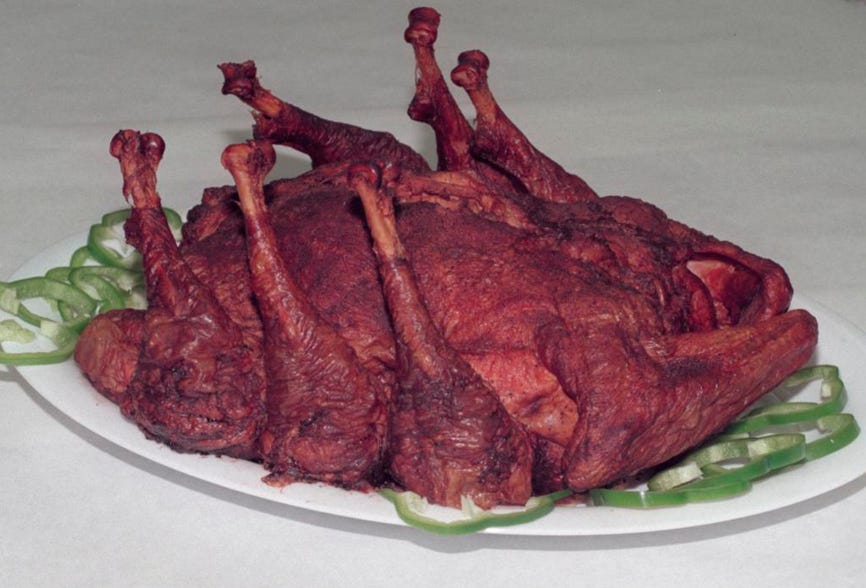

Mini Market Lookback: Tariff Wishbones, Policy Turduckens

Favorable UST variances and happy equity markets came even as Trump dangles 25% tariff threats on the two largest trading partner nations.

Some choices look better from a distance but should be avoided…

A very favorable weak for both duration and equities saw 10 of 11 S&P 500 sectors in the green along with the NASDAQ, Dow, and Russell 2000 all positive on the week. The curve rally pushed long duration bond ETFs into the top tier of performers.

The flurry of rationalizations to raise hopes for economic sanity in tariffs include

“it is just a negotiating tactic” and “he does not really mean it,” but the top 3 trade partners named in the Truth Social threat – Mexico, Canada, and China – need to look at all potential outcomes as the clock ticks down to the Jan 20 inauguration.The threat of 25% tariffs aimed at the #1 trade partner nation (i.e. ex-EU trade bloc) and largest importer (Mexico) and the largest export market (Canada) was accompanied by an updated threat to China. This all made for heightened debates on what could happen but with more focus on what would happen.

The favorable handicapping of “what would happen” and related industry-level odds-making still carries the day as the market in no way reflects the darker scenarios and multiplier effects that would come with 25% tit-for-tat.

The worst headline was Trump’s idea of including Canadian oil in the tariffs in what would be the most inflationary action possible and would certainly invite aggressive retaliation.

The week was eventful for the headline-generating power of Trump and his creative use of Truth Social to set policy debates aflame even before he has any legal authority. The threat to slap 25% tariffs on Mexico and Canada thus begins the next stage of the adventure (see Tariff: Target Updates – Canada 11-26-24, Tariff: Target Updates – Canada 11-26-24).

Asset returns stuck with optimism on the outcomes as the market saw a 29-3 score in the positive vs. negative count across a banner week for stock returns and duration in bond ETFs. We will look in more detail and across more time horizons in our weekly Footnotes publication on asset returns.

Among the more notable performances was the long duration 20+ Year UST bond ETF (TLT) coming out on top at #1. The other bond ETFs were spread around with the longer duration IG Corp ETF (LQD) also in the top quartile. The second quartile included the EM Sovereign ETF (EMB), the AGG and GOVT while the HY ETF (HYG) and short duration UST (SHY) ranked in the bottom quartile. The top quartile saw winners in income-heavy and interest rate sensitive equity ETFs such as Midstream Energy (AMLP), Homebuilders (XHB), and Real Estate (XLRE).

