CPI Oct 2024: Calm Before the Confusion

The inflation you expect this month is less of a focus than the inflation you fear “tomorrow” as the market ponders tariff and deportation impacts.

Working group for economic planning and tariff policy…

The -25 bps for Dec appears to be a lock for FOMC action after a more-or-less consensus inflation reading, but Shelter keeps fighting the hopes for more progress.

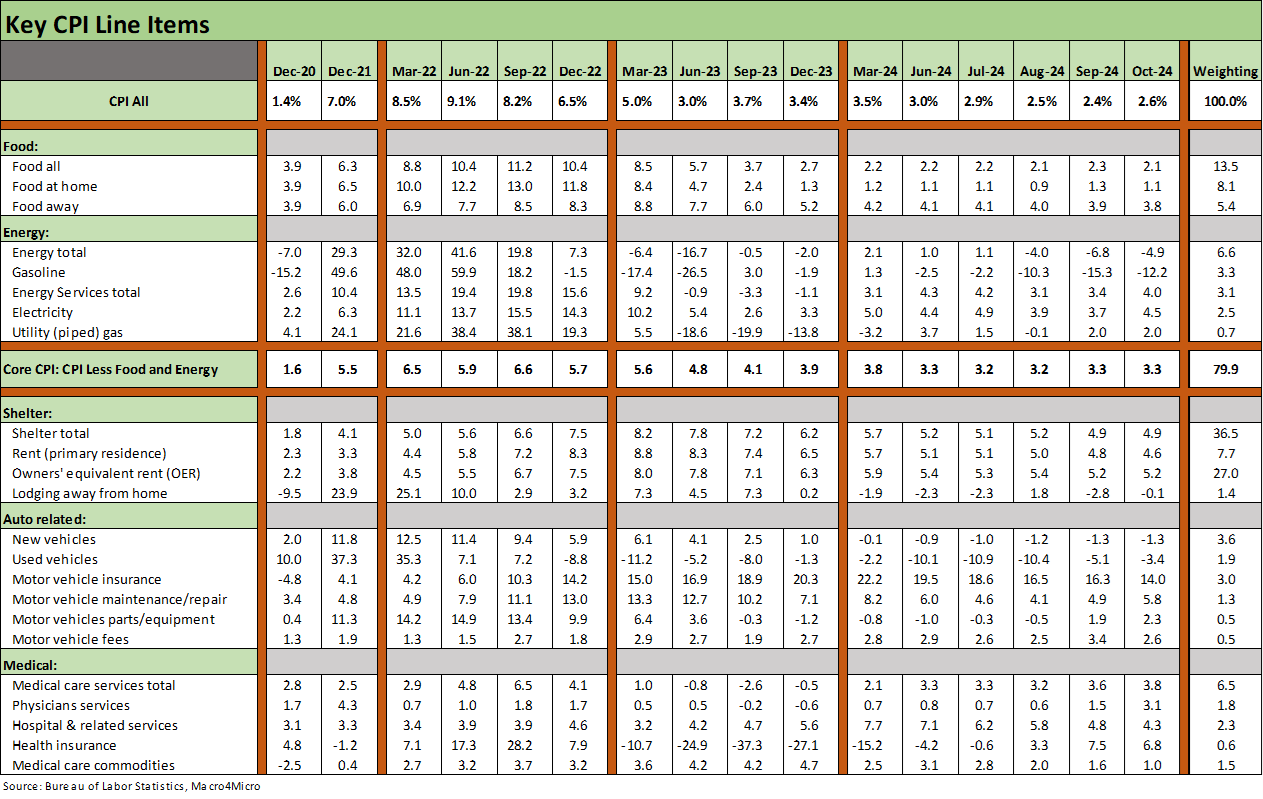

The +2.6% headline inflation ticked higher sequentially while Core CPI was flat YoY at +3.3%. MoM changes were flat at +0.2% for All Items and also flat for the +0.3% Core. Commodities less food and energy deflated YoY along with new and used vehicles with gasoline at -12.2% but with Shelter still spoiling the party at +4.9% with its high CPI index weighting (36.5%).

The tariff question (timing, targets, amounts, exemption process, etc.) and the almost Newtonian effects of tariffs on either costs or prices is going to be an over-the-wall concern that does not get a lot of airtime from Wall Street or business leaders and especially those that will be in line looking for exemptions as they work through lobbyists and some beg in person (if they donated).

The mass deportation threat to labor supply-demand imbalances and wage inflation will not go away until it is tested with a very mixed message since the election victory on “how many” and “how soon” on the gross numbers.

