Reciprocal Tariffs: Weird Science Blows up the Lab

Those caring about tariff coherence or facts might be disappointed, but at least we have the numbers. Sort of.

We knew the reciprocal tariff roll-your-own analysis would come up with high numbers on the other side of some secret bubbling sauce that the White House used as their starting point for assigning outsized tariffs (see Reciprocal Tariffs: Weird Science 2-14-25). Toil and trouble are anticipated.

The stacked tariffs on so many billions of trade flows are on top of the current tariffs in place and do not include the Section 232 reviews that are underway now and those being pondered on pharma, semis, lumber and copper, among others. The baseline tariff for the world is 10% under the national emergency that Trump has declared which gives him legislative authority (IEEPA).

Next comes retaliation and then perhaps “retaliation to the retaliation.” Trump’s conviction runs high that this mental whiteboard exercise is right just because he thinks it is. The economic costs and employment casualties are trifles to him and analytical complaints are so much globalist claptrap. The White House fact sheet was thin on details and anorexic on concepts.

Trump combined a fascinating level of factual falsehoods with extreme conviction that is almost superhuman in its ability to combine the delusional, dangerous, and comically absurd. That is quite a recipe for downside as one looks at the import lists in total, by country, or by leading trade partner and ponder costs. We detail a few of the numbers lists below as food for thought. We detail a range of trade partner product lines in the links at the bottom. Go watch a replay of his presentation. It is something.

We knew we were going to see some lofty numbers when Trump opened his presentation by citing how the US has been “raped and pillaged” by trade partners for decades. After that, we just wanted the numbers, and he seemed to take forever. He of course wedged in the fiction that he (and he alone) had the greatest economy in history while forgetting to mention he negotiated the USMCA in 2018 and bragged about it back then in a way that was supposedly “rape and pillage free” (see Trump's “Greatest Economy in History”: Not Even Close 3-5-25).

As far as the Trump 1.0 economy, “best ever” as a story sounds better than the truth of “bottom quartile in the past 60 years” (see Presidential GDP Dance Off: Clinton vs. Trump 7-27-24, Presidential GDP Dance Off: Reagan vs. Trump 7-27-24, Annual GDP Growth: Jimmy Carter v. Trump v. Biden…just for fun 1-6-25).

The reciprocal tariff numbers Trump cited offered no hint of any conceptual framework for the methodology or give any indication that the trade partners were aware of how they were computed. Currency manipulation, trade barriers, VAT taxes, and a lack of interest in US autos all mattered. The “generous” haircut to the trade partners’ theoretical tariff equivalents are thus derived from a made-up number. The tariffs he used in the end were off the charts when you consider the costs that will flow in from the major importers.

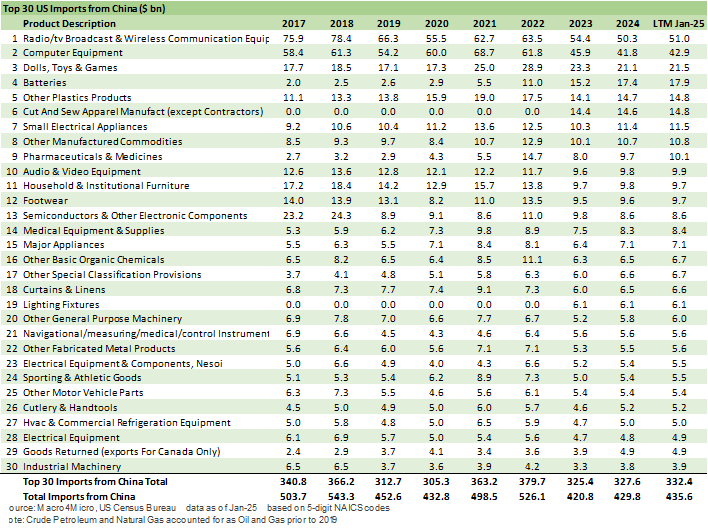

As an example, the stacked tariffs on China hit 54% when adding the new 34% to the current 20%. The punitive tariffs on Asia cover a lot of imports that will now get hit with major cost hiked for buyers who of course pay the tariffs. For example, Japan 24%, India 26%, South Korea 25%, Taiwan 32%, Thailand 36%, Indonesia 32%. We had to take a screenshot of the portion of the poster he was holding up. Shoddy is as shoddy does. These numbers were not even in the initial White House fact sheet. Maybe they’re available on a Signal group chat.

