Footnotes & Flashbacks: Credit Markets 12-9-24

A quiet week for spreads as investors “mark the days” for a great year in equities, strong numbers in HY, and respectable returns in IG.

That’s a big bag! Modest shrinkage will not matter much…

The credit markets are winding down a year when credit risk maximization has been the winner and duration was an obstacle. The spread tightening was needed to overcome adverse curve moves on longer-dated bonds in total return composites across a year when a bear steepening has been the trend YTD beyond 3Y UST (see Footnotes & Flashbacks: State of Yields 12-8-24).

The record highs for the NASDAQ and S&P 500 last week do not change the fact that the individual subsector returns showed a lot of negative numbers in the mix with tech and financials leading the recent moves higher for the broad benchmarks (see Footnotes & Flashbacks: Asset Returns 12-8-24).

IG was quiet the past week, tightening by -1 bps to +81 bps while HY OAS narrowed by -7 to get back down to +267 bps as the June 2007 and late 1997 flavor remains in place (see HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24, HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24 ).

The economy has been steady and solid as we await CPI this week. Next week we get a final read on 3Q24 along with an early pre-Christmas PCE release and retail sales numbers for some home stretch signals on the consumer.

Between now and inauguration, there will be one eye on economic data and one eye on social media for the next round of Trump media domination (usurping) and perhaps more on tariffs (EU?) and deportation.

The above chart updates the running total returns and excess returns for IG and HY. We frequently comment on the credit risk maximization strategy being the clear winner in 2024 on the debt side. For credit, less duration and higher credit risk has been the victor.

The consensus for 5-6 cuts and a downward UST shift around this time last year did not come to pass “early and often” but the belated 4 cuts in 3 (as in 4 x 25) looks likely to get wrapped up this month with a Dec cut of -25 bps. We see around 86% odds on the cut from the CME by midday 12-9-24 as we go to print this morning calling for -25 bps. The day started at over 88%.

A bullish posture on credit risk was well timed for many asset managers in the context of private credit and firms making their case to grow their AUM and offer more institutions and wealth investors ways to play that rapidly emerging asset class. The credit risk asset menu has expanded materially in 2024.

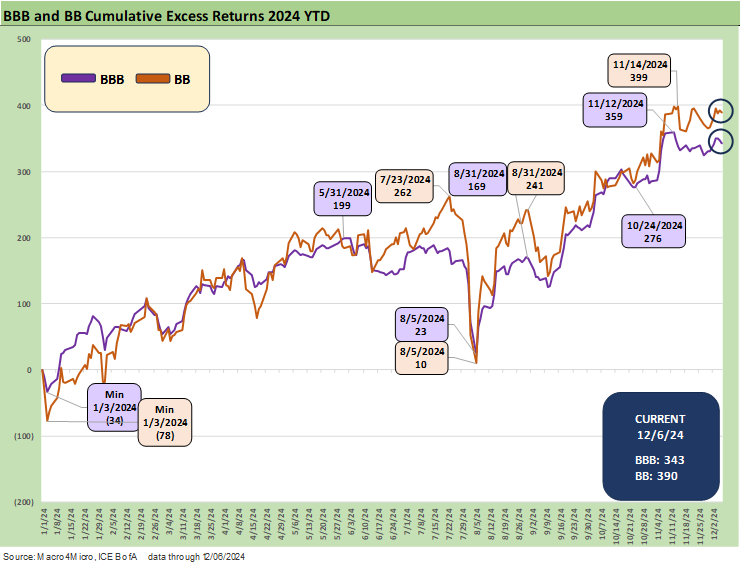

The above chart updates the running excess returns for HY vs. IG with a healthy differential justified and meeting the criteria of “higher returns for higher risk.” The compression of spreads to June 2007 levels call into question how strong the returns could conceivably be in 2025. Consumer spending and corporate sector investment have been quite favorable for the economy this year even if those realities were somewhat drowned out in the election noise. The economic backdrop was strong (if numbers matter).

A big variable from here is how many policy risks Trump 2.0 is willing to take that could directly impact the consumer or influence capex investment. That is notably the case in what influence the tariffs will have on goods and services prices, export volumes (retaliation, strong dollar effects) and capital budgeting decisions (capex, reshoring), and working capital management (inventory). Such effects could flow into equities, where current earnings expectations are high but which will be a hostage to policy actions.