The biggest challenge is finding credible senior economic advisers who are willing to say “selling country pays” rather than “buyer pays” with their outside voice as the war on reality continues. We assume there will be a ready supply of lapdogs available.

The above chart flags the comfortable differential between effective fed funds and CPI at +2.2% (vs. the long-term median of +0.5%) just as we saw with fed funds and PCE (see PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24). Sept saw a slightly warmer (not hot) CPI last month (see CPI Sept 2024: Warm Blooded, Not Hot 10-10-24), and Oct had the recurring problem of sticky services numbers and shelter numbers. The shelter CPI just cannot be shaken for myriad reasons we look at each month in our various housing sector commentaries on new home sales, existing home sales, and home starts (see links at bottom). As we detail below in the special aggregates chart, we saw +1.3% CPI for “All items less shelter.”

The market is in a tough handicapping mode right now given the expectations for high tariffs and mass deportation running alongside a soaring government deficit that will require record financing needs. The toggling of PCE and payroll worries with FOMC policy and the reaction of the market (who controls the longer end of the curve and thus mortgage rates, etc.) is all part of a big swirl of risk factors that are hard to gauge.

A wildcard in inflation expectations for 2025 revolves around how extreme the tariff and deportation actions will be relative to campaign rhetoric. The topics have been downplayed as a “negotiation tactic” but the old rule of “don’t pull a gun unless you plan to use it” could flow into heightened inflation anxiety as we get going.

Any increased flavor of authoritarian behavior in substance could start to influence corporate behavior (capex, hiring) and the consumer (PCE) if the behavior starts to heighten fears of more extreme tariff and immigration actions. Investment in fixed assets has been running strong and well ahead of pre-COVID levels during “Trump 1.0” in 4Q19 when tariffs were creating problems (see Fixed Investment in 3Q24: Into the Weeds 11-7-24). The campaign promises of growth requires the capex plans and consumer spending to show up.

The above chart updates the history of CPI and fed funds across time and the FOMC is likely to move rates lower again in Dec. Meanwhile, the CPI is well below the long-term median of +5.1%. That fact serves as a starting point on the way into the transition weeks and political appointments ahead.

Challenges to Senate hearings by Trump and dictator 101 on the military should influence inflation worries…

The Trump demand that the Senate allow appointments without hearings and leaked plans in the WSJ on hand picking and purging military leaders is making the rounds today. Besides being spooky to extrapolate for a guy with only 50.2% of the votes, it sends signals on economic policies that Trump plans to do exactly what he said on tariffs and deportation. That can only play out by way of action in the months ahead. The Trump victory pales in comparison to many other victories (see The Inflation Explanation: The Easiest Answer 11-8-24). There were a lot of reasons for the Harris defeat (see Morning After Lightning Round 11-6-24).

The headlines as of today from the Wall Street Journal show the early stages of military purge by executive order and using a handpicked committee to do it. That implies having a command structure more amenable to the use of military against US protests as he desired in Trump 1.0 but was opposed by Milley and the Joint Chiefs. We also have a Fox & Friends host as the selection for Secretary of Defense, so the early indicators are for an extreme policy approach. That points toward aggression on all fronts. That would imply high tariffs and big numbers on deportation, which would be above some initial rhetoric this week from allies that deportation is more about immigrants convicted of crimes (for now). The bid-offer seems to be shaping up somewhere between 1 and 21 million. The commentary from Trump allies is all over the place.

The fact that the Fox host was a veteran does not mean he is qualified, but Trump has asked the Senate to allow recess appointments with no hearings and checks by the Senate. It is not hard to extrapolate the direction of the authoritarian impulses, and that would send some signals that higher tariffs and higher deportations are more likely. Those are topics for other days that will not go away and could only get worse.

Waving the “sweeping mandate flag” is old time politics. That implies that the 50.2% of the country voted for extreme policies as opposed to “against the other guy.” Beyond only 50.2% of the popular vote (still counting in California), Trump got less than 50% of the vote in Michigan and Wisconsin, and it should not be lost on the world that the GOP failed in numerous swing state Senate elections where Democrats carried the day in Michigan (Slotkin), Wisconsin (Baldwin), Arizona (Gallego) and Nevada (Rosen). The GOP carried Pennsylvania in impressive fashion as Harris badly underperformed there and in Philly and broadly a lack of turnout that was low for Democrats.

We have highlighted that Trump won big, but let’s not mistake a foot for a mile. Those numbers don’t earn you a military leadership purge and demanding the Senate abandon its constitutional duties in a public forum with a 53-47 Senate mix. Bush had some 55 seat years and Obama had 57 in the Senate at one point. Those Senate high counts for both Bush and Obama in the Senate were higher than Trump’s 53, but military purges were not the order of the day. Their ability to select qualified people based on competence was also higher on the food chain than what Trump is putting up so far.

