Tariffs: Questions that Won’t Get Asked by Debate Moderators

We detail tariff risks and trade flows and wonder if the candidates/moderators will rise to the occasion to discuss facts and concepts.

Tariffs ‘R’ Us: Where do I put my hand first?

There is no shortage of questions to ask, but at the top of the series of questions on the list of critical economic facts and concepts is to ask each candidate, “Does the “buyer pay the tariff?” and “If the buyer does pay the tariff, did Trump collect billions and billions from China?” They should ask each candidate. The answer is “Yes” on the buyer pays and “No” on Trump collecting billions from China. That would set off some fireworks and might even inspire some thinking by more voters.

Another critical tariff question for Trump is “Mexico is currently the largest importer into the US. What will you do on tariffs with a free trade partner if they don’t honor your mass deportation requests?”

Another variation—one for each candidate—is as follows. For Trump: “How will a sovereign wealth fund get paid for by tariffs if the “buyer pays” and will you seek Congressional approval for that fund?” For Harris: “Do you agree with Trump’s wealth fund idea? Press reports indicate a “sovereign wealth fund” ambition under Biden. What is your view on any such plan and how will it get paid for?”

The chaos around tariffs needs airtime and clarity of statements. Congressional talking heads never answer the question as they remember the fate of smarter types such as Toomey and Corker on tariffs, so the only thing higher than the political stakes for the tariff lapdogs are the economic stakes, which are very high indeed.

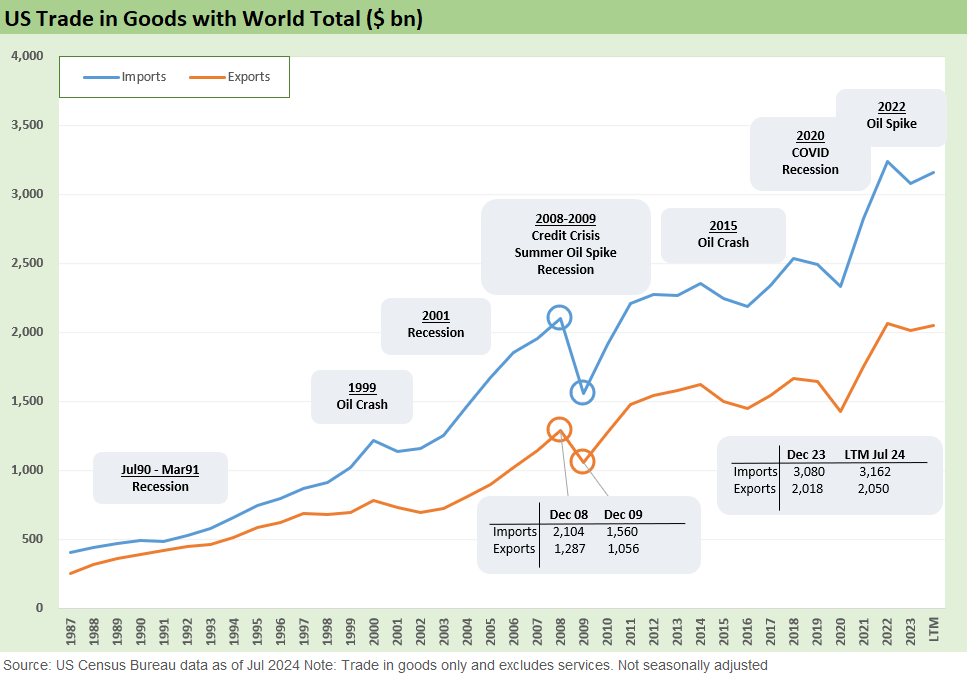

The reality of a growing economy is that “everything grows” as captured in the line chart above. If you fixate on one thing, like Trump does (trade deficits), you miss the point at the same time you miss the concepts, the facts, and the main economic mission. The upward rise noted in both imports and exports is connected to the growth in the economy (net of the trade deficits that are a small haircut on GDP). The growth of both lines is a critical part of rising revenue lines for many US companies and growth industries.

