Credit Trend: Stable

Summary credit profile:

Lennar combines exceptionally strong cash flow, a market position as one of the two largest homebuilders (with D.R. Horton), and a balance sheet with cash slightly above total homebuilder debt at 1Q25. LEN credit stability benefits from a favorable secular outlook for its products and services based on demographics and demand. The balance of factors translates into low credit risk. Even after giving effect to its land/lot distribution and cash contributions to Millrose Properties, the balance sheet liquidity and core operating strength remain intact (see Credit Crib Note: Lennar Corp (LEN) 1-30-25).

The challenge for LEN near term is below-peer gross margins and an operating strategy that implies weaker gross margins will continue based on the strategy to maintain level production and favor pace and volume over price and margin. That is in a market where consumer weakness and higher mortgage rates are likely to remain headwinds. Consumer weakness is likely to get worse with the Trump tariffs, and guidance was downbeat for 2025. LEN’s very strong balance sheet, national scale of its homebuilding operations, and the still-impressive coverage of total debt by cash and inventory still will carry the day for credit stability.

Relative Value:

LEN has some bond refinancing it can do with a bond maturity in May 2025, or the company can simply pay down debt. LEN only has short bond maturities in 2026 and 2027 that are very safe with low volatility risk and an average coupon in the 5% area for short-term income. We have seen several other homebuilders refinance and extend, and that could be an alternative for LEN.

LEN offers more resilience in a cyclical downturn than a BBB tier industrial with high fixed costs as a manufacturer and promises less volatility than commodity-based companies (energy, chemicals, metals, etc.) Homebuilders are variable-cost based and generate cash in a slowdown through inventory liquidation, so financial flexibility and favorable secular demand put builders in a better position vs. other BBB tier names with respect to cyclical exposure.

Business risk:

Homebuilders demonstrated less risk this past cycle than many had assumed as evident in the performance of builders across an inflation spike, a tightening cycle, and a sharp rise in mortgage rates into the 7% to 8% range. The mortgage rate pressure did not derail LEN’s ability to dramatically grow revenue and earnings since 2019 while reducing homebuilding debt and building a cash hoard. That was achieved despite buying back almost $6 bn in shares from 2021 to 2024 with buybacks of over $775 mn in 1Q25. The financial services operation provides steady earnings and important selling tools to drive volume.

We rate the business risk of Lennar as low based on a combination of factors, but LEN’s track record and disciplined working capital management is at the top of the list given the intrinsic cash flow resilience of builders if the market slows and inventory liquidates. A variable cost structure differentiates the homebuilders from a broader range of BBB tier industry groups.

Tariffs:

There is no question that the current tariffs in place and in process are a negative, but the ability of the builders to navigate higher costs ties back into pricing power and the ability to exploit very favorable demographic demand. Consumers and suppliers are likely to share most of the pain and there are ample actions the builders can take to mitigate their cost headwinds from materials and labor.

The NAHB details the adverse cost impact on their site, but companies downplay their opposition on conference calls and in financial media. The tariff on suppliers run the gamut from lumber and aluminum (esp. appliances) to a wide range of materials used in the production cycles and components (gypsum, steel, HVAC, etc.). The NAHB indicated 71% of gypsum comes from Mexico. More lumber and copper tariffs are in the queue with duties/tariffs already very high on lumber.

Profitability:

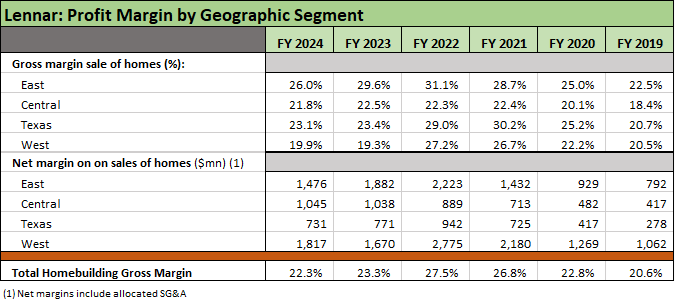

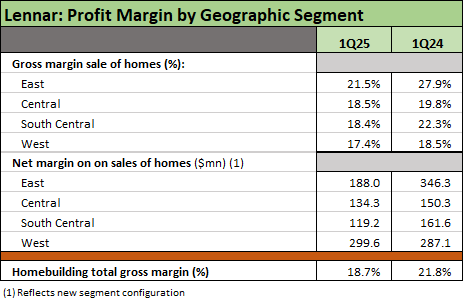

Margins have been compressing from the FY 2022 peak with Homebuilding operating margins down to 15.1% in FY 2024 vs. 21.2% in FY 2022. Gross margins on home sales declined to 22.3% in FY 2024 from 23.3% in FY 2023 vs. a FY 2022 peak of 27.5%. Gross margins compressed to 18.7% in 1Q25, down from 21.8% in 1Q24 after 22.1% in 4Q24. The pattern is clear in margin compression, and tariffs and supplier chain costs could keep pressure on margins. That said, favorable trends in turning over working capital and maintaining a healthy sales pace kept cash flow strong. We break out some key cash flow lines in the charts below, and the rate of stock buybacks, dividends, and balance sheet liquidity make a positive statement on credit risk even if margins disappoint the equity market.

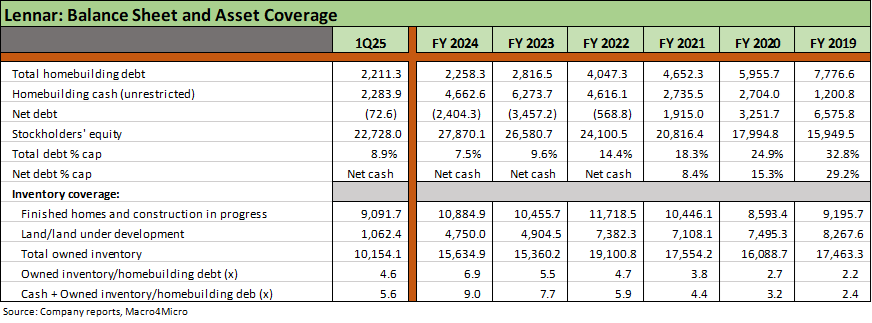

Balance sheet:

Total homebuilding debt of $2.2 bn at 1Q25 is offset by $2.3 bn in cash for a net cash balance of around $72 mn after the Millrose Properties (MRP) spin-off in 1Q25. Owned inventory of $10.15 bn is 4.6x total HB debt after the $6.5 bn in “land + cash” deployed to capitalize Millrose in the spin-off. The MRP transaction was in process across 2024. Total homebuilder debt % capitalization of under 9% reinforces the healthy leverage story. LEN has repurchased over $7.5 bn of stock from 2019 through 1Q25 with $6.7 bn since 2021. The annual total dividend payout grew over 10-fold from 2019 to 2024 and almost tripled from 2020.

Millrose Properties spin-off:

Lennar completed the taxable spin-off of Millrose (MRP) in early Feb 2025 after contributing $5.5 bn in land and $1 bn in cash to the newly created entity (REIT status for FY 2025). The spin-off impact on the LEN balance sheet still leaves it in a rock-solid position even if the distribution is by definition a reduction of asset protection for bondholders.

For LEN, finished homes and construction-in-progress will leave LEN at a material multiple of homebuilding debt as detailed in the charts. The purpose of Millrose is consistent with LEN’s land-light strategy. MRP will serve as a source of “recycled capital” as MRP turns over LEN’s land contribution as LEN exercises its options with MRP reinvesting the cash flow and deploying option fees as part of its revenue stream. MRO as an option purchase platform is structured to offer a source of fully developed homesites. It has been billed as a “first of its kind.” MRP will be worth watching as a stand-alone operation since other homebuilders could emulate if it works well.

SELECT CHARTS

Strong growth from pre-COVID but down from the 2022 profit peak.

Higher volumes and a focus on inventory turnover and pace.

Prices are seeing some pressure as LEN seeks sustained level production.

Very strong, liquid balance sheet, but the Millrose deal reduced asset coverage.

Balanced capital allocation evident in debt reduction, buybacks, and dividends.

Gross margins by geographic segment show consumer pressure plus mix.

A tweaked segment mix in 1Q25 (“South Central”) shows margin pressure worsening.