Credit Snapshot: Avis Budget Group (CAR)

We summarize the credit fundamentals of Avis.

Credit Snapshot: Avis Budget Group (CAR)

Credit Trend: Stable

Summary credit profile:

The current run rates and balance of risks frame a stable credit outlook for Avis despite the volatility at Hertz and along the auto chain set against the tariff backdrop. FY 2024 was a weak year, but 2025 promises a rebound in EBITDA and improved leverage metrics with a fresh start and a revamped fleet. To its credit, Avis has demonstrated cyclical resilience to go with prudent fleet management and risk mitigation skills across some wild cycles for car rental operators. Those periods include extreme volatility in used car values and disruptions in air travel. We have additional background for readers to review Avis and car rental history [see Credit Crib Note: Avis Budget Group (CAR) (5-8-24), Avis: Credit Profile 8-3-23)]. The liability structure of Avis is a busy one with secured and unsecured corporate level debt along with nonrecourse vehicle funding.

Relative value:

Given the mix of cyclical crosscurrents for the consumer (leisure travel fallout), tariff impacts (covered below), industry risks, and issuer metrics and operating history, Avis offers a steady core holding for a solid B tier name. Avis has proven itself in the worst of times and thus has credit market credibility. Avis has been busy since the post-COVID crisis refinancing wave as Avis extended liabilities into more unsecured bonds and reduced structural subordination. That is intrinsically positive for credit risk by freeing up lien room for contingent scenarios and easing maturity schedules.

The liability extension included both $ and € bonds. Despite the potential for volatility tied to tariff headlines and Hertz financial distress, Avis has shown it can navigate markets and the idiosyncratic issues of Hertz and what that could mean in fleet risk. While the credit metrics and fundamental trend line has been unfavorable for Avis, the high coupon 8.25% bonds near 9% offer the best value even if there is room for more volatility in the sector. As of last night close, we saw +500 bps for the 8.25% of 2030 and 8.9% yield. The EBITDA expectations we assume will get better with the company guidance of a $1 bn EBITDA minimum. Used car inflation picks up after the tariff effects and will help support net fleet costs on higher residual values.

Business risk:

Car rental presents high business risk for multiple reasons, but history is the easiest answer to explain why. The industry risk was evident in spectacular fashion with Hertz from 2016 through its Chapter 11 process and then again after it emerged from bankruptcy and soon became an overleveraged issuer riddled with another fleet overreach problem in EVs. Back in 2016, fleet mismanagement sent HTZ into a tailspin. They swung for the fence again after emerging and it backfired. The interconnected risks across the car rental business were on full display with cash losses in the fleet turnover cycle. Used car markets literally drive collateral damage for car rental borrowers in secured and unsecured corporate layers and across a range of fleet financing activities that are outside the guarantor group.

Tariffs:

Tariffs on cars directly impact new and used pricing. Car rental pricing (rental rates) must recoup all fleet cost at a healthy enough profit margin to satisfy shareholders. As we cover below (depreciation as a cash cost), residual values of vehicles need to be reliably estimated and built into pricing strategies. The effect of tariffs will be to constrain new car supply and jack up prices. With tariffs and barriers to imports, the supply issue will drive used values higher (thus the initial brief, favorable short-term reaction to tariffs in Avis equity). The risk ahead will be higher new vehicle acquisitions for the fleet, so the next fleet building season in 2026 will face a new set of conditions with higher new vehicle prices.

The other big worry from tariffs and trade wars on this scale is damage to the consumer sector. That in turn can translate into less discretionary leisure travel and retrenchment in corporate budgets. That can hit volumes, utilization, and rental pricing and raise the stakes around the industry properly managing fleet size and supply-demand balance.

Profitability:

Management framed EBITDA guidance above $1 bn in 2025 and free cash flow greater than $500 million. That is the good news. We will see if Avis pulls back on that in 1Q25 earnings season. The tradeoff for now is downside in cyclical volumes vs. upside in used residuals. The past cycle saw extraordinarily volatile margins around the residual value X-factor that drove record margins in 2021 and again in 2022 on the dramatic recovery of used vehicle values during the post-COVID shortage period of 2021-2022. EBITDA margins in FY 2024 were well below pre-crisis norms and even further below the distortions of the post-COVID used vehicle prices.

Delta just reported 1Q25 earnings, pulled full year guidance, and cited soft “domestic and main cabin softness” which should mean volume headwinds for car rental. Passenger count and “bodies at the counter” are the main event for on-airport car rental volumes. A cost structure with a higher mix of variable costs (fleet prices and number of vehicles) allows considerable flexibility in managing cash flow risk via fleet management and discretionary stock buybacks. Hitting the right numbers for vehicles in total, the mix across price tiers, and the allocation by location both on and off-airport has seen the fleet management and pricing systems get more sophisticated over the years.

