Trade Exposure: US-Canada Import/Export Mix 2024

We update the final tally for 2024 on US-Canada import/export as the clock ticks down to mood swing N+1.

Tariff this!

The US-Canada trade relationship has ducked (so far) one of the crazier trade policy ideas since the onset of the Great Depression, but the 25% tariff remains in play on Trump’s whims with no transparency in terms of the requirements or milestones to end the threat.

We would expect some of the damage to be lasting in terms of corporate investment confidence and economic planning on the Canadian side of the border. The energy sector needs some risk mitigation in Canada with new international markets targeted and autos still very much in harm’s way for future product commitments. That does not mean the US will gain what Canada might lose.

The main takeaway from the import/export Canadian drama is that Trump has missed an opportunity to pull his imaginary enemies closer through better coordination in energy policy and infrastructure planning and the potential for a “fortress North America” energy producer alliance. He just reverts to “become the 51st state” (see US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25).

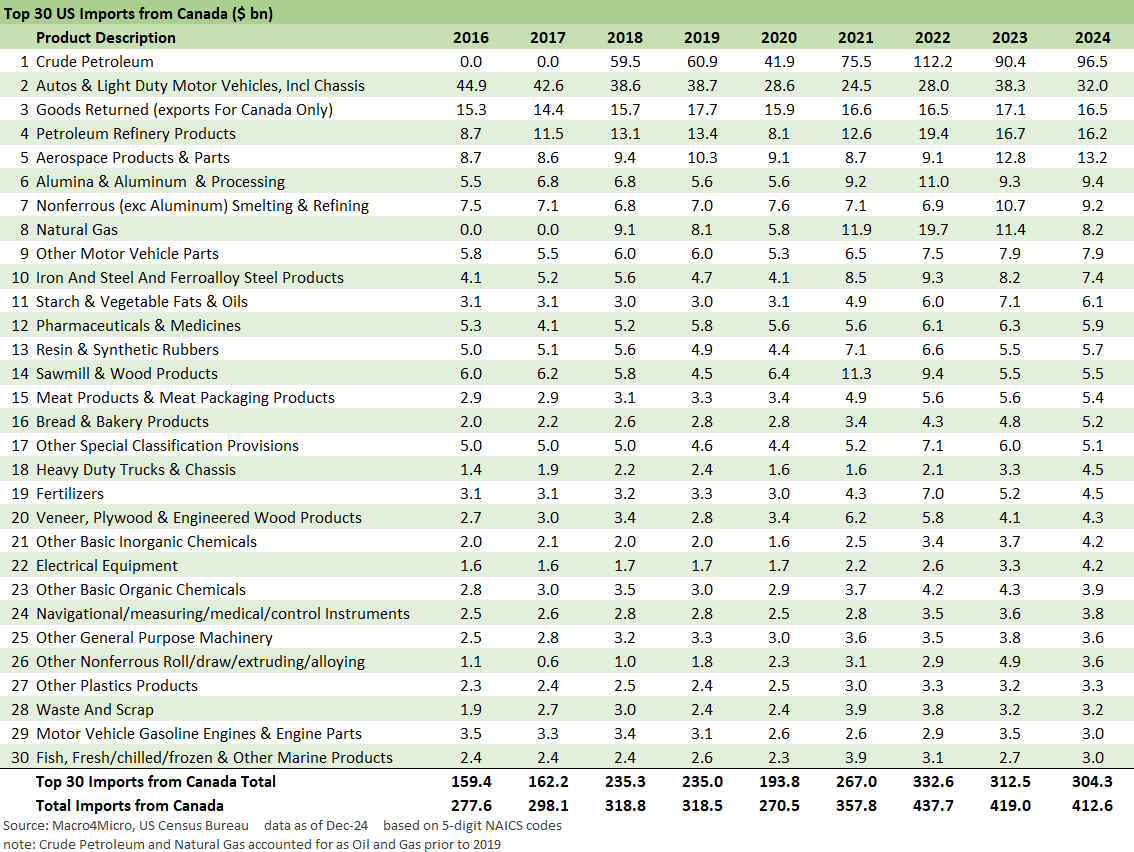

We look at the import-export mix below for Canada as the largest US export nation. The details include an import list that is critical to the US on many fronts despite nonsensical statements to the contrary from the White House.

The above chart shows the steady climb in economic activity between the US and Canada with some of the import movement tied to oil prices along the way. The swings in crude oil dollars were notable in volatile years such as 2008 (record high WTI), 2015 (oil market crash), and 2022 (Russia invades Ukraine). Further below, we break out the product mix for imports and exports for 2016 through 2024.

The above chart updates the history of the goods trade deficit between the US and Canada. If you back out crude oil and other energy products, the US has a surplus. If you throw in services, the surplus ex-oil increases even more. Canada is a major exporter of natural resources with very strong demand in the US in some notable mining volumes where the US cannot produce enough of these natural resources for a wide range of reasons (aluminum, potash, uranium, etc.).

For Canadian crude oil, volumes also rose as more major oil sands projects came online and takeaway capacity expanded. US demand kept on rising. The Midwest refiners with more advanced processing capabilities are major users of Canadian crude feedstocks and the feedstock share has also increased in the Gulf region. Canadian crudes compete with Venezuela among other countries with heavy crudes. Tinker with that and you get inflation at the pump to go with higher energy costs for manufacturers and service companies.

