CPI Feb 2025: Relief Pitcher

CPI takes some heat off as the market is still very early in the game of tariff flow-through and supply-demand adjustments.

Let’s close this out Wild Thing…only 20 innings to go!

Headline CPI MoM came in below expectations at +0.2% in Feb vs. +0.5% in Jan. Core MoM weighed in at +0.2% vs. +0.4% in Jan 2025. YoY headline CPI was down sequentially and came in at +2.8% vs. +3.0% in Jan 2024 while Core CPI was +3.1% or down from +3.3% last month.

On a day when steel and aluminum tariffs are rolling in, there is some irony in a mild market celebration for better CPI metrics. Good News >Bad News. That said, the tariff waiting game and handicapping of forward product price risk and wage inflation (deportation impacts) are in their early stages and there will be a lot of action ahead with some major moving parts wagged by one man.

With a wave of tariffs and fights still slated for April on reciprocal tariffs and autos, pharma, semis, lumber, and copper still in the crosshairs and major questions around how Japan and South Korea will flow into the trade wars, uncertainty and volatility will stay a fact of life.

The slow process of interpreting monthly consumer PCE releases (income and outlays as well as prices), investment and capex planning (durables, construction, housing etc.) will continue. The considerable line item nuances will keep seeing the words “very important” attached as investors scan for the dagger of stagflation. Investors will be glued to1Q25 guidance threats of lower revenue growth, lower earnings, and potential multiple compression.

The above chart frames some of the high-level Special Aggregate CPI indexes we look at each month (Table 3 of the CPI release). Our Big 5 CPI lines and “Add-ons” are broken out further below.

“All items less shelter” (64.6% of CPI index) at 2.0% does not promote too much worry, but the overall Shelter CPI line is over 35% of the CPI index at +4.2% for Feb 2025. Meanwhile, total Services at +4.1% remains sticky at 64% of the index. That is a major problem in a Services economy where Services also dominate payrolls (see Payrolls Feb 2025: Into the Weeds 3-7-25, Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25).

“Services less rent of shelter” (28.8% of index) at +3.8% is still high. Housing affordability challenges are something we cover in detail in our housing and homebuilder single name work. We will see how much relief we can get for mortgage rates subject to the moves in the 10Y UST and mortgage spreads (see Footnotes & Flashbacks: State of Yields 3-9-25). Next week we get a fresh read on starts and existing home sales. The color from the housing sector has not been good into 2025 and homebuilder equities have taken a beating (see Footnotes & Flashbacks: Asset Returns 3-9-25). Tariffs on raw materials (notably on lumber, metals and the components chain) will hit everything from builder construction costs to appliances in new homes.

Among the notable line items above that are in deflation mode is the Durables line at -1.2% and just under 11% of the CPI index. Material costs (steel and aluminum now and copper and semis later) could create any combination of cost pressures for the manufacturers in terms of production schedule slowdowns that feed supply-demand imbalances but can also add to pricing power. Auto delays on semi shortages were a major problem in recent years for some OEMs more than others.

