Footnotes & Flashbacks: Asset Returns 12-8-24

We look at the decidedly mixed returns with CPI due this week and the FOMC’s -25 bps cut expected the following week.

That which shall not be stated, “Buyer Pays!”

The running returns are still telling a very favorable story for the final 2024 return rankings and absolute returns from large caps to small caps, but some anxiety around long rates seems to be creeping into some of the subsectors more sensitive to 10Y rates.

The recent tech stock comeback is in evidence as the Mag 7 heavy ETFs (XLY, XLC, XLK) and NASDAQ surge while Financials (KRE, XLF) keep confidence high on the credit cycle and relative credit availability.

Bond ETFs turned in an all-positive week to go with an all-positive 1-month period that cuts across the first, second, and the third quartile. That comes alongside a trailing 3-month period with 7 bond ETFs in the bottom 10 and 4 of them with negative returns.

The above chart frames the high-level benchmarks we watch for the debt and equity asset classes. The trailing 1-month period has moved back to all positive after some recent struggles with bond market returns after the UST backed off from the Sept rally. We still see the rolling 3M UST time horizon returns for UST and the IG Corp index in the negative zone. There is also the fact of an underwhelming +2.5% YTD return for UST ETFs and +4.7% for the longer duration IG benchmark.

HY OAS tightened by -72 bps YTD and IG -23 bps YTD. HY rode spread compression and the par weighted 6.38% coupon with less of a hit from the duration setbacks YTD. We look at the curve shifts each week in the Footnotes publication on yields (to be published later today). For IG, the UST action YTD undermined some of the positives of the spread compression and 4.3% par weighted coupon.

Equities has posted a banner year by any standard with the second back-to-back returns of greater than 20% for the S&P 500 in the postwar (as in WWII) era. The last time was a longer streak from 1995, but both represent rare moments in market history. Before the 1990s, the last time the S&P 500 achieved that was during the Great Depression and Roaring 20’s.

We update our 1500 and 3000 series above, and the Small Cap and Midcap world had a more challenging week. We see Small Caps still running along with an exceptional rolling 3-month run rate as we cover in the ETF sections further below.

The above chart shows Russell 3000 Value with a minimal 1-month return but +8.2% for 3-months. Meanwhile, the S&P 1500 Industrials turned negative for 1-month, but it posts +13.2% for 3-months. Growth has been back in action with a 5.6% rolling 1-month folded into a +19.5% 3-months. Energy is in the red for 1-month numbers and has been volatile while sitting on the bottom of the YTD return rankings at +11.2%.

