Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk

We look back at another jam-packed week of macro X factors, tariff noise and softening economic headlines.

Everybody knows that dictator FDR bombed Tokyo Bay on Dec 7 and started WWII!

The week was busy on multiple fronts as nervousness around tariff threats, Walmart spooking consumer sector watchers, the updated UMich sentiment numbers adding some anxiety, soft housing starts, and a fresh round of broad-based tariff threats all flowed into the stock price action and even an unusual bout of weakness in HY spreads.

After the flight-to-quality rally of UST curve, we get the second estimate on 4Q24 GDP this coming week plus the latest round of PCE inflation and related income and outlays numbers.

We look at the geopolitical and domestic political backdrop for what it is, which is more than just the usual partisan toxicity and is now spilling into macro threats on multiple fronts.

The clash of facts, concepts, economics and politics…

Among the victims of all the partisan head banging since 2016 is the failure to use facts and apply concepts. Facts used to be inviolable absolutes (just ask Ayn Rand…Reagan and Trump were both supposedly big fans), but now the economic debates are often cast adrift in a sea of adjectives and half measures in applying concepts. Facts are often not used at all, and lately they are omitted or flat out falsified. To some, election results are not facts. Who invaded a country is not a fact. Buyers paying the tariff is not a fact. We live in a strange world that gets stranger each week.

Matters like “seller pays” vs. “buyer pays” are fact problems in this market (“problem” as in there is only one fact), and especially across a timeline that saw a fresh wave of tariff threats this past week – some specific and some anything but clear on magnitude and timing. How the tariffs transmit their economic effects across the broader economy and predicting secondary reactions (e.g. price vs. cost impacts) are more about applying concepts and using assumptions. The “buyer pays” is the fact but how the tariff flows into the economy is a conceptually derived analytical opinion.

