Housing Starts Oct 2024: Economics Rule

Home starts show sequential weakness with total permits down, starts down, and completions down.

Emptying these out cannot be the housing plan…

Starts dropped to the lowest levels since July with total starts down by -3.1% from Sept 2024 and single family down by -6.9% from revised Sept numbers with the key South regional market down by -10.2% in single family. Single family completions were down as working capital is staying under control.

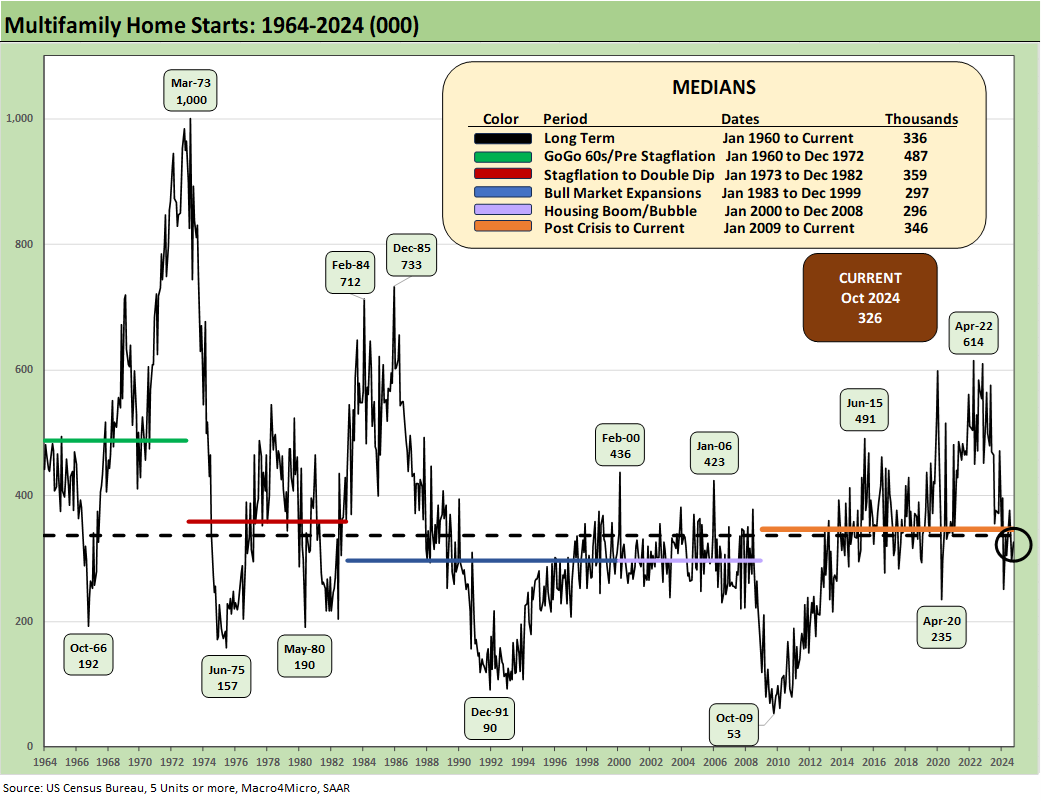

Multifamily ticked higher sequentially by +9.8% but is down by -12.6% YoY. Completions in multifamily were down by -9.0% but up by +61.4% YoY as Multifamily units under construction continued to decline to lows in Oct.

With mortgage rates going the wrong way and existing inventory still in semi-lockdown on embedded low mortgage rates (“golden handcuffs”), the path to material improvement in residential construction remains constrained.

We enter 2025 with amorphous plans around freeing up more federal lands, adding more residential space through deportation, and tackling regulations that are typically more state and local than Federal. It is not like there have not been plenty of red states to tackle these issues in the dominant South region that comprises over half the total starts. Tangible evidence of a real plan is hard to find.

The single family starts rate detailed above at 970K is below the long-term median despite much more demanding demographics today as new housing expectations remain under a cloud of uncertainty tied to mortgage rates. A side note that has not gained a lot of attention is how a trade clash could also flow into homebuilding and supplier chain strain. That would slow building cycles again.

The South comprises the majority of starts in single family and that just hit its second lowest month of the last 12 months below July. For the total starts level, the smaller decline was tied to a higher sequential move of +9.8% in Multifamily.

The above chart updates starts and permits in total and also for single family alone. This chart uses “not seasonally adjusted” metrics to get closer to the action in the trenches. The prior chart on single family starts was SAAR-based.

We see total starts down sequentially and for single family from Sept to Oct. The YTD NSA single family starts are higher by +9.3% while total starts NSA was down by -3.2% on the back of a -29.3% decline in Multifamily starts.

Permits were up sequentially for the month on an NSA basis for total permits, single family and multifamily. On a YTD NSA basis, total permits were down -1.9% while single family is up +9.4% but multifamily down -21.3%.

The regional breakdown for single family starts underscores the dominance of the South market (notably TX and FL). The above chart is on an NSA basis. The South and Northeast are down for the month while the West and Midwest ticked higher on NSA basis.

On a SAAR basis, the South was down by -10.2% but the #2 region in the West saw a +4.6% increase. The Midwest posted a +4.6% SAAR increase and the small Northeast markets declined by -28.7% SAAR in single family starts.

Multifamily starts were up by +9.8% sequentially from Sept 2024 levels but at 326K are modestly below the long-term median and well below that 1960-1972 boom.

The Multifamily permits level was down sequentially by -3.0% and by -20.9% YoY on a SAAR basis. Using Not Seasonally Adjusted (NSA) numbers, we see Multifamily permits down by -21.3% YTD. In contrast, single family NSA permits were up by +9.4% YTD.

See also:

Footnotes & Flashbacks: Credit Markets 11-18-24

Footnotes & Flashbacks: State of Yields 11-17-24

Footnotes & Flashbacks: Asset Returns 11-17-24

Mini Market Lookback: Reality Checks 11-16-24

Housing:

New Home Sales: All About the Rates 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Existing Home Sales Sept 2024: Weakening Volumes, Rate Trends Worse 10-23-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Housing Starts Sept 2024: Long Game Meets Long Rates 10-18-24

KB Home: Steady Growth, Slower Motion 9-26-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

Credit Crib Note: KB Home 7-9-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24