The rolling return visual

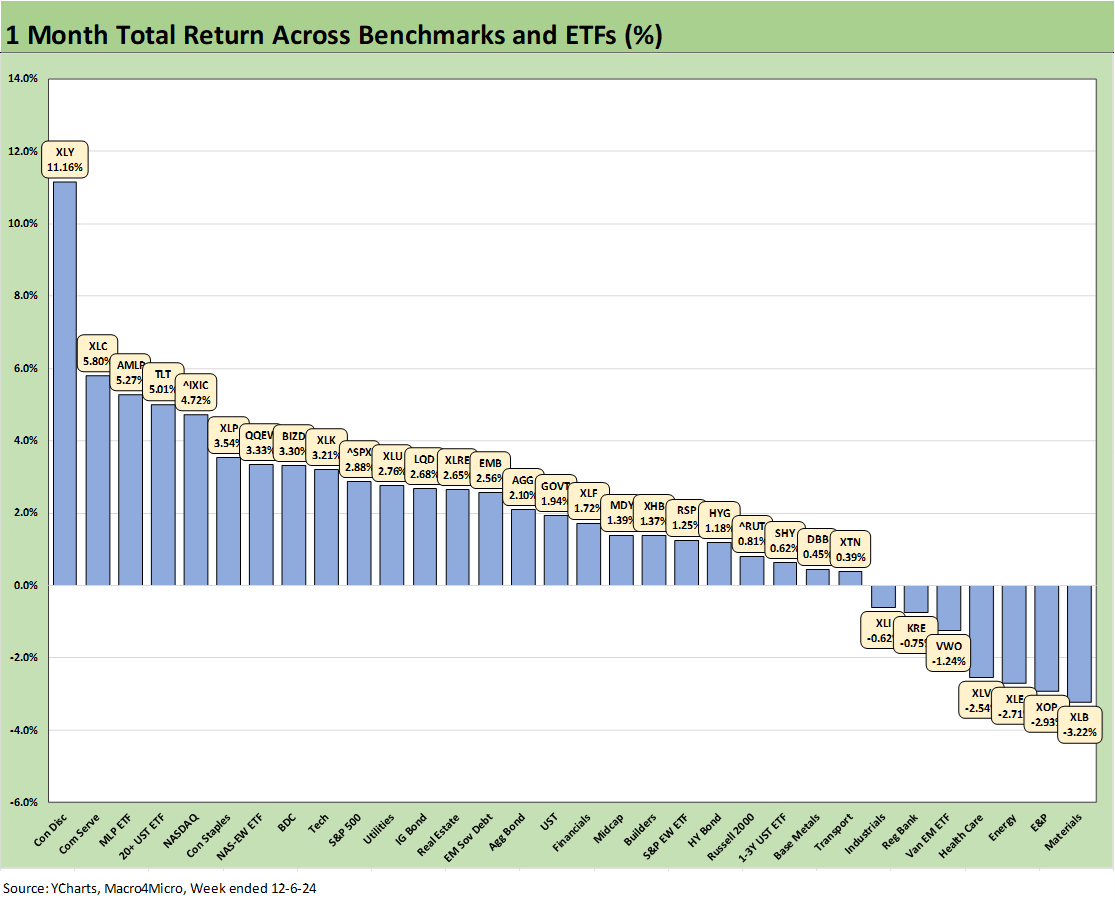

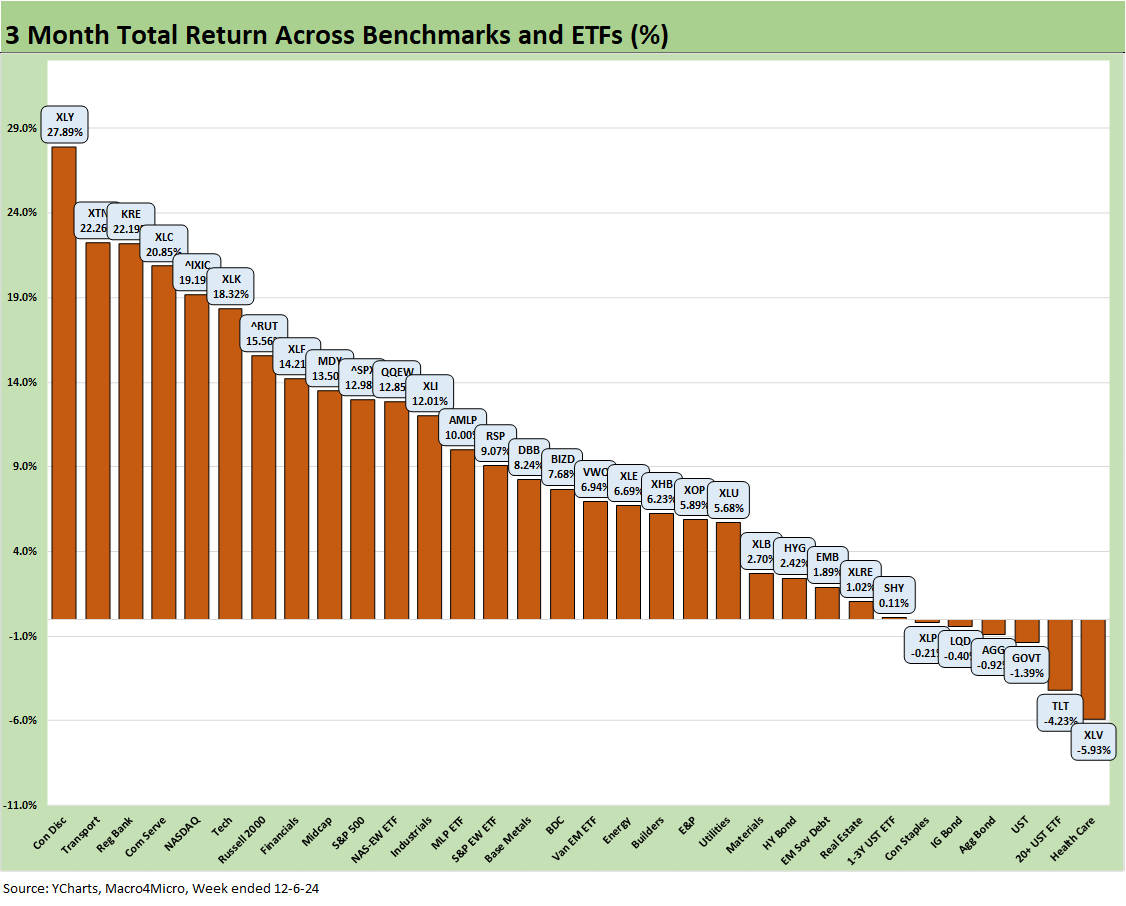

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of the trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes. We also have a YTD version that we include in the broader commentary on the time horizons further below.

