact that red state assembly and component operations in right-to-work states will be taking more and more market share at the expense of their employer. We have seen how that movie ends.

Tech pain faces the EU and Asia challenge…

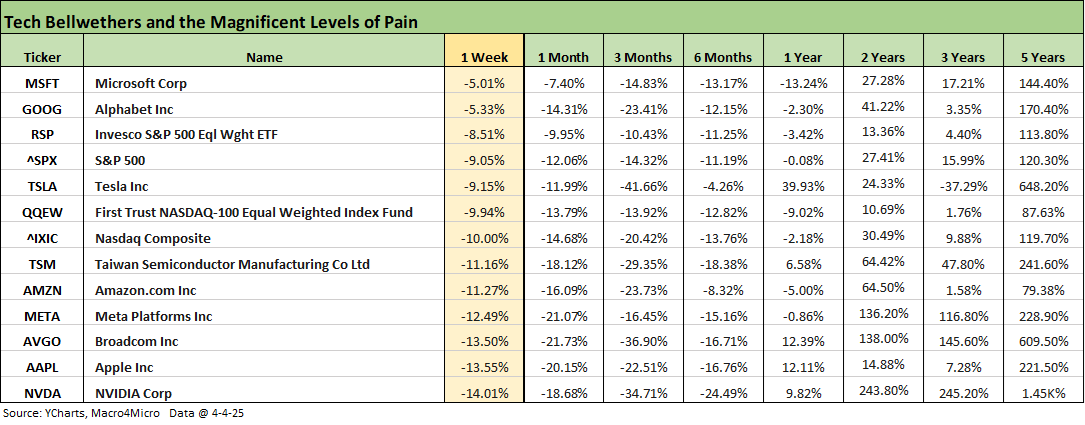

The tech bellwethers broken out above got an enormous amount of coverage on the week as the erasure of value for Mag 7 and other lead names crossed into the trillion zone. Trump’s response from Thursday through the weekend was to go golfing and cozy up to Saudi golf interests (at his real estate properties), and that caught a lot of commentary/criticism. Trump posted on social media, “Only the weak will fail.” He was also quoted saying how well the tariff programs were going. The chart above tells a different story.

The above chart lines up the tech leaders (Mag 7+ Broadcom + Taiwan Semi) in descending order of total returns for the week. We see all lines negative over the 1-week, 1-month, 3-month, and 6-month period. We also include some benchmarks: the S&P 500, the NASDAQ, Equal Weight NASDAQ 100 (QQEW) and Equal Weight S&P 500 (RSP). Looking back across the 1-year returns, we see 9 of 13 lines negative with 4 of the Mag 7 negative with Tesla, Apple, and NVIDIA positive.

Tariffs: ideology, emotions and the theoretical will now meet reality and the empirical…

