Tariffs, Pauses, and Piling On: Helter Skelter

The market still confronts a multi-front trade war with record tariffs and major trade clashes with 60% of US trade volumes.

Manson Family of Trade offers a needle and thread.

The market can now return to the reality of an escalating trade war with the world’s #2 economy and how tariffs will bring higher prices, higher costs, and lower volumes at a time of massive UST funding needs that fueled a UST scare this past week and moved Trump into Plan B (pause and reinvent reality).

We are still seeing record tariffs as a debatable (but high) multiple of recent aggregate tariff levels with much more to come north of 20% overall when the smoke clears. The constant toggle back and forth from “tactics and negotiation” to “They are permanent. Start building!” has been an embarrassment and made it almost impossible to rely on those tariffs as long-term inputs into economic decision-making. That is the case for US or offshore entities.

Projects will be committed where the economics are already compelling (auto transplants, select tech to derisk the Asia geopolitical risk factors), but the Trump 2.0 behavior pattern makes trusting the US impossible (this has been a theme of late from the street and corporate sector).

For economic growth, the ability to look past the actual transaction impacts of the “buyer pays” tariff costs flowing into real experiences is a challenge in handicapping the GDP impact as recent currency trends make the tariff cost even worse in dollar terms.

The post-tariff price impact comes at a lag set against a backdrop already showing very troubling directions in consumer sentiment with the UMich consumer survey reporting another consumer sentiment plunge today and even higher inflation expectations. Fixed investment also remains under a cloud.

The UST market now lurks with the combined effect of moderating Trump behavior (for now) but also one that raises awareness of the vulnerability of the dollar and the curve. Broader mortgage rates away from the typically lower Freddie Mac benchmark have been creeping back up toward the 7% line in a troubling sign for the housing market (using Mortgage News Daily).

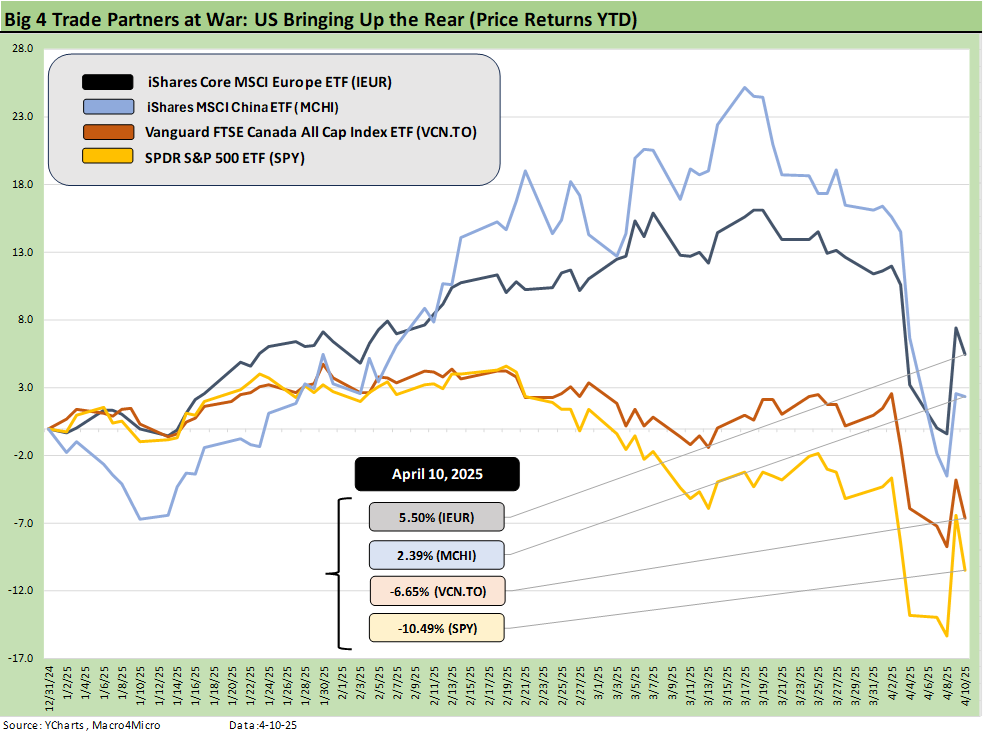

The above chart updates the YTD price returns on some benchmark ETFs that capture the S&P 500 (SPY) and set those against broader benchmarks for Europe, Canada and China. The US is in last place. It is early in the game but will raise questions around where dollar assets might head in recession backdrops.