Even if Presidents all play games on appointments at some point, what Trump is proposing is not making him look less like an autocrat with an anti-Democratic end game. There are enough power-hungry ideological opponents of facts and reality to pull it off. Cowardice offers safety in numbers and the economy be damned if it means less power.

The stakes here for the Senate abandoning its constitutional checks process would (and should) send worrisome signals on economic policies in the area of the Fed, trade, potential labor market disruptions, health care, and household consumption (the critical PCE line in 2025). Less regulation and more M&A come with it, but the real world also beckons where tariffs need to be recovered, flowed through, or eaten. That is not an aphrodisiac for more investment or lower rates without a recession risk in the mix.

The above chart updates the running headline CPI vs. headline PCE across the decades. The next leg of the journey will be heavily influenced by any potential (even if partial) solution to the housing supply problem. Trump carried the red states and swing states where the headquarters of most all of the major homebuilders are located (e.g. TX, AZ, FL, PA). One would hope they can get on the same wavelength for a game plan.

CPI lines by the numbers…

The special aggregates line always offers useful angles. Given the very high weighting of Shelter at over 36%, the “All items less shelter” at 1.3% takes some of the edge off if you are a homeowner with no mortgage or a low fixed rate mortgage. Of course, even that comes with an asterisk if you want to sell and take gains and buy another home facing current mortgage rates.

The CPI for “All items less food, shelter and energy” at +2.1% gets the market closer to a useful core metric that has non-shelter services in the mix. As noted in the table, total Services CPI stood at +4.7%. That is a rough metric for a Services-heavy economy. We see Durables in deflation mode at -2.5% and Nondurables at -0.5%.

The above chart includes our roll-up of the Big 5 CPI groupings. We include Automotive related lines since autos are such a critical part of the household budget even without considering loan costs and gasoline (see Automotive Inflation: More than Meets the Eye10-17-22). The Big 5 above comprises over 75% of CPI.

We see Food in check and Energy deflating. As we have covered in the past, Food CPI does not deflate back to the starting point after inflation spikes. That is unlike Energy (see Inflation Timelines: Cyclical Histories, Key CPI Buckets11-20-23). Automotive vehicles are deflating, but the other moving parts in autos are not with insurance especially brutal. The financing costs of buying a car are also higher in 2024 and stubbornly so (and not reflected in the CPI line). Meanwhile, trade-in values are going down.

The big wildcard in 2025 will be the GOP promise to reform Obamacare with many millions of insured likely to see higher costs, less coverage, and some will lose coverage entirely. That is one of the topics where the politics of the process was asking many to deny reality. That will be something for later.

The biggest risk in health care is about losing coverage entirely and playing roulette with household financial viability if someone gets very sick. “Repeal and replace” vs. repeal and trade down” or “repeal, replace but lose coverage” are major items for households in 2025. Ideology rules, and facts are a lower priority these days.

The above add-ons total over 11% of the CPI index and are near and dear to many households. The list shows 3 up and 3 down with airline fares showing the bigger sequential move along with Recreation Services.

A big question would be whether apparel will get hit by tariffs and on imports “from where?” For example, there are plenty of anecdotal stories in the financial trade press around the scramble to pre-order a lot more footwear ahead of the tariffs. One assumes those retailers heard a rumor that the selling country does not pay the tariff – the buyer does. Who knew?

See also:

Footnotes & Flashbacks: Credit Markets 11-12-24

Footnotes & Flashbacks: Asset Returns 11-10-24

Mini Market Lookback: Extrapolation Time? 11-9-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24

All the Presidents’ Stocks: Beware Jedi Mind Tricks 11-1-24

3Q24 GDP Update: Bell Lap Is Here 10-30-24

The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24

Durable Goods Sept 2024: Taking a Breather 10-25-24

New Home Sales: All About the Rates 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Existing Home Sales Sept 2024: Weakening Volumes, Rate Trends Worse 10-23-24

State Unemployment Rates: Reality Update 10-22-24

Housing Starts Sept 2024: Long Game Meets Long Rates 10-18-24

CarMax: Why Do We Watch KMX as a Bellwether? 10-3-24

Inflation Related:

Footnotes & Flashbacks: State of Yields 11-11-24

The Inflation Explanation: The Easiest Answer 11-8-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24

JOLTS Sept 2024: Solid but Lower, Signals for Payroll Day? 10-29-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

CPI Sept 2024: Warm Blooded, Not Hot 10-10-24

Inflation Timelines: Cyclical Histories, Key CPI Buckets11-20-23