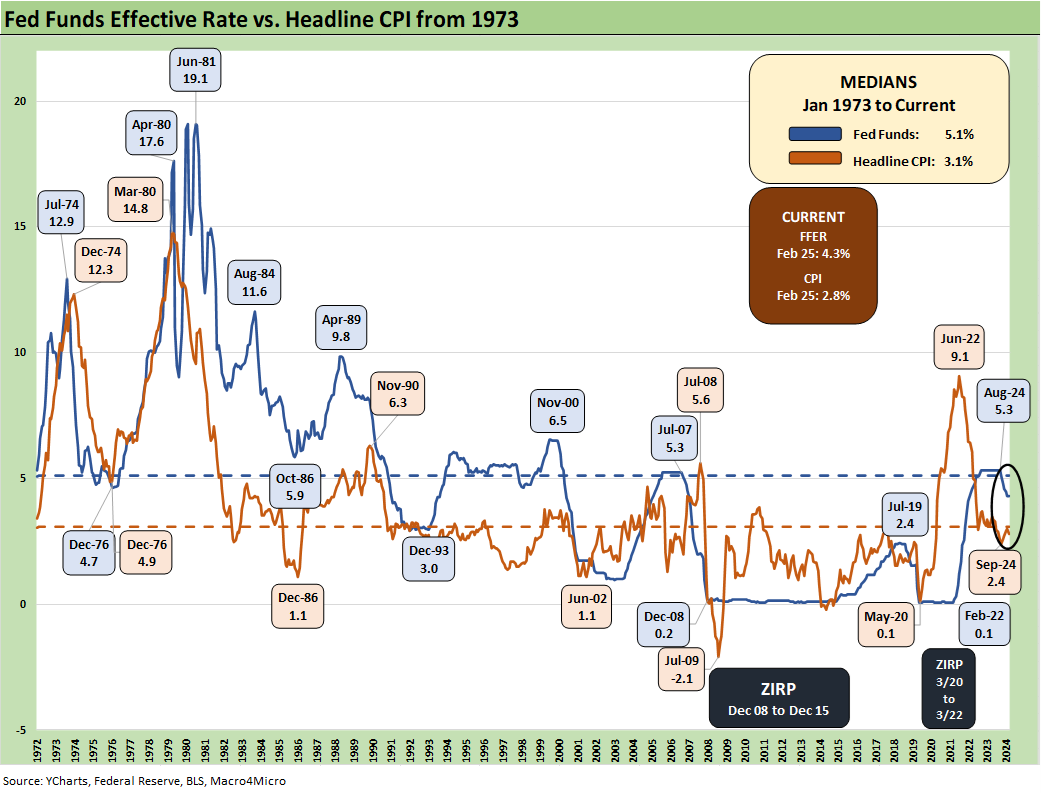

The above time series plots the fed funds effective rate (FFER) vs. headline CPI, and the current FFER of 4.3% is comfortably above the headline CPI of +2.8% (Core +3.1%). The real fed funds rate is thus in a respectable zone after spending a good stretch of 2022 in negative range and thus in what amounted to accommodation mode for the early stages of tightening.

We are certainly aware that the FOMC sets its sundial by the PCE price index (see PCE Jan 2025: Prices in Check, Income and Outlays Diverge 2-28-25), but we like to watch the fed funds vs. headline CPI comparison in addition. The improved CPI will keep the oddsmakers busy on FOMC policy and consider whether GDP growth or payroll numbers will start to fade.

For the FOMC, most of the action lies ahead as pins-and-needles syndrome sets in across the spring and into early summer on how the reality of “buyer pays” (just don’t tell the White House that the seller does not pay) flows into the macro level with GDP or pricing (inflation). If the Trump tariffs are not passed along in pricing, then someone is eating the costs (earnings get hit) or companies must remove other costs to offset the tariff (Payroll? Investments?).

There is also the impact of currencies that are less predictable but generally mitigate some of the USD tariff cost impact. The currency story line is a tricky one since a strong USD that often comes on the other side of tariffs can put a dent in the motivation to incur massive capex to relocate to the US. Those demands entail multi-year, big-ticket construction projects in the US to relocate. Currency changes can dull the economic incentives. That was the BAT Tax pitch from the House GOP back in 2017. That is, currency adjustment would make the tariff costs neutral to the US buyer. Someone was “full of it” then or now.

The ability in the face of uncertainty to just hit pause is also very relevant as we have been discussing since 2018-2019. The ability to model the economics of projects in politically polarized and volatile countries has unfortunately made policy volatility one more important risk factor for investing in the US.

Do you incur the cost to build when the tariffs come off later or see “White House blank checks to set tariffs” legislated away by corrective legislation? GOP Senators (notably Corker and Toomey) tried to claw back some control of Section 232 abuse in Trump 1.0 and Trump declared war on them. They did not run for reelection. As a result, the Senate does not dare challenge Trump on tariffs.

In theory, the House and Senate controls the initiation of tariff legislation (per the constitution). However, the current White House game is to take Congressionally settled law and twist it for their own purposes (Fentanyl emergency under the IEEPA, Steel/Aluminum under Section 232, anything Chinese under Section 301, etc.).

We typically expect the Senate to be a leader in such action, but Senators “ain’t what they used to be” (“Grandpa, were you a spineless wimp when you were a Senator and bowed to separate branch of government?” “No Johnny, I was an effective pragmatist with loyalty to my party. It was teamwork.”).

