Trade: Betty Ford Tariff Wing Open for Business

The EU vs. US trade clash has already turned into an elementary schoolyard brawl.

The war Trump ducked taught us a few lessons worth remembering: You can’t always get what you want.

If you grow up in a tough neighborhood, you learn a simple rule: you learn to stand up to bullies, but you also need to prepare to get hit hard. The alternative is surrender and try to live with your status as a coward (or run for Congress, preferably the Senate). On the other hand, the bully should expect that some potential targets will stand tall and fight.

The idea that Trump thought he could enter into a retaliation-free tariff battle was strange enough in Trump 1.0. Now the new lesson is that there was no first lesson as he once again threatened to escalate on the EU after a retaliation move. The threat from Trump was a new 200% alcohol tariff on the EU. We need to see how widely that alcohol tariff extends (just wine and spirits or beer/ale also?).

The problem with the approach of “retaliation to the retaliation” is that the domestic political audience for the leaders of the trade partners are often the more threatening party that will hit you as well. Many EU voters likely loathe Trump, and fighting back can be a point of national pride and patriotism.

In the case of EU, the voters by country are bigger than Trump in determining their leaders’ fate. Similarly, the future of the EU and Eurozone requires a decision that is not a full retreat from someone like Trump. That happened after Munich, and it did not go well.

“Escalate! There is no substitute for victory!” has been tried and sometimes it just does not work out as expected (cartoon from the Vietnam Era). The tariff binge of 2025 is likely to be one of those times. Those that bear the immediate costs are not the White House or Congress. The losers are the buyers, the freight and logistics operators, the retailers and consumers among others. Then sellers from the US side also lose during the retaliation. Trump’s “facts” to the contrary, the “buyer pays” – not the seller.

The above chart is a cut-and-paste from our earlier commentary on goods trade between the US and EU (see US-EU Trade: The Final Import/Export Mix 2024 2-11-25, Tariffs: The EU Meets the New World…Again…Maybe 10-29-24). The EU is now back on the front burner (big stove) with Canada, Mexico, and China as it enters the retaliation and tit-for-tat game after the steel and aluminum tariffs set by Trump.

The EU retaliation has now been met with a response to the retaliation tariff on American Whiskey. The two GOP Senators from Kentucky (McConnell, Paul) and KY’s Democrat Governor (Andy Beshear) all complained since Kentucky is the home of Bourbon. They oppose the Trump policies but the Senators don’t do anything about it. The new tariffs on US whiskey (whatever subcategory) is politically noisy at home and now Trump is turning up the volume.

The above US-EU chart shows Wines, Brandy, and Spirits at #17 in the depth chart for total EU imports. That means they will feel it, but the Southern US whisky circuit also takes their Kentucky bourbon (e.g. Wild Turkey) and Tennessee whiskey (Jack Daniel’s) very seriously. Some people care deeply about the “bourbon vs. whiskey” label or the “whiskey vs. whisky” thing. Pick your label and spelling. It is booze.

The scale of the revenue involved is important to the companies, but it is more the concept, the image, the demographic, and the audience. For the capital markets, the fact that Trump had gone trigger happy twice in one week (the reaction to the Ontario power surcharge and now this latest 200% threat) reinforced to the market that he is highly unpredictable and cannot be relied on for any consistency whatsoever. That may be useful in a real estate deal, but that does not work for corporate sector capex planning, working capital management, and contractual commitments. This is the “real economy” and not just stock price action.

It is also not about Trump’s new pitch that essentially “stock markets don’t matter” (not exactly a Trump 1.0 theme!), but there is the reality of forecasters trying to handicap margins on the wrong side of the revenue and/or cost pressure – or both. Lower expected multiples and lower earnings make for bad math relative to the higher earnings and higher multiples the market had entered 2025 expecting. As we go to print, the S&P 500 had entered correction territory.

Bessent was out on CNBC again (rare frequency for a Cabinet member of that importance) saying “the one with the surplus always loses” – as in the EU. The losses will come in votes and credibility if inflation rises after all the election campaign noise and if prices actually defy the reassurances from Commerce and Treasury. There will be a lot more tariffs and retaliations in April-May while the actual economic facts and transactions of “buyer pays” will only come at a lag. The stock market impact is more immediate since the market tries to discount those future period results.

Trump serving up some whine…A look at France-US trade…

The US typically associates wine or spirits with France (wine or spirits) or Scotland (spirits), but Scotland is not in this one. We assume Ireland will catch the spirits part (e.g. Jameson) only one day after the Taoiseach visited Trump in the White House. We thought some line items of France-US trade might be worth a look on this topic. As noted above, we have already covered the EU broadly.

The above chart plots the import and export line. Total trade keeps rising, and that trade deficit is now below the peak as we detail below.

