Retail Sales Mar25: Last Hurrah?

We look at a foreboding spike in retail sales as tariff effects loom and consumers are getting worried.

An increase to headline retail sales at +1.4% MoM might be good for optics and spin, but the reality of tariffs making their way through the transaction chain is a looming setback for the consumer.

With pricing uncertainty mounting across categories with ongoing tariff policy shifts and a confusing array of reciprocal tariff talks, it’s likely that consumers pulling purchases forward drove much of this month’s gain.

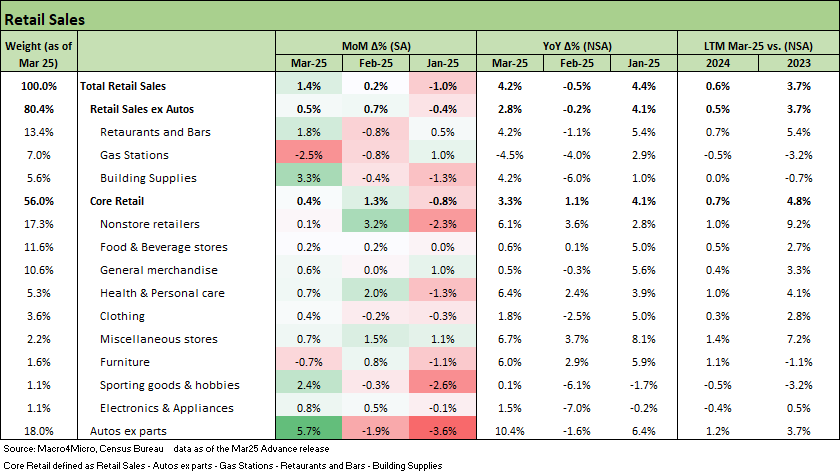

Major contributors to growth this month are a 5.7% surge in Autos and a +3.3% increase in Building Supplies. The pull-forward effect is much easier to see for these groups with tariffs so directly pointed at the cost lines.

It is worth noting that Core retail sales continued to grow at 0.4% MoM but with the drivers of demand focused on smaller groupings of less frequently purchased items.

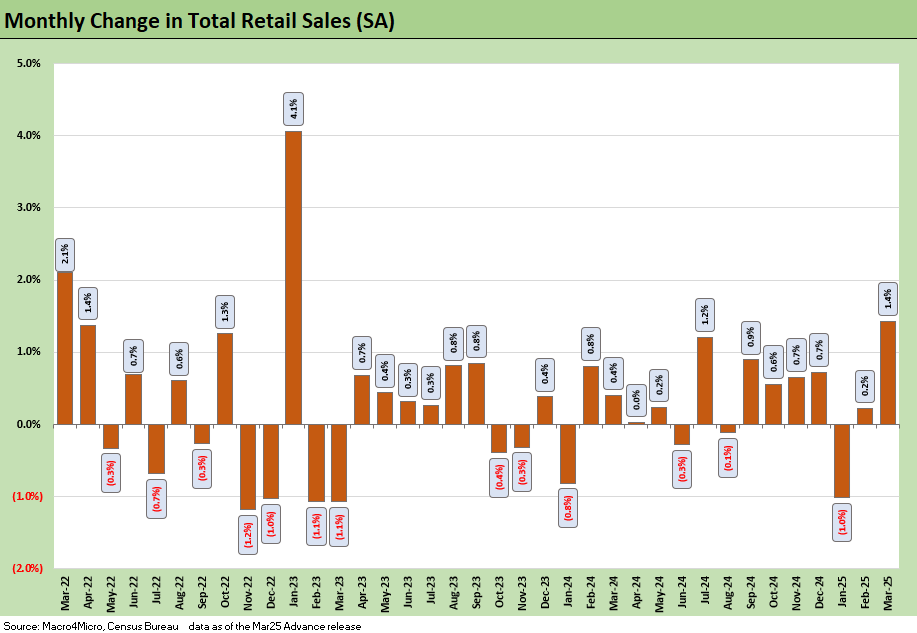

The monthly changes to retail sales are shown above as this month’s print marks the strongest gain in over a year but coincides with the mounting anticipation of major tariff policy changes. While this is the last release before tariffs come “mostly” into effect in total volumes, the anticipation of higher future prices has already begun to shift consumer behavior. The most recent UMich consumer sentiment reading reflects the unease of declining economic outlook and expectations of renewed inflation.