Tax cuts and less regulation are certain, but tariffs have a bid-offer of 0% to 25% as of now for Mexico and Canada, our #1 and #2 trading partner nations. The tariffs could go much higher for Mexico if they do not accept whatever migrants the US seeks to return across the border. Trump has threatened additional punitive tariffs. Meanwhile, China is a story unto itself in the new year on tariffs and retaliation.

The BBB vs. BB excess returns are posted above, and the differential between the two is a bit less compressed now than they had been along the way. The risks of spread gaps in the BB tier were muted this year with a few notable moments such as early August revisiting the decompression waves that we often see across the HY cycles.

In the BBB tier, anxiety around Boeing and the direction of the mega BBB names in automotive will remain on the front burner in the IG and crossover tiers while the BBB-heavy Energy and Midstream issuer base has a major presence that will be subject to some big moving parts in the theme of “drill, baby, drill,” as well as the free reign the Midstream players are likely to get sooner rather than later. In the pro-energy policy actions, one of the wildcards will be whether Trump seeks to torpedo the Canadian oil names after his tariff threats flow into an eventual Canadian policy.

The B and CCC tier excess returns are leveling off after an impressive run in 2024 with the constituent-dependent CCC tier rolling to over 14+% excess returns. That noisy CCC tier excess return number by itself is well ahead of the long-term return on equities as an asset class.

For CCCs, we sure did not see that type of number coming and the lesson as the year went on was that the most aggressive deals (i.e. LBOs, recaps., etc.) found better controlled and more reliably consistent risk pricing over in private credit and not the usual late cycle HY bond excess seen in past HY cycles.

In theory, that rise of private credit promises less HY bond price volatility tied to HY fund redemptions and the OTC backpedal and secondary liquidity impairment often seen over the decades. Early 2016 had been a redemption panic price dislocation for the ages as so many weak B tier E&P names and CCC issuers were all being wagged by the same variable (price of oil and negative cash flow).

Running across the spread trends…

The overall spread action on the week was mild and slightly positive with the IG market -1 bps tighter and HY OAS -7 bps tighter back into the sub-270 bps range. The IG timeline above shows the closing IG OAS a handful of bps wide to the March 2005 +79 bps and slightly above the multicycle lows seen in Nov 2024 as noted on the chart.

We could again flag the +53 bps level of Oct 1997. That record low tick was a world apart, but it is also worth flagging that month and year as the start of the crisis in Asia as USD Asian/Yankee bonds started to face serious pressure in the following weeks until the EM contagion risk worries picked up to true crisis levels in the summer of 1998 (and sent LTCM to the House of Pain).

IG credit spreads bouncing off the lows of Oct 1997 offer a reminder that every year is a new year for macro shocks. As of now, the US is dancing close to the fire on trade war risk and a bottomless pit of deficit funding requirements; Ukraine is potentially facing a Russian slaughter in 2025; China is more committed to owning Taiwan than at any time since 1949; NATO is in Trump’s crosshairs; France is in a period of upheaval with its share of fiscal challenges; German industry is struggling, and the Middle East is now seeing Syria likely to set off an array of new dynamics in Mideast geopolitics (including kicking out Russia with the fleet already evacuated). That is a full macro event risk dance card. We rank tariff and trade war risk as the biggest odds-adjusted risk.

As noted earlier, HY had another good week with spreads at -7 bps to +267 bps and -72 bps YTD tightening hitting levels that are not sustainable. The low level of HY OAS of +241 bps was hit twice in early June, but the moving parts were moving quickly with June 2007 ending at +298 bps or comfortably above current OAS. The memory of how quickly HY spreads can move was evident in late 2007 and the summer of 1998.

The “HY OAS minus IG OAS” quality spread differential is staying impressively low with everything tight and risk appetites in the credit markets high. The +186 differential is just above the Nov 2024 lows of +180 bps which was the lowest since the credit bubble of June 2007. That is set against the long-term median of +327 bps.

If you buy into the view that you need weak employment, low PCE, scaled back capex, and weaker credit metrics to worry about sustained credit market selloffs, then we agree. If you also believe credit markets will always lead equities and economic contraction risk, then the world is in good shape. Equities lagged credit in 2007, in 1999, and in 1989, so the big, bad cycles of earlier periods are reassuring even if equity market whipsaws could pull HY wider on the usual correlation effects.

To really make credit risk repricing stick for a long stretch, you need bank system problems (credit contraction) and consumer weakness. The 7-standard deviation outliers like COVID are different while trade wars on a massive scale would send everything into repricing mode. However, sea level economic trends and bank system health are firmly in the “steady as she goes” camp. The ever-unpredictable Trump could self-inflict a trade war, but we shall see. The clock is ticking.