The above chart plots the history on the US-France trade deficits. The trend follows the pattern we have seen broadly in the EU, North America, and Asia. In its basic form, Trump’s game plan entails a 4-front trade war that includes two oceans and two land borders. What could possibly go wrong?

Trump ran for office on growth, low inflation, a lower government deficit, and eliminating a trade deficit all at the same time taxes are cut. Tariffs slow down economic activity (see The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25). The tariffs will hit exports on both retaliation and currency issues. That strategy is as flawed now as it was in 2018-2019. The plan now is just on a much larger scale.

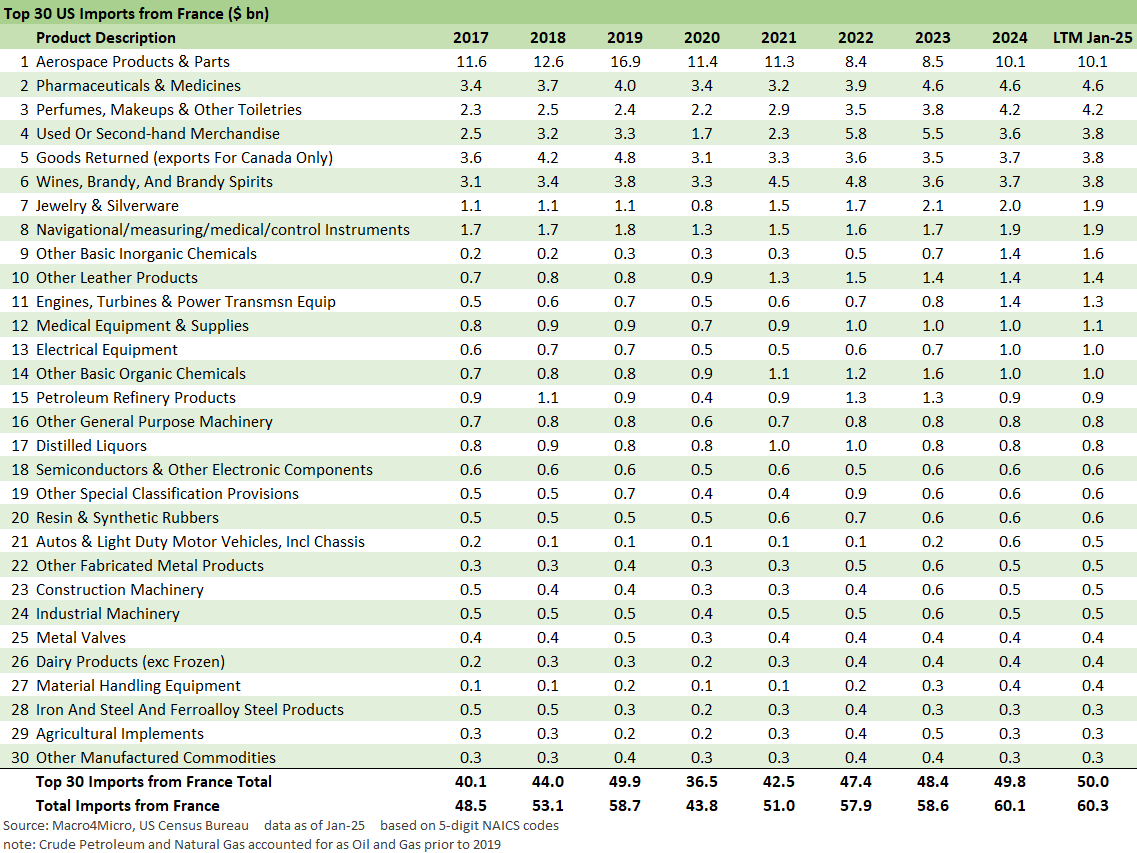

The above chart from the Census shows wine and spirits in the top tier of goods imports from France. We see Aerospace at #1 on the Airbus connection and Pharma at #2. Airbus has major operations in Alabama, so maybe commercial aerospace will not be a battle in the weeks ahead (unless it gets really ugly, and Boeing gets swept into the trade wars somehow – more likely in Asia). The ugliest product segment clashes in the periods ahead are Autos and Pharma given their role in US-EU trade.

