Mini Market Lookback: Extrapolation Time?

We look back at a week that was tumultuous for asset returns, the country and the world.

Rollo Tomassi just keeps on rolling…

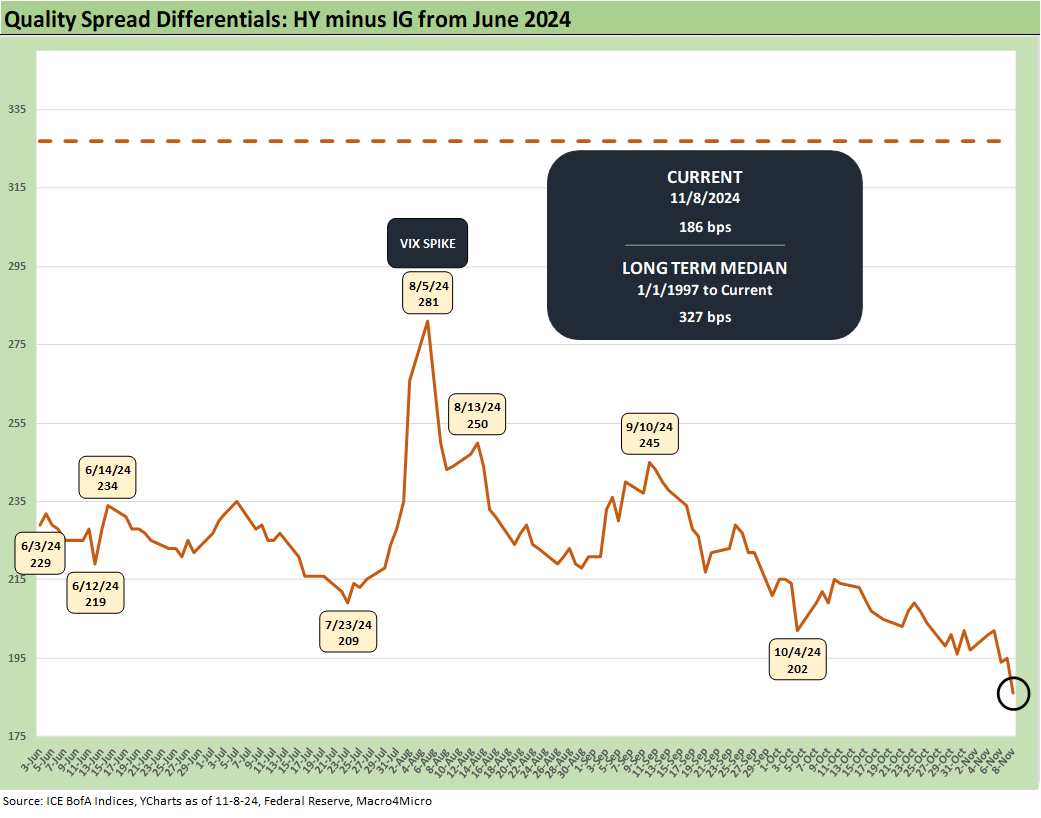

The post-election asset performance drove a great week in one of those “buy’em all now, sort’em out later” moments that showed all 11 S&P 500 sectors in the green, the NASDAQ at +5.7%, a monster rally in small caps at a dazzling +8.6%, and another tightening wave in HY spreads to June 2007 levels (see HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24).

The prospects for lower taxes and less regulation was an immediate catalyst as the market is apparently sticking to a combination of “he did not really mean it” on tariffs and “he will go easy on deportation” as their base case. These are the questions that will just need to play out. After Inauguration Day on Jan 20, 2025, we can roll into 4Q24 earnings season to gut check capex and hiring plans by companies.

Trump inherits a strong economy with low inflation, a strong and resilient consumer (see links at bottom), and a high base of fixed asset investment that is well above Trump’s last pre-COVID quarter in 4Q19 (see Fixed Investment in 3Q24: Into the Weeds 11-7-24). To top it off, the FOMC is easing. Positive economic momentum is Trump’s to lose with policy excess if he does what he said he would do.

While the Harris loss to Trump and the underlying trends revealed in the vote are very troubling for Democrats, the reality is the vote was close in the context of past elections (see Morning After Lightning Round 11-6-24). We look at some of the notorious Presidential beatdowns across time. Those elections make the 2024 election look tight. In the end, Trump’s vote tally was similar to 2020 (and a lot less than Biden got in 2020) while Harris saw almost 11 million less than Biden in 2020.

