US-Canada: Tariffs Now More than a Negotiating Tactic

Worries on the tariff plan and poisoning the relationship with Canada is crossing a line into aggression and threats against NATO allies.

Hey Panama, put’em up! Hey Greenland, how long before you melt?!

The past week escalated the tariff threat as Trump’s words took on a darker tone around annexation of Canada and potential military action against Greenland and Panama. At the same time, more ego risk and political credibility is on the line with tariffs.

We put together a list of questions to ponder in the context of Canada as the 51st state, Panama as a strategic military target, and Greenland as a new age “Manifest Destiny” retro imperialism moment.

The mix of commentary from Trump this past week does not bode well for what comes next in trade. The tariff issue is a numbers game based on the final de facto “import tax” rates (i.e., the tariff), and we have seen no real economic analysis on the tariffs from team Trump since they are forbidden from saying “the buyer pays” (i.e., the truth and the facts).

Economic risk can rise when you insult leaders and countries while expressing annexation ambitions. That can serve to unite the “other side” to organize, dig in, and fight back – especially in an election year in Canada. That heightens the risk of the collapse of the USMCA.

That’s a big state…

We try to give some context to a very noisy week and what some of the noise might mean for the ever-shifting handicapping of tariffs and trade. The term “game theory” is the murkiest term one can use since you really can’t figure it out until it all plays out (otherwise it would not be game theory). Even at the end, outsiders cannot honestly know what the game plan was in advance once it gets revised after the fact. This week took “murky” to “disturbing.”

The week brought annexation to the fore with economic coercion of a USMCA trade partner an admitted goal. We also saw military threats against sovereign nations to surrender their sovereignty to one man who is not even in office yet. A strange week indeed. We ran with the Cowardly Lion visual at the top given what still seems to be a pervasive fear of facts that Washington needs to get over.

Questions to ponder:

The latest behavior and rhetorical shifts by Trump raise some questions to consider:

Did the higher volume and frequency of tariff threats shift the odds on his more extreme threats going into action or did the mere act of saying them put his ego deeper into the psychic need to use the tariff weapons on Day 1?

Does the reality of Trump attacking multiple parties at once whether threatening tariffs or challenging the sanctity of sovereign rights (Canada, Mexico, EU/Greenland, and China) run the risk of all four retaliating at the same time?

Will the attacks on smaller EU nations (Denmark) end up reminding US leaders that the EU was formed for a reason with the tool of bloc-wide retaliation?

As we framed in some of the earlier US-Canada trade commentaries, is the US-Canada clash now further damaged by this recurring annexation rhetoric? Will any viable leader of Canada up for the top job in an election year now face a domestic political need to “drop the gloves” on any trade and tariff clash? (see Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24).

As we have already seen in the Canadian press and from leaders from both Canada and China, will a collapse of the USMCA lead to closer trade ties between Canada and China? Would the same hold true in Mexico and other Latin American nations if both the USMCA breaks down and Panama faces threats?

Will Trump threaten the large base of land-locked and US-dependent Canadian oil sands that flow into the US and cause a 4Q18 style dislocation of supply-demand on that side of the border that could drive a major decline in Canadian crudes? (Back then, WTI vs. WCS differentials soared and Alberta used production quotas.)

Would an attack on Canadian crude oil beg a massive retaliation from Canada on the high value-added US exports and ag mix?

Does Canada and Greenland noise spill into NATO and the EU as well as heighten the risk of a major US-EU trade clash based on the attacks on NATO ally and EU member Denmark? (See Trump Tariffs 2025: Hey EU, Guess What? 12-20-24, Tariffs: The EU Meets the New World…Again…Maybe 10-29-24).

Has Trump still failed to understand the all-for-one, one-for-all nature of the EU, the purpose of its formation, and how they will operate if any of their members (including Denmark) are threatened with tariffs?

