The Inflation Explanation: The Easiest Answer

As much as there is a lot to consider in the election postmortem, the dagger was the lasting inflation pain.

Democrats: I wonder if it was my footwork or his sword?

For all the layers that get peeled back, the most obvious explanation for the election outcome, and the easiest one to point at with a very clear historical precedent, is that inflation is the kiss of death in a Presidential election. When the menu reprices to levels that shock household budgets, bad things happen to incumbents. All one needs to do is look back at the fate of Gerald Ford in 1976, Carter in 1980 and Harris in 2024.

The challenge of the food menu in particular (essentially daily reminders in the aisles) and housing (rent is a monthly reminder even if house prices are less of a daily experience) weighed on the majority of households (see Inflation Timelines: Cyclical Histories, Key CPI Buckets11-20-23, Misery Index: The Tracks of My Fears 10-6-22).

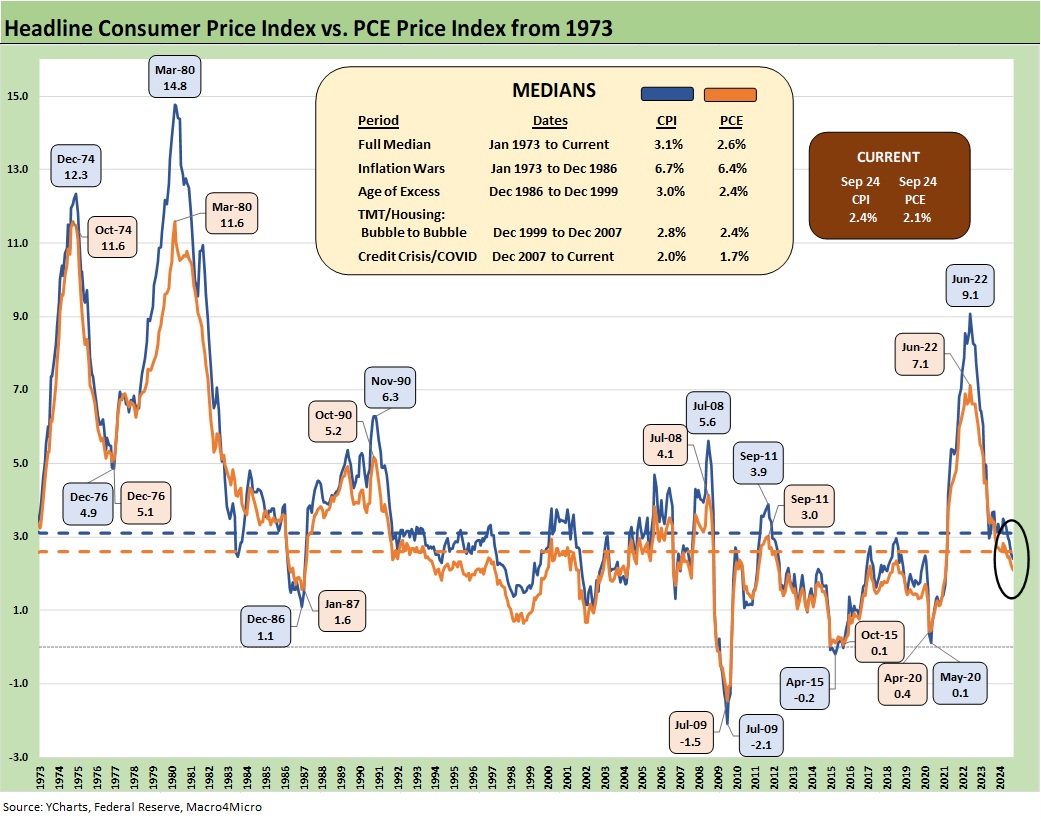

There are plenty of trends to ponder that also mattered (see Morning After Lightning Round 11-6-24), but inflation was the main event with the experience seared into memories even if Biden/Harris ended the term with a low CPI that is the starting point for the Trump term (see CPI Sept 2024: Warm Blooded, Not Hot 10-10-24).