The service bias in the economy is not intrinsically bad, but the dislocations in manufacturing were not well managed under the rules of the past 4 or 5 decades. The problem started long ago with the 1980-1982 double dip and waves of deregulation that turned so many industries upside down and shook the change out of their pockets.

When you brag about record stock markets (as Trump did ad nauseum), you cannot forget how many industries drove that performance. In many cases, entire industries evolved and adapted to global competition. Others grew from scratch and flourished and notably so in tech and in the shale sector with E&P drilling advancement.

Part of the boom in growth and in some cases survival (e.g. autos, cap goods) was tied to global supplier chains and leaner unit costs. Reversing those structural evolutions is tricky at best. The problem with blank check tariffs is like a surgeon wearing a blindfold. You hope the doc doesn’t cut off or gouge out anything vital.

Both those imports and exports have multiplier effects of economic effects from materials and components to freight and logistics (including warehousing and distribution) to real estate and financial services. If you only focus on one thing in trade deficits you have two problems: 1) You missed the bigger economic picture and how those payroll ranks, stock markets, and GDP got here. 2) You’re a clueless dope.

In predicting economic apocalypse (or saying it’s already here) and American carnage, Trump has missed a lot. It is worth considering that all the major global auto OEMs are building cars here. (Toyota, Nissan Hyundai/Kia, VW, BMW, Daimler, and more). Airbus is now here too. Supplier chains have a tendency to follow the OEMs (in part) and legacy US suppliers can grow their operations. You hope that more of the supplier chain arrives here. Ironically, that can have the effect of growing the trade deficit.

You also do not want to deter more expansion by penalizing the supplier chains that have not come here (e.g. engines and major component systems, etc.). Unless you plan to develop more mining and materials industries, you should be cautious around broad-based tariffs on all imports that push metals and steel prices higher for manufacturers.

The above chart updates the most recent LTM trade deficits by trade partner. China posts the highest deficit followed by the EU, Mexico, and Vietnam at #4. The trade deficit with China is at a low now under Biden after being at a high under Trump, who reversed that fact in the first debate while Biden struggled to respond given how fast and furious the lies came (see The Debate: The China Deficits and Who Pays the Tariff? 6-29-24).

Vietnam’s rise as a trade partner offers a reminder that tariffs on one major country (China) can often just change the address rather than make the US less exposed to trade deficits or bring jobs home. Labor arbitrage and low-cost sourcing is here to stay. You need to be more tactical about that risk.

We are not chasing the issue of “good and bad” trade deficits and the underlying reason why those exist. That horse is hanging in the glue factory by now, and Trump left those lessons on the classroom floor (how about producing those college transcripts from the schools he had Michael Cohen threaten). Some trade deficits are worth having (cost and comparative advantage) and some are not (unfair trade practices and trade barriers for the US).

The US is the largest consuming nation on the planet with lean and efficient companies that have spent decades building out low-cost sourcing capabilities. The result is that when the US economy is doing well, the trade deficit goes up. The decline in the trade deficits after the 2008 credit crisis was not good news!

In the pre-shale-boom days, the deficits also would go up every time oil spiked given the traditional role of the US as a major importer. The US is now a major exporter but also still a major importer from Canada. Obama was the first president to allow oil exports, and that can remain a priority to support Europe and undermine Russia. Oil is a national security issue that makes life challenging for climate advocates. It is also an inflation issue.

The maze of issues in trade had been on our front burner since Trump first wanted to tear up NAFTA back at the start of his single term in 2017. We have looked at the array of issues in earlier commentaries (see links at the bottom). The issues around tariffs do not change much from history classes (McKinley seems to get a lot of airtime from Trump with less Smoot-Hawley). The same rules from economics classes in the 1970s apply even if real world applications get complicated in Washington legislation and in the negotiation of free trade deals.