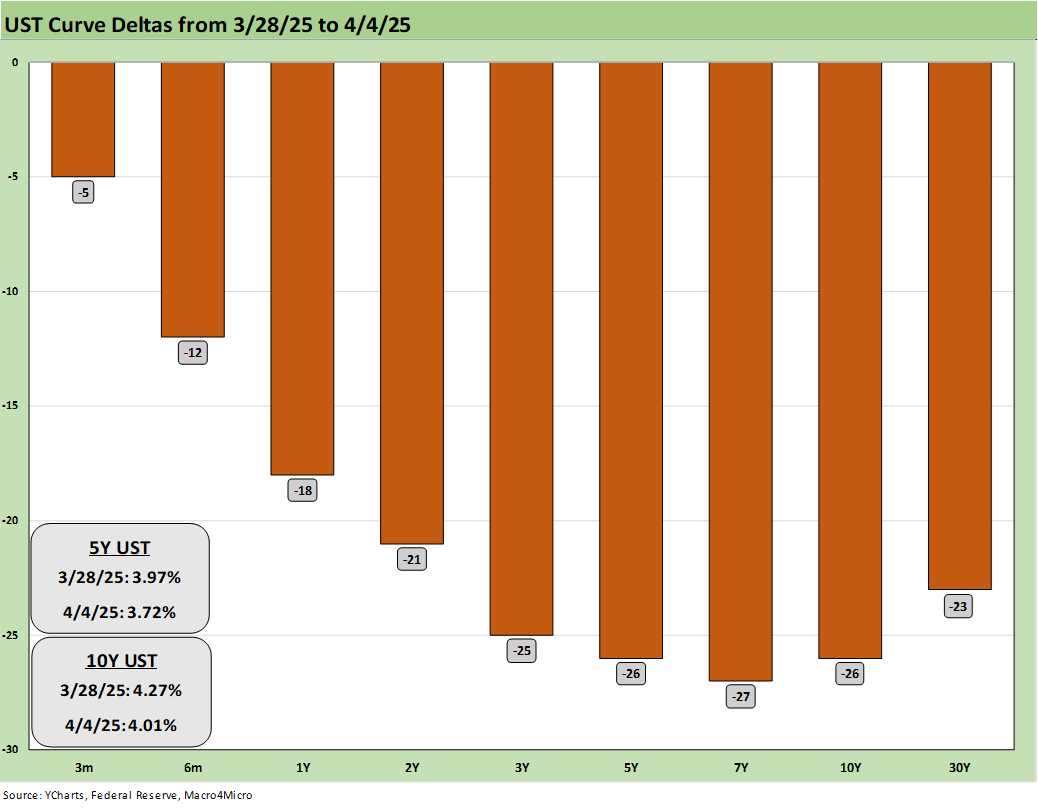

After such a brutal 2 days, we see the flight to quality and growing sense that a recession cannot be avoided or at least some contraction quarters. Whether the NBER official names a recession in the next year or two is a separate debate (see Business Cycles: The Recession Dating Game 10-10-22). When you have stagflation fears for the first time since the 1980-1982 double-dip, the substance of the weakness will count more than NBER’s inevitably belated “sticks and stones” moment.

The Fed to the rescue?

For those looking for the silver lining of the “Fed put,” the interview with Powell displayed what anyone would see as rational and logical (and predictable) answers. Solid jobs had just been reported (see Payroll March 2025: Last Call for Good News? 4-4-25), and the recent PCE inflation numbers are well above target PCE inflation and even had a mild setback as Core PCE ticked higher (see PCE Feb 2025: Inflation, Income, Outlays 3-28-25). That is not a formula for easing even if the CME odds are now calling for 5 cuts in 2025. Inflation (as in not rising) and labor (as in job losses) would seem to be necessary.

The tag of the Burns/Miller “Curse of the Fed heads” would want to be avoided by any FOMC Chair unless Trump shoots Powell and replaces him with the Mar-a-Lago gardener. The Nixon-Ford period saw waves of regulatory change, wage-price controls and inflation spikes before Carter took over and his Fed leaders did not hold the line. In the economics trade, they get the biggest statues in the Hall of Shame. Powell is not going there. He will not move when inflation shows up, which will certainly be the case with these tariffs. Inflation higher with payrolls lower will be tricky calculus for the FOMC. The price inflation rise will show up on a broad scale as more of the post-effective tariff date transactions get booked and make their way into the economic data.

The expectations are that tariffs will have an adverse impact on prices for reasons that escape virtually no one outside the White House even if some take the angle of transitory or one-time events (the monetary double-talk economist wordsmith thing). There is no question “purchasing power will erode” (think tariff rates vs. wage rates). Trump was out hammering Powell to ease now, but he is looking for someone else to share the blame on inflation. Remember, Trump demanded Powell move to negative rates back in Trump 1.0.

Policy rigor and coherence is MIA…

The reality that “someone loses somewhere” is a guarantee as these tariffs come into effect on the other side of orders or inventory planning. While the promised benefits are a theory largely concentrated in the mind of one man with too much sole-decision-making power surrounded by sycophants. Arguably, Trump’s actions could be challenged legally on a broader scale based on the abuse of legislative intent. Excess use of emergency powers to assume absolute power usually ends badly, e.g. 1930s Europe and dystopian films.

Since I don’t work on the street any longer, I don’t have to write in euphemistic code (that is why I quit the street in May 2000 to start CreditSights in the first place), but what is unfolding in Trump’s tariff policy defies polite words (impolite is in line with Trump’s level playing field anyway).

The embarrassingly incomplete, concept-lite methodology on reciprocal tariffs delivered by the White House economics swat team displayed a unique combination of stupidity and laziness (an analyst would be fired in the real world for such shoddy work). We assume most of them are not stupid, but if we assume submissive and lazy we might be in the right zone.

That tariff output from all the time was unimpressive (to be super polite). “[A] divided by [B]” is not exactly cutting edge. The point is that millions in the US and offshore will be crushed economically by these decisions. That outcome may not be ideal. One of my economics professors in college might say “put that in your pareto optimality pipe and smoke it.”

