Industrial Production: Capacity Utilization Circling Lower

We look at a fade in headline capacity utilization with Durables the weakest part of the story as we head into a period of tariff uncertainty.

I see some auto names with too much EV, Mexico, and China exposure. Too soon?

The capacity utilization trends posted a mixed set of results before the election with inventory planners and supply chain managers now wrestling with how to gauge what policies will actually roll into place after inauguration.

We see both Total Industry and Total Manufacturing down with Durables weak along some lines such as Autos and Aerospace. Industrials broadly are facing some tough decisions ahead on capex and inventory planning under the shadow of a policy agenda that is only looking more aggressive this week given the collection of nominees and what it might signal on the trade-off of politics vs. competence.

Looking for signals in how much was election posturing and how much is genuine extremism has taken a setback with some zany selections that indicate motives more about political control and blind loyalty than experience and credibility with the markets and the rank and file.

For the ultimate manufacturing question of tariffs and trade and policies toward Mexico, the early read lacks specifics at this point on issues that could upset critical customers (China in aerospace and a vulnerable Boeing) and damage to supplier chains and OEMs (notably from Mexico in components and light trucks).

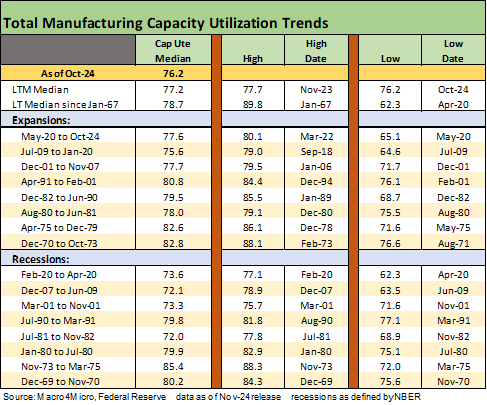

The above chart updates the high-level trend line in capacity utilization for Total Manufacturing. We see the steady slide from the start of the tightening cycle in spring 2022 from 80% to the current 76.2%. Looking back across the cycles, we see the 78.9% in Aug 2018 as an ugly replacement process for NAFTA (rebadged as USMCA) was in the home stretch for final terms before it moved on to the protracted ratification process by July 2020.

The period after Aug 2018 saw a very ugly close to the year with equity markets and credit markets battered back during what Trump has termed the “economic miracle” and “the greatest economy in history” (see HY Pain: A 2018 Lookback to Ponder 8-3-24, Histories: Asset Return Journey from 2016 to 2023 1-21-24). Fixed investment suffered into 2019, prompting the Fed to ease.

The fixed investment mix is currently very strong as of 3Q24 (see Fixed Investment in 3Q24: Into the Weeds 11-7-24). This raises the stakes on risk-reward symmetry if policies disappoint. The ability to put plans on hold and buy back shares or pay down debt is always an option. So is growing by M&A, which often is accompanied by layoffs.

The reality is that tariffs already roiled markets in 2018-2019. The new tariff strategy is slated to be higher and broader and will include a willingness to add more in as punitive measures for anyone who crosses Trump on deportation on a large scale or does not see the dollar as the reserve currency. Mass deportation is uncharted territory, and threatening countries with more tariffs who do not take back deported immigrants makes the event risk unpredictable around retaliation.

The above table updates the capacity utilization numbers across major manufacturing lines. We see MoM and YoY declines in Total Industry, Total Manufacturing, and in Durables. YoY declines are in place for both Durables and Nondurables. Mining and Utilities are also both down YoY.

As far as optimism at the manufacturing level in the stock market vs. optimism in the trenches for inventory and capex planning, the manufacturers cannot just say “less regulation and more M&A, let’s party!” The working capital cycle and capital budgeting game plan for 2025 requires consideration of these other variables where trade flows will have new economics tied to tariffs and currencies and labor costs. The super strong dollar is not helping the export themes. There will be much to sort through in 4Q24 earnings season and guidance as more specific policy details flow through.

The above table updates the larger industry group within Durables and Nondurables with 4 of the 5 Durables lines down and Motor Vehicles and Aerospace the weakest. Even with autos higher in Oct at the retail sales levels, the questions looking ahead are how to balance build rates and supplier chain risk management around tariffs as these questions loom large. There will be consumer demand questions with borrowing rates still high and potential price increases in vehicles if border issues with Mexico weigh on vehicle supply and tariffs. The theory was that financing demands for consumers would be more affordable in 2024, but the UST curve from 2Y to 5Y UST might not cooperate.

The potential for trade battles with Mexico raises the stakes on planning (see Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24). There is the chance of problems with Canada in the auto production chain and how Trump views the cross border production patterns (see Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24).

Last but not least, the growing base of production in the US and Mexico of EU brand vehicles and how those supplier-to-OEM chains function are not risk free to the supply-demand balance in US and how pricing and dealer stocking plays out (see Tariffs: The EU Meets the New World…Again…Maybe 10-29-24). The same is true for the Japanese OEMs, who have not seen as much noise on the tariff issue – yet.

The above chart updates the history of cap ute averages across expansions and recessions across time. We detail the current Oct utilization rates on the left at 76.2%. The history is an eye opener for highlighting how higher or lower cap ute levels do not always correlate with profitability trends. That is a function of the ability of many industries and companies to lower their unit costs (notably after the credit crisis) and lower their breakeven volume levels for a given product mix and price structure.

The challenge into 2025 will be gauging what effects tariffs have on the cost structure and what it means for pricing. Steel, semis, and components could all see tariffs. That in turn flows into what higher prices might mean for OEM volumes at a time when the breakeven rate is going in the wrong direction.

The above chart offers another vantage point for consideration in looking back across expansions and recessions and what the high and low moves were in cap ute across a range of economic cycles since the late 1960s.

See also:

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

CPI Oct 2024: Calm Before the Confusion 11-13-24

Footnotes & Flashbacks: Credit Markets 11-12-24

Footnotes & Flashbacks: State of Yields 11-11-24

Footnotes & Flashbacks: Asset Returns 11-10-24

Mini Market Lookback: Extrapolation Time? 11-9-24

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

All the Presidents’ Stocks: Beware Jedi Mind Tricks 11-1-24

PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24

Employment Cost Index Sept 2024: Positive Trend 10-31-24

3Q24 GDP Update: Bell Lap Is Here 10-30-24

The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

JOLTS Sept 2024: Solid but Lower, Signals for Payroll Day? 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Durable Goods Sept 2024: Taking a Breather 10-25-24

New Home Sales: All About the Rates 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Existing Home Sales Sept 2024: Weakening Volumes, Rate Trends Worse 10-23-24

State Unemployment Rates: Reality Update 10-22-24

Housing Starts Sept 2024: Long Game Meets Long Rates 10-18-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

CPI Sept 2024: Warm Blooded, Not Hot 10-10-24