Is there an element of pretense in these maneuvers for Trump to find an escape route from NATO while also pulling back from Ukraine support?

Does the glaring lack of respect shown to sovereign rights send all the wrong signals to Putin in Ukraine and China in Taiwan when Trump maybe only wanted to send them to Putin?

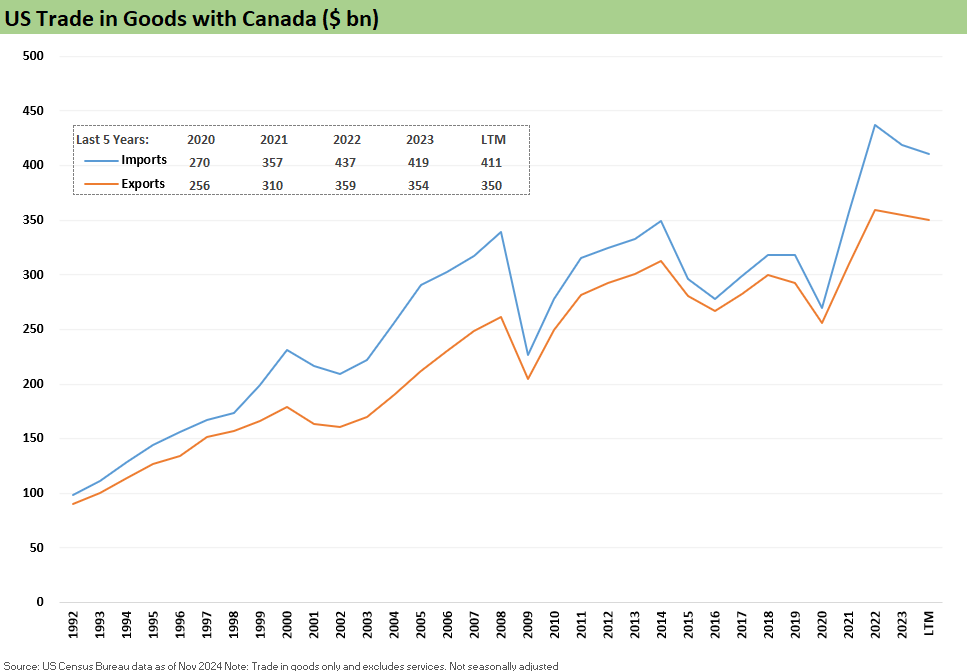

The above chart updates the US-Canada goods trade lines through this past week’s trade release. We have looked at the import/export product line items in earlier pieces (see Tariff: Target Updates – Canada 11-26-24).

While Trump’s rambling press conference and comments about Canada implies “Who needs Canada?” the fact is that Canada is the #1 national export market (EU #1 as a trade bloc) and has a very high value mix of exports from the US to Canada. Imports from Canada are biased toward energy, metals/mining, chemicals among a wide range of other products detailed in past research.

One reality check for Trump is that over half the US states have Canada as their largest export market. That includes the “Blue Wall” states that elected Trump. He is playing with economic and political fire in his Canada strategy right now if it goes wrong. The biggest risk for Trump’s tariff plan is that Canadian politicians and provincial leaders are braver than US Senators, which is indeed a very low bar to clear.

Trump also raises the Canadian domestic political stakes by dumping all over Canada in his comments. Among the patronizing comments is that the US does not need Canada as a partner for arctic icebreakers that are strategically important in defense. Trump neglected to mention that the US has 2 and Russia has 40. Perhaps that is not a scoresheet to get cocky about and especially with China (the largest shipbuilder in the world) eyeing the arctic.

Trump better recheck the defense budget and delivery schedules on those icebreakers. Russia is the only country that makes nuclear icebreakers. Trade reports indicated that the two US icebreakers are quite old, so that also raises the stakes for the news around the US, Canada, and Finland partnering to produce them. Trump just trash-talked that icebreaker partnership news. Finland (another NATO ally) is a major manufacturer of icebreakers.

