Mini Market Lookback: Fed Gut Check, Tariff Reflux

The overall market posted a decent week in returns but with the Fed revising its Dec 2024 macro projections in a negative direction.

I thought that was us. Who are these MAGA guys?

The Fed messaging was clear enough with lower GDP growth for 2025 dropping to 1.7% (from 2.1% in Dec 2024), unemployment ticking higher to 4.4% (from Dec 4.3%), headline PCE revised higher to 2.7% from 2.5%, and Core PCE raised to +2.8% from +2.5%. The median target fed funds rate was held at 3.9% in a sign of confusion and “uncertainty” around tariff impacts (see Fed Action: Very Little Good News for Macro 3-19-25)

The weekly asset returns rang up well across industry groups with all the major benchmarks positive despite soft Mag 7 numbers. Our group of 32 benchmarks and ETFs weighed in at 27-5 favoring positive. All 7 bond ETFs were positive with the IG ETF (LQD) the best among bond ETFs for the week a few notches ahead of the long duration 20+Y UST ETF (TLT).

The Equal Weight S&P 500 ETF (RSP) came in just ahead of the Russell 2000 and Midcaps with the S&P 500 lagging slightly in the second quartile and the NASDAQ down at the bottom of the third quartile. The S&P 500’s 11 sectors saw 6 negative set against 4 positive and 1 flat, so the large caps were mixed.

The above chart shows a lopsided week for the 32 benchmarks and ETFs at 27-5. The Base Metals ETF (DBB) was on the bottom with some interest rate sensitive sectors despite the UST rally. The FOMC was not very reassuring on fundamentals or rates despite sticking with 2 cuts. We saw 9 dots for 2 cuts, but 4 for no cuts and 4 for 1 cut. “Uncertainty” may now be a part of a drinking game at frats. It could get ugly. Homebuilders (XHB) and Materials (XLB) were both negative for the week.

We saw energy lead the week with E&P (XOP) and broad energy (XLE) at #2 with Financials (XLF) at #3, the BDC ETF (BIZD) at #4 and Health Care (XLV) at #5. Regional Banks (KRE) also edged back into the top quartile.

The above chart lines up the tech bellwethers and benchmarks in descending order. The results show a poor week for the Mag 7 with 5 of 7 in the red for the week. Broadcom also was in the red while Taiwan Semi was positive. The trailing 1-month is all negative for all lines. Trailing 3-months shows only 1 positive with Meta at +1.97%.

In the tariff battles, we would highlight that the EU media has been debating the use of the Anti-Coercion Instrument (ACI) for a while as a weapon to wield and notably against tech service leaders. In a sustained escalation of the EU-US trade tension, this could take a sharp turn for the worse and with damaging price action in the equity markets. The reality of another Trump Tariff Tantrum N+1 kicking into high gear lurks with his next “retaliation to the retaliation.” The short form rationalization for the use of the ACI follows:

The European Commission proposed the ACI in 2021 as part of its new trade strategy, as a specific tool to address economic coercion. This is defined as a situation where a third country attempts to pressure the EU or a Member State into making a particular choice by applying, or threatening to apply, measures affecting trade or investment against the EU or a Member State. The instrument can be triggered by a wide range of coercive practices.

The ACI has been batted around for months in the trade press and some think tanks (e.g. Peterson Institute). Using the ACI would be a major throwdown and could be an open-ended escalation that would deliver some market carnage in a core US strength (IP and Tech services). The more aggressive reactions could include digital taxes to restricted market access. That would not go well for anyone.

Below is another excerpt of information from the EU details on the ACI on what “coercion” means (for those keeping score in Greenland or Denmark):

What exactly does 'economic coercion' mean?

‘Economic coercion' under the Regulation refers to a situation where a third country is seeking to pressure the Union or a Member State into making a particular choice by applying – or threatening to apply – measures affecting trade or investment.

Such practices unduly interfere with the legitimate sovereign choices of the Union and its Member States. Whether a third-country measure fulfils those conditions would be determined on a case-by-case basis.

Economic coercion may affect any policy field and may take the form of legislation or other formal or informal action or inaction.

Who could that possibly apply to? It could have been applied to China (for example Taiwan recognition), but certainly applies to the US at this time.