The comparison of Trump to Rollo Tomassi in the picture above ("the guy who gets away with it") was working the political circuit and talk shows for a while. The Trump inauguration will tee up waves of Jan 6 pardons for the violent MAGA mob who sacked the capital and served Trump’s desire to thwart the 2020 election. Many voters stopped caring after the inflation of 2022-2023 (see The Inflation Explanation: The Easiest Answer 11-8-24).

Asset returns cranked up…

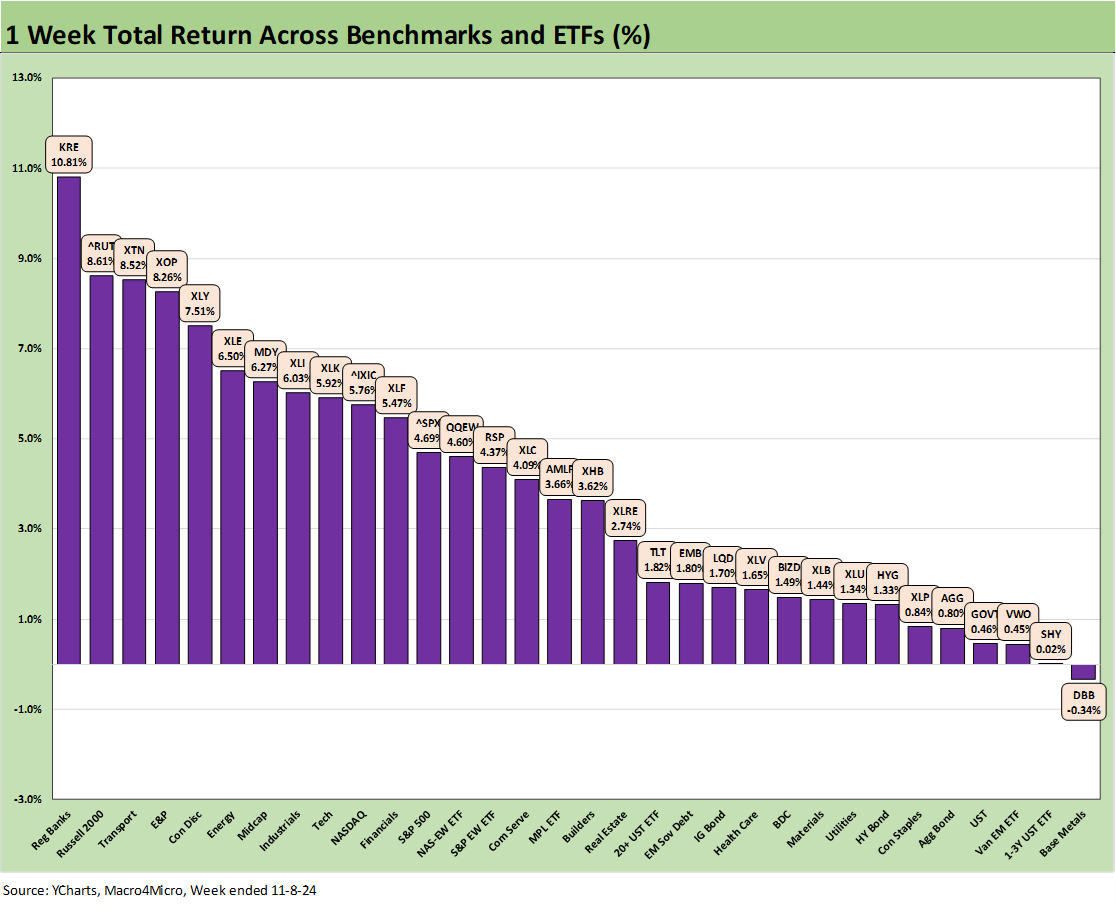

This is not the market’s first Conga Line of “buy all risk” and we just had another one last week. The above chart shows the 1-week returns on the 32 benchmarks and ETFs we track. We see 31 positive and 1 slightly negative. We see the entire top quartile above +6% returns with the #1 performer at +10.8% in the Regional Bank ETF (KRE) with small caps #2 at +8.6%, Transports #3 at +8.5% E&P (XOP) at +8.3%. Midcaps, Small Caps, and Industrials (XLI) along with the Regional Banks (KRE) reflect a level of cyclical confidence that is very hard for us to reconcile with the tariff plans as pitched by Trump.

