Auto Tariffs: Questions to Ponder

The auto tariffs promise chaos and trade wars with the only virtue being “it could have been worse.” Brace for retaliation.

Made in America. In Texas. Near the Alamo (Not Mexico). Red state. Do I get a pass?

We list some questions to ponder on the next leg of the journey for supply, demand, unit costs, and price distortions as tighter supply and tariffs flow into new vehicle pricing and used cars see some price inflation alongside pressure on new vehicle prices.

There are more than a few ways the laws of unintended consequences could flow into reactions along the supplier chain (e.g. financial stress along the Tier 1, 2, and 3 suppliers) as injured nations and their OEM industries’ frame their retaliation options.

The auto retail sector and franchised dealers now have to weigh inventory pressures (volume and price) and how the public dealers should plan their M&A activities by brand based on mix issues (imported brands made in the US vs. the homeland or Canada/Mexico). One big question is how the tariffs could materially shift the profitability and valuation of those smaller dealer operations that might have been targeted for consolidation.

Stock market gut check…

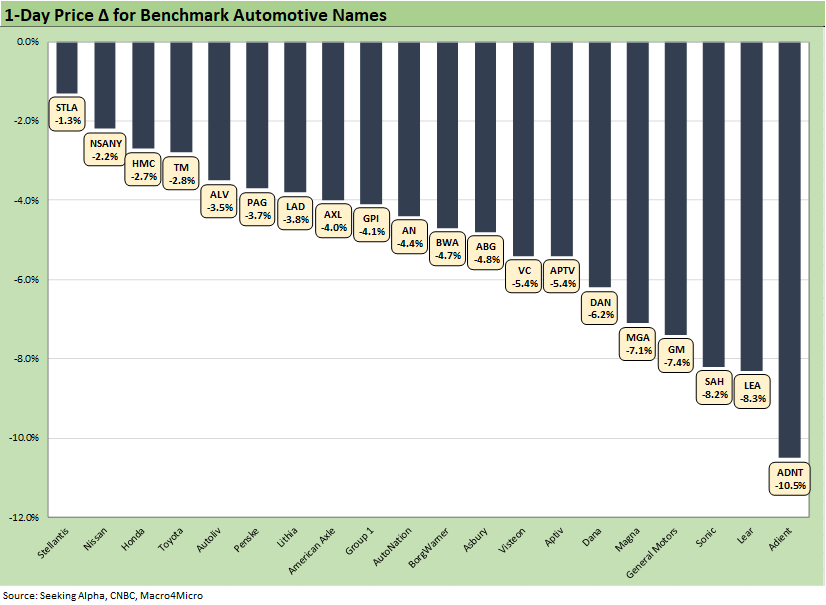

The above chart is a 1-day stock price delta. It is just food for thought on how yesterday’s market reacted to a full day of “morning after” thinking on the supplier-to-OEM-to-dealer chain. Among the OEMs, GM was beat up the most while suppliers broadly were hit hard. Needless to say, there are a lot of moving parts from here including how to sort out US-content rules and how that flows into each model’s eventual tariff.

Dealer equity valuations are sorting through how volume, inventory turnover, and vehicle price shocks could create an all-new world across different product price tiers. That is especially the case for those dealers with a heavy mix of imports from offshore (vs. “import brands” sourced from US transplants).

The fact that the Japan 3 and Hyundai/Kia are major employers and multiplier effect US employers (directly and in their supporting economic ecosystem) seems to have evolved Trump’s thinking on “foreign” vs. “foreign-owned.” Note: We do not include Hyundai in the above chart, but it was only off by -0.5%, which was surprising given the high mix of imports sold out of South Korea. The Hyundai/Kia dealers will still feel the challenge.

In the case of transplants, Trump still wants the engines, transmissions and tech-heavy components made in the USA. That will raise some serious challenges for US suppliers who embrace the global sourcing models and have billions in imbedded investments offshore in places like China.

