Unemployment, Recessions, and the Potter Stewart Rule

Supreme Court Justice Potter said “I know it when I see it…” We apply that to the “recession now” talk in the market.

The famous quote of Supreme Court Justice Potter Stewart can be applied to the term “recession” these days. The original quote came in the context of a landmark obscenity case in front of the court where he commented on “hard core pornography” with the legendary statement:

“I shall not today attempt further to define the kinds of material I understand to be embraced within that shorthand description, and perhaps I could never succeed in intelligibly doing so. But I know it when I see it…”

This statement could have been about “Recession” as a shorthand description of what the current mix of economic variables means in the US. Justice Stewart was an Eisenhower appointment and regarded as a staid measured centrist who spoke common sense. He was mixed in his agreements and disagreements with the liberal and conservative justices. He was a rare centrist (these days, that is like a sighting of Sasquatch riding on the back of the Loch Ness Monster in the Potomac). In other words, he was balanced. It is hard to find balance in how the inflation and jobs reports get weighed by policy makers in these toxic times. More jobs are good economically. Higher inflation is bad. Not rocket science, but the monetary and fiscal balancing act is quite tricky and unpredictable.

I like the balance theme after watching talking heads on cable this morning chatting about strong numbers in jobs (thus bad for inflation trends) while others are still saying the economy is in recession now. If I were looking for a recession underway now, I would probably know it when I see it. I sure don’t see it even if just on the payroll numbers. I do expect one in 2023, but it takes time. The poor growth line items are there to frame in GDP numbers, and those will be addressed in other commentaries. PCE is positive, and that is worth something with the PCE at 68% of GDP. The Gross Private Domestic Investment lines will feel more pain, especially in Residential.

The latest payroll report weighed in at +263K in payroll and a drop in the unemployment rate to 3.5%. The jobs numbers always get a lot of attention and a double dose of it near elections. That dosage is likely to skirt overdose levels this fall as the CPI relationship with Unemployment will be a fixation for a while. We saw the reactions on the UST curve to the JOLTS report, but the basic Newtonian laws of “Mo jobs, Mo money” is hard to contest when the unemployment rate is 3.5%. Even if structural underemployment is a fact and real wages are suffering, I use the “three Big Macs is better than two Big Macs” rule. The biggest bears are calling for a can of spam to be split four ways.

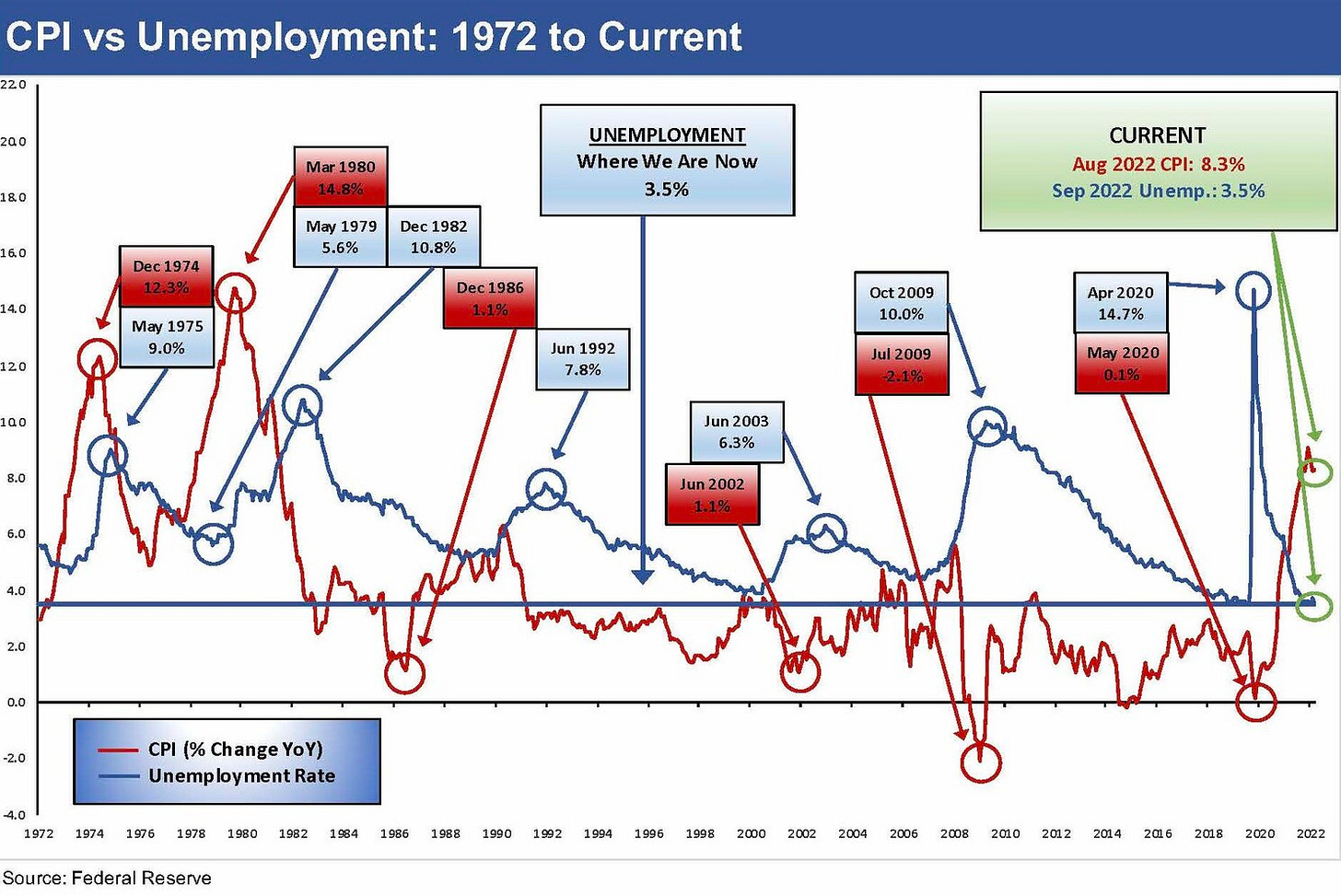

As I show in the chart above, that horizontal blue line of 3.5% looks very strong all the way back to 1972 across the cycles. That is a solid foundation for marching into troubled times. With OPEC thumbing its nose at the White House this week on its overtures for an increase in oil production while instead cutting oil production, the strong jobs number to unemployment lows heightens CPI anxiety. With that payroll profile, the idea of an imminent (or current) recession is more about a debating point and using the facts that agree with your view.