The reciprocal tariff Rose Garden show was incoherent enough to listen to, but in the end his charts and the raft of follow-up from the media and markets seeking to see more supporting research were sorely disappointed. The expected mental rigor, intellectual gymnastics or in-depth research into the non-tariff barriers were not there. (see Reciprocal Tariff Math: Hocus Pocus 4-3-25).

Except for a few well-placed anecdotes for cable show talking points, the release was more for show but cost markets a lot of dough. The B-Team economist yes-men on the team thus have the added problem of sloth to go with serial shilling for the boss.

We cannot wait to see the Section 232 reports. Most likely they will seek executive privilege like they did on Autos during Trump1.0 (under Biden some were released with redactions). They will cite national security but there might be some embarrassment under that about low quality work (like the 232 Auto rationale from Trump 1.0).

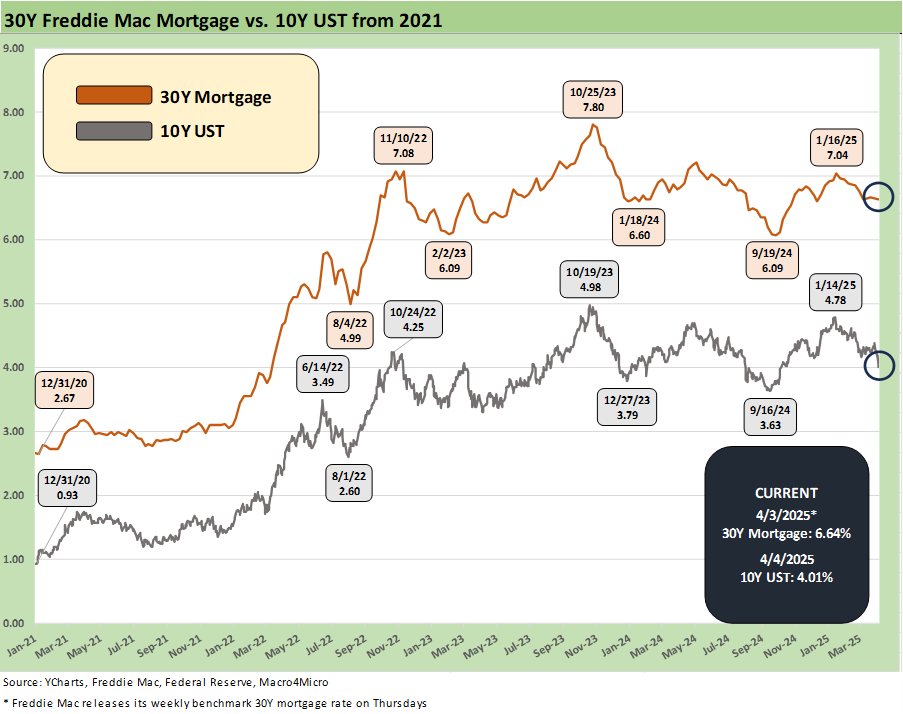

The above chart updates the 10Y UST history relative to the Freddie Mac 30Y benchmark (released at Thursday noon). The 10Y has been moving lower quickly, but the mortgage rates have lagged. We looked at some other mortgage indexes and there was very little movement through Friday with one index -3 bps lower from Mortgage News Daily. It still is not back to the 6.0% handles we saw in Sept. If mortgage rates do get back to that late Sept level, this time the consumer will be in worse shape with builders staring at higher supply chain costs and steady flight/deportation (or hiding) in the labor pool. Consumer credit is also likely to tighten in the direction the market is heading.

The ideology behind the tariffs is not conservative…at all.

The tariff theories get twisted by the White House and by their low-detail but high-conviction talking heads. They need to decide what latitude or spin and reinvention of facts that they need to satisfy the audience. If none of the data works later, they will attack the data quality.

As someone who grew up in a house where Goldwater, Nixon and Wallace got votes in the 1960s and early 1970s (God bless the working-class Boston Irish), one can easily look at these developments through a conservative lens as well (even if many conservatives have turned into boned fish to please Trump). For those who want to take fluoride out of the water and see it as socialized medicine, even that crowd has to see the following:

Businesses do not get to decide how to maximize their profits by low-cost sourcing.

Consumers do not get to decide how to spend less on the goods they want.

Not sure who would have voted for having those signs on your lawn at election time, but that is exactly what Trump is saying.