Tech was mixed with the Tech ETF (XLK) and Equal Weight NASDAQ 100 ETF (QQEW) in the bottom quartile while the NASDAQ was positioned in the third quartile. As we cover below, the MAG 7+ saw diverging performances this week.

Tech performance mixed…

The above chart updates the weekly tech bellwethers in descending order of total return for the week. We look at the Mag 7 + Broadcom and Taiwan Semi against the noted benchmarks. The tech leaders posted a mixed week with 5 of the Mag 7 holding down the top 5 spots while NVIDIA and Tesla were in the red.

Tariff quandaries and game theory assumption dependency…

The tendency of talking heads and longer time horizon investors to look past the specific facts and economic effects of the narrow policy proposals has been a practice across the fall season whether in the election or with respect to Trump’s broader talking points. The game plan for many has been to embrace the mitigated version of the policy that will come on the other side of the final decision.

For game theory at this level of uncertainty, gauging the reaction of the trading partners to such economic attacks is subjective and the risks are not showing up in pricing at this point. The currency markets are operating differently than credit risk and US equities despite some clear selloffs in the auto sector. The targets are seeing their currencies suffer and that flows into the economics of the tariff analysis in some cases. That currency wildcard is discussion for another day as we saw when Ryan/Brady proposed the border adjustment taxes in 2017 (way back when the GOP called tariffs “taxes”).

Since these latest tariff threats tie into immigration and fentanyl, the issues are somewhat different than the “reshoring” and “reindustrialization” priorities that are a long shot and only come at a multiyear (and multicycle) lag. This latest gambit is tied more into the mass deportation priority around where those migrants seized will be “shipped.” Maybe this is just a signal and pretense to warn Mexico and Canada to clean up their borders now, tighten security, and don’t mess with Trump’s social priorities.

As detailed below, we have a few immediate takes based on the trade flows and the tone of the headlines and political commentary.

Canada presents a wide range of domestic political factors…

We will look at the Canada issues in a separate commentary. We were digging through the headlines and political leader soundbites this week in the Financial Post and the Globe and Mail, and it is important to remember that 2025 is a Canadian election year, and Canada has more than its share or hard right vs. hard left political clashes. There are also some deep differences of opinion on immigration and borders and how to satisfy Trump. That said, Canadian hardball politics is still “AAA ball” vs. the US, which is the major league for hatemongering, political psychosis, and its legions of theocratic freaks taking it up a notch in the mass deportation program.

In Canada, there is no shortage of political pressure for immigration reform and adding resources. That is not only considering the state of immigration in North America broadly, but also given the potential for waves of reverberating effects and dislocations as Stephen Miller and his Merry Band of xenophobes go into what they have billed as a “shock and awe” policy. The risk of uncontrolled migration from the US into Canada is reason enough to get more aggressive on borders and make those efforts a variation of kissing Trump’s “ring” (to keep this G -rated). Maybe Trump will use effort by Canada to pause the 25% threat.

The flavor of articles in Canadian press since the threat has been extensive with diverse views, but the bottom line is the goal of taking every step to avoid what would be a crushing blow to Canada’s economy. After all, Mexico is Trump’s main target. China is a close second.

If action is taken and Trump still “sticks it” to Canada, the trade war would impact some states in the US more than others, but inflation and weaker GDP is a certainty. States with Canada as the #1 export market include critical swing states such as Michigan, Wisconsin, Pennsylvania, and Minnesota. Canada is the #1 export destination for Indiana, Ohio, and Iowa as well. A wider retaliation from the two largest trading partners and the death of NAFTA/USMCA would inflict serious pain ahead of US midterms and put the House (at the very least) at risk.

Canada is the easier one in many ways given the difference in the threat. As detailed in one Globe and Mail piece, the Northern border reportedly had immigrant “encounters” (attempted migrant crossings away from approved locations) that were less than 2% of the Southern border. For fentanyl, the poundage seized was cited at less than 0.2% of the total seized by the US with 96% at the Southern border.