Other excerpts:

The range of potential measures is designed to be broad, in order to allow the selection and design of an effective and efficient response to an individual case of economic coercion with minimal or no impact on the EU economy. The aim of these measures is always to induce the cessation of the coercion.

The ACI permits import and export restrictions to be placed on goods and services, but also on intellectual property rights and foreign direct investment. Additionally, the ACI enables the imposition of various restrictions on access to the EU market, notably to public procurement, as well as the placement on the market of products under chemical and sanitary rules.

Crucially, the EU's response measures are available only as a last resort and subject to a number of conditions – but they can be deployed swiftly, if the need arises. They must be proportionate to the harm they counter, and must be targeted and temporary (i.e. only apply as long as the breach prevails).

It does not take a lot of imagination to see how this could throw rotten pear-shaped fruit at any nation or overly aggressive leaders looking to damage EU members. Leaders who are accustomed to no checks (e.g. from a spineless Senate) and no balances or “behavioral modifiers” (i.e. impulse control) might find the ACI to be bitter medicine. Those that seek to check behavior such as the courts can only do so much. In the case of the EU, there is no 5-4 or 6-3 SCOTUS refuge against the ACI.

Strange week N+1 for Macro: Attack media, judges, allies, gut government services.

The clash with the courts: The Alien Enemies Act of 1798 has been a large font headline the past week as Trump 2.0 seeks to decide it applies to circumstances outside war just by saying “it is a war on (fill in blank).” Imagine “war on radical left lunatics” or “war on urban unrest” or in a recent memory “the war on voting machines.”

The strangest aspect of it has been the messaging from the White House that “radical left lunatic judges” are behind the decisions. This is in a world where the President dubbed the criminal vandalism of Tesla vehicles (and a dose of properties arson) as “worse than January 6.” That said, pardons for the Jan 6 motley crew inspires criminal behavior all around.

The utter lack of cause-and-effect concepts clearly extends beyond tariffs and inflation. The complaint that the court has more court actions against this White House correlates with the cause and effect from the actions taken. It is meant to be challenging to purge government institutions set up by the House, Senate and President via legislation. Trying to purge all of those institutions without Congress involved is legally tricky business, and you will get dragged into court.

The latest Press Secretary framed the Alien Enemies Act process as being caused by another radical left Democrat Judge appointee. In keeping with the new fact-free world, the Federal Judge in question was actually appointed by George W. Bush, who hails from the family tree that also appointed Samuel Alito and Clarence Thomas to the US Supreme Court. George W Bush, who appointed Judge Boasberg (the judge in the current Enemies Act case), appointed Alito while his father George H.W. Bush, appointed Thomas. We would put this sales pitch from the White House in the same bucket as Trump claiming the “seller pays” tariffs. Purely false.

The sovereign relationship problems: More than a few connecting bridges between the US and Canada are already burning, and the media in Canada (e.g., Globe & Mail, Financial Post) is more intensive and widespread in its coverage on a daily basis on how bad things are between the US and Canada as the #1 export market of the US. A Canadian election is expected to be announced on Sunday for late April (4-28 reportedly the date). The contest will be who will stand up more to Trump.

China and the EU see opportunity. We see headlines from China’s Ambassador signaling China wants to repair relations with Canada. We also see opinion articles and polls citing why Canada should try to join the EU. Considering that the US runs a trade surplus with Canada ex-crude oil, that can’t be good. The news of China’s willingness to explore a free trade deal with Canada has overtones for the death of the USMCA, which has clauses in the agreement covering such events. The USMCA seems dead already given the actions by the Trump administration and the “51st state” rhetoric. China must be enjoying this.

If the goal of the US is to cripple Canadian auto production, China and Canada might have some ideas for targeted EV transplants that might appease the environmental forces to strike a deal in energy infrastructure. Canadian auto workers might need the jobs.

The Alberta “demand list” from this past week includes a lot to consider at the Federal and provincial level in the upcoming elections. In a world outside the US where quotas and supply management are common, there could be deals to strike across the provinces and with third party nations to counter US influence.

The demise of the USMCA and a new relationship with China and strengthened ties with the EU would mean 3 of the 4 largest trade partners are united in their disdain of US behavior. That may be impractical to expect a smooth navigation, but the US offer is “become a state.”

