Tariffs: Some Asian Bystanders Hit in the Crossfire

We demystify import totals from Taiwan, India, Thailand, Malaysia, Indonesia, and Cambodia. The tariffs make zero sense.

McKinley sets the bar and tradition lives on…

The Trump Tariffs use their “reciprocal tariff math” to take a hard line on any country with a high trade deficit as part of Trump’s fact-light and concept-free global trade war policy plans (see Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25).

We have been looking at some of the largest trade deficits that are usually at the center of peak tension, but Asia as a region saw no nation spared. Some EU countries were lucky to get refuge from the EU bloc rate since some would have been hit harder using the nonsensical formula used by the White House that had nothing to do with reciprocity parameters (see Reciprocal Tariff Math: Hocus Pocus 4-3-25).

Other than Taiwan, which always gets attention as a geopolitical flash point, we had addressed Vietnam as an outlier in an earlier commentary (see Tariffs: Stop Hey What’s That Sound? 4-1-25). We also had looked at Japan and South Korea separately (see Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25).

In this note, we look at 6 other Asian trade partners import mix in descending order of the size of the trade deficits by nations (not including EU as a trade bloc), Taiwan ranked #6, India at #11, Thailand #12, Malaysia #14, Indonesia #15, and Cambodia #18. We note that China was #1 and Vietnam #3 (5 notches ahead of Canada, who had a surplus ex-oil). We used Jan LTM data.

“Other” Asian partners: thanks for being a friend…

It is no surprise that Taiwan is the import epicenter for semiconductors, but many trade experts were taken aback by the “reciprocal tariff” of 32% assigned by Team Trump. That trade partner has made commitments of a few hundred billion between tech and energy. Taiwan seem to get penalized for good behavior given the reciprocal tariff methodology of simple long division used to derive the tariff rate (Reciprocal Tariff Math: Hocus Pocus 4-3-25).

Taiwan is more than just another trade partner since it plays an outsized role in postwar US history. That cuts across some history lessons from the “China Lobby” and McCarthyism to Nixon’s ping pong diplomacy that saw the opening of relations with Mao. The early 70s saw the question of who sits at the UN to represent China on the Security Council. That was resolved in 1971.

Then later in the Carter years, the People’s Republic was recognized as the sole government, and the US withdrew recognition from Taiwan (then “Republic of China,” which is still recognized by a very small group of small nations). The newly aggressive stance around Taiwan from Washington in recent years raises questions of what the US would do if China asserted more aggressive control or intruded militarily (e.g. blockade).

The fact that Trump chewed out Zelensky in the Oval Office about risking WWIII, the idea that Trump would defend Taiwan seems dubious. This high tariff rate on Taiwan also sends a signal to China on Trump’s relative commitment to “his friends” with a 32% Taiwan tariff. Trump’s priority is his best friend (the guy in the mirror). Taiwan did not get the tariff-free love that Trump gave Russia and Belarus. That is notable.

The 32% tariff on Taiwan does not apply to semiconductors (yet), but the computer and electronics line screams cost and price pressure for US buyers. For semis narrowly, many remember the massive disruption in automotive production tied to the shortage of semiconductors that caused the loss of millions of units in production.

The post-COVID setback and semi challenges cost the US production around 12 million vehicles in total units and billions in revenue (per S&P Global, Congressional Research Service). The peak was in 2021-2022 with a substantial majority of that shortfall in 2021. That had the effect of driving high price inflation of vehicles. The shortage of new vehicles even took used car CPI levels to over 40% handles with numerous double-digit inflation months for new vehicles (see CPI Wrap for 2022: Beginning of the End? 1-12-23).

When you ponder what could unfold with heightened tensions between China and Taiwan and the US, the geopolitical stakes get spooky. The economic fallout for US inflation and automotive production serve as a tail risk that is just not that long at this point. It just got shorter with Trump kicking off a massive trade war with China. We doubt Trump would do anything other than threaten more tariffs if matters grew hostile between China and Taiwan.

As we go to print, Trump is aiming to slap 50% tariffs on China by midnight, taking the total to 104%. The fallout for supplier chains will get worse just on that action, but we will see China retaliate. One way to retaliate is to restrict the free flow of critical exports from China to the US.

As we have laid out over the years, there is a lot to choose from in terms of impairing supplies from China to the US. They have less to aim at from the US export list. China needs the aircraft from Boeing for growth, but they could always pause orders. There is nothing sacred. The China UST holdings will inevitably come up again. Lists making the rounds include potential attacks on US services and more targeting of ag products.

The India mix was more diverse than some others with high-value-added pharma as well as low labor cost lines (notably “Cut and Sew”). Pharma and medicines rank #1, and that group could still be up for additional Section 232 tariffs. The pharma tariff attacks have not moved forward yet. That product group could cause a full-blown trade war with the EU. Pharma is the #1 import from the EU and #2 with the world (see US Trade with the World: Import and Export Mix 2-6-25) and would have relevance for India exports.

The above chart details Thailand imports with its important role in semis, electronics and computers. Many semis from Taiwan find their way to Thailand for other components and products on the way to the US. The stakes are high not only for the broader tariffs on products but semis as well in the case of Taiwan. The regional stakes of any disruptions in the life of Taiwan by the US or China (from tariffs on semis to military action) would be a case of economic multiplier effects on steroids. Trump has not called for Section 232 on semis yet, but he waves it around.

Malaysia is smaller in imports than Thailand, but a similar backdrop can be seen. Semis and electronics import levels really add up across Asia trade partners.

