Happy War on Allies Day

We reproduce the import and export details for Canada and offer a memory jogger on Canada’s role as an ally.

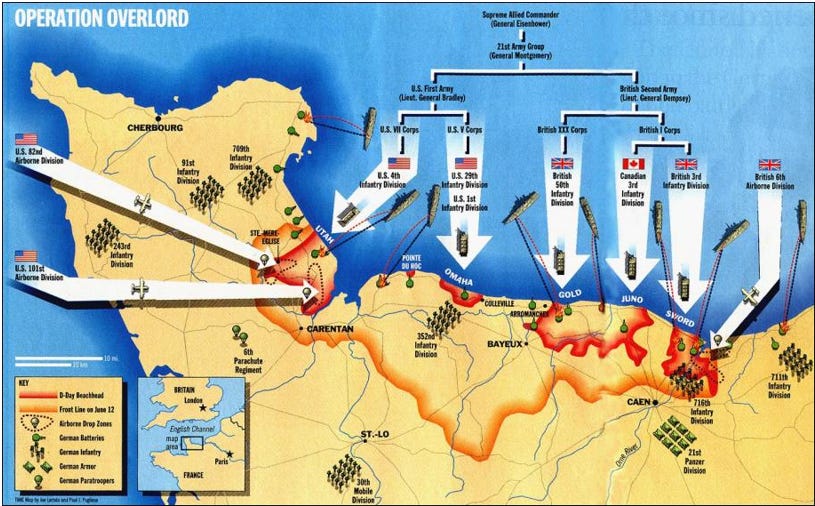

Dear Donald, find the Canadian flag… D-Day was not about bone spurs…

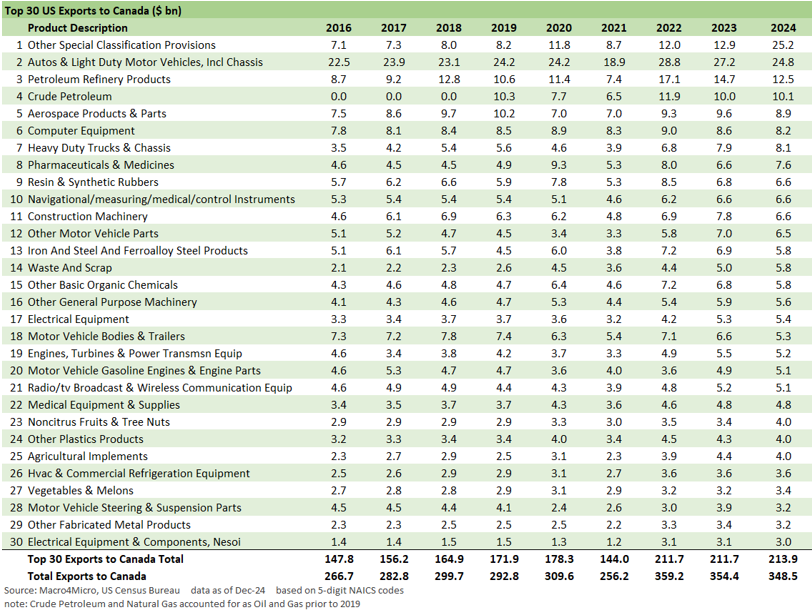

We reproduce the import and export details from Canada, the US’s #2 national total trade partner (import + export). Canada is the #1 export market and #2 behind Mexico in imports (see The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25). Total trade matters in economic activity.

As we wade into a trade war, make no mistake that these tariffs are not about fentanyl. Trump needed to use that for legal cover to get around legal barriers of making unilateral decisions from the White House without Congressional checks. It is a version of “soft dictatorship” action. Hold that thought…

When we consider burning alliances to the ground, history should play a role. For Trump, history is his own hyped bio profile not about the historical course of US alliances across the ages. That is why he could not get along with his Generals in Trump 1.0 and had to find lapdog replacements for 2.0. The desire to undermine Military leaders when they disagreed with him is in his behavioral profile. Since then, he has attacked them nonstop. He now has his Muppets doing the same with Zelensky even as the Pentagon Purge is ongoing.

D-Day as a symbol of alliances…

“The Juno Beach Centre stands as a testament to our country’s courage, sacrifice, and values…we fly the flags of our country’s allies who participated in the Normandy landings, including the Stars and Stripes—honoring the American servicemen and women who fought alongside Canadians.”

We have a hard time resisting highlighting the contributions of Canada in its role as a close ally in war and peace. The Canadian military was famous in WWII as being the best stocked military to backstop the UK after Dunkirk. Canada was there alongside the US and Britain to support the opening of a second front on D-Day at the Battle of Normandy.

The performance of Canada in WWI was also the stuff of legend at a critical juncture early in the war – long before the US arrived. The Battle of Passchendaele was one of the more famous examples that students of history should know from cemeteries, monuments, books or movies.

We know Trump is perplexed by war history and heroes. He resents them. Passchendaele had some similarities to Belleau Wood as a critical battle. We all know how Trump treated Belleau Wood heroes while making the world safe for combovers (see Memorial Day: Ponderings for Donny the Dodger 5-26-24).

Bone spurs were not an option for those Canadians who landed at Juno Beach as highlighted in the above D-Day map. While the Trump family was making a fortune building housing for wartime workers in Brooklyn, some of those who served on D-Day did not make it back to occupy any of them.

Back to imports and exports and total trade…

Total trade is a major indicator of economic activity that bridges a wide range of secondary and tertiary revenues and payroll impacts. You learn about multiplier effects in Chapter 1 of the typical Econ 101 texts. It is so basic that it takes very little time on the basis of how incredibly obvious it is.

Such entry-level concepts tend to be a cornerstone of fiscal policy and come up in tax incentives at the state and local level since companies relocating bring a lot of multiplier effects with them. In past cycles, just the idea that Southwest Airlines would relocate to a satellite airport would have material effects on follow-up impact and economic decisions on location and expansion.

Imports and exports run on the same principle. Free market decisions on “what to buy and sell” and from where/who now give way to politics. The “level playing field term” gets abused and misused with regularity. Plan on a smaller total pie and higher prices.

The import list tells a story we have already covered, so we refer you to that commentary (see Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25). Oil, autos, various natural resources, and metals/steel dominate the upper ranks. The auto operations in Canada are owned primarily by the legacy Detroit 3 with some transplant operations as well (see Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24). We also see Toyota and Honda with a major presence in Canada.

The big news for auto by far is in Mexico (3.86 million light vehicles produced in 2024, 1.37 million in Canada). For those keeping score at home, the potential for a downsizing of Mexican or Canadian auto operations does not necessarily mean expansion somewhere else, e.g. the US.

The market or hopeful northern states might consider the long-term secular trends that offshore investment by international OEMs tends to be in the “transplant states” and not places like Michigan or Wisconsin. The domestic auto operations also could simply downsize.

To the extent supplier chains are taxed, the international players do not have to rush since supply-demand imbalances and downsizing of GM, Ford, and Stellantis operations might benefit status quo US operations for Japan and South Korea. They can take their time (as in years even after an announcement date). The professed friend of labor in the Midwest might not be such a friend after all if new OEM capacity moves to places like Alabama, Georgia, Mississippi, and Texas among others on the “right to work” state list. People voting against their self-interest is not new in US behavior patterns. That is why emotions are there - to play on them.

The export list above is also a high-value-added mix with Canada the largest export market for well over half the US states. That will factor into retaliation strategies by Canada, which are already unfolding as of today with more to come at the provincial level.

Tariff links:

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24