The 3.5% line is a fact. A deeper sustained contraction in PCE and investment is a theory…

The jobless rate is just too much for the bears to counter at this point even with all the very bleak risks that can be detailed. As someone who grew up in a declining industrial town (Brockton, MA), the most important variable is always a job. I expect such bias to be broadly the case in households not run by economists. The nuances of the Phillips Curve theories and its shapeshifting are not on the short list of focal points when joblessness is high. There is no question the overall economic trend is negative in the major moving parts, and those headwinds will eventually flow into payroll. However, the depth and duration is very debatable. The market volatility is in part attributable to the size of the economic plates rubbing up against one another. Oil and geopolitics also can be the “plug” for framing a wider range of outcomes.

Labor trends are perplexing bears at this point. After so many months of shortages, some economists even spin the theory of “labor hoarding” as companies seek to be defensive available workers. That is not a bad theory. “Ride it out and wait to see” if interest rates and inflation do in fact hammer revenue. That is why 3Q22 earnings season will be very important in framing guidance. Of course, maintaining low labor turnover is not an uncommon practice and a prudent ambition in many cultures – corporate and national.

I don’t question the links between inflation and unemployment since we are a fan of the concept of supply and demand. Lower demand for labor will weigh against labor pricing power eventually. Payrolls are just not weakening yet. There is also a cushion zone above that 3.5% rate to absorb some payroll rollbacks as the chart underscores. The unemployment rate lows leave a lot of room for negative surprises.

Some leading employment categories tell a story…

We see a sharp rise in Leisure and Hospitality and also in Health Care employment in the September payroll numbers. Leisure payroll increases do not signal a panicking consumer yet. In fact, consumers are out spending money and waiting in long lines at airports. Those Leisure and Heath Care jobs are seldom the high-end multiplier effect jobs, but those who accept them will be spending their paychecks. That is a positive economic factor by definition. The rolled-up damage via CPI effects is a theory. Health care is constantly talking about labor shortages, so another question might be Medical Care inflation fallout rather than near term contraction in that sector.

Most important in my view was the rise again in manufacturing jobs which have been solid for months across this CPI rise. After brutal supply chain disruptions and shortages, we look forward to hearing about capex and staffing plans in the earnings season to the extent those are given any transparency. If supply chains are catching up, there will be inventory to potentially rebuild in some sectors as more companies get away from lean inventory practices after so much stocking trauma. The pattern will be part of a case-by-case and industry-by-industry process. Autos are the more headline-driven inventory problem in chips, but the China and European supply chain issues are much broader and will have a lot of tension ahead.

Supply and demand still rule in economics even if not in Washington…

That view that supply and demand is a governing principle in economics might bring me into disagreement with more than a few Congressional (House and Senate) talking heads, but generally the equity and bond markets will embrace today’s facts while trying to price in forward looking expectations on the “facts” to play out ahead. The departure from supply and demand is a major problem in energy policymaking for the near and intermediate term. With the crisis backdrop unfolding in Europe on Energy, the hope for supply and demand coherence in energy policy was thwarted, and the political themes still dominate. Congress has a lot of lawyers, and the advocacy of a position rules in the legal world. “Make the case and use the facts that work for you.” In a relatively fact-free backdrop in Washington, they often just skip the fact part and move directly to blanket statements and advocacy of a view. That is on the left and right.

CPI and jobs framed as enemies…

For the CPI-Jobs connection, I will let the think tanks and old-school economists meander down memory lane and keep debating the history of the Phillips Curve, engaging in the “deep thinkifying” of trying to model what the CPI-Unemployment Rate connection all means in the markets ahead. The idea that tight labor keeps wage pricing power high is fair enough. Those looking to be correct on a “recession” will still have to explain how to reconcile the CPI relief to be gained from another 1 or 2 points of unemployment rate above where the 3.5% line is situated in the above chart. I recognize that the GDP growth numbers are awful (that could mean stagnation) and inflation is high, so adding those two together does imply stagflation. There is still an easier case for stagflation than recession as of now, but then it gets into the “sticks and stones” debates. Even if you call it a recession, the real action for securities holders is down in the weeds of earnings trends, relative multiples and credit spreads, and where balance sheet metrics and free cash flow have trended.

Recession bottom line…

The weight of inflation will weigh on the consumer and the corporate sector in the US, and turmoil in Europe will take its toll on the #1 trading partner of the US. Supply chains will face some surprises even if freight rates keep declining. China also is in a strange and troubled position right now, and the strain of the Taiwan topic with the US could further test supplier chain planning. Moves to India (e.g., Apple) or “reshoring” always carry costs and transition risks. In other words, the recession is coming, but the discussion is whether it be “economic contraction lite” as in Mar 2001 to Nov 2001 or the “high and inside recession” such as Dec 2007 to Jun 2009, Oct 1973 to Mar 1975, or Jul 1981 to Nov 1982.