Tariffs have not even experienced Trump’s “Liberation Day” yet…

Auto tariffs as a topic have been getting picked over since Trump 1.0 as the Commerce Department was tasked then (and more now) to reverse engineer studies to support the house view that imports of steel, aluminum, lumber, autos, etc. constitute national security threats under Section 232. Copper and Lumber are next while Autos had an old report that did not see the partial light of day until 2021 under Biden (Trump 1.0 had invoked executive privilege on that one).

As a reminder, tariffs are in the domain of Congress, but Section 232 allows Trump to set the tariffs unilaterally and comply with the laws that had delegated the responsibility from Congress to the White House. Any Senator who stuck their head up to put checks on Section 232 during Trump 1.0 had that head chopped off (Toomey, Corker). Lesson learned by the current crop of bold souls in the Senate. The Democrats just raised that potential for a legislative check again, and it was blocked in Committee (by the GOP).

The Section 232 analysis was more about top-down requests for a pre-set conclusion rather than bottom-up economics and the rational use of economic analysis. It was old school “Here is my opinion, so now get me an analysis that says that.” What that approach lacks in intellectual honesty and rigor is more than compensated for in career advancement and job preservation. Welcome to Washington.

There is no shortage of information on where the various vehicles get manufactured. Automotive News breaks out the production details for each model in the US, Mexico, and Canada each month (see Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24). One product group that stands out is the heavy mix of trucks made in Mexico and more narrowly pickup trucks for GM and Ram. There is a lot of value-added coming across the border.

As a reminder, 2024 saw Mexico total production of 3.86 million units with Canada at 1.37 million for a total of over 5.2 million with the US at 10.8 million. How can that mix not create tremendous anxiety when you declare war on that much production? A substantial majority of that production in Mexico is exported to the US and varies by OEMs across manufacturers from US, Europe, Japan, and South Korea.

Canada has a narrower group with the legacy Detroit 3 including Honda and Toyota in scale. That is for another day. Whether it is around direct impacts or secondary and tertiary problems, a very intertwined system of suppliers across other nations and various product areas (materials to components to vehicles) are bracing for more tariffs and retaliation. If their thought process to this point is like their earlier Section 232 report quality and depth, God help the North American economy.

Questions to ponder:

OEM and supplier chain risk

The OEM finished vehicles made outside the US are the main targets, but the supplier chain issues and how those flow into US content will face a lot of questions by model and by component mix based on what we have seen so far. The supplier part of the tariff decisions to this point avoided Judgment Day.

GM is the most exposed with a heavy mix of Mexico (e.g., Equinox, Silverado/Sierra, Blazer/Terrain). As noted above, GM stock saw a material decline at -7.4% on the day. GM’s mix of imports from Mexico push back on the theme that the high margin products are generally made in the US. They are made in the US, but they are also made in scale in Mexico. Those are topics for another day.

Questions:

How do the OEMs more exposed to Mexico and Canada production volumes adjust their planning and coordinate with franchised dealers on their risks? Will there be more incentives to support dealers? As a reminder, the dealers are independent, but they are critical in the value chain and need to take balance sheet risks on the inventory.

For smaller, lower priced vehicles where the Mexico “labor arb” was critical to the capacity decisions in Mexico, would it be much cheaper for the OEMs to just close the Mexican facilities? Trade off volume for the uncertainty longer term on whether these tariffs can survive the 2028 election? It takes years for new capacity to be built out.

Smaller cars in theory could only be made profitably in Mexico. How would tariffs and capacity reductions flow into the supply-demand profile for passenger vehicles and impact pricing? Would that hurt affordability? Would OEMs simply shutter that capacity and not relocate? That would roil small vehicles supply-demand and send prices higher.

What is the exposure of the legacy Detroit 3 (GM, Ford, STLA’s Ram and Jeep units) to higher margin product segments and notably in light trucks? How do capacity choices play out in Canada and Mexico? GM in particular has a lot of high margin light trucks in Mexico.

Are there brownfield conversions to do in the US or is it more new greenfield projects to relocate? What is the time horizon for that transition? We hear 2.5 to 3 years is an optimistic estimate. That is the Presidential election year. If it takes almost 3 years to bring in new capacity, will there be similar North America capacity downsizing overall as Mexico scales back once we include Canada? Does that shift the supply-demand balance for vehicle pricing support for the OEMs?

