Mini Market Lookback: Reality Checks 11-16-24

The week was negative for equities, duration, and credit spreads as the market saw bizarre nominations for critical cabinet roles.

How many political appointments do we need by next week?

The equity markets saw 3 of the past 4 weeks in the red zone with the post-election week a major home run (see Mini Market Lookback: Extrapolation Time? 11-9-24, Mini Market Lookback: Showtime 11-3-24, Mini Market Lookback: Burners on Full 10-27-24 ). The past week saw 8 of 11 S&P sectors in the red with 2 positive (Financials, Energy) and 1 flat (Utilities).

We look at more time horizons in the broader Footnotes publication on asset returns to be posted later, but some of these cabinet appointments tie into sectors (notably military, health care) that are major factors in the economy and the debt and equity markets and in some cases are massive employers with extensive supplier chains.

The main takeaway to us is that there will be a lot of ebb and flow and surprises ahead if Matt Gaetz can be nominated for Attorney General and a Fox & Friends host as Secretary of Defense with zero experience appropriate for the job. To the extent that being a soldier in the field qualifies you to become head of the largest military in the world with a budget larger than the next 10 combined, there are plenty of better choices without the white supremacist tattoos and who at least could pass a security check.

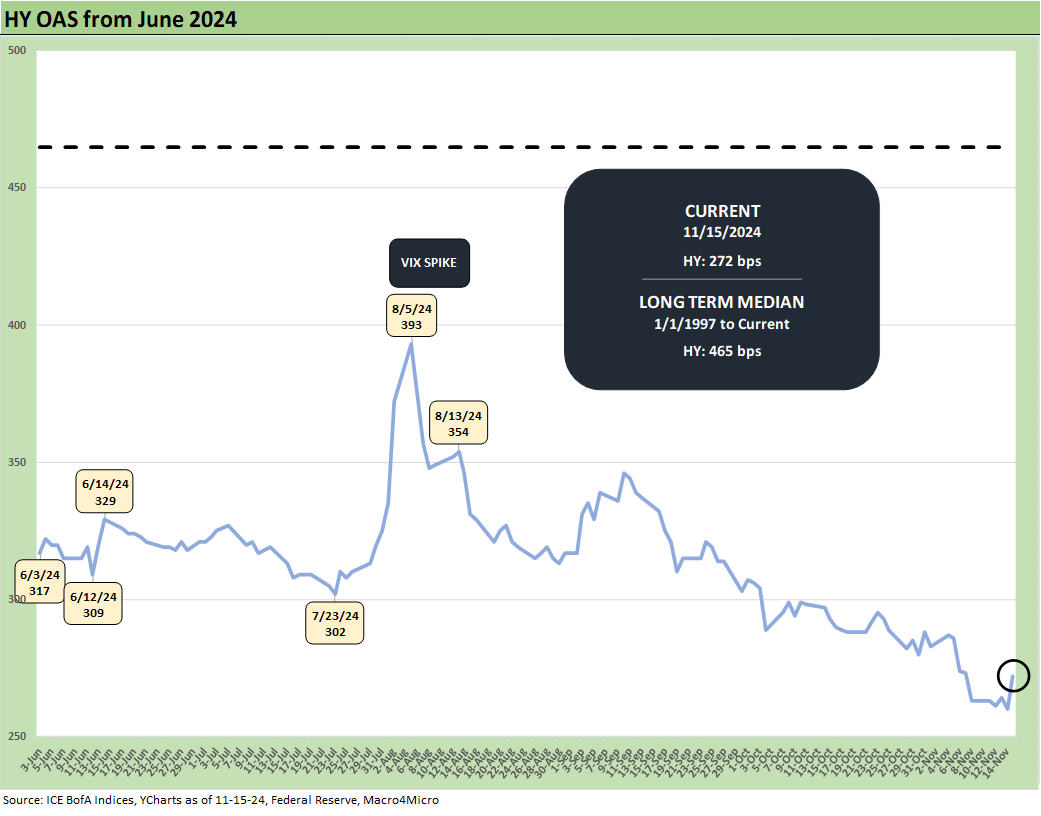

Spreads finally widened to end the week with both IG and HY still around the multicycle lows seen in the 2007 credit bubble for HY and even longer for IG (see Footnotes & Flashbacks: Credit Markets 11-12-24, HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24, HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24).