The use of Canadian crudes gets a lot of attention in the trade press. We have looked at the Canadian oil sands majors in detail in prior lives, but that is a topic for another day. A healthier relationship with the US could encourage more expansion in Canada and more infrastructure investment, but the threatening behavior of the Trump team makes such capital commitments riskier for investors. That is true not only for investment in Canada but for infrastructure in the US that could increase the use of Canadian energy while allowing the US to further expand its export asset base.

The US-Canada combined picture is a “solve for X” exercise on heavy vs. light crudes and what capacity is needed to get the crude and refined products capacity to end markets whether domestic or across borders. The US is at a record level of hydrocarbon production, but Canada has a lot more in theoretical reserves for a given price range. The climate-based political interests are on their heels in the US, so that is another major variable. That constituency is still strong in Canada.

The above chart shows the mix of product categories that the US imports from Canada with Autos a very distant second to Crude Oil. Refined Products, Aerospace, and Aluminum round out the top of the leader board. Frequent reference has been made in the recent trade fight to the inorganic chemicals and nonferrous metals that Canada provides to the US. That includes potash as a critical part of the agriculture chain (fertilizer among the major uses).

The Saskatchewan (potash) and Alberta (oil sands, heavy crudes) tag team are valuable to the US end markets. These two resource-heavy provinces are politically conservative by Canadian standards. Attacks on their economies by the US is thus an easy way for the GOP to alienate fellow travelers on the “right side of center.” In the case of potash, a 25% tariff would be negative for US food costs, so there is a food inflation risk factor (or farmer losses) that would pile onto any other tariff retaliation on US agriculture and food products.

Heavy metal noise for US costs…

With respect to damaging US raw material costs on the US side of the border, the same is true in metals and mining such as nickel and aluminum. None of this is news. It just did not make it to the podium when Trump said, “Canada has nothing we need.”

We appreciate the need to take hardball negotiating postures, but you need to avoid advertising nonsense and looking like an ignoramus. Such an approach just makes people nervous and encourages them to change how they do business with other nations (and to pursue more business with other nations to reduce political risk). That is true whether in the Arctic with the EU (and Greenland) or in crude oil (with China and the EU).

Canada as a source of low-cost aluminum is also a major asset for the US. Canada had always been a hub for the major aluminum producers of decades gone by (Alcoa, Alcan/now Rio Tinto, etc.). Electricity is a major part of the total cost of refining alumina and Canada always boasted low cost hydroelectric. Canada does it better and cheaper and on a larger scale than the US.

In Aerospace, Bombardier is one of the two big players in regional jets along with Embraer. The A220 jet (formerly the Bombardier C Series) is assembled by Airbus in Alabama and takes parts from Canada. That use of imported aerospace components by a US final assembly operation has not gained much press but offers another example of why blanket tariffs without exemptions is a bad idea. Airbus might not even be in Alabama if Canadian and EU tariffs were very high and the policy was to tariff all imported supplier chains without exemptions.

Currency impacts on the supplier chain vs. the finished goods is another variable to ponder. A strong dollar can support offshore supplier costs for the US OEM sourcing for a dollar-based assembly location. That was part of the Caterpillar global supplier chain model built out from the early 1990s. In CAT’s case, the offshore supplier base operated as somewhat of a currency hedge for their exposure in the export markets.

That Airbus supplier chain issue mirrors the auto transplant decision points as well. Under the heading of “duh,” you cannot just pick up an entire global supplier chain and drop it in production ready on Day 1. Supplier chains take time to migrate and for investment to be assessed and deployed.

Coercion can also lead to tabling expansion plans along the way as global manufacturers have to consider the full economic chains from assembly to Tier 1, Tier 2, and Tier 3 suppliers when making investment and capital budgeting decisions. Furthermore, EU companies in particular face unions and domestic political interests. That element also demands retaliation to Trump tariffs. It is never simple – unless you just focus on making noise from the “bully pulpit.”

The above chart details the leading exports to Canada. The “Other special classification provisions” is one of those strange buckets in the Census reports on trade that can mean a number of things, but we assume this one is around defense and advanced technologies and other types of disclosure that get “suppressed.”

Canada is a NATO partner and partner in NORAD (Canada is literally in the command structure of nuclear defense). The newfound focus on the Arctic by the White House and interest in annexing Greenland and Canada might call for more roses and fewer thorns.

A quick scan of the export list to the #1 export market nation of the US shows a high value-added and diverse mix of products and also a deep base of buyers of agricultural products and food. Over half the US states have Canada as their #1 export market.

Once again, autos is a very complicated “round trip” production story with finished vehicles, vehicles-in-process, and supplies/components moving along both the lines for imports and exports. The Canadian auto sector could be pushed into a painful doom loop that would also have very adverse knock-on effects on US OEMs, US suppliers, dealers, lenders, and stockholders. That is before the usual economic multiplier effects we address in our comments (see The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25).

As a reminder on autos, the Trump 1.0 team did a study to rationalize the use of Section 232 national security grounds for auto tariffs. It ended up being suppressed and scrapped. The rumor was that it was too embarrassing to produce. Congress demanded it be produced, but the Trump 1.0 team countered with executive privilege. Indeed, that must have been a very embarrassing report. Sometimes facts and concepts do matter. Just not often enough these days.

Tariff links:

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23