The above table updates our “Big 5” CPI index bucket that accounts for just over 75% of the CPI index. We craft our own version of Automotive since autos are such an important part of the household budget even before including gasoline in the tank, which we include with Energy.

A few highlights below as we run across the Big 5:

Food: “Food all” ticked higher YoY but with “Food at Home” flat and “Food away from home” feeling the pressure of myriad other factors such as labor and operating costs outside of the food price action. Food tariffs will weigh on the numbers eventually, and the supply-demand imbalances within USMCA could drive domestic supply excess with prohibitive tariffs in retaliation moves by trade partners (Mexico, Canada). We could see more retaliation from Asia. Food is never an easy equation.

Dairy could turn into a major battle with Canada given the US penchant for massive oversupply and the Canadian focus on supply management. The high political stakes on both sides of the border have very important constituencies such as Wisconsin in the US and a Canadian election likely sooner rather than later.

For now, Trump is simply lying about the tariff rates on dairy (not a shocker) since those tariffs only kick in above quotas that have not been crossed. Trump is also itching for a fight to annex Canada. The relationship with Canada gets worse by the day. That is the largest export market for the US and majority of the states and leading natural resource provider. Fostering hatred seems like an ill-conceived plan.

Energy: Good new for gasoline could get even better if Trump gets Putin back in the global supply picture in a bigger way. Energy MoM dropped to +0.2 from +1.1 in Jan 2024 while YoY deflated by -0.2%. Trump is rooting for a big oversupply since plunging oil is like a major tax cut for the consumer and a major unit cost offset for many business lines in manufacturing and services. It would be bad for energy stocks and credit quality though. That Energy X-factor could be one more motive for his demonstration of love for Putin. Oil oversupply is a passport to inflation relief since it flows into so many lines in Core Inflation metrics as well as headline numbers.

Electricity moved sharply higher MoM to +1.0% from 0.0% in Jan 2025 and to +2.5% YoY from+1.9% last month. The question of power generation shortages and high future demands from AI needs and data centers has been a hot topic, but it is an interesting side story in aluminum, where electricity as an input had traditionally been around 30% of aluminum production costs. There is a reason that Alcoa’s Canadian operations are much larger than its US operation. The comparative advantage of low cost hydroelectric has always been a distinct advantage.

The power factor is not going away with demand only rising. The DeepSeek mini panic in utilities equities was a reminder with power demand driving so many utility stocks in 2024. Aluminum costs flow into many end durable markets and notably into autos and housing. The tariff motives have zero to do with the economics of building new smelters in the US (massive price tags and power demand). It is one of the dumber moves on the dumb list and hurts the US across a broad range of end markets.

Shelter: The housing aspects of CPI have been discussed in numerous past commentaries. Housing inflation is not tied to home prices. That approach was abandoned in the early 1980s (home is an investment, etc.). The Shelter CPI index combines rent and derived metrics such as “Owners’ Equivalent Rent” with its 26% weighting in the CPI index and its theoretical assessment of an implied cost of shelter. From the non-BLS, non-CPI angle, the tariffs on lumber, metals and supplier chain products are a direct increase in the cost of building and/or remodeling a home.

The rising costs of labor for subcontractors will be a side effect of deportation and the same for the array of other tariffs from materials to component systems to finished goods. All of these will drive up the cost of equipment used by subcontractors. The NAHB has said so. It is not a partisan issue. Those costs will directly factor into home affordability. The homebuilders do not build the homes – the subcontractors do. The builders always pass it on and structure and price their homes accordingly. They also manage their working capital carefully in line with sales cadence.

Autos: The challenge to autos from tariffs could be going through a shocking level of uncertainty ahead subject to the tariff decisions on imported autos but also metals and semiconductors. The inflation price action for new and used vehicle lines of 2022 will be hard to replicate – thank god (see Automotive Inflation: More than Meets the Eye10-17-22). During 1H of 2022, we saw 9 straight months of double-digit new vehicle inflation and even cracked 40% handles on used vehicles in two months and posted 30% handles on two other months.

