Credit Snapshot: AutoNation (AN)

We summarize the credit fundamentals of AutoNation.

Credit Trend: Negative

Summary Credit Profile:

We notch down our credit trend for AutoNation (AN) to negative from stable on the tariff-driven setbacks to fundamentals (see Credit Crib Note: AutoNation (AN) 6-17-25, AutoNation: Retail Resilient, Captive Finance Growth 2-21-25). Adverse profitability in 2025 will be tied to pressure on cost of sales and post-tariff prices moving higher. Price hikes could flow into volume weakness during 2025. Very strong 1Q25 OEM sales, pre-tariff buying, and inventory restocking now face the 2Q25 and 3Q25 reality of tariff impacts. The silver lining is that they are sitting on low-cost inventory heading into peak selling season but with the tariff challenge ahead. The working capital planning needs to be prudent, but dealers can be far more insulated from the financial tariff damages.

AN offers the operational stability of a franchise auto dealer and is the only IG-rated public dealer (see Credit Crib Note: AutoNation (AN) 6-17-24). AN could face downgrades with a large debt-financed acquisition, but the ability to grow by smaller deals is a well-worn path in AN’s successful track record. AN is a higher rated credit than peers and a BB tier rating would be right in line with competitors if AN was downgraded. AN’s focus on capturing more of the “auto retail value chain” ($ per unit) had led them to grow a captive finance unit. That plan makes sense strategically and is mirrored at Lithia.

Relative Value:

The Big 6 public franchise dealers are BB tier-heavy in bond mix with AN at the top with a low BBB composite. In a brutal backdrop for auto tariffs, franchised dealer retail is the most resilient. The industry has more short/intermediate duration bonds with manageable event risk and disciplined capital allocation plans. AN did a recent 10Y bond deal (5.89% of March 2035) in mid-Feb 2025 priced at +133 bps which widened by 40 bps with all the tariff news and broader spread widening. That was before the latest Trump speech on Wed after the close, and Thurs saw AN 2035s around +20 bps wider near +190 bps (per BondCliQ) but retraced slightly to low 180s by the end of the day. AN has manageable fundamental downside exposure but remains exposed to widening given its cusp IG bond rating. On a positive note, AN has an economic interest in higher credit quality with its rapidly growing captive auto finance operations.

The auto retailers have seen much worse cyclical backdrops than this current macro environment even if the tariff challenge is unprecedented. Dealers and autos saw very strong 1Q25 sales volumes, but tariffs on the scale announced will break all-new ground and challenge inventory planning. The 6 franchise dealer stocks were all off during the first trading after the “Liberation Day” news. AN held in slightly better at -4.81% at the close (LAD -7.8%, ABG -7.5%, GPI -6.7%, SAH -6.2%, PAG -5.6%). AN edged out the S&P 500 with AN ahead of Midcaps (S&P 400) and the Russell 2000. On Day 2 (today), the market was calm for dealers with AN and its public dealer peer group barely moving (some even positive) as the S&P 500 (-5.97%) and Russell 2000 (-4.4%) were getting crushed.

Business Risk:

AN was the industry leader before Lithia (LAD) took over as #1 with its more aggressive M&A program. Less aggressive could be a positive now. AN’s recent foray into auto finance focuses on the AN franchise and will be an execution challenge but one with material upside in fee generation and a steady growth of its earnings asset base. Finance operations can bring an advantage in terms of selling tools. Lithia and AN are both pursuing this strategy. Used car sales opportunities will be improving again with AN the #2 franchise dealer in used vehicles.

Note: The AutoNation Finance segment should not be confused with the extensive and lucrative F&I operations of the individual dealerships. The dealers work extensively with the captive finance units of the OEMs and other third-party auto lenders (new and used) to generate material fee income from F&I products.

Tariffs:

The tariff threat is a negative risk factor for the entire auto chain across the Tier 1, 2, and 3 suppliers to the OEMs and the auto retail and dealer operations. AN sales and inventory show premium luxury and import brands holding the leading share of revenue mix. AN has high exposure to non-US manufacturing whether USMCA trade partners (Mexico, Canada), in European luxury, or with Japan and South Korea. Completed vehicles face the highest tariffs while “import brands” manufactured in the US transplants will be subject to uncertain tariffs tied to the high value-added components (engines, transmissions, high electronics and tech-based systems). With modern vehicles dominated by software value, the visibility of the component tariffs need clarity. The same is true for USMCA-qualified vehicles.