The brutal sell-off and then record rally gave way to self-congratulations on such a banner day, which somewhat typifies the absurdity of the salesmanship and distorted rhetoric when the reality is quite simple. The arsonist sets a fire and then shows up with the fire department to put out some of the fires. He does not get to congratulate himself.

In the meantime (as in today and much worse ahead), the global trade system is breaking down, trust in the US is shot, the UST curve is tenuous, and currencies are behaving in atypical fashion for the dollar in post-tariff markets. The currency move only makes tariffs that much worse in dollar cost.

The 90-day pause and retreat on a broader scale of reciprocal tariffs kept the crisis at bay and might give time for an offramp (we hope) to design something more grounded in concepts and some actual research (like a detailed breakdown of non-tariff barriers).

“That was then, this in now” or “this is about the summer and fall.”

The 1Q25 earnings season (led this week by banks) are like the current crop of March economic releases. Those all fall under the headline of “that was then, this is now.” We would argue the overall market isn’t even “now” in the batter’s box but is “in the hole” and not even on deck. The overall market will be in the batter’s box maybe in 90 days with this pause and details on what Trump has in store for copper, lumber and on a grander scale in pharma and semis. The tariffs roll in at a lag around working capital management and capex planning. To beat the metaphor senseless, you have a White House on the mound still aiming at your head.

The focus from here will be in gauging the sea level action in a world where policy makers are all over the place on facts, concepts and quantifying impact or avoiding all of the above. We see more than a few ideology-driven, talking-head economists doing their reverse-engineered work (conclusion is the horse and concepts and facts are maybe in the cart). We also see many “pocket economists” running top-down narratives that don’t get down into the industry-level or look at a major company process as reference points. A few of the cable regulars should flag their affiliations with the America First Policy crowd. It qualifies the opinion.

The economists avoid industry and company level examples for a reason. Higher steel costs and aluminum costs? What does this mean? Major tariff on imported components under contracts and with customized tooling and specs? What does this mean? There are thousands of examples. They should try a few on for size.

There is a long list of flawed conclusions tied to fact avoidance, but at the top is whether that analysis starts with the FACT that the “buyer pays” the tariff. Sometimes it breaks down there. Anyone who cannot state that as the fact (like 2+2=4) is not worth listening to and is completely axed. You can still contrive a scenario after that fact that shows the US as a hub of the universe in all manufacturing while China is beyond Thunderdome, but you better have your facts straight at Step 1. Ask the question “Does the buyer pay the tariff?” and watch the smartest and most successful two Cabinet members do their best Michael Jackson Moonwalk and go into verbal evasive action.

Deranged Tariff Syndrome: symptoms include confusion and uncertainty convulsions

Too many corporate leaders are wondering how a real estate executive from Queens who never worked in manufacturing (other than niche/novelty branded products typically manufactured offshore) and a C Team economist from a B Team school could highjack the livelihoods of literally millions of employees and shareholders within the US and across the globe. Attacks on all allies (for now) in Europe, Asia, and North America was a big swing of the bat. As in the cartoon, the swing of the bat ended with the bat hitting the policy makers in the back of the head.

The process has evolved from permanent tariffs to bring manufacturing home and no negotiation (depending on who was asked and was talking on any given day) to a wild time in Dodge City. Now the success litmus test is bragging about the dozens of countries seeking to negotiate or – to quote Trump – “kissing my ass”. That latter bragging is not a great way to reduce the domestic political risk for the people on the other side of the table. If anything, it reduces the chances of success and raises the risk of retaliation (in one form or another) when the bid-offer on terms might be wider than the miles of distance to the trade partner.