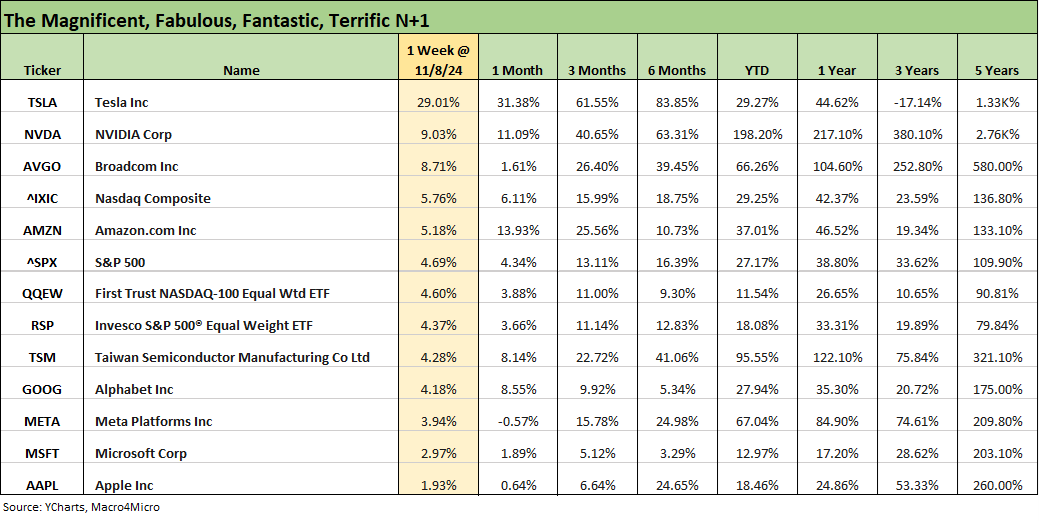

The only Mag 7 heavy line item in the top quartile is Consumer Discretionary (XLY) on the back of another banner week of the always volatile Tesla at +29%. The sense that Elon Musk is Trump’s kindred spirit (or his Rasputin?) is spilling into Tesla stock in part on the idea that Musk can leverage the massive conflicts of interest that get no shortage of headlines. The issue around what is in store for Tesla’s aspiring competitors in EVs and the Biden era incentives will be one of many topics.

Bond ETFs looked like they were heading for trouble initially and then rallied with the long duration UST ETF (TLT) leading the pack. The short duration UST 1Y to 3Y ETF (SHY) was sitting in second to last. We have a hard time getting into a comfort zone on extending duration on the combination of the tariff threat to inflation and earnings dilution, the deportation fallout for wages, and a US funding deficit that will soar in 2025.

The tech bellwethers had a great week with the election as a regulation-free spirit is in the air along with the potential for a clear road to engage in large scale M&A. The Info Tech sector of the S&P 500 was +5.4% on the week and the NASDAQ was over +5.7%.

The bellwethers above are comprised of the Mag 7 + Taiwan Semi + Broadcom. We noted Tesla’s off-the-charts week already. For the other bellwethers, all the lines were in positive territory this week after a bumpy few weeks. We see 4 of the Mag 7+ bringing up the rear this week with NVIDIA a solid #2 and Broadcom at #3. The rest of the pack is well behind with Apple on the bottom and weaker for the 1-month horizon. Meta is negative for the month and Microsoft is also lagging the group over the 1-month period.

