Auto Tariffs: Japan, South Korea, and Germany Exposure

With Trump (for now) a green light on Canada and Mexico tariffs, we look at auto import levels from some other leaders.

Trump seeks good working relationship with major trade partners.

We look at the top non-USMCA auto trade partners with Japan, South Korea and Germany leading the list of non-USMCA auto importers as Trump says all systems go on blanket Canada and Mexico tariffs (of course that was 30 minutes ago).

We look at the other major auto trade partners based on total trade (imports + exports) with Germany #4, Japan #5, and South Korea #6 among trade partners with only Mexico (#1), Canada (#2) and China (#3) above them in total trade (the EU is a trade bloc). Trump is picking a major fight with all 6 of them. What could go wrong?

While the trade relationship with Germany rolls up under the EU umbrella, the relationship is now badly damaged over Ukraine and active support of the AfD.

Mexico leads the auto import ranks by a hefty amount, but US owners dominate the volumes from Mexico and Canada. That in turn brings an intrinsic financial threat to some major US employers and their related supplier chains, dealer networks, and secondary and tertiary infrastructure and services providers.

The above chart is a reminder of the total trade leaders with the US based on “imports + exports.” We take the combined total imports and exports and rank the trade partners (see The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25). We separately break out the imports, exports and trade deficits (a few surpluses) in other commentaries, but “total trade” is a good proxy for the level of economic activity in the trade relationship.

There is a lot of action that kicks in with multiplier effects once any import enters the US (see The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25, Tariffs: Questions to Ponder, Part 1 2-2-2 ). If every offshore purchase is a “rip-off” and the assumption is that the selling nation is ripping off the US implies the buyer is as well. The arrogance and ignorance of thinking a White House resident knows more than the educated and informed buyer mirrors the rejection of elections since he also knows more than the voter. That is just logic – not partisan.

Single metric trade partner assessment beats thinking…

Using one metric (like trade deficits only) is ok if you like knowing less and ignore many other economic variables. That can get you a “C” in economics (if you have grade inflation). On the other hand, you can always fall back on being President of the United States.

There is no shortage of economic interests along the chain starting with the US purchaser who ordered the product for a reason. That buyer is the one running a business. The private sector in a functioning free market decides what they buy. There are plenty of examples, but the interests of freight and logistics providers (and whoever made their equipment or built their warehouses), retailers, consumers who wanted to buy a household product for their use, etc., make their own decisions.

One might also consider whether there are domestic substitutes at all and whether they might end up paying more for it. With a tariff, paying more is highly likely.

The tariffs are now set to pick up pace next week if Canada and Mexico stay on schedule as Trump indicated again this morning. With Trump’s ratio of “verbiage to facts and concepts” off the charts, the old guard GOP would have to speak up. Senators Toomey and Corker tried during Trump 1.0 and basically got purged while the rest of the Senate GOP was cowed.

Back to autos…

Below we break out the list of imports in 2024 from 3 major light vehicle importers into the US: Japan, South Korea, and Germany. The industry leaders of each of these countries have major assembly operations in North America and the US and have a major import presence.

As we have covered in other commentaries, the economic multiplier effects of their activities across materials and supplier chains upstream and dealers and financial services operations downstream generate impressive levels of transactions (that is, $$$ for people, companies, the tax base, etc.) that don’t get captured in a single border metric (see The Trade Picture: Facts to Respect, Topics to Ponder (2-6-25).

We first detail Japan, who is the #4 US total trade partner with an extensive OEM assembly and supplier chain base serving its US operations. Japanese OEMs (whether imports or produced in North America – overwhelmingly in the US) have an extraordinary presence downstream across US auto dealers such as AutoNation (see AutoNation: Retail Resilient, Captive Finance Growth 2-21-25) and Lithia (see Credit Crib Note: Lithia Motors (LAD) 9-3-24) among others.

AN and LAD happen to be the two largest in the US, and auto retail employs more workers in the US than auto manufacturing. The downstream multiplier effects of both the domestically manufactured vehicles and import vehicles are massive - right down to who built the dealerships.

We also break out the import rankings from South Korea, whose lead auto OEM team – Hyundai/Kia – ranked #4 in US auto sales in 2024. We see 3 of 5 non-US companies leading in US sales in 2024 with Toyota #2 (behind GM), Hyundai/Kia #4, and Honda #5.

Japan: Big in manufacturing in the US and in imports

With $41 billion in imports as detailed recently by the Census, Japan is still dwarfed by Mexico’s $79.6 bn of imports. That total from Japan is well ahead of Canada’s $32.5 bn (which includes some Japanese transplants also).

As we look at the Japanese import list above, we see that the list is dominated by autos. A 25% tariff on Japanese autos would be the equivalent of an economic declaration of war. We will look at the North American production base and import-domestic mix of the Japanese transplants in a separate commentary, but industry leaders such as Toyota have a very large base of production in the US and a huge direct and indirect influence on payrolls.

South Korea: US growth hits record with major footprint in US and in imports

For South Korea, we see over $36 billion of imports on the light vehicles line with the #2 line being Semiconductors, another potential tariff target Trump tossed out last week with Autos and Pharma. The lack of specifics keeps you guessing. The $36 billion from South Korea is higher than Canada.

The past commentary by Trump around South Korea on defense issues has been toxic and there is ample reason to expect that will only get worse. As the son of a Marine who fought in the Forgotten War (and Coldest War), Trump’s ignorance of the Korean War has always been disturbing. He avoids discussing Vietnam for obvious reasons, and they also rank among the top trade partners – dominated by low-cost imports.