Nationalism, domestic political pressure, and alternative alliances are factors…

The overall color in the trade press and global media is that the approach is driving former antagonists into closer alliances to address the “American threat.” That might be useful for authoritarian game plans looming to narrow the influence to a small coterie of trusted aids at home (part of loyalty oaths by way of action), but it is bad economics and creates volatile markets.

The bad markets part of that worry is already in evidence in asset returns, VIX, UST volatility indicators, etc. The economics part will only play out over time as tariffs are fully in effect, measurable transactions are rolling into macro numbers, companies will be reacting to offset costs (layoffs anyone?), and many parties head to the court to challenge actions.

The retaliation game is early in the EU, Canada, and Mexico. As those countries start feeling the results, and the Trump Team keeps talking trash, the domestic political support for more aggressive retaliation will climb. The erratic nature of White House unilateral action and repeated reversals make it almost a fiduciary breach for a company management team to rely on today’s pledge when tomorrow’s unwind might come after capital has been committed, contracts rolled into place, and the economics of projects evaluated. That by itself undermines the theoretical purpose of all this tariff action. “Irrational” has been the most polite term I have seen to describe its foundation and the behavior patterns.

For framing the timelines on trade deals, we would remind readers the NAFTA transformation in a Trump-engineered USMCA (to much applause by Trump for himself on that deal) was agreed in principle by fall 2018 but not finally implemented and in place until mid-2020. These things take time.

There is no chance for any deal with Europe if it plays out as a shakedown (no to “zero tariffs,” ban VAT taxes, and buy $350 billion in energy from the US). The Mideast energy players and Canada have a great opportunity to step in front of Trump on some of these global energy trade opportunities if Canada can get out of its own way. We would think someone threatening to annex you via economic coercion would bring people together. Canada’s extreme heroism in multiple World Wars and in Korea is a better tradition than a 1968 draft dodger tantrum.

The economic costs are coming. Markets want immediate reactions but 25% on many now and a minimum base case of 10% on most of the world is a bad outcome. That is possible with too much of the usual fawning, obsequious behavior of Congressional jellyfish but also more than a few economists and appointees putting power-seeking ahead of concepts and facts.

See also:

CPI March 2025: Fodder for Spin 4-10-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25

Footnotes & Flashbacks: Credit Markets 4-6-25

Footnotes & Flashbacks: State of Yields 4-6-25

Footnotes & Flashbacks: Asset Returns 4-6-25

Mini Market Lookback: A Week for the History Books 4-5-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25

Credit Snapshot: Taylor Morrison Home Corp (TMHC) 4-2-25

JOLTS Feb 2025: The Test Starts in 2Q25 4-2-25

Credit Snapshot: United Rentals (URI) 4-1-25

Mini Market Lookback: The Next Trade Battle Fast Approaches 3-29-25

PCE Feb 2025: Inflation, Income, Outlays 3-28-25

4Q24 GDP: The Final Cut 3-27-25

Durable Goods February 2025: Preventive Medicine? 3-26-25

New Homes Sales Feb 2025: Consumer Mood Meets Policy Roulette 3-25-25

KB Home 1Q25: The Consumer Theme Piles On 3-25-25

Lennar: Cash Flow and Balance Sheet > Gross Margins 3-24-25

Mini Market Lookback: Fed Gut Check, Tariff Reflux 3-22-25

Existing Homes Sales Feb 2025: Limping into Spring 3-20-25

Fed Action: Very Little Good News for Macro 3-19-25

Industrial Production Feb 2025: Capacity Utilization 3-18-25

Housing Starts Feb 2025: Solid Sequentially, Slightly Soft YoY 3-18-25

Retail Sales Feb 2025: Before the Storm 3-17-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

Tariff and Trade links:

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Stop Hey What’s That Sound? 4-1-25

Tariffs are like a Box of Chocolates 4-1-25

Auto Tariffs: Questions to Ponder 3-28-25

Fed Gut Check, Tariff Reflux 3-22-25

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25