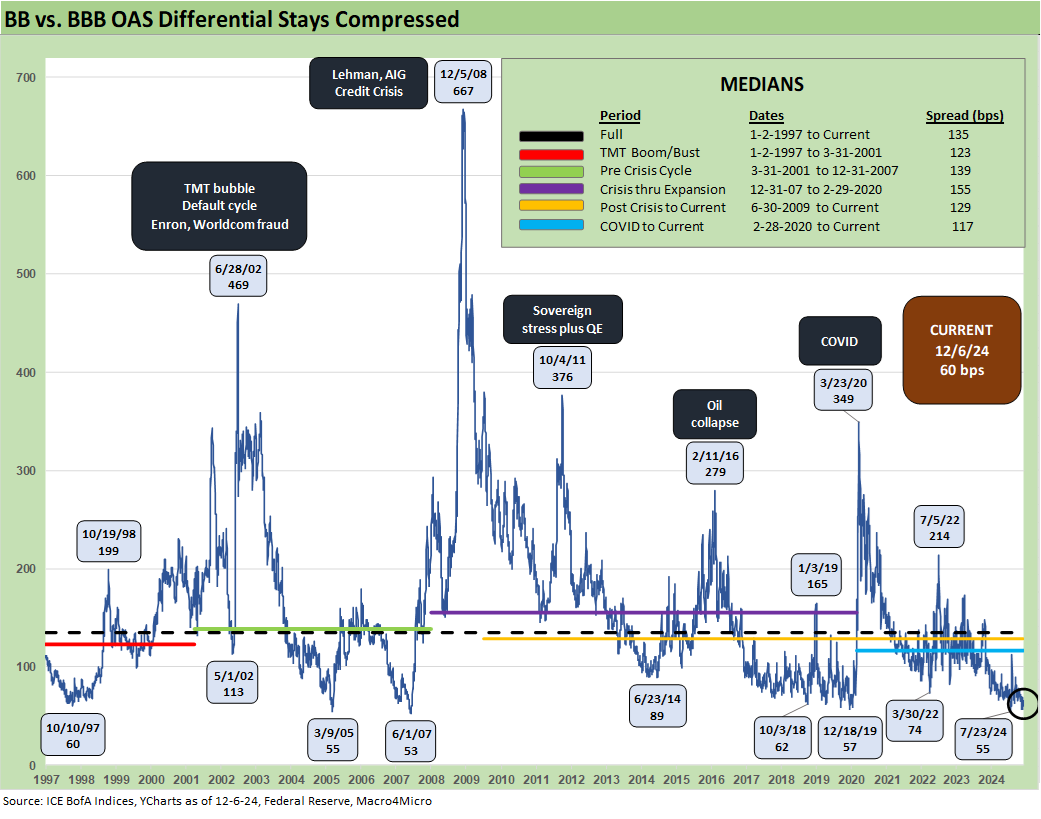

The “BB OAS minus BBB OAS” quality spread differential at +60 bps narrowed by -5 bps on the week and is +5 bps for the July 2024 lows that had not been seen since June 2007 (the credit bubble) and March 2005 (just as BBB auto paper was set for downgrades to BB and spread dislocations later that year).

The BB tier tightened by -5 bps on the week to +162 bps which is +5 bps off the lows of Nov 2024. Even June 2007 did not see such low levels. The BB tier is -43 bps on the year and comprises 52% of HY face value.

The B tier is now -77 bps tighter on the year at +273 bps and has moved wider from the Nov 2024 lows of +254 bps. Sub-300 bps B tier OAS is rarefied air given the long-term median of +468 bps.

The above chart plots the history of the B tier vs. the CCC tier to highlight the points of divergence between the two during periods of rising stress. The current CCC tier OAS of +730 bps is well inside the +959 bps median for the CCC tier. With the asterisk of constituent moving parts, defaults (dropouts) and distressed exchanges, the CCC tier has tightened by -172 bps YTD and comprises just under 14% of HY face value (12% of market value).

The above chart shortens up the timeline from just before the tightening cycle started (ZIRP ended March 2022). The timeline shows the swings in the B vs. CCC tier and the divergence during 2022 as HY spreads went through a wild ride on cyclical worries and curve handicapping.