The UST curve dynamics will get tricky…

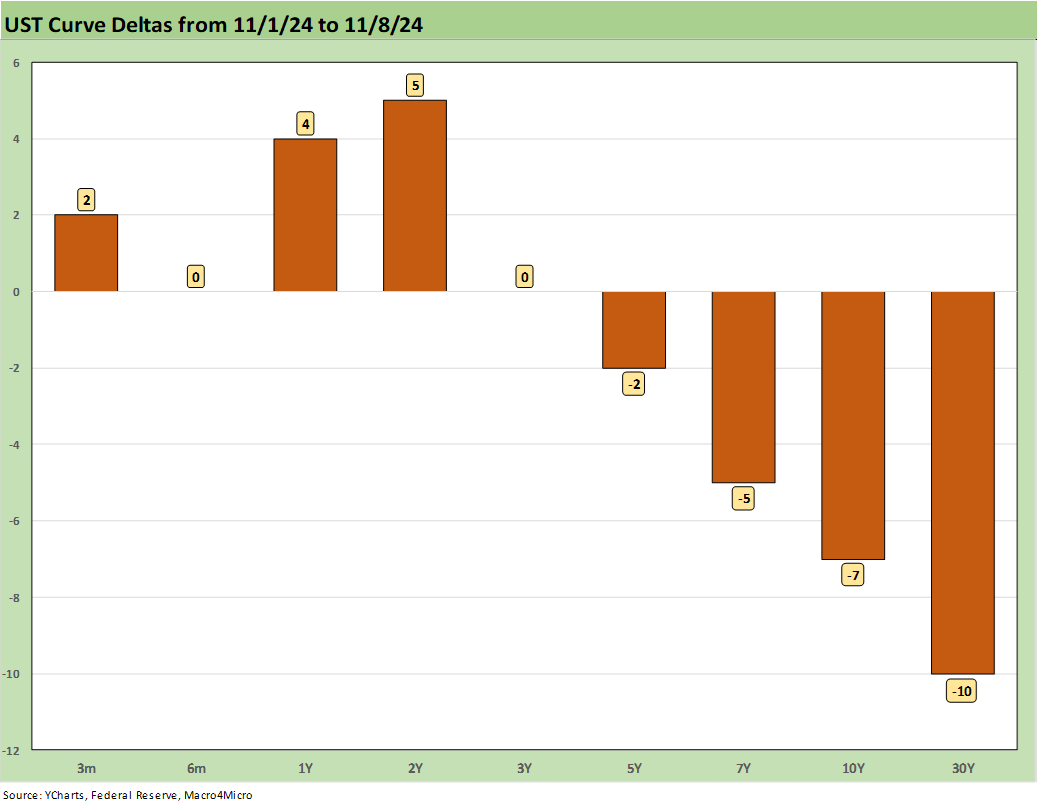

The UST was jumpy ahead of, during, and after the election with the 10Y UST running up by +16 bps when it was clear Trump was getting the brass ring. This past week saw an FOMC meeting as almost a minor sidelight, and the -25 bps FOMC easing came along with a tone that signaled more to come. We will get fresh CPI and PPI numbers this week.

As noted above, the close on the weekly UST deltas saw the long end levels lower and flatter from where it had ended last week. After an initial steepening beyond 2Y UST across October, the combination of the FOMC and the cushion built in since being around 3.6% before the Sept payroll shock still leaves the 10Y UST ending the week around 4.3%.

Looking ahead, the main event will be the world of tariffs in what action is actually taken (as opposed to just campaign jawboning) on mass deportation. The basic laws of economics in a strong economy with solid demand is going to bring a reaction. When a tariff cost is incurred that the buyer pays, it needs to be “eaten” or passed along (shhhh! don’t tell Trump). Prices will need to move and apparently already are moving in expectation as orders are being booked.

For deportation risk, the Stephen Miller Rail Express or his own version of the Bolt Bus (or is it “The Hate Boat”?) is teed up for the mass deportation of many people that are currently employed and many that are consumers. There will be some math and double-entry accounting reality that will weigh on some of the election season theories that were spun. Wages and prices used to be a focal point and will be again.

For tariffs, the internet was lighting up this week on how many people still did not understand tariffs and how that could end up as a rude awakening. If Trump does not go ahead as planned, it should be an economic relief, but he will take a lot of bad PR (he hates it when people make fun of him). So, we need to assume he is going ahead on China and Mexico aggression and soon enough on the EU.

The risk there is that a tariff attack on Mexico could tank the USMCA early and ahead of the scheduled mid-2026 review. Those are discussions for another day. We have covered the Mexico challenge in the past (see Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24). That is the #1 importer as a nation (EU is #1 as a bloc), and Trump started Election week threatening Mexico again specifically on the issue of tariffs and migration.