The path from George HW Bush signing NAFTA in 1992 across Clinton joining in on bipartisan legislation in 1993 (NAFTA started as a GOP bill with strong support from border states (mixed in California) to NAFTA being effective in Jan 1994 to China entering the WTO has been a long trail in global trade deals and trade law evolution. These events always saw political tension with labor groups and progressives. After 2000, the trade deficit accelerated as the chart above shows.

NAFTA annoyed unions, and union membership declined. Manufacturing was moving South of the border to find labor cost at a fraction of US-based costs (e.g. $4 an hour in a Mexican auto plant not long ago). Japanese transplants flocked to right-to-work states (but not exclusively). Japan was followed by Korean and European companies (notably Germany). Kentucky flipped to a right to work later in 2017. Michigan (2013, the home of Detroit) and Wisconsin (2015, the home of Progressivism and La Follette) also flipped to right to work status in a shock to unions. Michigan flipped back in 2024 by legislation.

That is a lot of change as the UAW (autos and ag) and USW (steel) unions were battered across the decades. After spectating Carter and Reagan policies around autos in clashes with Japan (anyone remember “Voluntary Export Restraints” under free trader Reagan?) and the crushing burdens on domestic steel, the term Rust Belt was part of the vernacular. The damage in Pennsylvania, Ohio and Indiana had set off some shifts in political alignments as years went by. PA is the only state still up for political grabs of those three.

Even for those who see lower trade deficits as a worthy goal and think it is ok to tear out the Econ 101 chapter on “comparative advantage,” the rush to tariffs and opposition to free trade deals does not eliminate the need to identify the risks or state the facts of how tariffs work.

We have looked at some of these issues before, but for this piece we just update the exposure by country or trade bloc (EU) as food for thought. Every time you hear “tariff” you should think “higher costs” in supplier chains. The “buyer pays” phrase seems to be something that most Trump supporters (whether brilliant, average, or dumb as rocks) do not seem willing to say out loud or admit.

On the facts of the transaction flow, we even saw former SEC Chair Jay Clayton (Trump supporter) duck the question when directly asked on CNBC this morning. He changed the question to being about countervailing duties and ignored the question on the tariff payment transaction facts. Becky Quick challenged him but by then the flow moved on. He was paired up with Kyle Bass (Trump supporter) who detoured the discussion to “national security,” which is of course a very legitimate part of tariff strategy. He was also avoiding admitting that “Trump collected zero from China” and not “billions and billions.”

We will see if the ABC moderators or Kamala Harris can get the actual facts conveyed in the debate tonight. We’ve watched Peter Navarro duck the question for years in interviews. The opinion on the “Why?” of the tariffs and the “strategic” nature of negotiation tactics is a separate topic. It does not negate the need to get the cornerstone facts right:

Buyer pays.

Buyer must recover the tariff cost in price or sacrifice margin.

If the buyer does not recover the cost, profits get squeezed or other costs need to be taken out.

If the cost gets passed on, inflation results for that product, and laws of elasticity kick in (that is why retailers freak out).

This is not an application of rocket science. Maybe bottle rockets.