AN volume was comprised of 46% import brands and 27% from premium luxury (import brands) with 27% from legacy Detroit 3 brands. The mix of models manufactured “offshore” (outside the US) is not standard disclosure. That will need to change in this unfolding tariff mess.

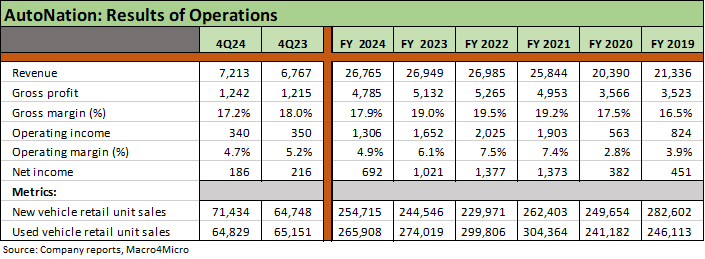

Profitability:

Margins are thin in auto retail. Auto retail cash flows are traditionally less volatile given steady replacement cycles and high margins (48% area) in Parts & Service revenue including those from warranty and service plans. AN posted favorable same-store unit volume growth in 4Q24/FY 2024, impressive P&S performance at $2.2 bn in gross profit, and solid finance unit origination/asset growth. That is tempered by adverse same-store profit trends in FY 2024 in new and used vehicles and overall margin compression for 2024. The product segments posted margin declines with Premium Luxury the most profitable in dollar terms and in profit margin.

Tariffs will bring pressure on customer affordability, higher cost of sales, and challenges to inventory turnover as 2025 proceeds. Across the auto manufacturing chain, materials and supplier costs and production could be disrupted, and that could flow into supply-demand imbalances. The scale of tariffs on Japan and South Korea add a new ugly element for dealers. The dealers will adapt their inventory mix accordingly and work with the OEMs on the tariff-exposed OEM products to find partial solutions.

The Big 6 public auto franchise dealers will be pressed to give more disclosure on their mix of imports vs. “import brands” and which are US made. They will be pressed on what the changes mean for the growing used car operations. Used car retail will get hot again with the tariff distortions. AN is the #2 used car among franchised dealers (i.e. ex- Carvana, CarMax) Lithia is #1 with its growing digital operations.

Balance Sheet:

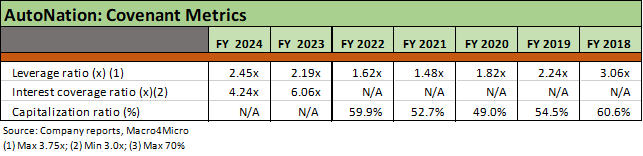

Leverage increased to 2.45x in 2024 to the highest level since 2018 within the 2x-3x target range. AN has ample latitude under credit agreement metrics and is well inside the 3.75x max in the credit agreement. Interest coverage of 4.24x is above the 3.0x minimum. Leverage terms were revised to make temporary room for M&A in line with the industry trends of sustained dealer acquisitions.

Captive Finance operations:

AutoNation Finance started in late 2022, and that business is off to a good start with non-recourse financing and ABS alternatives as it grows. The ramp-up takes a few years, and they are on track. AN Finance has rapidly grown with improving quality metrics. “Product attachment” in vehicle sales and finance is accretive and supports earnings. Bigger tests come in a downturn. The average FICO score in 2024 was in the lower prime range. High margin Parts and Services (P&S) and used vehicle sourcing is lower risk for franchise dealers given trade-ins.

SELECT CHARTS

Auto retail is low margin, but low volatility and lower fixed costs help.

Import brands dominate the income statement but offshore vs. onshore matters.

New vs. used ebbs and flows with tariffs possibly shifting toward used again.

The balance sheet is growing on both sides with industry consolidation.

Covenant leverage inside the 3.75x max but weakest since 2018.

Unlike Lithia, AN has been more about buybacks than M&A.

Auto finance ramping since 2022 acquisition, now focused solely on AN stores.