Reciprocal Tariff Math: Hocus Pocus

The White House trade team turned to simple long division to compute tariffs. Simple is as simple does.

When rigor gives way to mortis, bad things happen in economics.

Trade deficit % Imports is just the flip side of the Trade deficit % Exports as an easy metric to portray “relative badness.” We broke out the latter occasionally against exports for a way to find a measuring stick (see Tariffs: Stop Hey What’s That Sound? 4-1-25).

At least we admit such simple ratios are concept-lite since they do not explain “Why?” the goods deficit exists in the first place. Not exactly cutting-edge stuff to use in turning global trade on its ear. Reckless is more the word to describe it.

The econometric whiz kids in the White House will not be booking their tickets to Stockholm for their Nobel this year. They actually would get kicked out of the Community College economics study group to place that much weight on this ratio with such high stakes.

Below we break out the Top 20 trade deficit nations and rerun the simple ratio. It is a tribute to top-down management of numbers with little in-depth study other than “the boss” saying “make them higher.” There is no published research on how they got here on the topic of tariff equivalents and barriers in these other nations. The lack of rigor is another reason they are likely to invoke executive privilege again in the Section 232 studies underway.

The above is an image snapshot of what Trump was holding up during his rambling, wandering descriptions of “rape and pillage” by trade partners.

As the market tanks today, the White House is taking fire for the simplistic approach on tariffs and the lack of visibility on “how they got here.” Trade experts were left scratching their heads yesterday until someone noticed a close relationship to the math detailed below that mimics in loose fashion the above chart math.

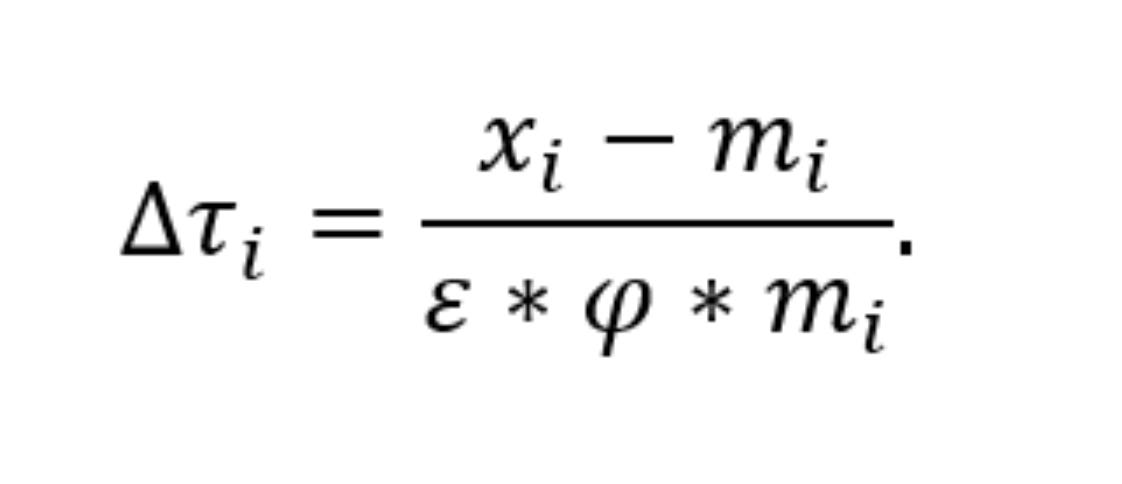

The White House threw in some variables such as elasticity which are like a floating craps game juggling corporate and consumer sentiment, pricing power, and the existence of substitutes among other factors. The White House finally succumbed to admitting the formula they used as a starting point:

The CNBC guests were busy making fun of it while street research was citing credibility problems.

Top 20 trade deficits with enemies that “raped and pillaged” per Trump.

The next two charts include a Top 20 trade deficit bar chart followed by the apparent pivotal long division for what makes an enemy in trade. That ratio has been determined to be “trade deficits divided by imports”. After all, if Musk can use AI alongside recommendations from the “Big Balls” code boy on his team to slaughter Federal payrolls, there is no reason some long division cannot be used to turn the global trade order upside down, drive costs higher, and cause price spikes and torch payrolls.

The top 20 for deficits % imports…

Below we run the simple math on what was apparently the core of the esoteric economic theories debated over Big Macs at the White House. We use the same nations in the top 20 deficits and rerun the highest to lowest in that same group.

The Asian targets jump out. We see the lack of interest in buying US products in Asia and Europe for many nations. The question is when these nations cease to be major suppliers of low-cost inputs or desired imports to the US (whether for corporates or consumers), will these smaller nations become major buyers of US products? (Hint: No). Will they relocate their operation to the US (hint: No).