The non-US OEMs with major US operations also import a material amount of components (large and small) coming in from these nations in support of their US operations. To the extent tariffs strike at the supply chain from components to steel/aluminum, the idea that such punitive economics encourages more investment in the US is certainly no layup. The history is that expansion of transplants in the US has been impressive without tariffs (notably in red states).

It might be worth rethinking the premises since one school of thought is that less assembly capacity and less expansion in the US might be more appropriate for parent earnings if trade wars bring a recession and hurt the consumer. There is also the reality of currency trends and political winds shifting every handful of years. That raises questions on the uncertainty of long-term economic assumptions – notably tariffs.

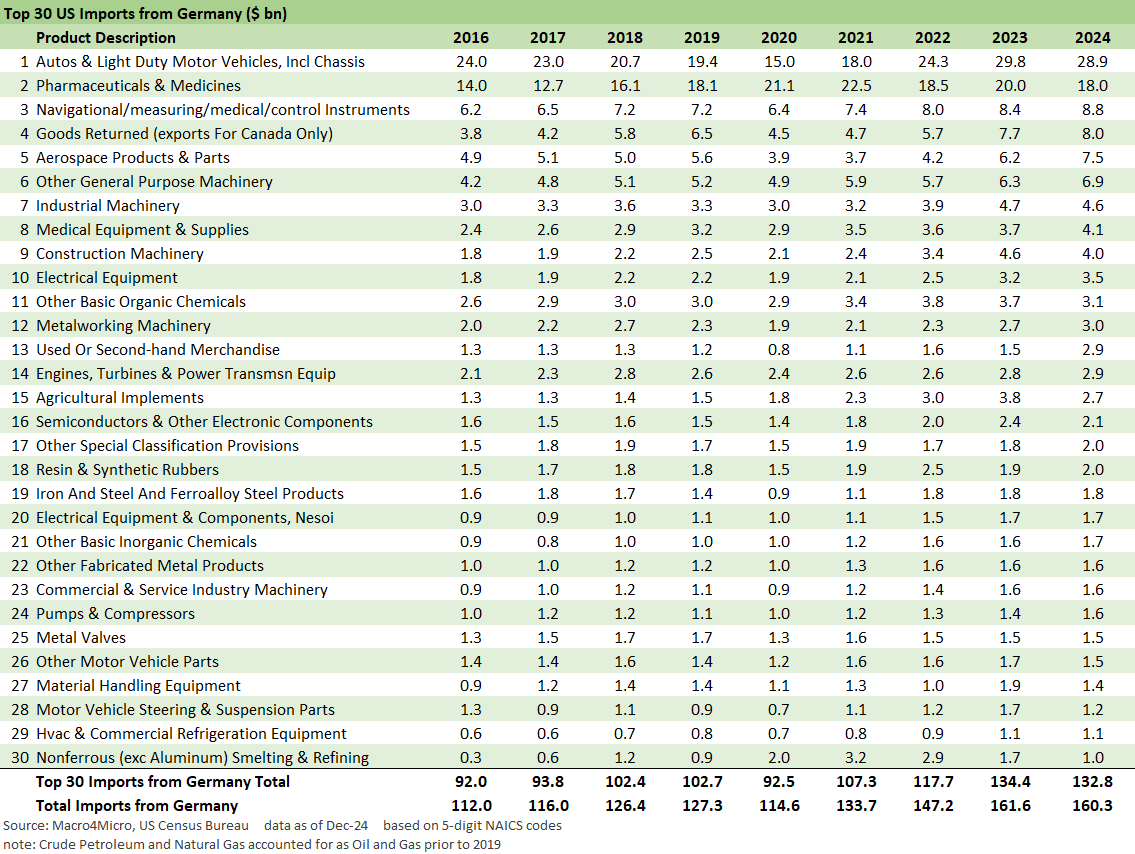

Germany: The Main Target is Now Europe

At $28.9 bn, Germany is smaller on the light vehicle import line than South Korea or Japan, but Germany has a major import line for Pharma, which ranks #2 on their import list. If you add vocal disrespect to Germany from the Trump team (notably JD Vance recently in Munich), the decisions get complicated.

We also have Musk doing his version of self-inflicted “Heimlich Maneuver Diplomacy” as he choked on common courtesy. His vocal support of German right-wing AfD (with its dash of neo-Nazi sympathy) would presumably influence any German approach to EU-wide tariff retaliation (even if they don’t admit it). You can see where the largest economy in Europe might not react well to an assault on its export market when German interests have so much direct investment in the US (red states in assembly operations and in the blue financial districts).

The array of high value-added German imports into the US have been ordered by the US buyer for a reason. Brand power in the lucrative luxury segment has clear winners: BMW, Lexus, and Mercedes with Audi to a lesser extent.

Trump initially ruled out exceptions (otherwise he might need to explain his thought process, which would be an intrinsic risk), but we would imagine there are many products on the list that do not have an easy substitute. That means the buyer would need to pay more, costs go up, pricing would go up (or earnings would go down). Some industries such as aerospace already complain of supply chain problems, so tariffs in many product lines could exacerbate the issues but obviously raise costs since the “buyer pays” the tariff.

See also:

Footnotes & Flashbacks: Credit Markets 2-24-25

Footnotes & Flashbacks: State of Yields 2-23-25

Footnotes & Flashbacks: Asset Returns 2-23-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Existing Home Sales Jan 2025: Prices High, Volumes Soft, Inventory Up 2-21-25

AutoNation: Retail Resilient, Captive Finance Growth 2-21-25

Toll Brothers 1Q25: Performing with a Net 2-20-25

Housing Starts Jan 2025: Getting Eerie Out There 2-19-25

Herc Rentals: Swinging a Big Bat 2-18-25

UST Yields: Sept 2024 UST in Historical Context 2-17-25

Tariff links:

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24