Even if some supplier chain products are not targeted with the main component tariffs aimed at major higher value-added systems (engine and transmissions, electronics intensive), will the supplier chain fallout in Mexico or Canada be enough to trigger more bankruptcies and financial stress?

Could financial stress in the supplier chain trigger production disruptions that reverberate up the chain and feed more stress for other suppliers on the disruptions? We saw what can happen with semis in the last cycle in terms of lost production. Could such vulnerabilities be targeted as part of offshore retaliation by China or Mexico?

Will the capacity challenges by definition lead to a lot of labor stress and battles on labor costs? We have seen this movie before.

Will supplier chain “trade credit” become a problem? Accounts Receivable and Payables risk could rise.

Dealers and Auto Retail: Inventory, price, and import problem affects M&A

Auto retail is generally viewed as a lower risk subsector with relatively predictable cash flow generation. Dealer fundamentals have been viewed as favorably positioned on demographics and the intrinsic need for mobility in a “driving nation” with limited mass transit. We also saw dealer equities beaten up as detailed in the chart above.

Used car players such as CarMax (+2.5%) and Carvana (-0.45%) saw minimal reactions given the questions around how used cars just got another bump in affordability. That said, “sourcing” used cars will not get easier since used cars will become renewed business line priorities for franchised dealers after a rough patch. Names such as Lithia are well positioned there after heavy digital investments and operational evolution.

We will be looking into more of the moving parts for franchise dealers ahead, but life just got more complicated for the leading public dealers in how to value the smaller privately owned dealers they had been rolling up as consolidators (see Credit Crib Note: Lithia Motors (LAD) 9-3-24, AutoNation: Retail Resilient, Captive Finance Growth 2-21-25). The best dealer valuation and highest margins tended to come with premium luxury and non-US brands, and those are in the Trump crosshairs with a high mix of imports. A mitigating risk factor is the massive base of transplant capacity.

Questions:

The large base of imported vehicles flowing into dealer lots will need to see major price hikes, so how does that get managed by franchise auto retail operators? Some of the highest concentrations of vehicles in the most valuable public dealers include the Japan 3, Hyundai/Kia and European luxury brands, so it is a major issue for some of the most popular dealers.

Will the tariff binge bring down inventory turnover materially and undermine dealer volumes almost by definition as the market adapts to new price pressures in 2025?

Will even those Asian OEMs that have large transplant operations in the US face pricing pressure from the tariff on high value-added components that were targeted (e.g. tariffs and transmissions, electronics), in turn putting even more competitive pressure on dealers with heavy import exposure (even imported parts into US transplants).

Will national level tariffs be stacked on top of auto tariffs after next week’s Liberation Day?

With a high mix of imports from Japan and South Korea, will this set off a fresh trade war retaliation front on the Asia-Pacific markets including China? What form will that retaliation take?

Car rental operators: fleet replacement costs, residual value risk

We saw a stunning jump in Avis and Hertz stock in the market yesterday with +20.5% on Avis and +22.6% on the highly distressed Hertz with its $4 handle stock price. The table has been set for a car rental industry that will remain volatile across seasons and will be subject to fleet replacement cost pressures with some upside this year in residual values.

The potential for material relief in used car residual values near term likely generated some of the bullish price action since higher new vehicle prices help used car valuations. Tighter supply-demand flows and materially lower depreciation costs are something we saw in 2022 (see Credit Crib Note: Avis Budget Group (CAR) 5-8-24, Credit Crib Note: Hertz (HTZ) 5-14-24). That does not change the fact that the industry would be destabilized, and the timing of the risks of reversals is no picnic in toggling seasonal fleet replacement demands and remarketing. Even if benefits roll in during 2025, next year will bring the reality of much higher fleet acquisition costs and the game begins anew.

Questions:

Does the immediate timing of the tariffs create upside on used car residuals that will be supported by tighter supply ahead? How will the franchise dealers respond in the used market and how will that impact car rental remarketing game plans?

Will companies such as Avis change their mind again on holding periods for their fleet after just deciding to take a massive impairment charge and realigning the fleet to shorter periods and new vehicles?