For the week, the UST curve saw another modest bear steepener with the FOMC weighing in as expected with -25 bps. The CPI was not helpful but still a secondary factor to the fears around what tariffs and deportation and an off-the-rails budget deficit might lead to in 2025 for the UST curve.

The 1-week return mix on our 32 benchmarks and ETFs showed 7 positive, 1 at zero, and 24 in negative range. We see Financials (XLF) and Regional Banks (KRE) in the lead along with the 3 energy related sectors across Midstream (AMLP), Energy (XLE) and E&P (XOP). In the case of Utilities (XLU), it seems like you can roll your own reason for decent performance with demand for Power strong. The usual easy explanation for XLU performance includes them being defensive or interest rate sensitive. It is a sector that seems to hold up well across a wide range of conditions. Interest rates were not XLU’s friend this week, but fundamentals remain strong.

We see the Health Care ETF (XLV) in dead last. We could attribute that to the RFK Jr HHS appointment that covers an area that spans 18% of US GDP. As an Irish Catholic Democrat from Massachusetts who remembers a delivery guy coming to the door and telling us to turn on the TV the day JFK was assassinated and later watched RFK on TV in 1968, it is with some regret that I see RFK Jr as just one more tragedy to befall that family. During the week, LLY was smacked by double digits and JNJ, MRK, and ABBV were all in red. Those 4 pharma leaders are 4 of the 5 largest holdings in XLV.

It is not hard to google around for a collection of RFK Jr’s craziest theories that he typically denies despite the fact that they are on the record (he should fit right into the “deny deny deny” reality and facts school). The equity markets do not seem to know what to make of him, but the assumption might end up being that he will be allowed to make noise but will not do as much damage as feared. There is just too much money in the space and “money talks” even if RFK Jr squawks.

Hopefully that curbing of RFK Jr will take place before the rubella and polio outbreaks. Note: I had measles, mumps and rubella the old-fashioned way as a kid but was fortunate to have the early “dixie cup” polio vaccine. RFK Jr looks to take us back to the early 1960s it appears. The worry is that could bring a body count. After RFK in 1968, the DNA pool really thinned out.

Bonds and tech lose…

We see the bond ETFs all in the negative range also on the week but spread out across the first, second, and third quartile with the short UST 1Y-3Y ETF (SHY) negative but sneaking into the top quartile. The long duration UST ETF (TLT) brings up the rear of the bond ETFs at the bottom of the third quartile.

Small caps came in just one spot ahead of last place Health Care (XLV) only a week after a very strong post-election move for RUT that saw them at #2 last week just behind Regional Banks (KRE) (see Footnotes & Flashbacks: Asset Returns 11-10-24). Midcaps also joined small caps in the bottom quartile.