A look at Trump’s 51st statehood bid for Canada to cede its sovereignty…

Trump’s offer to Canada is to give up its sovereignty for 2 senate seats and the right to be abused by the electoral college, gerrymandered states, and embrace the minority rule dictate we see today in the electoral college. As US citizens, we are stuck with it, but Canada would need to volunteer for it.

Below we give a harder-edged version of what Trump has bid for Canada’s natural beauty, strategic geographic positioning, natural resources, manufacturing assets, and banking system and more. Look at the map above one more time before reading our version of his compelling offer:

Trump to Canada:

Senate role: We award you the same number of Senators as Wyoming even though your population is around 70x that of Wyoming and you will now be the most populous state in the US (Canadian response due once they get up off the floor from laughing hysterically).

States rights: We see your 10 provinces as homogeneous and therefore you are a single state. We will get back to you on the house allocation of Reps for your single state since we need to wait for feedback from Team MAGA. Apparently, a few dozen MAGA house reps are on their way to the hospital after they all had strokes on this news.

Regulatory matters: We will assign the DOGE twins a mission to terminate all Canadian Federal-level employees.

Health care: All government-paid health care benefits are cancelled.

Elections: We will only count your votes from the most conservative provinces such as Alberta. All Quebec votes will be viewed as fraudulent in advance.

Environmental laws: They are all repealed on the closing date of the sovereign takeover.

Civil rights: We outlaw the use of the term “First Nations” as woke. They will now be called “First Immigrants.” I am told they walked across the Bering Strait land bridge. We will need proof of citizenship, or they will need to get on Stephen Miller’s travel bus.

Supreme Court: Yours will all be terminated on deal closing. I already own one, so we don’t need them.

Bottom line: How can Canada possibly turn that down?

The main drama for the markets is the tariffs…

Today’s market risks and economic setbacks are the main event here. Talking about military actions against allies and economic coercion to annex a G7 NATO ally like Canada is very distracting from the risk of doing things like blowing up NAFTA/USMCA and setting off trade battles with the four largest US trade partners. Maybe that is the point (distraction), to deflect focus from what will be very painful economic impacts if (or when) the tariffs get launched.

US-Canada statements by Trump were worse than the military nonsense…

The US-Canada topic was arguably the most important this week since it goes right to a near term market risk tied to the 25% tariff threat. We like to read the Canadian press that gets little airtime in the US (Globe & Mail, Financial Post). The coverage over the tariff threat and annexation pressure has been lighting up the screens in an election year in Canada. The political scramble will now get accelerated with Trudeau calling it quits.

The idea of coercing a critical NATO ally into annexation surrender is way over the line as well as reckless and destructive. This week’s tone shifts the odds in favor of the tariffs given Trump’s constant focus on the topic but also given his apparent fear of being viewed as a paper tiger (or Cowardly Lion).

We don’t believe his view of Canada factors in the history of the relationship or items such as Canada saving the day (and maybe the war) at Passchendaele in WWI or landing at Normandy with the allies on D-Day in WWII. That might be something a draft dodger allergic to history might not appreciate in terms of respect for an ally.