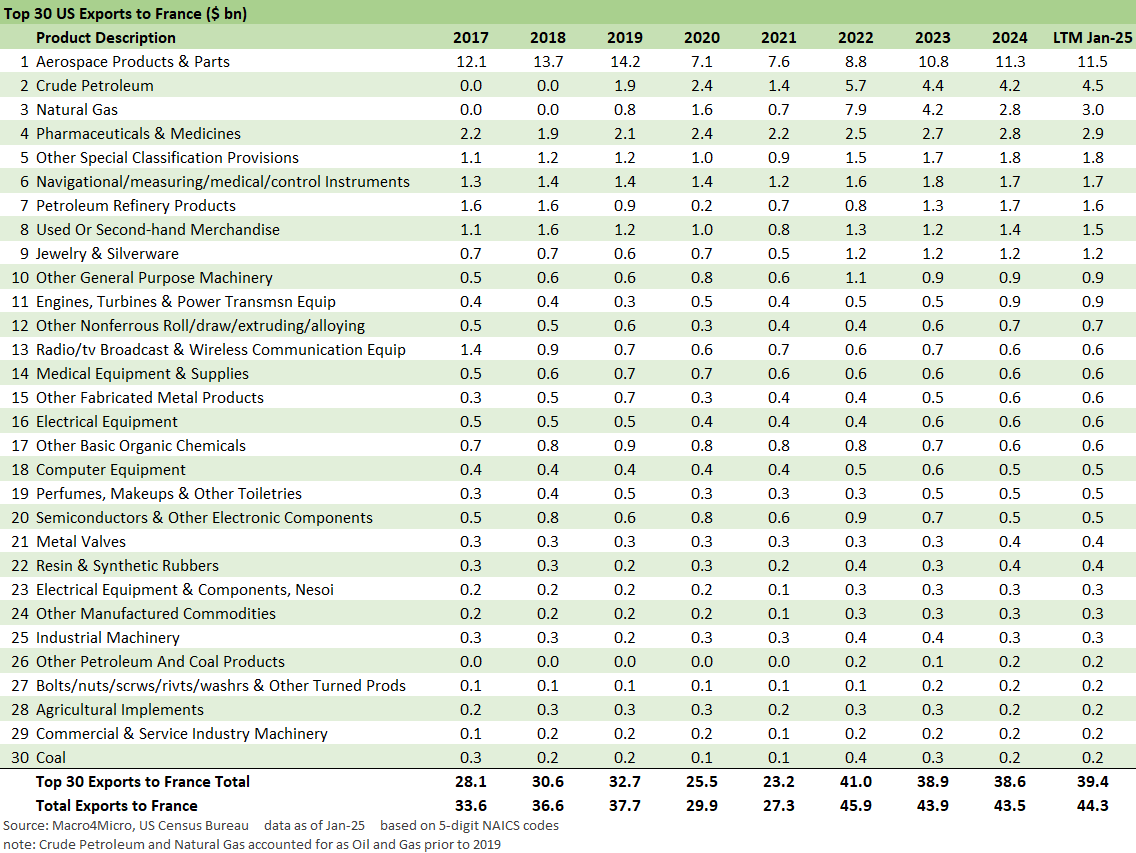

In terms of exports to France, we also see Aerospace at #1 and Energy products at #2 and #3 with Petroleum Products a few notches further down the list. We see Pharma at #4. If you view Germany and France as the dynamic duo of the EU, we would say starting a fight with a reasonably healthy value-added or strategically important export mix seems ill advised. That is especially the case given that the trade policy is built on conceptual quicksand and a factually incorrect foundation for Trump’s views (“buyer pays” not the seller).

Trump can’t stop talking about Canada…

I was watching Trump in a live interview today, and he shifted the conversation to Canada and kept saying “We don’t need anything they have.” It is not worth debating whether 2+2=4, but his reaction to the electricity surcharge might suggest otherwise. There is a reason he wants Canada as a state, but Trump has never been known for the consistent use of facts or facts at all.

Can you imagine his reaction to a 20% surcharge on potash from Saskatchewan? Someone might need to explain to him what potash is used for. Canada is by far the largest producer and it is critical in fertilizer, so that is one obvious need. Potash is critical in the ag sector, and US cannot supply its own. His strong rural voting bloc could explain that to him. The #2 producer is Russia and #3 is Belarus, so Trump’s friends are next in line.

The NAHB might explain that lower cost lumber could help in housing affordability. Team Trump will presumably study the lumber markets as part of the Section 232 process, do a sawmill capacity analysis and make the case. Trump said, “we don’t need it,” so the analysis might get reverse engineered.

The downstream US refiners love low cost discounted Canadian heavy crudes and could not do without it in many refineries without shortages and higher prices for the consumer. Unfortunately, Trump has forbidden Cabinet members from using facts in their commentary on tariffs.

The incoherent and erratic communication effectiveness has roiled the market when so many facts get misstated. Trump overreacts as a core strategy, and that hits both the capital markets and causes more private sector planners to hit the pause button and possibly hold it down. The economic impacts are only going to be rolling in at a lag.

You are hearing the words “negotiating tactic” less these days. Earlier today, we saw that Lutnick was trashing Ontario Premier Doug Ford on Bloomberg just ahead of his meeting with Ford and the Federal Finance Minister Dominic LeBlanc. Lutnick is a brilliant and successful brokerage executive, but he has struggled with the tariff topical material and the application to various industries such as aluminum. He comes across like someone trying to beat 5 bps out of a trade in the 1980s. Not his playing field.

Tariff links:

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24