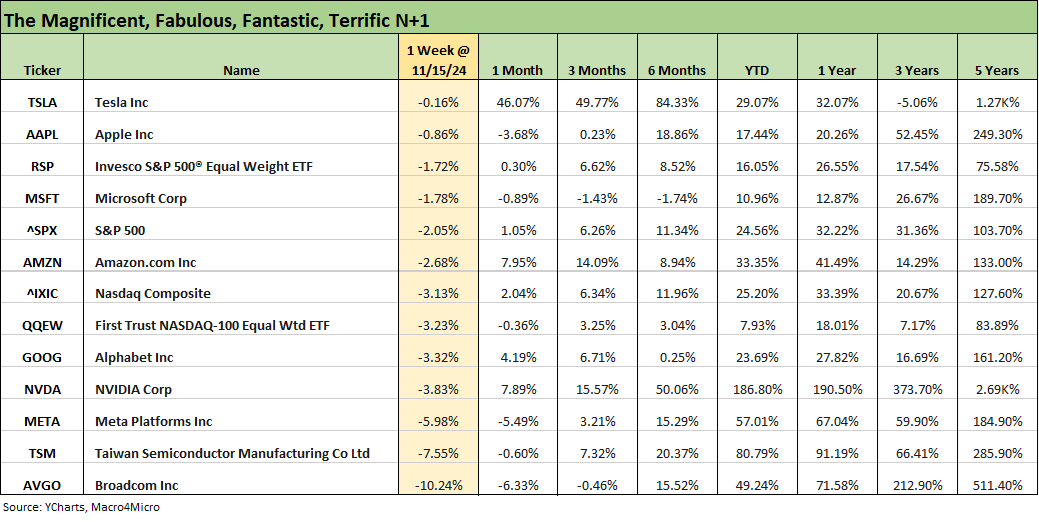

As we cover in the table below, Tech names large and small had a rough week with the above showing the Tech ETF (XLK), the equal weight NASDAQ 100 ETF (QQEW), and NASDAQ all in the bottom quartile.

The above chart updates the running weekly returns on the tech bellwethers, which is basically the “Mag 7 + Taiwan Semi + Broadcom.” They are listed in descending order of weekly returns, and they are all in negative range this week. Broadcom and Taiwan Semi took the worst beating.

The above chart plots the UST deltas for the week, and we see another modest bear steepener for the week from 2Y to 10Y with the 10Y to 30Y flat on the weekly deltas comparison. The move was enough to put all the bond ETFs in the red.

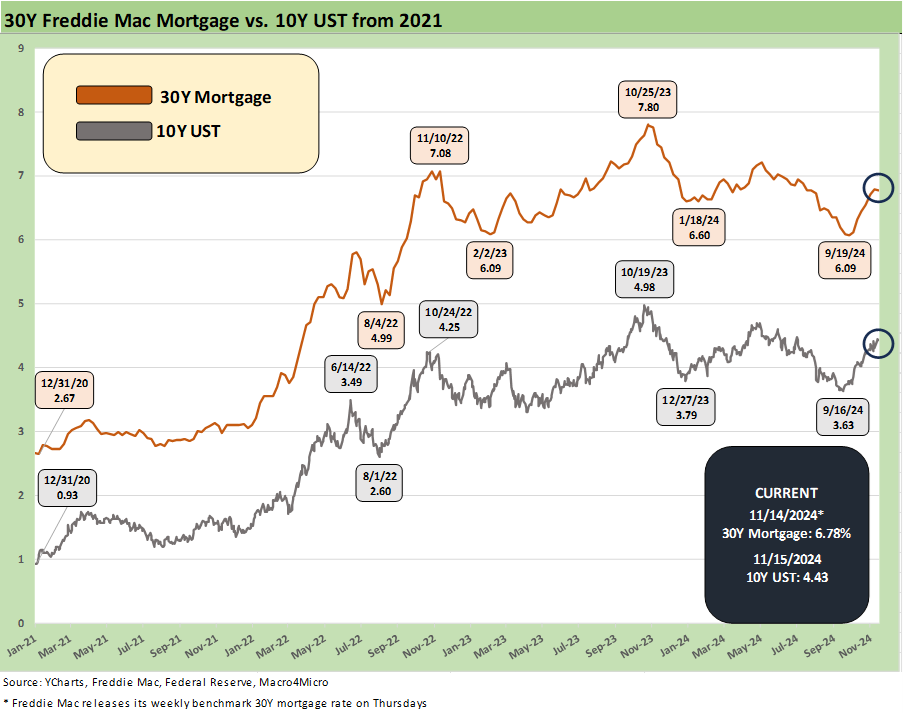

The above chart updates the 10Y UST series since the start of 2021 during ZIRP and plots that against the 30Y Freddie Mac (which is set on Thursdays). We see a minimal move from 6.79% last week to 6.78% this week. We have moved quickly in the wrong direction on the 30Y mortgage since the Sept 2024 low of 6.09%.

HY index spreads moved +9 bps wider on the week with a +12 bps move on Friday. The +272 bps HY index OAS is still very much in the June 2007 and late 1997 neighborhood as we have covered in past commentaries (see links). The +465 bps long-term median is again a very long walk from current levels.

