The Curve: Slopes Can Get Complicated

The FOMC and markets need more signs and data input with the odds of easing plunging.

The UST curve should be entering an exciting period from now until the next FOMC meeting on Dec 9-10 as the government moves back into economic release mode on payrolls, CPI, PPI, PCE (and Income and Outlays), Retail Sales, Industrial Production, and Durables among a raft of other data sets in key areas such as Housing and Trade.

The conspiracy theories will be running loose if the BLS and BEA stall too long on data updates and feed theories around top-down pressures. One worry is that the fear of institutional survival could influence the stewardship of data in the age of Project 2025.

With the recent plunge in odds for an FOMC cut at the Dec 9-10 meeting, the recent inflation numbers and steady macro story line as reflected in corporate earnings make a tough case for the doves unless payrolls get hit hard.

The Dec SEP report and dot plot will beg a lot of questions as to how the FOMC operated with limited data to update forecasts.

NOTE: The chart above and those that follow update our rolling review on the state of yields. We break some sections into two parts: “Recent Trends” and “Historical Context.” The historical context is more about background, memory joggers, and for new readers. The recent trends is a quick summary of the recent UST action.

Recent Trends:

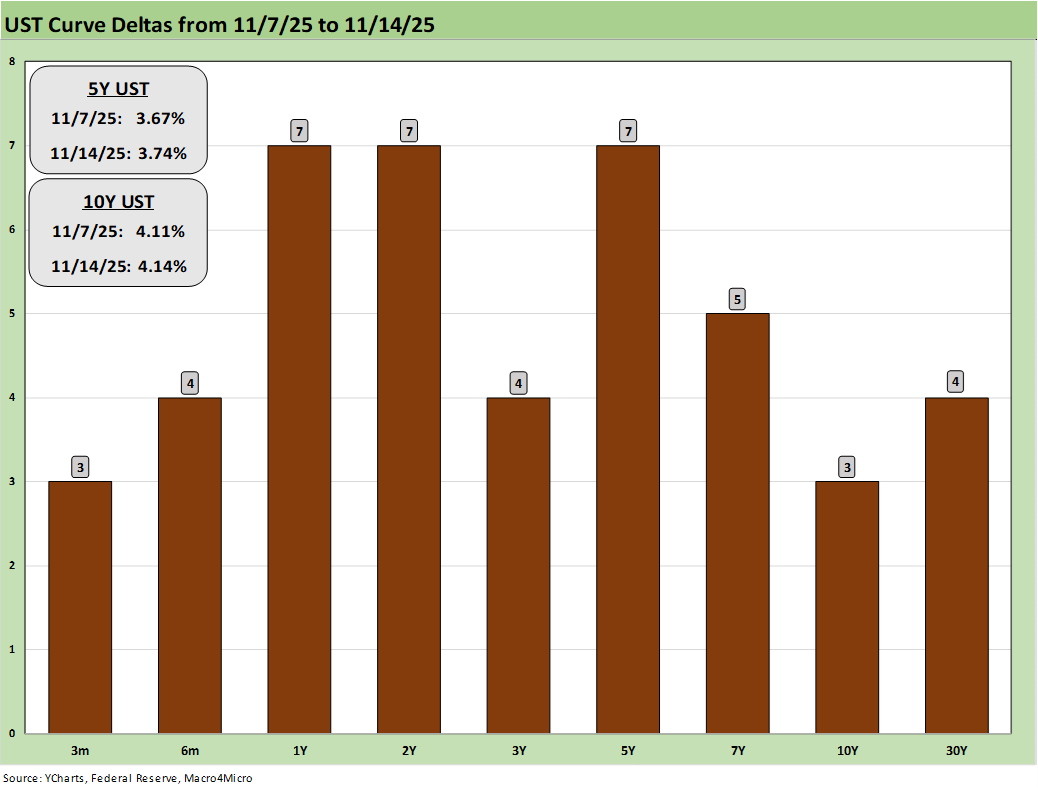

The past week saw 6 of 7 bond ETFs in negative return range (see Market Commentary: Asset Returns 11-16-25). As we cover in the UST deltas further below, the UST curve worked against duration and hit bonds. Mortgages remain stubborn and the oddsmakers are continuing to reduce the odds of even a -25 bps cut in December. At last check, FedWatch was at just over 45%. In last week’s commentary, FedWatch had dropped from over 94% (10-27) to 62%.

With the government reopening underway, economic data releases will be back in action. It is unclear how quickly data will be available and how timely the data will be for payrolls, CPI/PPI, PCE Inflation (with Income and Outlays), and 3Q25 GDP line items (notably Personal Consumption Expenditures and GPDI Investment lines). Many data points have been MIA since August data releases with the Sept CPI the most important of the limited information so far.

With a critical FOMC meeting ahead in December 9-10 with the full dot plot and SEP reports etc., the need for more data is clear enough but it is unclear what will be provided and what gaps will limit the visibility. We assume there will be more information forthcoming this week. Some level of distrust is justified around what the Project 2025 crowd has up their sleeves in managing data and moving ahead with their stated desire to overhaul and restructure the data services. Our working assumption is that the initiative will be centered on downsizing and tighter control.

