3Q24 GDP Second Estimate: PCE Trim, GPDI Bump

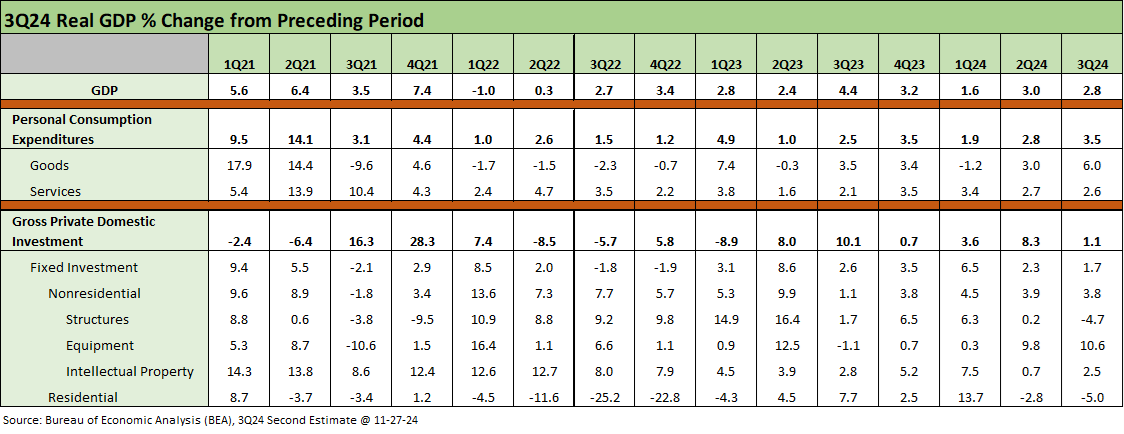

3Q24 Headline GDP is unchanged with some minor tweaks lower for PCE in Goods and GPDI revised higher on IP Products.

Be careful. I hear there is a tariff blight…

The second estimate for 3Q24 brings minor changes only with some give and take between Personal Consumption in Goods and Fixed Investment in IP products.

PCE is still running at a solid 3% handle at +3.5% even if down from 3.7% in the advance estimate (see3Q24 GDP Update: Bell Lap Is Here 10-30-24).

Government Consumption and Investment was flat at the top level with some realignment between Federal and State and Local.

The run rate averages for Biden are still ahead of Trump for both annual rates and quarterly medians with a sound economy ready for handoff to a new administration and a very different set of policies (see The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24).

The above chart updates the main GDP deltas across PCE, GPDI, and Government Consumption and Investment. We still see the healthy PCE line holding in well even with the Goods lines revised downward.

Personal Income & Outlays was released at 10 am today, and we will be out later with commentary there. In the PCE release, Personal Income growth rates ran ahead of consumption for the month and savings rates ticked higher.

For Fixed Investment, Structures and Investment are topping off after a very solid run on the back of the consumer demand rally and the heavy slate of fixed investment that came with the post-COVID recovery. That is especially the case with the megaprojects flattening and high run rates. The initial growth ramp came with legislative initiatives on Infrastructure, CHIPS and IRA among others. The growth rates on investment levels since 4Q19 have been impressive and cut across a breadth of line items (see Fixed Investment in 3Q24: Into the Weeds 11-7-24).

Government consumption and investment has been strong and the same in government hiring in recent periods as covered in prior commentaries. Local economies have posted up favorable metrics at the household level despite the political noise (see State Unemployment Rates: Reality Update 10-22-24, State Level Economic Reality Check: Employment, GDP, Personal Income 9-28-24).

The above chart updates the run rates from the start of 2021 after the COVID peak. Back in 2021, ZIRP was the monetary strategy of the day, and the vaccines were just getting rolled out on a large scale. Mortgage rates were near record lows and many households were locking in refinancing rates that provided substantial monthly cash run rate savings. That was followed by a market that would see the value of homes rise and the home equity base in turn offer a nice net worth cushion for those who could take action and buy/refi. Obviously, we are in a very different mortgage world today at much higher home prices (see links).

See also:

New Home Sales Oct 2024: Weather Fates, Whither Rates 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Footnotes & Flashbacks: Credit Markets 11-25-24

Footnotes & Flashbacks: State of Yields 11-24-24

Footnotes & Flashbacks: Asset Returns 11-24-24

Mini Market Lookback: Market Delinks from Appointment Chaos… For Now 11-23-24

Credit Crib Note: Ashtead Group 11-21-24

Existing Home Sales Oct 2024: Limited Broker Relief 11-21-24

Housing Starts Oct 2024: Economics Rule 11-19-24

Mini Market Lookback: Reality Checks 11-16-24

Industrial Production: Capacity Utilization Circling Lower 11-15-24

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

CPI Oct 2024: Calm Before the Confusion 11-13-24

Mini Market Lookback: Extrapolation Time? 11-9-24

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24

Employment Cost Index Sept 2024: Positive Trend 10-31-24

3Q24 GDP Update: Bell Lap Is Here 10-30-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Durable Goods Sept 2024: Taking a Breather 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24