The long-term time series for the “CCC OAS minus the B tier OAS” is detailed above. The current quality spread differential of +466 bps is just inside the long-term median of +484 bps. The B vs. CCC relationship has a wild history with the differential often better measured in dollar prices than spreads (see The B vs. CCC Battle: Tough Neighborhood, Rough Players 7-7-24). The current dollar price differential is over 13 points for the B vs. CCC tier but across a very wide Hi-Lo range. On a side note across the cycles, there is often considerable overlap with the B tier based on capital structure layers.

The above chart updates the shorter timeline from Jan 2022 for the CCC OAS vs. B tier OAS quality spread differential. The time series offers more granularity on the ride to a peak of +741 bps in Nov 2022 from +315 bps in Jan 2022. The fall of 2022 was a time when many were saying the US was already in recession despite low unemployment and solid PCE numbers (see Unemployment, Recessions, and the Potter Stewart Rule 10-7-22).

A look at yields…

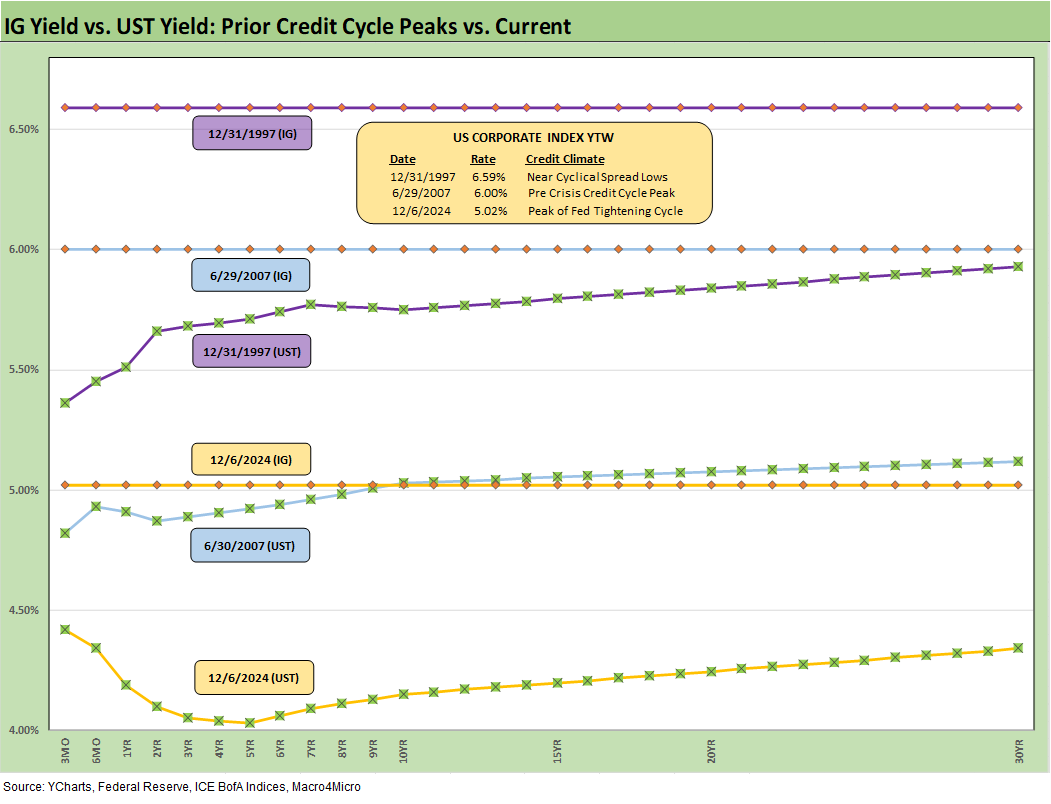

The above time series updates one of our replay slides we use each week as a reminder of what low UST curve and tight spreads in historical context deliver for all-in yields in the context of prior credit cycles. The pre-crisis, pre-ZIRP years are the more logical frame of reference for what a “normal” credit cycle looks like since the ZIRP and QE days distort investor memories and the UST curve. That is, the 6.1% for IG and +9.3% for HY from 1997 to the end of Aug 2008 is the most rational, logical comparison.

The reality is that current interest rates along the UST curve are exceptionally low across history with the exception of the ZIRP years. Political promises of ZIRP type long UST rates in non-ZIRP markets is thus more sales pitch than reality (see Footnotes & Flashbacks: State of Yields 12-8-24).

We update the latest IG Corp index yield from the past Friday (horizontal lines) and give it some historical context by framing it against the IG Corp yields from June 2007 and Dec 1997. These periods reflect general time zones of prior credit cycle peaks. We also include the UST curves for each of those dates. For IG Corp yields at credit market peaks, the UST curve is the key driver as we see in the 5.02% for current IG yields that are well inside the June 2007 and Dec1997 all-in yields.