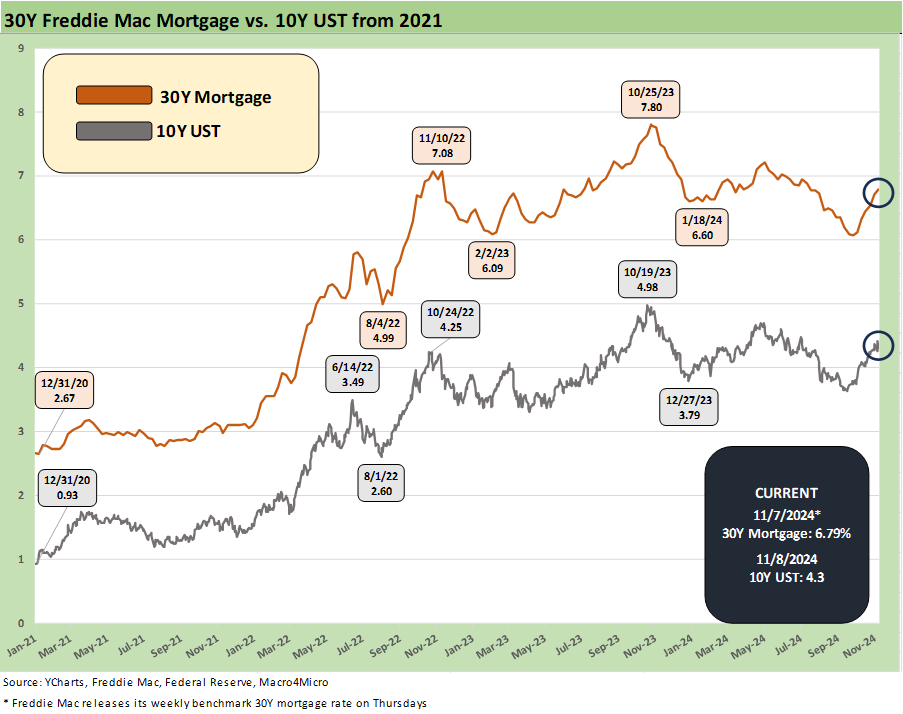

The above time series plots the 10Y UST vs. the Freddie Mac 30Y Mortgage Benchmark with the rate ticking higher this week on the Freddie mortgages to 6.79% from 6.72%. We were close to 6.0% in late Sept, so the good economic news has been the driver of rates that further undermines housing affordability. Tariffs on supplier chains will not help construction costs. We will not get a chance to test the theory that Harris was working on with respect to how to address supply, so we can just wait for how Team Trump will seek to address the supply challenge.

The NAHB checklist on how to improve the market backdrop for housing is there to put to work, but regulatory impediments do not get removed overnight and some are outside Federal control. We assume that there will be some tax plan offered that will help the supply side given the Trump tendency to run with “damn the deficits, full speed ahead” approach on business stimulus. We still have minimal specifics from Trump on housing. His main go-to theme is deportation as the key to more affordable housing. That will get put to the test and especially when so many construction laborers get deported also.

Risk pricing set for an eventual reality check…

HY spreads tightened -20 bps on the week while IG spreads narrow by -9 bps to below the +80 bps threshold at a Friday IG OAS close of +77 bps.

The “HY OAS minus IG OAS” differential kept the quality spread compression going this week at +186 bps or -11 bps tighter vs. last week. The +186 bps differential is -141 bps inside the long term median.

The “BB OAS minus BBB OAS” differential shows that the middle tier quality spread differential is -8 bps lower on the week to +60 bps vs. the long-term median of +135 bps.

One last note on the election…

Given the stakes and toxicity while entering Election Day with the sense of a dead heat, the numbers put on the board by Team Trump were impressive. The range and breadth of the Trump victory made it seem like a serious ass kicking. The reality is that the votes and differential numbers pale in comparison to the pain inflicted on the losing candidates in many past elections. That does not make the defeat less bitter, but a little context helps for perspective.

Trump got around the same number of votes that he got in 2020, but Harris got around 11 million less votes than Biden (the counting continues). Biden’s margin of vote over Trump in 2020 was around double Trump’s margin of victory over Harris. Of course, in MAGA Fantasy Land, only one of those elections was fair and free (that would be the election he won in 2024). Apparently, the deep state, Venezuelan techno-wizards, and the Italian satellites took the day off this year.