While there are lots of items on the list that are all very relevant (race, gender, misinformation, power of the theocrats, etc.) inflation and price pain at the household level flows right into the great American tradition of “throw the bums out” that is likely to remain part of the voting culture and has been on display in most (not all) midterms over recent decades (notably 2010 and 2018).

The inflation risk is one that Trump and the GOP will need to keep in mind as they potentially go off on a “White House gone wild” bender. One cure for inflation is recession, but that does not shelter electoral risk (it did not work in the stagflation of 1973-1975 and 1980-1981).

With the tumultuous election week now behind us, we thought a fresh look back at the history of the CPI and PCE price index in the above chart was worth considering again in the context of the election results. High inflation markets offer an easy reminder of what was arguably the main event. That is, inflation was the ultimate dagger for the Biden-Harris popularity and the outcome for Harris. Someone always takes the fall for inflation even when events in the world can be the prime driver (Arab Oil Embargo, Iranian Oil crisis, COVID and supplier chains, intrinsically necessary fiscal demand stimulation in the face of supply problems, etc.).

There is a wide range of items to put on the list as to why the US would elect the Decathlon Gold Medalist in the Liar Olympics. Trump may try to set a world record throw in the Javelin event for Wannabe Dictators with the spear aimed at Democracy. Putin is the current record holder. However, one fact stands above all others, and that is the reality that brutal bouts of inflation have historically fallen hard on incumbent Presidents.

The warnings for Trump and the economy…

If the House ends up with the GOP (likely), then there will be no hiding from accountability in every economic release and every monthly trade release, every CPI and PCE Price Index release, and every quarterly earnings season and guidance change. Even in a fact-free world, the effects at the household level are always more important than the talking heads and mitigating data story lines (GDP, Jobs, etc.). Trump knew the “feeling side” mattered more in economics. Inflation was inescapable and the same arguments on causes have been raging since the 1970s. The Biden/Harris administration could not change minds or feelings using intellectual reasoning.

The moving parts of inflation and household economic pain are no mystery as we detail below. We skip the interest rate issues for now, but the UST curve immediately steepened.

Tariffs: The person who controls tariffs (Trump) keeps stating that the seller country pays (China, Mexico) and not the buyer. That lie apparently did not concern the average voter (questioning the median voter’s factual grasp of reality as tariffs will bear down on market pricing in coming months). Once the tariffs get rolling, every move in the CPI will get some scrutiny with time sensitive data sources likely to be all over this topic. We will see if Trump follows through on the Project 2025 threat to reel in data services such as the BEA and BLS to avoid accountability and factual performance analysis.

The limits of tariff “negotiation tactics”: By threatening tariffs on a massive scale in one room while allies say “just a negotiation tactic” in another room, it is safe to say the game theory is tainted. The opponent can say “go ahead” and test US endurance. The ability to retaliate is the negotiation tactic of the tariff target, and the political damage of inflation is evident in banner headlines to the trade partners on the other side of the table. The counter from China and Mexico et al to the US might be “Our ability to screw with your inflation metrics, yield curve, and supplier chains is our negotiation tactic. Good luck in midterms!” The trade partner in the process can go on a public relations offensive that screams “We don’t pay, you do! Trump lied.” Let that settle into the world of facts known by many but not by enough. Some may learn the hard way when they get laid off.

Supplier chain distortions: COVID did damage to the supplier chains, and we will see how tariffs and related retaliation effects flow into pricing and supply-demand relationships. The trade experts always point at how China could screw up the entire pharmaceutical chain. The range of supply-demand imbalances could be daunting across targeted retaliation on product lines that inflicts maximum disruption risks along the supplier-to-OEM chain. Then the multiplier effects kick in (inflation, layoffs, asset quality erosion, defaults in the corporate and consumer sectors). The trade partners in the crosshairs have their own domestic constituencies and getting bullied is a bad look (no one wants to be the Neville Chamberlain of trade negotiation).