Despite all the efforts to mischaracterize who pays on tariffs, some consumers clearly understood the basic fact that prices will rise - and they acted accordingly. Though the recent demand trends revealed some residual resilience of what entered the year and 1Q25 as a healthy consumer sector, the months ahead will serve as a real-world stress test as inflationary pressures (or “reduced purchasing power” setbacks for the monetary purists who object to the term “inflation”) build again so soon after the last bout.

The above table covers the underlying details of this morning’s report with key lines of ‘ex-Autos’ and Core Retail. Looking below the headline 1.4% increase on the month, only 0.5% of that came from ‘ex-Autos’ growth and 0.4% for the Core Retail reading. For ‘ex-Autos’ the decline in Gas Stations due to decreasing oil and gasoline prices was more than offset by renewed spending at Restaurants and Bars. We flag the food service category rise since such an increase to discretionary spending stands out from other strong performers this month.

Looking behind the Core Retail growth, we see the largest two categories of Nonstore retailers (e-commerce) and Food & Beverage stores as the lowest growth area vs. usually strong performance. As the bulk of the Core grouping, these are more representative of day-to-day necessities. The strength in this month’s core reading is focused further down the line into larger or less frequent purchase categories. These are categories linked to anticipatory demand ahead of tariffs that are likely to be more pronounced such as Clothing and Electronics & Appliances. Both of those areas tie into low-cost Asian production where the reciprocal tariffs assigned were especially ugly (before the pauses).

In a vacuum, today’s print would be cause for some minor optimism in the macroeconomic picture and support the ability of the Fed to stay measured in their actions. However, the clouded near-term future of tariffs, retaliations, and uncertain pricing leaves the consumer preparing for the worst. The tariffs could disappear overnight (they won’t), but the perception pain to come is already in the consumer mindset.

We expect the next few months will see lower demand overall even if there are few solid months for some categories during the tariff pause. The inability of many companies to give revenue and earnings guidance reflects that confusion and uncertainty.

See also:

Industrial Production Mar 2025: Capacity Utilization, Pregame 4-16-25

Credit Snapshot: Lennar (LEN) 4-15-25

Credit Snapshot: Iron Mountain (IRM) 4-14-25

Footnotes & Flashbacks: Credit Markets 4-13-25

Footnotes & Flashbacks: State of Yields 4-13-25

Footnotes & Flashbacks: Asset Returns 4-12-25

Mini Market Lookback: Trade’s Big Bang 4-12-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

CPI March 2025: Fodder for Spin 4-10-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25

Footnotes & Flashbacks: Credit Markets 4-6-25

Footnotes & Flashbacks: State of Yields 4-6-25

Footnotes & Flashbacks: Asset Returns 4-6-25

Mini Market Lookback: A Week for the History Books 4-5-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25

Credit Snapshot: Taylor Morrison Home Corp (TMHC) 4-2-25

JOLTS Feb 2025: The Test Starts in 2Q25 4-2-25

Credit Snapshot: United Rentals (URI) 4-1-25

Mini Market Lookback: The Next Trade Battle Fast Approaches 3-29-25

PCE Feb 2025: Inflation, Income, Outlays 3-28-25

4Q24 GDP: The Final Cut 3-27-25

Durable Goods February 2025: Preventive Medicine? 3-26-25

New Homes Sales Feb 2025: Consumer Mood Meets Policy Roulette 3-25-25

KB Home 1Q25: The Consumer Theme Piles On 3-25-25

Lennar: Cash Flow and Balance Sheet > Gross Margins 3-24-25

Mini Market Lookback: Fed Gut Check, Tariff Reflux 3-22-25

Existing Homes Sales Feb 2025: Limping into Spring 3-20-25

Fed Action: Very Little Good News for Macro 3-19-25

Industrial Production Feb 2025: Capacity Utilization 3-18-25

Housing Starts Feb 2025: Solid Sequentially, Slightly Soft YoY 3-18-25

Retail Sales Feb 2025: Before the Storm 3-17-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

Tariff and Trade links:

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Stop Hey What’s That Sound? 4-1-25

Tariffs are like a Box of Chocolates 4-1-25

Auto Tariffs: Questions to Ponder 3-28-25

Fed Gut Check, Tariff Reflux 3-22-25

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25