Retail Sales Feb 2025: Before the Storm

Headline Retail Sales fails to impress, but the core reading is a useful snapshot of the “before” with a lot to come “after” as tariffs weigh in.

Ready to weather the tariff storm…

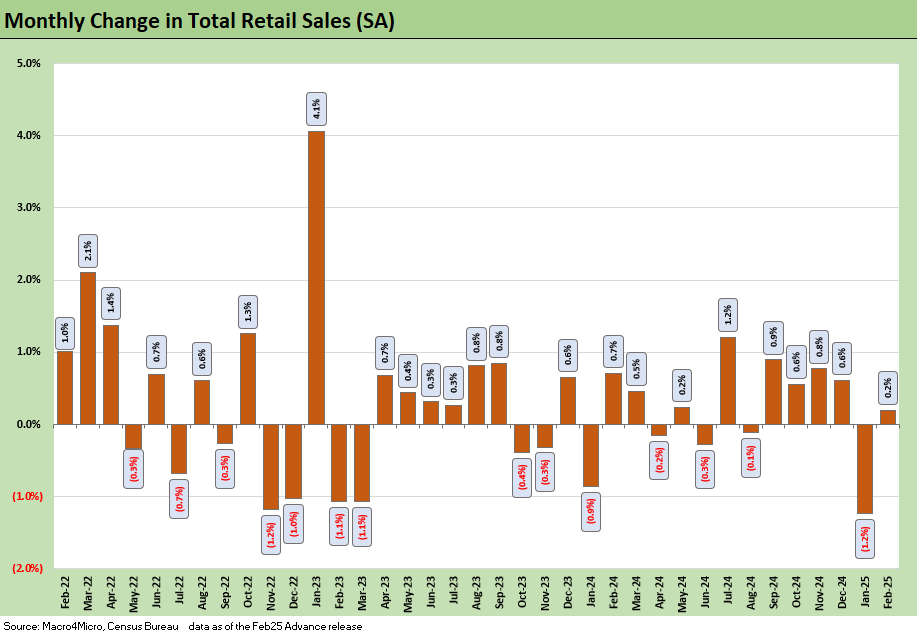

Total retail sales this morning were lower than expectations at +0.2% MoM, following January’s print that was revised down to a “worst since Nov-22” mark at -1.2%. After a wild tariff ride in the capital markets and so much uncertainty, the data point shows a resilient consumer but more tests ahead.

We see that part of the headline dip is price effects from declines in gasoline prices, but the release shows weakness in discretionary goods that usually see benefits of saving money at the pump.

Looking below the headline shows more mixed results but with Core retail sales showing resilience with a +1.0% bounce back driven by strong results in Nonstore retailers and Health and Personal Care.

With the last few weeks of market activity marked by a flurry of tariff headlines and brewing trade wars, some hard data on how the consumer held up in February is a welcome calm for market participants. The biggest tests lie ahead.

The Feb report joins the slew of backwards looking reports (CPI, PCE, Payrolls) that combined show the US economy without any major issues for now but with the asterisk that the macro backdrop is transitioning to one rife with uncertainty. Trade tensions and tariff risks will negatively impact the consumer with their already declining confidence in the economy noted in the UMich survey. Inflation expectations were especially negative in trend.

The next leg of the analytical race will unfold with a wide range of potential outcomes from tariffs. Constantly changing tariff policy poses a very difficult problem in how to adjust for them since they are not yet set for many products. That will continue to lead to trade partners raising unpredictable retaliation effects and “retaliation to the retaliation” by Trump.

Consumer health continues to deteriorate at the margin the past year with a few headline scares along the way and an ill-conceived, shrill trade war bringing another wildcard for household disposable income.

Food for thought in the next bout of economic uncertainty is how many levers are viable or unavailable to provide economic relief. The Fed is likely to continue to play the slow game and wait for any new inflationary effects before accelerating the rate cut cycle. That is, unless we see a major growth slowdown or contraction that leads to rate cuts for the wrong reason. Payroll also could give the FOMC some ammo to ease.

The largest big box retailers likely will see less flexibility to pressure suppliers to absorb some of the tariff costs and need to find more alternative suppliers to meet demand. That is to say, this time is different than the first tariff bout in Trump 1.0, and models tend to poorly incorporate such nuance.

The table above shows the underlying details of this morning’s retail sales report as well as the key ‘ex-Autos’ and Core Retail tallies. The declining gas prices on the month are an easy culprit for the Gas Stations decline on the month. We similarly see decreases in the Restaurants and Bars line at -1.5% and disappointing trailing results. When looked at with poor discretionary spending results in Clothing, Sporting Goods, and Electronics, it points more towards some caution or retrenchment as consumers are trading off gas savings this month to other uses.

That trend dovetails with the increase in savings rate in the most recent PCE reporting where economic uncertainty often leads to consumers withholding a few more dollars under the mattress where they can. Higher savings rates are a double-edged sword as it can be positive for household credit quality but also can bring weaker spending for the economy.

For the still-optimistic crowd, a strong bounce back in the Core Retail reading at +1.0% provides ample pushback and supports a resilient consumer. That strength is driven by a large rebound in Nonstore retailers and positive results in the largest Core line items that could evidence shifting consumer preferences instead of a pullback amidst economic uncertainty. The tariff wave could be the tiebreaker in the consumer tug of war with defensives retrenchment battle the high propensity of US consumers to spend.

See also:

Footnotes & Flashbacks: Credit Markets 3-17-25

Footnotes & Flashbacks: State of Yields 3-16-25

Footnotes & Flashbacks: Asset Returns 3-16-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

Trade: Betty Ford Tariff Wing Open for Business 3-12-25

CPI Feb 2025: Relief Pitcher 3-12-25

JOLTS Jan 2025: Old News, New Risks in the Market 3-11-25

Credit Spreads Join the Party 3-10-25

Footnotes & Flashbacks: Credit Markets 3-10-25

Footnotes & Flashbacks: State of Yields 3-9-25

Footnotes & Flashbacks: Asset Returns 3-9-25

Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25

Payrolls Feb 2025: Into the Weeds 3-7-25

Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25

Gut Checking Trump GDP Record 3-5-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Asset Returns and UST Update: Pain Matters 3-5-25

Mini Market Lookback: Collision Courses ‘R’ Us 3-2-25

PCE Jan 2025: Prices in Check, Income and Outlays Diverge 2-28-25

Durable Goods Jan25: Waiting Game 2-27-25

GDP 4Q24 Second Estimate: PCE Inflation the Main Event 2-27-25

New Homes Sales Jan 2024: Homebuilders Feeling Cyclical Signals? 2-26-25

Existing Home Sales Jan 2025: Prices High, Volumes Soft, Inventory Up 2-21-25

AutoNation: Retail Resilient, Captive Finance Growth 2-21-25

Toll Brothers 1Q25: Performing with a Net 2-20-25

Housing Starts Jan 2025: Getting Eerie Out There 2-19-25

Herc Rentals: Swinging a Big Bat 2-18-25

UST Yields: Sept 2024 UST in Historical Context 2-17-25

Tariff links:

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24