Canadian headlines are screaming with the need to prioritize energy infrastructure and new export markets. A close relationship with China and the EU would give a decent marketing edge for long term commitments to buy Canadian energy. That would take years and require capital, but the election season in Canada will turn the heat up to make promises and offer solutions. The reoriented defense focus of the EU and Canada and plans to materially increase spending with non-US defense contractors (note the F-35 “review”) will be critical trends to watch in coming months.

Such changes get back to the old question: If everyone is a net borrower, who are the lenders? And to which nation?

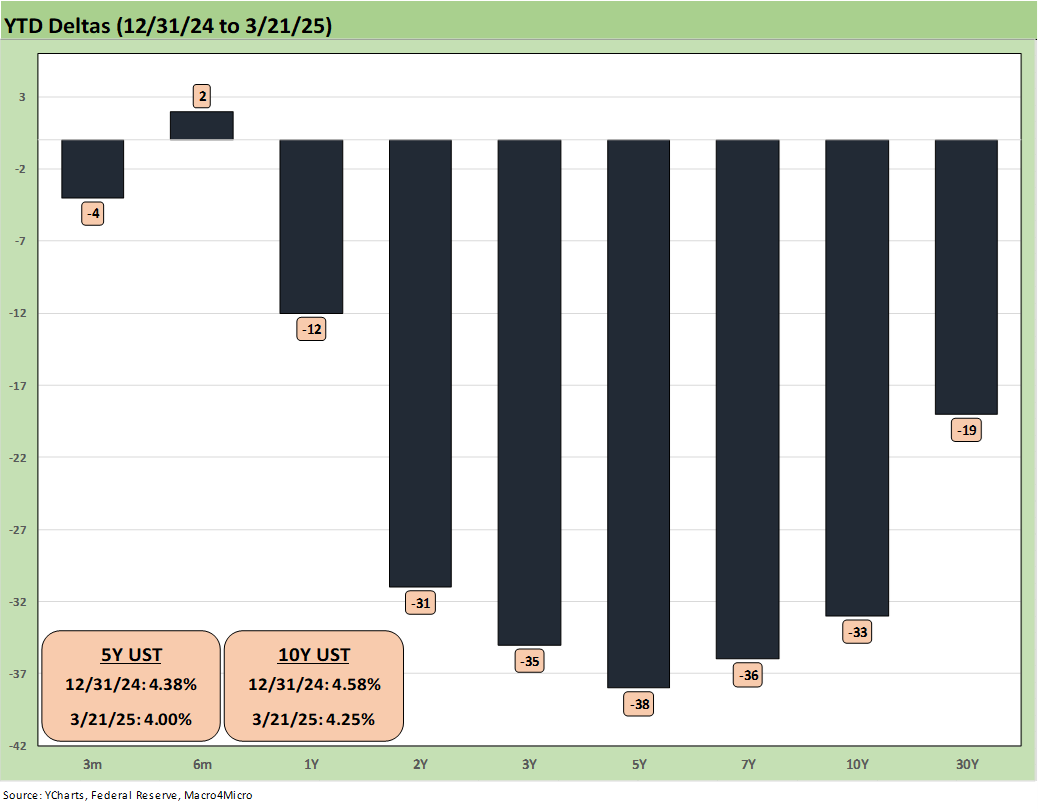

The above chart updates the UST deltas for the week. We see a modest rally. The Fed signaled slowdown this week. The battle of stagflation vs. slowdown will continue for a while until we get some real data on tariff impact and timing and how the supply-demand and pricing power dynamics will play out across industries. That will be a highly complex set of moving parts.

It is easy to notice that Bessent and Lutnick never get into the weeds of citing how a tariff will flow across various industries. The logic of tariffs are hard to frame since the math simply does not work. First, “buyer pays” (except in MAGA Wonderland) and that sets off the chain reaction as we have discussed in numerous commentaries (see links below).

The currency issues and supply-demand fundamentals by industry and the rest of the multiplier effects across and within borders are not as simplistic as the talking heads pitch. It does not help that the media has kid gloves on during Q&A (so they can get guests back). The questions are obvious and lack follow-up.

The above chart updates the YTD deltas for the UST. Duration has beaten fundamental risk as we cover in the asset returns and yield updates each week (see links).

The above chart updates HY OAS with a minor tightening to +321 bps from +325 bps past week.