Retailers buy low-cost apparel or shoes from Asia to make a profit. According to Trump, that is Asia “ripping us off.” Germany sells cars to the US that the US will pay for on quality and brand, and Germany is “ripping us off.” After all, GM and Ford manufacturing cars in Europe got their butts kicked for decades. Both Cadillac and Lincoln tried even on their home turf and Americans picked the Germans. It is called consumer choice. Meanwhile the superficial MAGA idiot short bus drops off a group saying, “We can’t be Europe’s ATM machine.”

Of course, then red states get rewarded with billions of investment from auto transplant and supplier chains. It’s about competition. The Germans won. Same with the Japanese and South Korean transplants. The tariffs will keep more Japanese and South Korean imports out, but they’ll just expand here. Many manufacturers will expand here in select industries. On the other hand, waves of products that are labor intensive will simply go up in price and price elasticity will get tested. The good news for Trump in those latter cases is both sides will suffer with a regressive tax and everyone losing. That should make his day.

Basically, Trump gets to decide what company’s do for supplier chains and sourcing based on the fact that he wants to lock down his ironclad 30% to scare Congress (and compete for the other 19%). To get it done, he invokes and misuses laws that give him a dictator’s call on tariffs. After Toomey and Corker were singled out for attack during Trump 1.0, the rest of the Senate GOP folded up their spines and sent them back for rubber recycling.

We watched two of the CNBC economics/trader folks battle on this corporate and consumer “choice” point. The issue of economic principles and Trump loyalty is clear enough in some “experts,” and they duck a lot of very real risks in the interest of keeping their diverse audience and range of guests returning. GOP Congressmen will not come back if you hit them with exacting questions.

Dictator blues can impact consumers and investment…

The tariff approach is consistent with a few other behaviors seen in the market of late in Trump 2.0:

Purging the military.

Purging the national security apparatus.

Attacking NATO allies and threatening annexation.

Inserting a “loyalty test” into control of law enforcement.

Looking to consolidate control of bank regulators starting with the FDIC (controlling guns and money…very old school).

Attacking the media.

Attacking judges and setting the dogs loose to scream to impeach them.

Attacking higher education and threatening them with financial harm.

Attacking law firms to penalize those who challenge Trump’s unbridled power ambitions and discourage representing anyone who challenges Trump.

Looking to assert control from the executive branch over state elections.

Cutting funding and services that fall hardest on urban areas that typically do not favor GOP candidates. Note: those areas typically generate a disproportionately high share of national income tax revenues often redistributed to red states.

Purging agencies that expand reach internationally and add more points of contact to narrow down those points of contact to the inner executive branch group.

Attack corporate leaders to silence them on tariffs (the tariffs are much broader and higher, but corporate leaders and boards are much quieter this time. Wonder why?).

Asserting control over cultural and educational institutions to inculcate the leader's ideology, rewrite history and alter long-established factual frameworks that are rooted in…well…facts.

…and that is the short list.

More than a few commentators have signaled that looking at US risk variables is getting more like emerging market sovereign analysis. “Rule of law” items show up on the risk checklist in EM debt.

In the end, you can applaud this behavior if you are a fan or a full-on, MAGA face paint type. The same is true for single issue voters (lowest taxes, theocrats, etc.). Just do not be surprised when a very large part of the country that sees the factors at work pull back in a way that hurts the economy.

Per Brookings, 60% of GDP was carried by Harris. Prior to the election, we could not have said her policies as proposed would necessarily have been better for the economy and a split Washington (GOP + Dems) would likely have mitigated any excess. We can say with certainty that Harris would not have sought to attack or annex allies or destroy world trade like Trump. This tariff plan is not what Trump ran on even if the MAGA crew attempts to spin it that way.

The assumption was that there would be some discipline in trade reform, rigorous research, and reasoned industrial policy. The elementary school math equation for trade policy did not qualify (see Reciprocal Tariff Math: Hocus Pocus 4-3-25).

When you are completely irrational and hire incompetent lapdogs (or competent power junkies that do not advise but enjoy having the juice you give them and don’t mind the Kool-Aid chaser), this is what happens. Don’t be surprised when prices rise. Don’t be surprised when more trade partners retaliate.

Credit markets are not happy…

The above chart highlights the spike in HY spreads from last week’s +347 bps to +445 bps. The equity beat-down reinforces the expectation of very real economic trouble and more retaliation ahead. Flexibility turns on one man, and he’d rather keep the hold on the 30% voting block that he can tell “2+2=5” and still get emotional and almost religious buy-in (literally in some cases). He can’t lose them by showing weakness (such as using truth and facts). Rational economics are not the ticket. Irrational, blind loyalty is his game. It works well for his exercise in power and turning men into mice, but economics will take its unforgiving course no matter what he says.