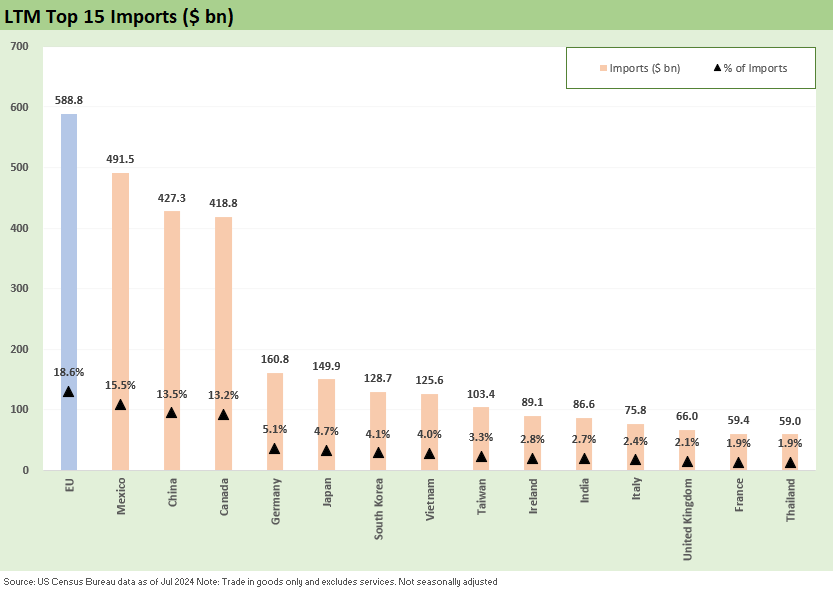

The above chart updates the numbers for the top trading partners (based on imports + exports) with the EU listed along with the major EU nations that make the Top 15. The top 4 trade partners (EU counting as 1) comprise 60% of US trade. Of that 60%, half of it is governed by the new NAFTA free trade deal (USMCA). A question for both Trump and Harris is whether they plan to renegotiate the USMCA in the official 2026 review.

The half-empty view of the above chart is to note there are a lot of dollars in that mix to aim at for tariffs but also a lot to retaliate against. Further below we detail the major product categories in imports and exports.

The most exposed product groups would impact the farm sector, where the US has a competitive advantage and is the usual China target. The end result in the last round of trade clashes was retaliation against the ag sector and a massive bailout. People forget that ag bailout was much bigger than the auto bailout. If we replay that event sequence, it will be a self-inflicted wound of many billions to bail out farmers again. Trump needs to be honest on the way in. There is no hiding from retaliation.

The above chart updates the leading imports by nation and trade bloc. These countries are basically all the targets based on what Trump has claimed he is planning. The EU will most definitely respond in kind. The rising level of tension with Mexico is getting more airtime of late and will come to a head with the mass deportation game plan. The Trump plan includes even more tariffs on anyone who does not cooperate, which then brings even more retaliation.

We have looked at the import mix from Mexico by product line in past commentaries (see Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24). High tariffs on all Mexico imports would be devastating for many US companies that rely on import flows including some major operators who own the assets in Mexico (autos). We will be revisiting those issues in future commentaries. There is no shortage of information available with the Census Bureau and BEA in the monthly trade data (which Project 2025 is targeting for a purge).

The above table revisits the largest import categories. We should look at this list in substance as the “import tax target” where the tariff will be paid by the buyer (again, that is how tariffs work). We see a lot of autos, crude oil/refined products, pharma, computers, semiconductors, electronics, aero, and motor vehicle parts among others. That is what a global supplier chain is all about. It is not putting a genie back in the bottle. It is a team of genies on steroids with high protein diets who fight back.

What Trump plans to do around Canadian crude oil is not clear under this blanket import tariff plan. There is after all a free trade deal and heavy Canadian crudes are much sought after by US refiners. Trump could use that leverage to extract more from Canada since the access to tidewater and global markets on a sufficient scale is a problem for the oil sands operators.

If Trump wins and uses his range of options on pipeline expansion and arm twisting with Canada, trade tension will increase. It would elicit a response as it did the last time. The US has a very high value mix of exports heading north. In other words, there is plenty for Canada to aim at. An aggressive strategy with Canada would be the equivalent of demanding a fight. Canada is renowned for civility, but they do know how to “drop the gloves.”