Mexico: #1 import nation, #2 export nation…

We looked at the mix of imports and exports and some of the trade mix for Mexico already (see Mexico: Tariffs as the Economic Alamo 11-26-24, Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24). The main threat is to autos with so much supplier chain and OEM assembly taking place in Mexico. We refer you to the links herein for the relative mix by OEM and models. Such tariffs would be very bad news for the operations of the legacy Detroit 3 (esp GM) but also for Nissan in Mexico and Volkswagen in Mexico. Nissan is already revisiting some of the financial horrors of the past, and VW is getting pounded at home and abroad.

As always, it all flows downhill from the OEMs to suppliers, who will take a beating on volumes as well as tariff-related disruptions. Financial stress on volume risk and unit costs from tariffs also often spread to OEM production scheduling and disruptions along the tier 2 and 3 suppliers from financial turmoil and liquidity problems. That is not factoring into Team Trump thinking. These are downside scenarios that you cannot simply ignore.

There are paths to serious trouble even if being heavily discounted in pricing as highly unlikely. For example, imagine if both Canada and Mexico as the #1 and #2 export markets retaliate in kind? Meanwhile, China could start retaliating on the ag sector again plus has a lot more in the arsenal to undermine critical exports from Tech to Pharma. If such scenarios were not there, Canada would not be so quick to throw Mexico under the bus. That was in the political discourse this past week.

The UST rally gets fresh life…

The above chart updates the UST deltas on the week. That move was a bull flattener that reverses some of the bear steepener of recent periods. With another -25 bps expected from the FOMC in Dec, the front end inversion could keep getting whittled down on the way to something resembling flat depending on whether the 10Y can push back to the Sept rally lows. We will look in more detail at the yield curve action in our Footnotes publication on the state of yields later this weekend.

The above chart updates the running 10Y UST and Freddie Mac 30Y Mortgage rates since the beginning of 2021 when ZIRP and record low mortgage rates ruled the markets. This week’s rally in the 10Y was covered earlier and this chart adds a minor downtick by Freddie to 6.81% from 6.84% last week. The mortgage setbacks are a long way from the Sept lows that were closer to 6.0%. Mortgage rates remain a headwind for existing home sales and a market reality that requires continued incentive programs from the homebuilders.

HY saw spreads move wider by +11 bps this week to +272 bps or still in the June 2007 and late 1997 zone (see HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24, HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24). The +272 level is a very long way from the +465 bps median.

The “HY OAS minus IG OAS” quality spread differential widened by +9 bps on the week to +190 bps but is still starkly compressed to the +327 bps long-term median.

The “BB OAS minus BBB OAS” quality spread differential widened by +7 bps on the week to +65 bps from last week’s +58 bps. The long-term median of +135 bps is double current levels.

See also:

PCE Inflation Oct 2024: Personal Income & Outlays 11-27-24

3Q24 GDP Second Estimate: PCE Trim, GPDI Bump 11-27-24

New Home Sales Oct 2024: Weather Fates, Whither Rates 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Footnotes & Flashbacks: Credit Markets 11-25-24

Footnotes & Flashbacks: State of Yields 11-24-24

Footnotes & Flashbacks: Asset Returns 11-24-24

Mini Market Lookback: Market Delinks from Appointment Chaos… For Now 11-23-24

Credit Crib Note: Ashtead Group 11-21-24

Existing Home Sales Oct 2024: Limited Broker Relief 11-21-24

Housing Starts Oct 2024: Economics Rule 11-19-24

Mini Market Lookback: Reality Checks 11-16-24

Industrial Production: Capacity Utilization Circling Lower 11-15-24

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

CPI Oct 2024: Calm Before the Confusion 11-13-24

Mini Market Lookback: Extrapolation Time? 11-9-24

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

Employment Cost Index Sept 2024: Positive Trend 10-31-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

CarMax: Why Do We Watch KMX as a Bellwether? 10-3-24

On trade:

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23