The 1-week and 1-month returns show a more mixed end to the year, but the 3-month timeline is more interesting given the sequence of macro events (monetary, political, policy expectations such as tariffs) coming as another earnings season and guidance wrapped up.

The positive balance for 3-months comes in a period where the election excitement and Fed easing cycle dominated a lot of the handicapping. The 3-month timeline shows just under half the asset lines posting double-digit returns and more than half if we exclude the bond ETFs and just include the stock and industry-based ETFs and benchmarks.

We see Trump keeping the home stretch of 2024 interesting with outsized tariff threats against the largest trading partner nations (see Tariff: Target Updates – Canada 11-26-24, Mexico: Tariffs as the Economic Alamo 11-26-24). We can assume there is more tariff chatter coming. The next round of attacks could include the largest trade partner bloc in the form of the EU. The potential for retaliation is not a small risk and the US might start asking for “receipts” to prove the campaign assertion that the “selling country” pays – not the buyer.

Trump’s recent quasi-authoritarian assertions of his influence are good reasons to not doubt his willingness to go “all-in” on tariffs and deportation. Either way, that will be clear soon enough with inauguration in 6 weeks. The recent actions signal determination include a very disturbing set of nominees for Defense, Health Care, Attorney General (the Gaetz fiasco), and National Intelligence. Trump initially demanded unchecked recess appointments with no FBI background checks and no Senate hearings.

Only a blindfolded, deaf partisan can see that recent news as a good sign on nominee competence and quality. Seeing those candidates as being nominated for reasons other than experience and competence is not a “leap.” We stick with the equation of politics= policy= economics. Right now, the worry is “policy=personnel” and the transitive property plays on.

The headline nominees raise questions around how measured his tariff, deportation, tax, and budget “demands” will be on his party at a time when his extreme policy positions are being downplayed in the market as “negotiating tactics.” The 25% tariffs move – if implemented – should be the start of a material risk repricing trend if the market is rational. The proposals would have very real and damaging economic effects. Inauguration is Jan 20, 2025.

Inventory planning is a real test in coming weeks for the private sector. A heavy slate of earnings reports come after the “Day 1” policy promises and the issues of the tariffs will loom large and no longer be as much a matter of speculation.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

We looked at some of the tech bellwethers (including comments on Tesla) in the Mini Market Lookback: Decoupling at Bat, Entropy on Deck? The tech-focused asset lines are showing a comeback after frequently falling out of the top quartile rankings in various time horizons. Tesla has been the big winner of late with an election kicker in its performance for various reasons – some objective and some subjective, some positive and some spooky negative.

For the week, we see Tesla and Broadcom in double-digit returns and Taiwan Semi rounding up to double digits with Amazon just behind them at a 9% handle. We see 5 of the Mag 7 ahead of the NASDAQ this week with NVIDIA and Apple just short and the Equal Weight NASDAQ 100 down in the 1% handle range below the Mag 7 names. The only one negative on the list is the Equal Weight S&P 500 ETF (RSP) giving the heavy weighting of underperforming industries this past week.

We looked at the 1-week asset returns in some detail in the earlier Mini Lookback, and the main takeaway is the weak comparative performance even though coming off a big tech week where the S&P 500 and NASDAQ hit new highs. The 15-17 score in the group of 32 badly lagged last week’s 29-3.

Tech and/or Mag 7 names drove 6 of 8 in the top quartile including Consumer Discretionary (XLY), the Tech ETF (XLK), and Communications Services (XLC) along with NASDAQ, the Equal Weight NASDAQ 100 (QQEW), and the S&P 500. EM Equities (VWO) was more wrapped in a laundry list of variables around China as well as the UST curve action. The long duration 20+Y UST (ETF) rode the UST curve this week into the top quartile during what was generally a subpar set of stock returns in the ETF mix.

Energy took a beating, and some sectors that are intertwined with the long end of the UST curve eroded on the week (notably XHB, XLRE, XLU). Bond ETFs were all positive just on old fashioned bond math. The FOMC handicapping saw the market setting overwhelming odds of a -25 bps soar on Friday, but there is growing skepticism of long rates where you can still get a vigorous debate.

The 1-month score was 25-7 with Tech and the bond ETF mix making a comeback with all 7 bond ETF lines positive after a rough period for duration that followed the Sept and early Oct yield lows. Mortgage benchmarks moved lower but are still closer to 7% than 6%.

Tech and Mag 7 heavy benchmarks and tech-centric ETFs were half of the top 10 with Consumer Discretionary (XLY) at #1, Communications Service (XLC) s #2, and NASDAQ #5. The Equal Weight NASDAQ 100 ETF (QQEW) and the S&P 500 (Mag 7 influence) are in the top 10. Sitting in the bottom quartile we see Materials (XLB), E&P (XOP), Energy (XLE), Health Care (XLV) and Emerging Markets Equities (VWO).