We believe Europe and Canada is warming up to fight back, and Mexico has to take some action at some point or risk looking like the runts of the litter. Runts generally don’t do well. The EU ace in the hole is an attack on services and tech and the ACI as discussed in earlier commentaries (see Fed Gut Check, Tariff Reflux 3-22-25).

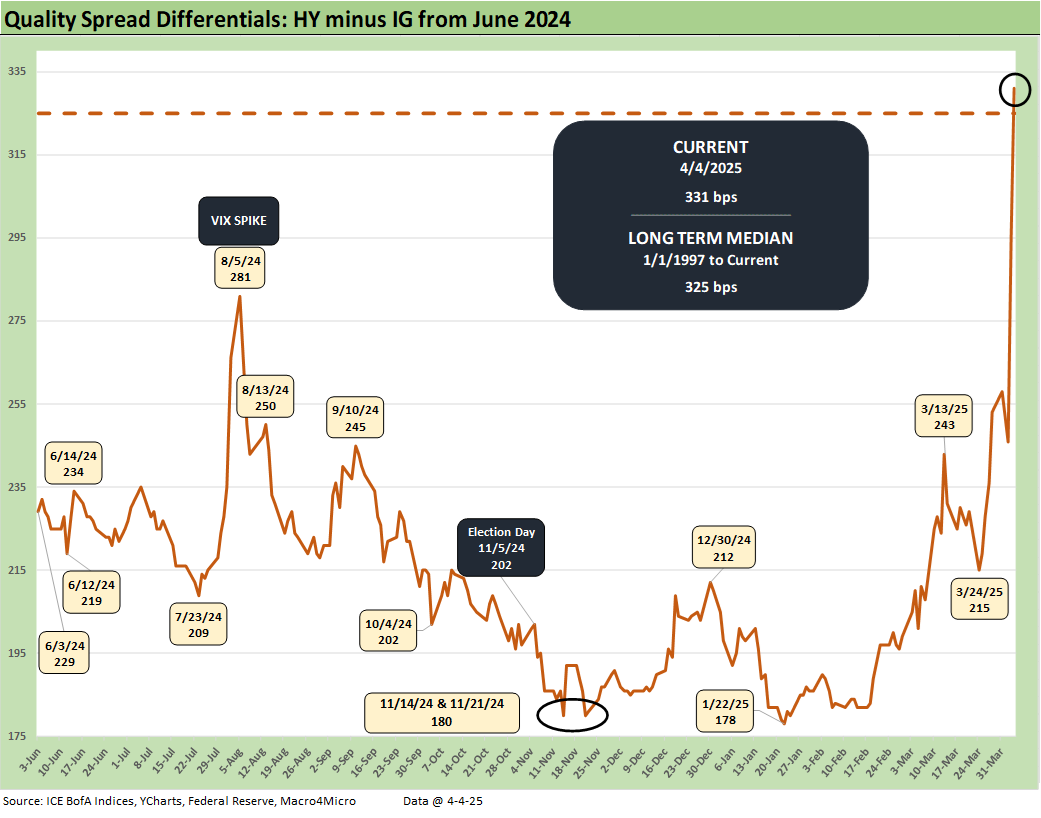

The above chart updates the “HY OAS -IG OAS” quality spread differential. This one has blown out from last week’s +253 bps to the current +331 bps or now above the long-term median.