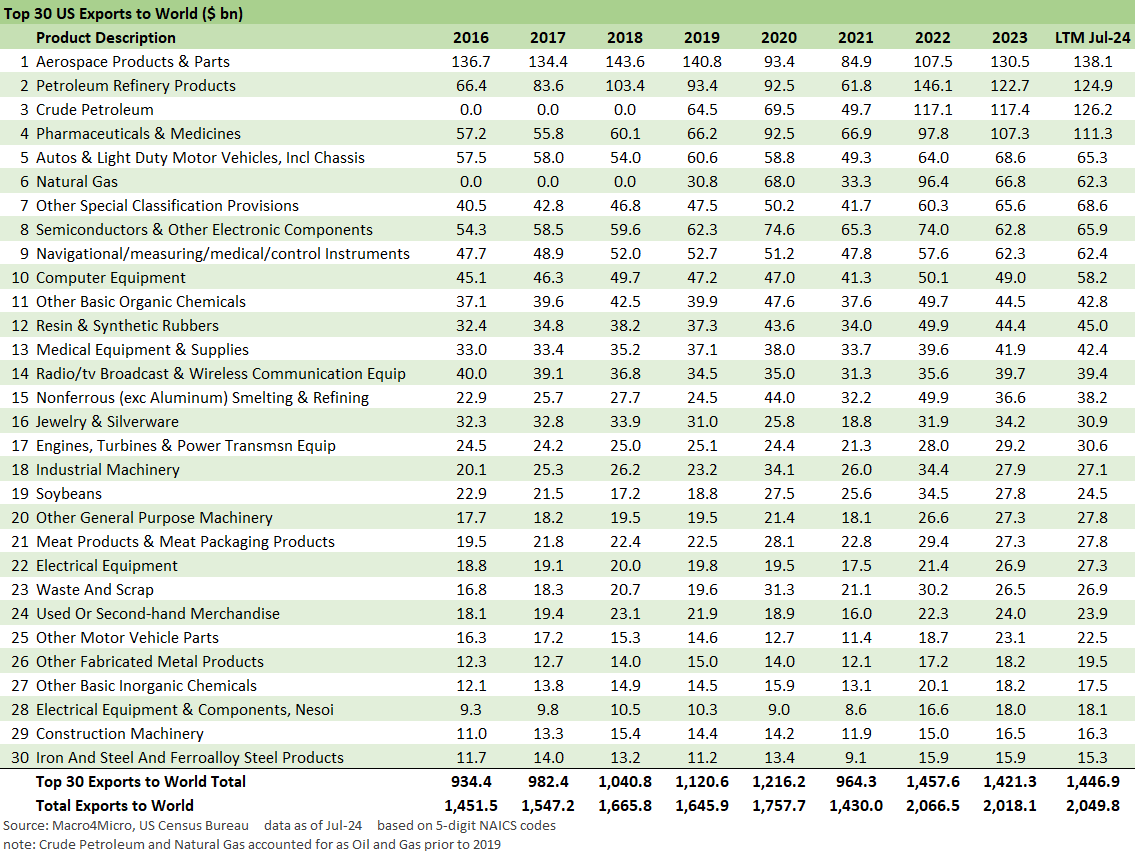

The above chart does the same drill on exports. There is no shortage of product lines to aim it – obviously. Even if there are more imports hit by tariffs, buyers cannot turn on a dime during working capital cycles. In the case of the NAFTA/USMCA partners, there is also a lot of two-way traffic back and forth for some products on the path to finished goods.

The product line list above covers “exports to the world” which might also serve as a target list for retaliation. Crude oil and LNG have gotten so large as export lines, the product list presented has split Crude oil, Natural Gas, and Refined Petroleum products into 3 lines. Those would not be likely to be retaliated against given the damage that they would do to the trade partners’ domestic markets and their compelling need for energy.

Aerospace, autos, capital goods, and a wide range of ag and food/beverage products would be fair game. There are many product groupings under agriculture to target, but soybeans would be at the top of the list as they were last time along with many other ag products. If the tariff is a blanket one on all imports, China would not have a hard time finding sympathetic and readily available sources of supply from many ag-heavy trade partners.

As a side note, the upper Midwest is a major soybean area with Walz’s home state (Minnesota) typically in the Top 5. Among swing states in the top 10 overall Ag states, we see North Carolina and Wisconsin also. The top ag states could end up 6-4 favoring Trump or 5-5. Tariffs are something for those voters to pay attention to.

Contributors:

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro40micro.com

See also:

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23