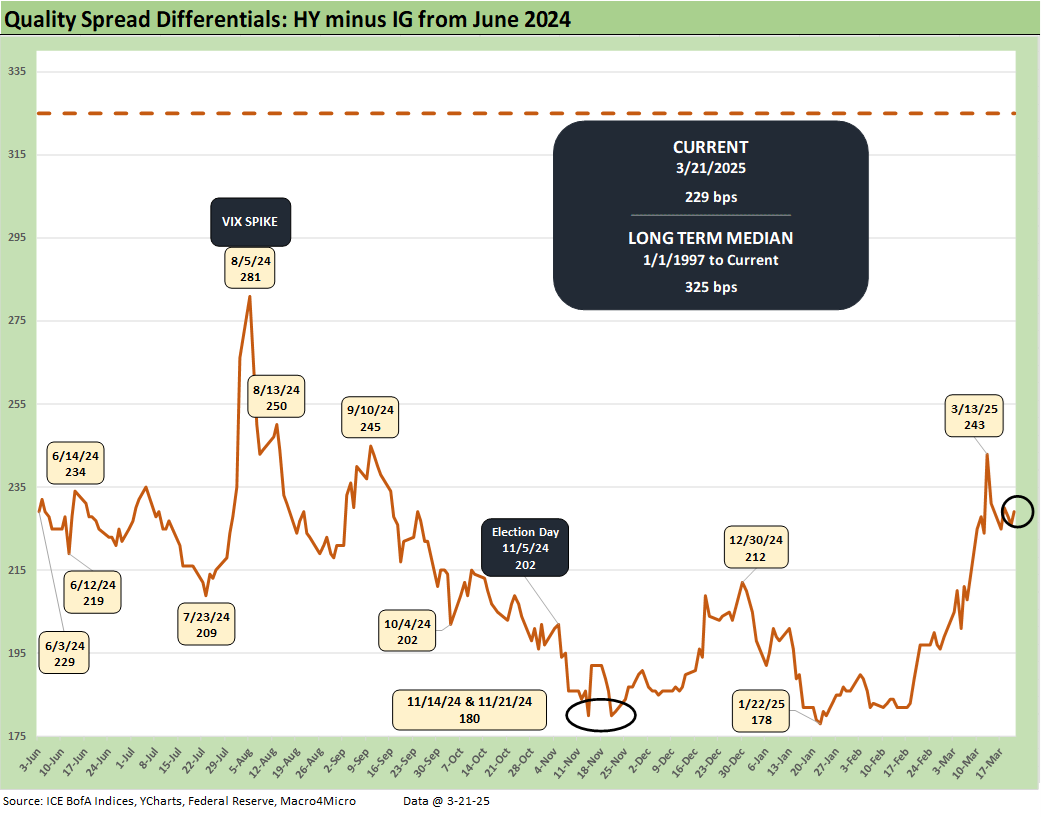

The HY OAS minus IG OAS” quality spread differential tightened slightly the week by -2 bps from +231 bps. That remains well inside the long-term median of +325 bps.

The “BB OAS minus BBB OAS” quality spread differential tightened slightly to +85 bps from +88 bps last week. That is well inside the +134 bps long-term median.

See also:

Existing Homes Sales Feb 2025: Limping into Spring 3-20-25

Fed Action: Very Little Good News for Macro 3-19-25

Industrial Production Feb 2025: Capacity Utilization 3-18-25

Housing Starts Feb 2025: Solid Sequentially, Slightly Soft YoY 3-18-25

Retail Sales Feb 2025: Before the Storm 3-17-25

Footnotes & Flashbacks: Credit Markets 3-17-25

Footnotes & Flashbacks: State of Yields 3-16-25

Footnotes & Flashbacks: Asset Returns 3-16-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

Trade: Betty Ford Tariff Wing Open for Business 3-12-25

CPI Feb 2025: Relief Pitcher 3-12-25

JOLTS Jan 2025: Old News, New Risks in the Market 3-11-25

Credit Spreads Join the Party 3-10-25

Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25

Payrolls Feb 2025: Into the Weeds 3-7-25

Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25

Gut Checking Trump GDP Record 3-5-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Asset Returns and UST Update: Pain Matters 3-5-25

Mini Market Lookback: Collision Courses ‘R’ Us 3-2-25

PCE Jan 2025: Prices in Check, Income and Outlays Diverge 2-28-25

Tariff links:

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24