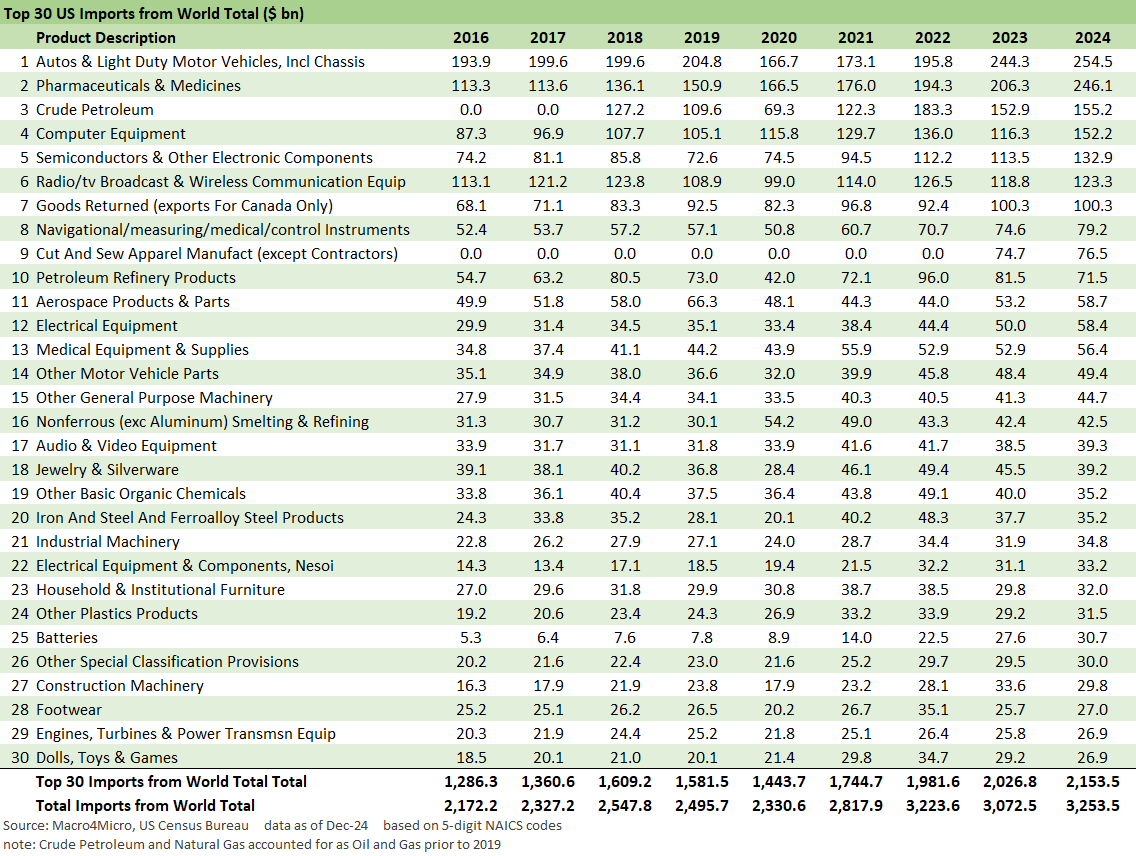

The week’s tariff drama included more open threats against autos, pharma and semis. We also saw more blurring of what “reciprocal” means in terms of taxes and tech legal risks. That pharma tariff targeting is no small risk and seems squarely aimed at the EU. Pharma is the #1 import into the US from the world. As a reminder, Trump is ticking off the list of top imports into the US from “the world” (see US Trade with the World: Import and Export Mix 2-6-25). We reproduce that list of top imports into the US below.

The EU battle that Trump seems determined to escalate comes against the backdrop of the Ukraine-Russia diplomatic crisis unfolding where Putin is a saint, and Zelensky the evil dictator. This past week also saw the G7 refuse to agree on unanimously terming Russia as the aggressor as in past statements. Trump and Rubio opposed and revised historical facts.

We reproduce the import list to the US from the EU below:

The target list for tariffs includes some very important line items to the EU trade bloc, which is the #1 trade partner in imports and exports for the US. Pharma is by far the #1 import from the EU. Autos are a distant #2 (you can only sell so many Mercedes and BMWs in the US). Aerospace is a battleground but with Airbus also making planes in Alabama. That could expose Boeing to retaliation while Airbus keeps selling US-made aircraft in the US.

New World vs. Old World: Let’s get ready to rumble?

The newfound (or is it?) “Trump Love” for Putin could take the economic elements of the trade attacks and inject more political and human nature into the equation. We just saw 3 fights in the first 9 seconds of a US-Canada hockey game last week with national anthem booing, etc. (Canada won the championship this week). That was a micro level sense of political risk and somewhat of a metaphor for the direction of trade wars that could impact many household-level economic realities.

For the EU, the big battles still lie ahead. Musk’s outspoken support for the AfD in Germany (the handicapping is for less than ¼ of the vote going to the AfD but that is a lot in German terms). JD Vance’s performance in Munich is not going to help reaction time and strategy on tariff retaliation. Trump and his allies restating why the G7 should become the G8 again (with Russia) this past week was another geopolitical out-of-body experience for foreign policy wonks.

The ill will being generated heightens the domestic political risk across some key EU economies. Trump loves a spectacle, and his wrestling and UFC relationships seem to get applied in too many cases.

From the US side, those trying to read the behavior patterns might tap into more than a few conspiracy theories that seem more realistic rather than long-tailed scenarios.

One increasingly mainstream view goes like this short form version:

Putin wants to reconstitute the Soviet “empire” (small “e”).

Putin first has to finish off Ukraine.

Putin cannot get “back to the future” with NATO even if he can take Ukraine.

Trump wants out of NATO. He has the gutless Senate cowed.

Trump makes Ukraine the aggressor and the “bad guys.”

A major trade war with the EU will fuel a major economic clash.

Canada also gets swept up in the G7 and NATO clash.

Trump will then have an excuse to leave NATO. He feeds off division.