Life did not begin with ZIRP and a post-crisis and COVID backdrop. We are now beyond the high inflation run rates and tightening cycle and have moved into an easing cycle. It is time to get in touch with realistic frames of reference as politicians promise to cut interest rates in half on campaign trails. They tend to just say “interest rates” and not state “which interest rates” (e.g. 3M UST or 10Y UST and mortgages). If we get back to 4% mortgages, it could be for very bad reasons in the health of the economy. If we have a good economy, cracking into 5% mortgage rates would be a home run.

In the above chart, we do the same exercise above for HY that we did for IG in the prior chart. With HY spreads in the sub-300 bps range seen in late 1997 and June 2007, the UST curve is the deciding vote. Once again, we see how low UST rates are now vs. those prior boom periods for risk in 1997 and mid-2007.

The 1997 period is especially relevant since that was part of the 20+% return streak for the S&P 500 and a time when tech equities would remain smoking hot into 1999 even as the default cycle kicked in. The 1995 to 1998 run was greater than +20% on price for the S&P 500, and we can add in 1999 in the streak if we use total return. The +86% return on NASDAQ in 1999 is often viewed as a typo.

As we covered in the asset return commentary posted on the weekend, 2024 will mark back-to-back S&P 500 returns over 20% for the first time since the mid-to-late 1990s Clinton boom (see Presidential GDP Dance Off: Clinton vs. Trump 7-27-24). The 2024 and late 90s performance was the only time that was achieved in the “postwar” period (fyi…old people still use “postwar” to describe “since WWII”). Prior to these markets, we need to go back to anomalies in the Great Depression and during the Roaring 20 to find back-to-back 20% years.

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com

See also:

Footnotes & Flashbacks: State of Yields 12-8-24

Footnotes & Flashbacks: Asset Returns 12-8-24

Mini Market Lookback: Decoupling at Bat, Entropy on Deck? 12-7-24

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Payroll Nov 2024: So Much for the Depression 12-6-24

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

JOLTS Oct 2024: Strong Starting Point for New Team in Job Openings 12-3-24

Mini Market Lookback: Tariff Wishbones, Policy Turduckens 11-30-24

PCE Inflation Oct 2024: Personal Income & Outlays 11-27-24

3Q24 GDP Second Estimate: PCE Trim, GPDI Bump 11-27-24

New Home Sales Oct 2024: Weather Fates, Whither Rates 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Mini Market Lookback: Market Delinks from Appointment Chaos… For Now 11-23-24

Credit Crib Note: Ashtead Group 11-21-24

Existing Home Sales Oct 2024: Limited Broker Relief 11-21-24

Housing Starts Oct 2024: Economics Rule 11-19-24

Mini Market Lookback: Reality Checks 11-16-24

Industrial Production: Capacity Utilization Circling Lower 11-15-24

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

CPI Oct 2024: Calm Before the Confusion 11-13-24

Mini Market Lookback: Extrapolation Time? 11-9-24

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24

Select Histories:

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24

Credit Returns: Sept YTD and Rolling Months 10-1-24

HY Industry Mix: Damage Report 8-7-24

Volatility and the VIX Vapors: A Lookback from 1997 8-6-24

HY Pain: A 2018 Lookback to Ponder 8-3-24

Presidential GDP Dance Off: Clinton vs. Trump 7-27-24

Presidential GDP Dance Off: Reagan vs. Trump 7-27-24

The B vs. CCC Battle: Tough Neighborhood, Rough Players 7-7-24

HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24

Credit Markets Across the Decades 4-8-24

Credit Cycles: Historical Lightning Round 4-8-24

Histories: Asset Return Journey from 2016 to 2023 1-21-24

Credit Performance: Excess Return Differentials in 2023 1-1-24

Return Quilts: Resilience from the Bottom Up 12-30-23

HY vs. IG Excess and Total Returns Across Cycles: The UST Kicker 12-11-23

HY Multicycle Spreads, Excess Returns, Total Returns 12-5-23

US Debt % GDP: Raiders of the Lost Treasury 5-29-23

Wild Transition Year: The Chaos of 2007 11-1-22

Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22

Greenspan’s First Cyclical Ride: 1987-1992 10-24-22

UST Curve History: Credit Cycle Peaks 10-12-22

Unemployment, Recessions, and the Potter Stewart Rule 10-7-22