Will the tariffs bring immediate upside in used vehicle remarketing later in 2025 but promise materially higher fleet replacement cost thereafter?

With car rental companies typically building fleets into a June quarter peak for the busy summer travel season, how are the various rental fleets positioned as of now for the coming turmoil?

Does the policy volatility make car rental intrinsically riskier in business as more trade clashes break out and elections come and go?

Will weaker players such as Nissan selling heavily into fleets have to keep prices low to sustain car rental penetration?

Section 232 and the phantom report…

Washington was always a struggle when it came to them factoring in variables like supply and demand while assuming they can bluster their way past any potential protracted trade battle by escalation. At some point nations will draw the line given their own political needs at home. It is not like the permanent team of jellyfish Trump has cultivated in congress. Sometimes people will show up for the fight. That could now include the EU, Canada, Mexico, and China at the same time. You never know with Japan and their infamous long game, but political chaos in South Korea could require a stronger response.

The fact that the White House did not release the early 2019 Section 232 report supporting the rationale for high auto tariffs was not well received. It made a statement about its quality, depth and methodology. When it was not released and Congress demanded that report with statutory authority, the Trump White House refused by invoking executive privilege. A redacted version of the report was later posted in 2021 under the Biden administration. It was a weak report. Given the stakes, it was embarrassingly bad.

After the report was demanded by Congress, Trump 1.0 refused. As a reminder, the report was addressed by the Department of Justice’s Office of Legal Counsel (DOJ):

“The President may direct the Secretary of Commerce not to publish a confidential report to the President under Section 232 of the Trade Expansion Act of 1962, notwithstanding a recently enacted statute requiring publication within 30 days, because the report falls within the scope of executive privilege and its disclosure would risk impairing ongoing diplomatic efforts to address a national-security threat and would risk interfering with executive branch deliberations over what additional actions, if any, may be necessary to address the threat.”

Basically, the national security angle in the autos report amounted to “We need to be good at cars in case someone needs a ride with a gun.” While that is an exaggeration of how bad the report was, the net upshot was that the US should protect its major manufacturing industries, promote R&D and technological innovation. It is not hard to find plenty of examples of that back then and now across American industry. It was a wordy set of platitudes.

The auto industry was certainly not disappearing with transplant expansion. The irony of technology evolution and the R&D angle in the Section 232 plan is that Trump has gone out of his way to submarine the EV evolution, which will be dominated to an even greater degree by China. With US ties to Mexico and Canada in tatters, the opportunities for China EV expansion in those markets (including direct investment) could change and especially if the USMCA ends up dead after all of this chaos and the US keeps talking annexation of Canada.

One could just as easily argue that low-cost global supplier chains increase the financial strength of American industry to invest and that strong alliances promote national security. It would not be too hard to win that argument in the moot court of history. One school of thought is that national security is not enhanced by threatening to annex allies in NATO. That notably includes Canada but also Greenland, which for now technically rolls up into a NATO ally.

With “national security” as such a focal point, it is somewhat counterintuitive that national security is enhanced by pissing off the #1 export market (the EU) and the #1 export nation (Canada) who are both military allies. Attacking the EU while embracing an ancestral “antagonist” in the form of a post-Soviet dictatorship who has set off the largest land war in Europe since WWII does not ring the bell as prudent – unless there is some other motive to the Trump-Putin alliance that many speculate on.

History does not allow the use of term “enemy” for Russia (WWII ally) unless you consider that the Soviets supplied China/North Korea in the Korean War and North Vietnam in that “20-year war.” Maybe the White House can order a Section 232 report on that (“Don’t buy goods from countries that have helped people shoot at you since the Nixon years.”)

From here, the tariff multiplier effects will be picked over and analyzed with some morning after stories on how such industries as steel will be impacted (with the major US trade surplus and notably higher value-added automotive steel exports to Mexico) or how the supplier chain will temper their capacity planning with a view that “there is always a next election.”

Tariff and Trade links:

For Anti-Coercion Instrument See: Fed Gut Check, Tariff Reflux 3-22-25

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23