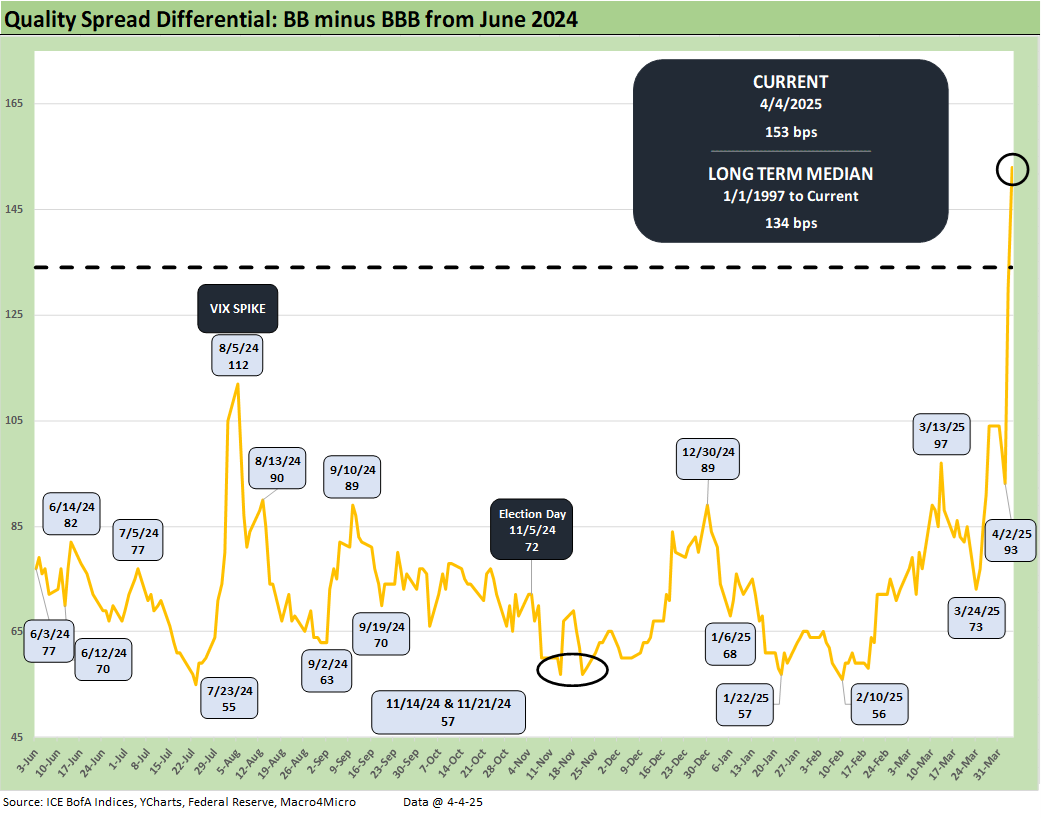

The “BB OAS minus BBB OAS” quality spread differential has also spiked from +104 bps last week to +153 bps to end this past week. That gap has more the doubled off the 1Q 2025 lows and is comfortably wide to the median of +134 bps.

All in…a great week for the new Golden Age.

See also:

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25

Credit Snapshot: Taylor Morrison Home Corp (TMHC) 4-2-25

JOLTS Feb 2025: The Test Starts in 2Q25 4-2-25

Credit Snapshot: United Rentals (URI) 4-1-25

Footnotes & Flashbacks: Credit Markets 3-31-25

Footnotes & Flashbacks: State of Yields 3-30-25

Footnotes & Flashbacks: Asset Returns 3-30-25

Mini Market Lookback: The Next Trade Battle Fast Approaches 3-29-25

PCE Feb 2025: Inflation, Income, Outlays 3-28-25

Auto Tariffs: Questions to Ponder 3-28-25

4Q24 GDP: The Final Cut 3-27-25

Durable Goods February 2025: Preventive Medicine? 3-26-25

New Homes Sales Feb 2025: Consumer Mood Meets Policy Roulette 3-25-25

KB Home 1Q25: The Consumer Theme Piles On 3-25-25

Lennar: Cash Flow and Balance Sheet > Gross Margins 3-24-25

Mini Market Lookback: Fed Gut Check, Tariff Reflux 3-22-25

Existing Homes Sales Feb 2025: Limping into Spring 3-20-25

Fed Action: Very Little Good News for Macro 3-19-25

Industrial Production Feb 2025: Capacity Utilization 3-18-25

Housing Starts Feb 2025: Solid Sequentially, Slightly Soft YoY 3-18-25

Retail Sales Feb 2025: Before the Storm 3-17-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

JOLTS Jan 2025: Old News, New Risks in the Market 3-11-25

Credit Spreads Join the Party 3-10-25

Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25

Payrolls Feb 2025: Into the Weeds 3-7-25

Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25

Gut Checking Trump GDP Record 3-5-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Asset Returns and UST Update: Pain Matters 3-5-25

Mini Market Lookback: Collision Courses ‘R’ Us 3-2-25

Tariff and Trade links:

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Stop Hey What’s That Sound? 4-1-25

Tariffs are like a Box of Chocolates 4-1-25

Auto Tariffs: Questions to Ponder 3-28-25

Fed Gut Check, Tariff Reflux 3-22-25

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23