Putin finishes off Ukraine and sets his sites (literally) on the Baltics.

Trump pitches NATO exit as defense budget savings and “America First.”

Trump supports more “populist” (right wing) movements in Europe.

EU becomes aggressive in EU trade war response.

Internal EU conflicts make it easier for Trump to strike bilateral deals.

Such scenarios would typically be the fodder for a bad Netflix movie, but it is staring us in the face right now. Like the mainstream media, street research tends to soft peddle the convergence of geopolitical and economic risks until after events (for fear of pissing off half your customers in this case). The approach to an emerging market analysis would include such commentary. You just can’t do it with the US and EU.

The reality is that such outcomes would have dramatic economic impacts across industry groups (oil and gas at top of list, autos next), sovereign stress, and global banks. In other words, trade and human nature and geopolitics will converge in this latest “cluster of circles.”

It does not take a lot of imagination to use the old “For want of a nail” poem to see how the EU-US trade issues blur and lead to escalation and major risks.

Benjamin Franklin’s version went like this:

For the want of a nail the shoe was lost,

For the want of a shoe the horse was lost,

For the want of a horse the rider was lost,

For the want of a rider the battle was lost,

For the want of a battle the kingdom was lost,

And all for the want of a horseshoe-nail.

The line “kingdom was lost” is topical given the tagline of “long live the King” posted by Trump about himself. Things are getting beyond strange and do represent threats at the macro level both for national and global risks.

We will look at the auto tariff threats separately in the context of autos supplier chains and related risks with Japan and South Korea. In addition, Trump’s threat against the defense budgets are aimed at the prime contractors and their ancestral clout in Washington. That comes in a week where Trump is purging the Joint Chiefs and targeting select military leaders. Defense names will get a lot of scrutiny in the coming weeks.

The above chart shows a mixed score on the week for the 32 benchmarks and ETFs we track at 14 positive and 18 negative. That is consistent with mixed results of the 11 S&P 500 sectors with 6 positive and 5 negative. The broad benchmarks were in the red for the week across NASDAQ (IXIC), S&P 500 (SPX), Midcaps (MDY), and Small Caps (RUT).

One twist in the numbers is that the Homebuilder ETF (XHB) is dead last even with a UST rally as mortgages have only moved modestly lower back into the high 6% range. The fundamental news out of the housing sector has not been supportive ahead of the peak spring selling season. Starts (see Housing Starts Jan 2025: Getting Eerie Out There 2-19-25) and Existing Homes Sales (see Existing Home Sales Jan 2025: Prices High, Volumes Soft, Inventory Up 2-21-25) were soft and Toll Brothers, one of the top performers across builder equities in 2024, sold off on its earnings report for 1Q25 (see Toll Brothers 1Q25: Performing with a Net 2-20-25).

We see some winners in defensive names such as Consumer Staples (XLP) while EM and China (VWO) and Base Metals (DBB) were in the winning ranks this week. Duration was a winner this week with the long duration UST 20+ Year ETF (TLT) in the top quartile. 6 others of the 7 bond ETFs were in the second quartile.

The tech bellwethers had a bad week with only two barely in positive range. We line them up in descending order of total returns for the week, and 3 of the Mag 7 came in worse than -5.0% on the week. We see 5 Mag 7 names comprising 5 of the bottom 6 in the chart with Broadcom joining that group. Apple and Microsoft were #1 and #2 at positive returns closer to zero than 1%.