We could see some classic industries such as autos and steel relocate to the US given the more natural end market opportunities. The “labor arb” story will be gone.

Let the “negotiation tactic” games begin again.

The use of the word “permanent” is almost a requirement to get companies to commit to rebuilding or moving to the US. The projects run into billions and involve multiyear commitments. The need for a national level commitment by the US would be required to commit in bipartisan fashion to a regressive tax (tough sell to Democrats). It also entails faith in Trump’s commitment and honesty. We could leave that one in the caveat emptor bucket since he just blew up his own USMCA deal.

Tariffs are the purview of Congress, but Trump has used existing laws on the books to play tariff dictator. “Trust me, they are permanent” is not likely to encourage commitments unless there are favorable economics. Examples such as Hyundai include auto transplants and steel to supply those downstream operations.

Lower value-added assembly line and labor-intensive products have a much harder time. Computers and electronics and textiles, etc. will see material inflation. If capacity declines offshore, pricing power will rise. Then the CPI and PCE feel the pain. Exiting entire product lines and retrenchment are economic solutions that also increase unemployment. That sets off recession risk with consumer spending and hiring contraction.

The alternatives for those from suppliers to finished goods manufacturers is wholesale downsizing and restructuring actions to mitigate tariff damage. Trump allies outside the White House underscore that there will be “give” in exchange for commitments. That does not help encourage long term capex.

The negotiating tactic pitch is a favorite of every “buy the dip” addict whether it be a kneejerk sell-off or an anomaly around macro variables in the economy or by industry. When does a sell-off run the risk of a broader repricing if the dip is construed by many as more a pea-soup-fog-in-an-abyss and not just a cloudy mix of outcomes?

Retaliation is coming…

One of the big X-factors that will be surfacing soon will be retaliation from China and the EU as well as Canada. Mexico has been more on the charm offensive, but we can assume that will change in Mexico soon enough when auto plants start closing and orders for Mexican made models start drying up. The low-cost assembly arb will also start to reverse and there will be widespread inventory shortages as the year goes on.

There are so many ways the EU and China leadership could light up the US in goods and services. Since there are no rules in a knife fight (think Butch Cassidy and Sundance), there is an arsenal of retaliation moves that cross into services where the US runs large surpluses. The EU has already been tinkering with the Anti-Coercion Instrument (ACI). We looked at the EU big guns in a recent comment (Fed Gut Check, Tariff Reflux 3-22-25). Macron was out this morning talking tough and more will be coming. The leaders in Europe also have domestic political constituencies.

Questions to ponder…

Can trade partners simply say, “zero tariffs on all US imports” (as Israel did) and then ask for the same in return? What would that mean for US tariffs or would it be status quo until the facilities are closed and moved to the US.

Despite the fancy math equation above, how did the White House factor in VAT taxes, local regulations, established practices (franchise laws, etc.)? Was it more visceral than analytical?

Can the US tariff overlord(s) detail what constitutes currency manipulation and what is required? A fixed exchange rate? Or whatever the US (Trump) needs it to be that week?

What happens when erasing trade volumes start to flow into dollar outflows from the markets and diminished buying of UST in the face of an exploding need for UST demand on record deficits and funding needs?

Will China and Japan step back on incremental UST purchases without even announcing it and let the US dollar and UST funding costs try that one on for size?

Since the current tariff regime has been tagged as being 10x the scale of 2018-2019, does the sales pitch that “it worked last time” even matter – as dubious as that statement is? (Asset prices were crushed in FY 2018 and the Fed had to ease in 2H19 on weak exports and weak fixed investment).

Will heavy borrowing by Europe and Canada start to lead to even more reallocation of investors away from UST and crowd out demand?

Will we need another massive farmer bailout on an even larger scale in 2025? The last one to offset tariff damage dwarfed the auto bailout. Will this one be more properly viewed as self-inflicted?

There will be a lot of action ahead in coming days with all eyes turning to retaliation game plans. The EU and China have the ability to do more harm on multiple fronts. Will the EU pull out the anti-coercion big gun, go after tech services, and crush the US NASDAQ and hammer the Mag 7?

Canada has critical resources (notably oil and potash) that could impact regional inflation ahead of peak driving season during the spring refining activity and the exposure of the agriculture sector to fertilizer costs.

A lot of action ahead. The biggest variable at this point is retaliation.

Tariff and Trade links:

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Stop Hey What’s That Sound? 4-1-25

Tariffs are like a Box of Chocolates 4-1-25

Auto Tariffs: Questions to Ponder 3-28-25

Fed Gut Check, Tariff Reflux 3-22-25

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23