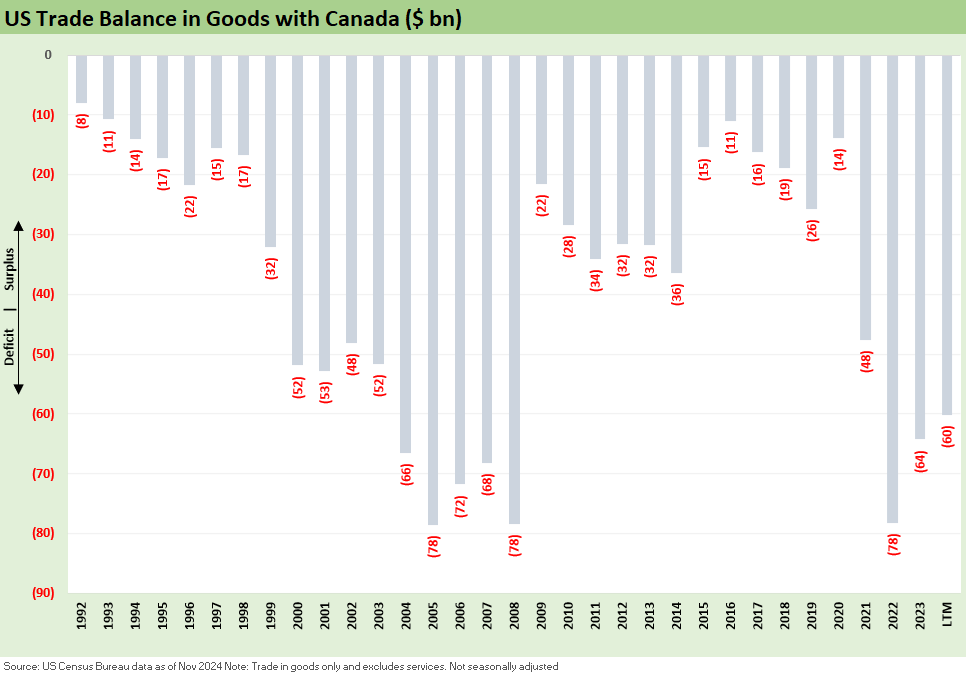

The above chart updates the history of the US-Canada goods trade deficit. Canada remains the largest trade partner as a nation for US exports, and it is a very high value-added mix. Europe and the EU are by far the largest trade partners as a bloc in both exports and imports.

The US actually has a surplus with Canada ex-crude oil, and that gets swept up in the question of how the combined US and Canadian crude production could be a formidable combination from distinct sovereigns (not annexed). The two-way traffic of crude and refined petroleum products across regions is more nuanced than the imported crudes total would signal. There is also a lot of pipeline politics in Canada just as there is in the US. That will be a topic for another day.

Panama is not a John Wayne movie…

Panama is a secondary issue for now and a more speculative topic. Panama is not an invasion target and for now this could get into the “all talk” accusation. A bill was introduced in the House to “buy” the Panama Canal, which by itself is a strange move with DOGE as a priority and budget deficits off the charts. If the canal is not for sale, why the legislation? If it is for sale, the question is whether other bidders can weigh in or is that in the category of The Godfather’s “an offer you cannot refuse.” On a semi-serious note, that sale might be hard to run through the budget in reconciliation and UST supply forecasts would not love the idea.

For the Panama Canal, the cost of freight and the topic of China control is more about propaganda. China does not “control” the canal. Hutchison Whampoa is a global leader in ports, real estate, and telecom. Hutchison operates a material share of the largest ports in the world given its Asian presence and learning curve. It is logical that Hutchison is there given their expertise. Based on trade reports, Hutchison’s long-term concession contract was renewed ahead of its 2022 term dated from 1997. We did not dig out any other information on it.

According to a Seatrade Maritime article back in 2021:

PPC is a subsidiary of Hutchison Ports Holdings and administers the ports of Balboa on the Pacific side and Cristobal on the Panama Canal Atlantic entrance.

Several economic sectors called for a review of the conditions of the contract with PPC prior to the renewal.

According to a government statement, PPC will make a payment of $130m in dividends, plus $20m for Social Responsibility and $14,464,491.35 in concept of tariffs (movement of containers and wharfage) totaling $164,464,491.35 “which represents the largest amount managed and received from any past administration during the term of this contract,” said the statement. However, it is not specified whether payment of dividends are advanced and up to which year.

We have not done anything to look into Panama Canal economics, but the concept of dividends as noted above and other descriptions we read, this is about project economics and that starts with the revenue lines of the port. We assume there are no “military intimidation discounts” available.