As detailed above, the China list by itself borders on a systemic threat to the cost of sales (see Facts Matter: China Syndrome on Trade 9-10-24). The Asian imports that migrated over to Vietnam were slammed also with 46% reciprocal tariffs (Trump highlighted their tariffs equivalents as 90% so 46% was “generous”). Textiles of all types will go ballistic, and the lists of price pain from Asian imports will be a task to compile.

For Europe, our understanding is that Pharma is subject to a separate tariff review. We are unclear on the intermediate medical inputs from China at this point. Regardless, count on healthcare costs soaring. Auto inflation – new and used – will also spike.

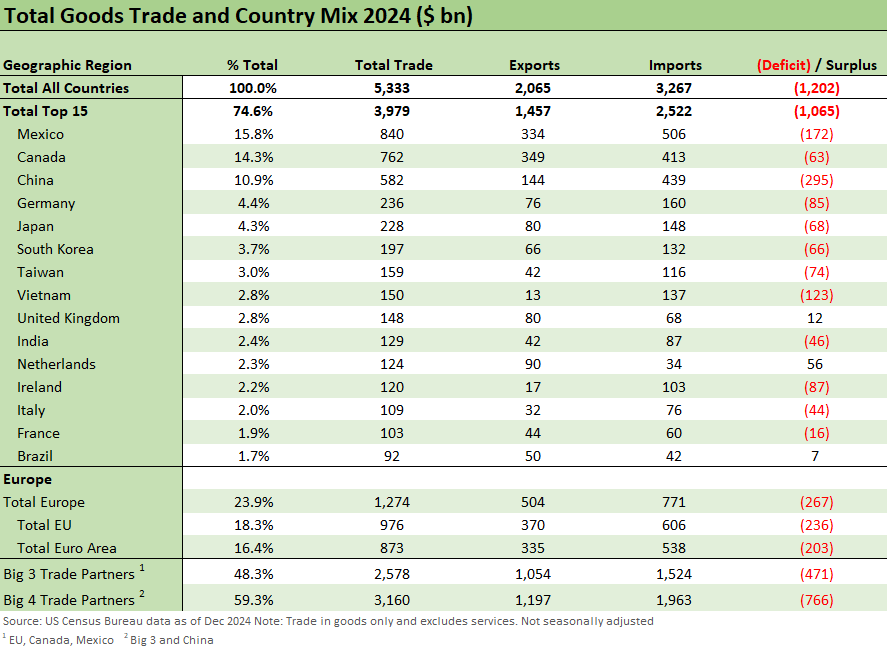

The above chart shows the top importer list. If we exclude the EU as a trade bloc, the 14 nations are comprised of 7 from Asia, 5 from Europe, and the 2 USMCA partners. We expect the EU to retaliate with a vengeance in proportionate fashion, but this time the “proportions” are very large after this latest Trump move. China is likely to respond with more of a tactical targeting approach to inflict damage since they just don’t have the dollar value to play with. Taiwan is in a very vulnerable spot at this point.

Japan and South Korea are wildcards and heavily exposed on the auto side. We have been looking at the car dealers recently, and a significant majority of the public dealers retail sales are import brands. In some cases, a vast majority are import brands. As an example, Penske has 2% of legacy US brands and the rest import brands. Sorting out the imports from offshore (or across the border) from the “import brands” manufactured in the US is an exercise easier from the top down than from the issuer level.

Tariff and Trade links:

Tariffs: Stop Hey What’s That Sound? 4-1-25

Tariffs are like a Box of Chocolates 4-1-25

Auto Tariffs: Questions to Ponder 3-28-25

Fed Gut Check, Tariff Reflux 3-22-25

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23