There is considerable uncertainty around production schedule reliability and how non-US trade partners will respond to high tariffs on vehicles that could be assigned to Mexico, Japan, and South Korea. European tariff issues and supplier chain issues in the US (i.e. non-US OE suppliers to US transplant assembly operations) are going to be interesting. The EU and Asian OEMs also have a mix of tariff exposure via Mexico and Canada (see Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24, Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25).

The variables in new and used vehicles include whether supply-demand imbalances are created by the tariffs that block out imports and in turn tighten up the supply relative to demand. That would flow back into new vehicle inflation at lower volumes. Lower trade-ins could in turn push used vehicle prices higher in a dynamic we have already seen. The counterpoint is that recession will bring lower demand, lower rates, and lower prices for vehicles. That is like cheering for the detached garage that did not burn down with the house.

Medical: We see upward pressure on Medical Care Services from 2.7% to 3.0% or just under Core CPI. Medical care commodities came in further below at 2.3%. Pharma was put on the tariff list ahead, and Pharma is the #2 import line in US trade with the world (see US Trade with the World: Import and Export Mix 2-6-25) and #1 from the EU (see US-EU Trade: The Final Import/Export Mix 2024 2-11-25).

Away from the Pharma issues, there will be some confusion around what gets measured in CPI and what cash burdens fall on the individual household in terms of cash outlays. That is notably the case if Medicaid gets cut back and how that gets measured in CPI or PCE. There is inflation of Medical Care Services, and there is the high base level for expenses associated with it. Then there is the question of who shoulders the cash burden of the expense. One needs to be a Nobel Laureate in Health Care economics these days to grasp the many moving parts, but it will be a risk factor to ponder in discretionary household spending and relative savings rates in the monthly PCE Income and Outlays data. It will also be a voting topic for the 2026 midterms.

The above chart frames the YoY CPI trends in some select line items that are familiar household experiences to varying degrees with some common to almost all (apparel, telephone, internet) and others that cut across a subset of households and can vary widely in price tier (recreation services, tuition, airline fares).

The mix is generally lower on the inflation scale with half of the lines lower in YoY for Feb 2025. Some are more deflationary. Recreation Services remains higher than headline CPI and Core CPI as does Tuition/Childcare.

Airline fares tend to track oil prices given the major role of aviation fuel in the cost structure and in fare setting. Looking ahead, weakening fundamentals will likely bring the added downward pressure of weaker travel. The wave of airline revenue warnings this past week are telling a story of where airline fares are heading – as in lower even if that is always subject to oil prices. Those airline warnings were more important to the statement they make on recent trends in the consumer sector – as in unfavorable.

See also:

JOLTS Jan 2025: Old News, New Risks in the Market 3-11-25

Credit Spreads Join the Party 3-10-25

Footnotes & Flashbacks: Credit Markets 3-10-25

Footnotes & Flashbacks: State of Yields 3-9-25

Footnotes & Flashbacks: Asset Returns 3-9-25

Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25

Gut Checking Trump GDP Record 3-5-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Asset Returns and UST Update: Pain Matters 3-5-25

Mini Market Lookback: Collision Courses ‘R’ Us 3-2-25

Durable Goods Jan25: Waiting Game 2-27-25

GDP 4Q24 Second Estimate: PCE Inflation the Main Event 2-27-25

New Homes Sales Jan 2024: Homebuilders Feeling Cyclical Signals? 2-26-25

Existing Home Sales Jan 2025: Prices High, Volumes Soft, Inventory Up 2-21-25

AutoNation: Retail Resilient, Captive Finance Growth 2-21-25

Toll Brothers 1Q25: Performing with a Net 2-20-25

Housing Starts Jan 2025: Getting Eerie Out There 2-19-25

Herc Rentals: Swinging a Big Bat 2-18-25

UST Yields: Sept 2024 UST in Historical Context 2-17-25

Other Inflation Related:

Payrolls Feb 2025: Into the Weeds 3-7-25

Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25

PCE Jan 2025: Prices in Check, Income and Outlays Diverge 2-28-25

Employment Cost Index 4Q24: Labor Crossroad Dead Ahead 1-31-25

Inflation: The Grocery Price Thing vs. Energy 12-16-24

Inflation Timelines: Cyclical Histories, Key CPI Buckets11-20-23

Automotive Inflation: More than Meets the Eye10-17-22

Tariff links:

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24