The 3-month returns feature half the top quartile in Mag 7 heavy and tech-centric benchmarks with Consumer Discretionary (XLY), Communications Services (XLC), NASDAQ, and Tech (XLK). Regional Banks (KRE) and Financials (XLF) also rode the post-election Trump trade on regulatory relief, lower taxes, and expectation that fed easing would be a Trump priority (a clash to come with Powell in 2025).

Small Caps and Midcaps have rallied with the election with the Russell 2000 in the top quartile and Midcaps just below. The top quartile also reflects the strong rally of airlines as those flow into the Transports ETF (XTN).

For 3-months, the bond ETFs comprised 7 of the bottom 10 and 5 of 8 in the bottom quartile with only HY (HYG) and EM Sovereigns (EMB) just above the bottom quartile. Real Estate (XLRE) And Health Care (XLV) are the only industry equity ETFs in the bottom quartile for the 3-month return rankings.

The YTD scoresheet comes in at 31-1 with only the long duration 20+Y UST ETF (TLT) in the red. The score has moved very little for the YTD positive vs. negative mix. We see a median return in the mix of 32 around 14.2% YTD.

Communications (XLC) takes the #1 spot at +40% with Financials (XLF) at #2 with +36%being joined by Regional Banks at #5 with +30%. The NASDAQ is in the top 3 at +33% and the S&P 500 at #6 with a 29% return make the top quartile. The differential of over 10 points between the S&P 500 at over 29% and Equal Weight ETF (RSP) at +19% is a reminder of the Mag 7 connection that is reasserting itself in the home stretch of 2024.

Small caps at over 20% and Midcaps at 21% are well-positioned in the second quartile just above the Equal Weight S&P 500 (RSP) at just under 19%. Banks are major factors on the small caps and more US-centric in profile. We see 6 of the 7 bond ETFs in the bottom quartile with the only equity ETFs in the bottom tier being E&P (XOP) and Health Care (XLV).

E&P had a rough year overall on oil prices and uncertain OPEC policies. The constant “drill, drill, drill” promise is more like a threat to E&P earnings while the Midstream ETF has the combination of high dividend income and the potential for more growth stories ahead to get AMLP a spot it the top quartile. “Drill, drill, drill” (a variation of the older “drill baby drill” soundbite) and the support for LNG expansion is more about infrastructure and lower regulatory barriers. That is how AMLP and E&P end up far apart in the top and bottom quartiles. The questions around how Trump will treat Canadian oil imports is a major swing variable as he continues his recurring struggles with basic trade economics and supply and demand relationships.

The LTM returns keep the 32-0 streak going and still include some weeks from the major Dec 2023 rally. We see bond ETFs comprising 6 of the 8 in the bottom quartile with only HY at the bottom of the third quartile. The lack of duration support has been a recurring theme for bonds in 2024 with a few timeline exceptions.

We see a median return in the 32 lines of just over 20% with the cutoff for the top quartile at almost 33%. NASDAQ weighed in as the top return with +41%, the S&P 500 ranking #7 at just under 36%, the Russell 2000 in the second quartile at +32%, and Midcaps at 29%. That is a wide ranging and impressive recovery even if the tech heavy and financial benchmarks and ETFs are disproportionate contributors in the top tier.

See also:

Mini Market Lookback: Decoupling at Bat, Entropy on Deck? 12-7-24

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Payroll Nov 2024: So Much for the Depression 12-6-24

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

JOLTS Oct 2024: Strong Starting Point for New Team in Job Openings 12-3-24

Footnotes & Flashbacks: Credit Markets 12-2-24

Footnotes & Flashbacks: State of Yields 12-1-24

Footnotes & Flashbacks: Asset Returns 12-1-24

Mini Market Lookback: Tariff Wishbones, Policy Turduckens 11-30-24

PCE Inflation Oct 2024: Personal Income & Outlays 11-27-24

3Q24 GDP Second Estimate: PCE Trim, GPDI Bump 11-27-24

New Home Sales Oct 2024: Weather Fates, Whither Rates 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Mini Market Lookback: Market Delinks from Appointment Chaos… For Now 11-23-24

Credit Crib Note: Ashtead Group 11-21-24

Existing Home Sales Oct 2024: Limited Broker Relief 11-21-24

Housing Starts Oct 2024: Economics Rule 11-19-24

Mini Market Lookback: Reality Checks 11-16-24

Industrial Production: Capacity Utilization Circling Lower 11-15-24

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

CPI Oct 2024: Calm Before the Confusion 11-13-24

Mini Market Lookback: Extrapolation Time? 11-9-24

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24