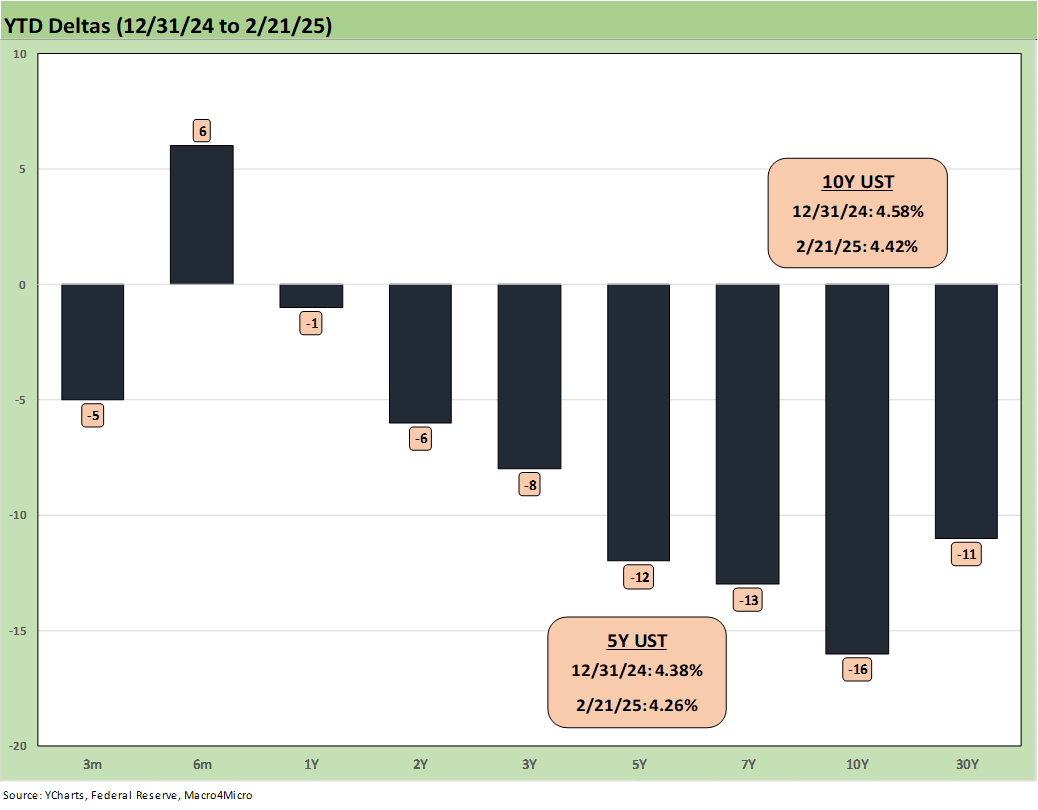

The above chart updates the weekly UST deltas with a slight bull steepener pattern from 2Y to 10Y on the week.

The above chart shows the YTD deltas with the bull flattener playing out with the 10Y UST rally. The 10Y UST is still a long way from the Sept 2024 lows (see UST Yields: Sept 2024 UST in Historical Context 2-17-25).

The above chart updates the journey of the 10Y UST and Freddie Mac 30Y Mortgage across the tightening cycles from the ZIRP period to the Oct 2023 high, then a return to lows in Sept 2024 when mortgages got back to just a 6.0% handle.

The above chart updates the running HY OAS. HY OAS widened +16 bps on the week to +278 bps. Even after the widening, HY spreads are still in the June 2007 range.

The HY minus IG quality spread differential widened by +15 bps on the week to +197 bps or still well inside the +325 bps long-term median.

The BB vs. BBB quality spread differential widened by +13 bps on the week largely on the back of the BB tier moving +14 wider on the week (+12 bps wider on Friday).

See also:

Existing Home Sales Jan 2025: Prices High, Volumes Soft, Inventory Up 2-21-25

AutoNation: Retail Resilient, Captive Finance Growth 2-21-25

Toll Brothers 1Q25: Performing with a Net 2-20-25

Housing Starts Jan 2025: Getting Eerie Out There 2-19-25

Herc Rentals: Swinging a Big Bat 2-18-25

UST Yields: Sept 2024 UST in Historical Context 2-17-25

Footnotes & Flashbacks: Credit Markets 2-17-25

Footnotes & Flashbacks: State of Yields 2-16-25

Footnotes & Flashbacks: Asset Returns 2-16-25

Tariff links:

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24