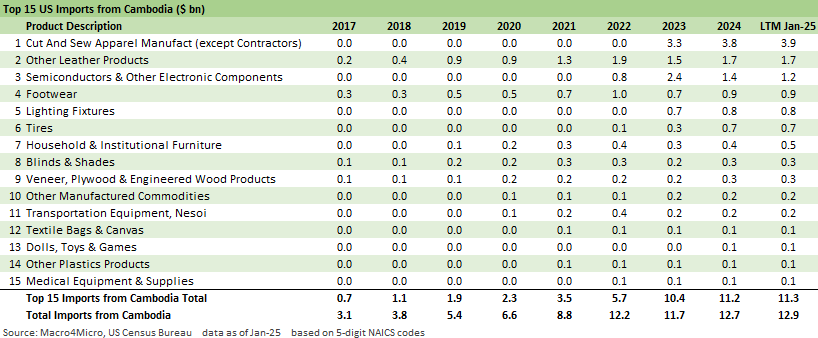

For these last two in the group, Indonesia and Cambodia, the unilateral and nonstrategic nature of the tariff plans are more obvious. The high mix of product lines such as “Cut and sew” and footwear raises questions of what the US is actually trying to get reshored for industries and jobs and notably where low labor costs are the swing factor.

Jobs that won’t come back or be competitive and will require extensive investment and various costs (many not incurred offshore) will not return. That means the US consumer gets hit with tariff-driven inflation and there is no mission to that plan. It is pure inflation on items such as apparel and footwear. Trump can of course take solace in the fact that imports will go down and there will be suffering and employment dislocation in trade partners that will now hate America.

There is always the thought process that taking such action will drive more nations to look for alliances elsewhere, and tariffed governments will have grudges against the US. In a tense world and with a lot of challenges ahead in Asia, having allies would not be a bad idea.

Cambodian imports into the US have much in common with Indonesia and do not present a case of high value-added multiplier effect sectors. The inability to even staff such jobs runs alongside an ongoing program to deport/expel the largest source of low-cost labor. That is not winning any prizes for conceptual consistency.

McKinley lives on…

We could not help but include an old McKinley geopolitical cartoon at the top of this commentary for numerous reasons besides the fact that Trump keeps bringing him up. It is no surprise that Trump grossly misstates how McKinley evolved in his view on tariffs from his earlier years as he entered his second term and was a believer in truly reciprocal tariffs (McKinley quotes from Sept 1901: “Reciprocity treaties are in harmony with the spirit of the times; measures of retaliation are not…Isolation is no longer possible or desirable.”) There is more, but evolution is a good thing and came as the US was expanding its reach in Asia and in Latin America.

Of course, McKinley was assassinated not long after that speech. Trump also neglects to mention the fact that income taxes were not constitutional at the time and tariffs were a critical source of revenue. Income taxes came later after the 16th amendment in 1913.

The world was less complicated in 1900 after a few decades of the Gilded Age and its myriad booms, busts, panics and depressions as two powerful economies (the US, Germany) saw explosive growth and industrialization. The US was a huge advocate of free trade and open markets after WWI and WWII. They were not quoting McKinley. Of course, after the roaring 20s, the US returned to protectionism. That did not go well.

Our view of Trump’s trade policies has been negative since he started stoking these up in the 2016 election. History is not on his side, but he tends to recreate factual timelines and events. He had to go back pretty far (he skips over Smoot Hawley) to contrive a bullish angle when some industrial powerhouses (US and Germany) were coming into their own. We can’t help but wonder if the peak of Jim Crow and women not voting also appealed to Trump as he looks for “warm and fuzzies” in the McKinley years.

See also:

Footnotes & Flashbacks: Credit Markets 4-6-25

Footnotes & Flashbacks: State of Yields 4-6-25

Footnotes & Flashbacks: Asset Returns 4-6-25

Mini Market Lookback: A Week for the History Books 4-5-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25

Credit Snapshot: Taylor Morrison Home Corp (TMHC) 4-2-25

JOLTS Feb 2025: The Test Starts in 2Q25 4-2-25

Credit Snapshot: United Rentals (URI) 4-1-25

Footnotes & Flashbacks: Credit Markets 3-31-25

Footnotes & Flashbacks: State of Yields 3-30-25

Footnotes & Flashbacks: Asset Returns 3-30-25

Mini Market Lookback: The Next Trade Battle Fast Approaches 3-29-25

PCE Feb 2025: Inflation, Income, Outlays 3-28-25

Auto Tariffs: Questions to Ponder 3-28-25

4Q24 GDP: The Final Cut 3-27-25

Durable Goods February 2025: Preventive Medicine? 3-26-25

New Homes Sales Feb 2025: Consumer Mood Meets Policy Roulette 3-25-25

KB Home 1Q25: The Consumer Theme Piles On 3-25-25

Lennar: Cash Flow and Balance Sheet > Gross Margins 3-24-25

Mini Market Lookback: Fed Gut Check, Tariff Reflux 3-22-25

Existing Homes Sales Feb 2025: Limping into Spring 3-20-25

Fed Action: Very Little Good News for Macro 3-19-25

Industrial Production Feb 2025: Capacity Utilization 3-18-25

Housing Starts Feb 2025: Solid Sequentially, Slightly Soft YoY 3-18-25

Retail Sales Feb 2025: Before the Storm 3-17-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

JOLTS Jan 2025: Old News, New Risks in the Market 3-11-25

Credit Spreads Join the Party 3-10-25

Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25

Payrolls Feb 2025: Into the Weeds 3-7-25

Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25

Gut Checking Trump GDP Record 3-5-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Asset Returns and UST Update: Pain Matters 3-5-25

Mini Market Lookback: Collision Courses ‘R’ Us 3-2-25

Tariff and Trade links:

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Stop Hey What’s That Sound? 4-1-25

Tariffs are like a Box of Chocolates 4-1-25

Auto Tariffs: Questions to Ponder 3-28-25

Fed Gut Check, Tariff Reflux 3-22-25

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25