The debt markets know the “Hutchison” name globally and are well aware of its global, multinational scale. The idea that China is expanding its relationships using soft power, using the Belt and Road Initiative, and exercising a lot of economic power as the #2 economy is hardly news. That China presence fits in with the bigger basket of trade risks. The potential for a US trade battle with China is also part of the much bigger bucket of risks.

The problem for the US is that Panama has sovereign rights. Threats to take control of the canal would be a diplomatic disaster with allies but would also elicit a response from those that use the canal. Guessing the economic cost of such an action by the US is a mug’s game. Maybe China stops buying UST and divests what they have if that is the route this is going? Make a list.

Perhaps the drama is a set-up where if China takes Taiwan, then Trump will use it as a rationale to seize the Panama Canal and assert more control over shipping. This is a mix of speculation and extrapolation on steroids, but it is also a sign of the times. Such market distortions lead directly to scenarios of supplier chain setbacks and supply-demand imbalances over time for gloom and doom bear oddsmakers.

History is not kind to US forays into Latin America…

We don’t want to dig into history too much here beyond the obvious abnormal nature of Trump’s behavior in geopolitical context. That will get you votes in MAGA Land, but it also raises economic risks and trade tension.

We refreshed our memory on the Banana Wars with a kindle download (“Banana Wars” was coined by an historian). We recall from long ago little league days reading about the exploits of the Marines and Chesty Puller in places like Nicaragua in the 1930s. There is a long list of military actions that unfolded well into the 20th century.

The Banana Wars are just one of a collection of topics across history, but the US has had a busy stretch of conflict from the Spanish-American War period to local battles with US troops (Haiti, Dominican Republic and more), the Bay of Pigs event in Cuba, the border wars with Mexican figures (Pancho Villa), the infamous Zimmerman Telegram ahead of US entering WWI, and events such as the not-so-secret US support for Latin American dictators and notably further south in Chile with Pinochet.

A lot happened outside the Banana Wars (coups, dictatorships, etc.). The history “ain’t pretty.” Trump is not real big on history reading. (If you asked Trump who “Sandino” was, he would probably say “The Godfather’s son who got shot in the movie.”)

Greenland, the EU connection, and sovereignty issue once again…

The Greenland situation is a bit more surreal since it attacks an EU nation and another NATO ally in Denmark. Even if Greenland is working toward independence, they are not signing up for anyone else’s annexation. Canada and Denmark are both NATO. Presumably Greenland as an independent sovereign would also be in that club for both safety and economics.

Those NATO aspects of the threat have a few more layers for the conspiracy theory types. There are many who simply believe America First has an ulterior motive of ending NATO and letting Putin be a global authoritarian partner in the game of “whoever has the most toys when he dies wins” (Putin and Trump being the collectors).

Tweaking nationalist sensitivities in other countries is asking for trouble….

National pride and nationalism are things that Americans see in their history, but some leaders seem to be forgetting that can be very much a force in other nations as evident in some past post-WWII colonial wars (Vietnam an obvious example for France and the US and basically all of Africa for numerous European powers across the past two centuries).

Military action in Panama would require permanent occupation and beg a lot of trouble in the region. That is for the regional experts to sort out, but history tells a sad tale. China would certainly see opportunities to build even more trade relationships in the region. A breakdown between the US and Canada or the EU also could (in theory) redefine opportunities for alternative trade relationships and investment with those alienated US trade partners and China. That is already all over the Canadian press.

The bottom line on this past week is the increased probability of tariff battles with Canada, Mexico, the EU, and China. The irony could be that many more trade and diplomatic opportunities for China trade may open up on the other side.

Contributors:

Glenn Reynolds, CFA

Kevin Chun, CFA

See Trade Related:

Trump Tariffs 2025: Hey EU, Guess What? 12-20-24

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Tariff: Target Updates – Canada 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23