With a record number of immigrants arriving during the past 4 years, one would have thought the deep state could turn out the Haitian and Congolese votes Trump and Mike Johnson kept talking about. Especially since the Democrats were actually in power this time. Time for a little logic people? Nah.

A sampler on what a real butt whuppin’ looks like…

For those who might overstate the nature of Trump’s victory (even if just because a majority for Trump in popular votes is like a Loch Ness team photo with Sasquatch), we look at some samples of lopsided wins below:

Nixon slams McGovern in 1972: This was a 49-1 state votes and was one to watch from my seat in high school. This election was just before Nixon carpet bombed Hanoi and North Vietnam during Christmas, so times were tense. Nixon won the electoral vote 520-17 and carried the popular vote by 18 million votes, or by 23% at 47.2 million to 29.2 million (note: that was a long time ago and a much smaller voting population). On a side note, the Democrats were back in power in after the 1976 election.

Reagan in 1984 crushes Mondale: Reagan posted a 49-1 win in states at 525-13 in electoral votes. The popular vote differential was around 17 million votes or by over 18%. Now that is a beatdown. Mondale only carried his home state. Reagan was at the helm in 1984 when the highest annual GDP growth of the last 50 years was generated at 7.2%, by far the highest during the Carter to Biden period and over double the best year in the new millennium with the exception of the Biden 2021 post-COVID rebound year (see The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24). Trump’s best year was his only 3.0% year in 2018 during what he has called his “economic miracle” and “greatest economy in history.”

Johnson in 1964 nukes Goldwater: We say “nuked” since Johnson arguably started the age of ugly political advertising with the “daisy ad.” (I recall everyone talking about that on the school bus). Johnson took 44 states vs. the 6 states carried by Goldwater. Johnson carried the popular vote by almost 22.6% or over 61% of the vote with a 16 million vote margin of victory. Goldwater carried his home state of Arizona and 5 southern pro-segregation states angry at Johnson’s position on Civil Rights (SC, GA, AL, MS, LA). In other words, Goldwater carried the Klan vote and the pro-disenfranchisement vote, but Johnson pulled out his home state of Texas. In retrospect, it was extraordinary to see a Texas Democrat losing so much of the “confederate vote.” That set the table for Nixon’s cynical “Southern Strategy”.

Obama in 2008 trounces McCain: It is tough to rival these earlier smashmouth elections in margin of victory, but Obama beat McCain by almost 10 million votes (9.6 million) or by a margin of over 7%. That margin of victory is more than double the Trump margin of victory over Harris. Biden’s margin of victory in the popular vote was almost double Trump’s over Harris (with counting continuing). Given the realities of the post-Civil Rights South and political balance of the nation since Johnson’s term and the arrival of Nixon in 1968, many Southern states are impossible for the Democrats. We have seen a few exceptions with a few stray victories by centrist Southern Democrats (Carter, Clinton). Obama also took Florida and carried Indiana, which last voted for a Democrat (Johnson) in 1964. For Indiana, Obama was the last time (and may remain that way).

See also:

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24

Footnotes & Flashbacks: Credit Markets 11-4-24

Footnotes & Flashbacks: State of Yields 11-3-24

Footnotes & Flashbacks: Asset Returns 11-3-24

Mini Market Lookback: Showtime 11-3-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

All the Presidents’ Stocks: Beware Jedi Mind Tricks 11-1-24

PCE Inflation Sept 2024: Personal Income and Outlays 10-31-24

Employment Cost Index Sept 2024: Positive Trend 10-31-24

3Q24 GDP Update: Bell Lap Is Here 10-30-24

The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

JOLTS Sept 2024: Solid but Lower, Signals for Payroll Day? 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Durable Goods Sept 2024: Taking a Breather 10-25-24

New Home Sales: All About the Rates 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Existing Home Sales Sept 2024: Weakening Volumes, Rate Trends Worse 10-23-24

State Unemployment Rates: Reality Update 10-22-24

Housing Starts Sept 2024: Long Game Meets Long Rates 10-18-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Retail Sales Sep 2024: Taking the Helm on PCE? 10-17-24

Industrial Production: Capacity Utilization Soft, Comparability Impaired 10-17-24

CPI Sept 2024: Warm Blooded, Not Hot 10-10-24

HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24