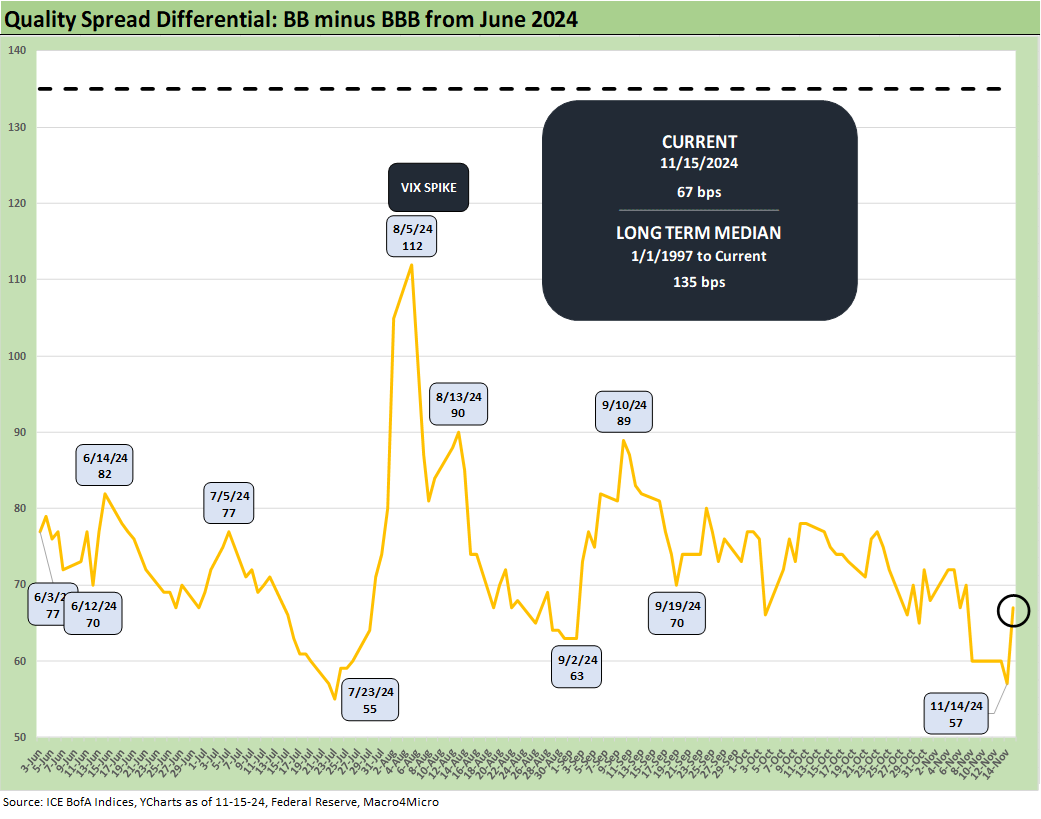

The “HY OAS minus IG OAS” quality spread differentials moved slightly wider as the +9 bps widening in HY outpaced the +3 bps widening in IG. The +192 bps differential is quite a journey from the +327 bps long-term median.

The above “BB OAS minus BBB OAS” quality spread differential of +67 bps was +7 wider on the week. That middle tier differential has been moving around in a range this summer and fall with the early August volatility whipsaw to +112 bps a notable exception (see HY Industry Mix: Damage Report 8-7-24, Volatility and the VIX Vapors: A Lookback from 1997 8-6-24).

See also:

Industrial Production: Capacity Utilization Circling Lower 11-15-24

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

CPI Oct 2024: Calm Before the Confusion 11-13-24

Footnotes & Flashbacks: Credit Markets 11-12-24

Footnotes & Flashbacks: State of Yields 11-11-24

Footnotes & Flashbacks: Asset Returns 11-10-24

Mini Market Lookback: Extrapolation Time? 11-9-24

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

All the Presidents’ Stocks: Beware Jedi Mind Tricks 11-1-24

PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24

Employment Cost Index Sept 2024: Positive Trend 10-31-24

3Q24 GDP Update: Bell Lap Is Here 10-30-24

The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

JOLTS Sept 2024: Solid but Lower, Signals for Payroll Day? 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Durable Goods Sept 2024: Taking a Breather 10-25-24

New Home Sales: All About the Rates 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Existing Home Sales Sept 2024: Weakening Volumes, Rate Trends Worse 10-23-24

State Unemployment Rates: Reality Update 10-22-24

Housing Starts Sept 2024: Long Game Meets Long Rates 10-18-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24