Affordable Care Act: Households could be in for a very big shock if Trump follows through on his decade-long ambition to snuff out Obamacare. This would cripple many households and would need to move more than a few more rebels in a Senate GOP body that has been suffering from a pandemic of spine amputations. Trump said he has a “concept,” but we are not sure if repeal is the horse and whether the replacement is the cart (or if he just shoots the “horse” by repeal…no replace). Food and health care are two very important line items in the life of the average household. Both candidates claimed they could lower food prices.

Trump inherits low inflation (see PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24) and strong payroll counts with job openings now just slightly below the Trump peak of Nov 2018 (see Payroll Oct 2024: Noise vs. Notes 11-2-24, JOLTS Sept 2024: Solid but Lower, Signals for Payroll Day? 10-29-24). He also inherits a much higher run rate of fixed investment than during the Trump term (see Fixed Investment in 3Q24: Into the Weeds 11-7-24). That makes for a high bar for promised growth when the US deficit and massive UST bond supply remain a threat.

The UST will need to be looking under rocks to find buyers while potentially slapping high tariffs on massive holders such as China and even the “good guys” like Japan. Clearing a supply need set to soar will make for a big challenge for yields to say the least at a time when you also in theory are changing the currency story with a new (recently revised) goal of keeping the dollar strong. That is a sell job.

Summary: the lessons of Ford and Carter played out for Harris…

I voted for Carter in 1976 against President Ford after a simply awful stagflationary stretch from late 1973 to early 1975 that inflicted lasting pain on my hometown. I did not vote for Carter in 1980 even though his first three years posted materially better GDP growth rates that all exceeded (materially exceeded in 2 years) Trump’s best year of +3.0% (his only 3% year, see The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24). Carter also had the highest percentage increases in payroll after rebounding from the ugly Nixon/Ford experience (see Employment Across the Presidents 8-15-23).

I started my first full time job in June 1980 with a 22% Misery Index, so that was a memory of how elections can turn quickly. The “throw the bums out” rule was invoked by many even with Carter doing very well in the polls until a late reversal. Inflation was the dagger for Carter.

Looking ahead, the GOP wants to avoid being on the wrong side of consumer sector inflation and housing sector pain if some of the more bearish post-tariff, post deficit-spiral scenarios play out. Mortgages are high and labor is tight. Mass deportation will make it much tighter. Employment is strong, but a rising cost of sales could play into some inflation downside scenarios almost immediately. Retail with its 15.7 million payroll is at the top of the shock list. Low-cost sourcing, order books, and contractual commitments could be in for more than a little turmoil.

See also:

Morning After Lightning Round 11-6-24

Footnotes & Flashbacks: Credit Markets 11-4-24

Footnotes & Flashbacks: State of Yields 11-3-24

Footnotes & Flashbacks: Asset Returns 11-3-24

Mini Market Lookback: Showtime 11-3-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

All the Presidents’ Stocks: Beware Jedi Mind Tricks 11-1-24

PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24

Employment Cost Index Sept 2024: Positive Trend 10-31-24

3Q24 GDP Update: Bell Lap Is Here 10-30-24

The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

JOLTS Sept 2024: Solid but Lower, Signals for Payroll Day? 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Durable Goods Sept 2024: Taking a Breather 10-25-24

New Home Sales: All About the Rates 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Existing Home Sales Sept 2024: Weakening Volumes, Rate Trends Worse 10-23-24

State Unemployment Rates: Reality Update 10-22-24

Housing Starts Sept 2024: Long Game Meets Long Rates 10-18-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Retail Sales Sep 2024: Taking the Helm on PCE? 10-17-24

Industrial Production: Capacity Utilization Soft, Comparability Impaired 10-17-24

CPI Sept 2024: Warm Blooded, Not Hot 10-10-24

HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24