Looking back at 2024 for Avis, the Americas and International segments both posted sharply lower adjusted EBITDA. Normalization of the vehicle backdrop (new and used) and competitive conditions in the car rental sector have been challenging including the added drama of the Hertz EV problem and a fresh financial crisis for the now #3 car rental operator (Avis now #2 behind Enterprise). Avis profitability was weak in 2024 despite very strong air travel and a cyclical high in “earning assets” (vehicle count). A $2.47 billion impairment charge was taken in 4Q24 as Avis accelerated its fleet rotation on higher cost vehicles purchased in 2023 and 2024. The impairment charge was a stark reminder of the importance of used car values and how sharp moves in new and used pricing can create costly fleet decisions. 1Q25 is the seasonal trough and Avis had guided to a $100 million loss on some lingering effects of the fleet rotation.

Vehicle depreciation as a “cash event”:

Depreciation costs rose sharply in 2024. For those new to car rental, the idea of vehicle depreciation as a cash expense that is backed out of corporate EBITDA (in company reporting, in covenants, and by analysts) was an acquired taste during the wild times of 2016-2020 for car rental. The need to recover the cost of the vehicle over the typical holding period on the way to remarketing means vehicle depreciation needs to be built into rental rates. Otherwise, you lose money when the vehicle leaves the fleet in remarketing. The funding entities are basically “billing the car rental company” for that depreciation, so the car rental operation needs to bill the customer for that cost plus a markup. That means Avis and Hertz need to be proficient at estimating residual values and develop optimal remarketing capabilities. That is not easy as evident across the past cycle.

Balance sheet:

The repair of the Avis balance sheet from the COVID peak stress was tied to reducing liens, extending out the curve, and locking in unsecured term debt while reducing secured loans. Avis was fortunate to move quickly to refi and extend during 2021 before the UST curve shifted higher with the tightening cycle. One of the critical takeaways from the Hertz experience was “don’t run out of lien room” as an asset-light branded service operation.

Avis issued $500 mn of term Loan A to refinance some fleet financing. The term loan A will be refinanced during 2025 as Avis looks for “opportunistic” 2025 model alternatives. Avis had also been busy refinancing and extending € debt and tapped USD bond market with the 8.25% bonds due Jan 2030 to refinance the 2029 term loan and for fleet debt repayment.

Leverage has been rising with weak adjusted EBITDA even after adjusting for one-off charges and notably on the fleet strategy. Leverage does stack up poorly against expected Enterprise Value multiples in the 6x to 7x area. Leverage is expected to normalize in 2025 on the EBITDA rebound back to under 5x. At least the residual value trend line will be supportive of leverage metrics via EBITDA.

Avis paid a $10.00 per share special cash dividend to common stock as of December 15, 2023. No dividend was paid in 2024. Below in the charts, we break out the stock buyback history. The 2021-2023 stretch was an unusually strong travel period after COVID and market supply-demand dynamics generated very strong residual values for used vehicles.

Vehicle funding securitization:

“Liabilities under vehicle programs” is a complex topic with over $17 billion at 4Q24. Fleet funding risks get into the layers of vehicle fleet management and residual values, loan-to-value math for credit lines, and ABS ratings/criteria. The use of Letters of Credit to support the LTVs in the securitization deals overlaps with the credit lines from the banks at both the corporate level (for the LOCs) and in the context of fleet purchases/sales and seasonal turnover that looks to the used car market. As the Hertz Chapter 11 process reinforced, it is all inextricably intertwined.

When looking at car rental, a convenient way to frame the analysis is that there are two operations: a car rental business and a vehicle funding business. Vehicle funding in fleet ABS is historically very reliable with deep demand. New vehicle prices and residual values both move higher in both good ways and bad ways. Fleet financing costs flow into lease and depreciation charges that need to be recovered by the rental operation to reimburse the vehicle funding entities. That expense naturally ties to the shorter duration segment of the UST curve. Fed easing would be positive, but stagflation would be a material negative given the consumer overlay.

SELECT CHARTS

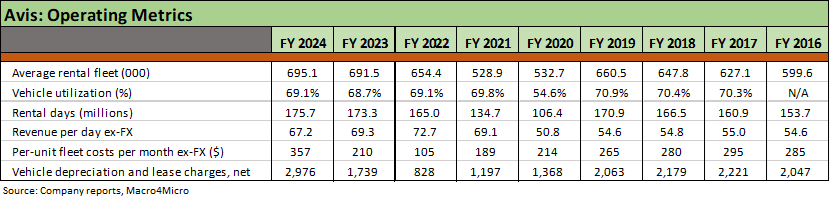

Looking for a return to pre-COVID “normal.” Used cars still a wildcard with tariffs.

Residual value boom of 2021-2022 were anomalies bolstering margins.

Average earning assets = fleet. Hit a high in FY 2024. Americas still the main event.

Fleet costs and depreciation hit a post-COVID peak in 2024.

Leverage hit by the EBITDA line and should decline to sub-5x in 2025.

Stock buybacks low in 2024 after going off the charts in the residual value boom.