Historical Context:

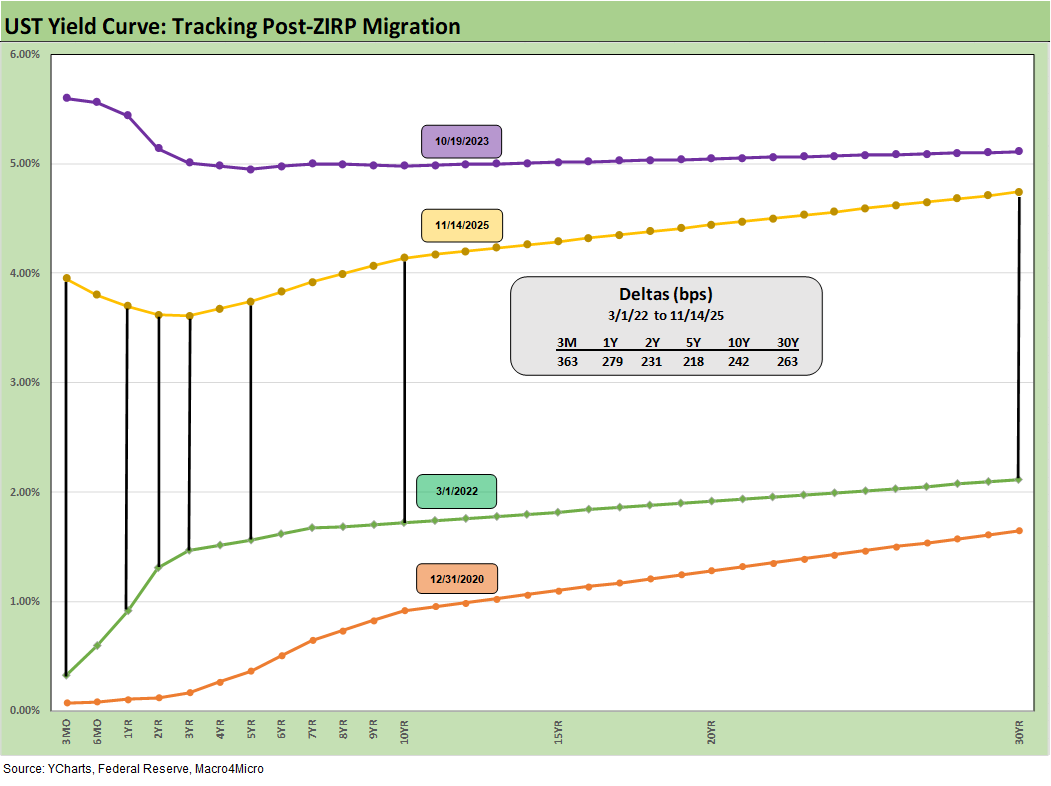

The above chart overall helps give historical context to the level and shape of the current yield curve vs. a range of market backdrops. The curves are plotted across some historical economic expansions and in some cases pending turns in the economic and/or monetary cycle. They are worth pondering for compare-and-contrast purposes since they mark key transition points in cycles and market risk backdrops. In some cases, the timelines included bouts of dulled risk senses and occasional valuation excess (notably 1989, 2000, 2006).

Highlights across monetary journey…

The last time a stagflation threat had to be considered was after the Carter inversion of 1978 indicated above. The stagflation threat then showed up in force by the Dec 1980 curve after a peak Misery Index of 22% in June 1980 and Volcker was in full swing trying to break inflation.

Another useful period to ponder is the TMT cycle faltering in 2000 on the way to a massive Greenspan easing in 2001. The current cyclical tech boom and valuations cannot escape looking back at the late 1990s. That period saw credit markets under pressure in 1999 and creeping up on 6% HY default rates, but that did not stop the NASDAQ from printing an 86% total return year in 1999 on the way to a March 2000 peak (see UST Curve History: Credit Cycle Peaks 10-12-22, Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22, Yield Curve Lookbacks: UST Shifts at Cyclical Turns 10-16-23).

That late 1990s period offers another case study in excess across equity and credit markets with the peak in 1999 (credit) and NASDAQ (2000). The TMT bubble bursting soon led to excessive easing by Greenspan in 2001 and then into early 2004, in turn setting the table for the housing bubble peak in 2006. During the 2004 to 2007 period, leveraged derivative exposure and structured credit was out of control and counterparty risk was soaring. The good news is that currently the credit markets and banking/dealer systems are sound unlike 1999 and 2007.

Private credit and rating agencies “working hard for the money” will bring some scrutiny, but the investors still face the obvious obligation to conduct their due diligence. As an analyst who started in private placements at Prudential in the early 1980s, there was plenty of focus on due diligence and covenant structure. Many of those analysts on “privates” team migrated to HY bond business lines.

“Private Credit” as a concept thus is not new but is traveling a different structural path now with new participants and AUM gathering. The silver lining of the opaque process is that some of the “smartest guys in the credit business” are driving it. They want the market to grow (by trillions) and being prudent about it now makes more sense than not. Assuming a cockroach festival still seems like extrapolation run amok. As always, there will be dogs. That is intrinsic to the process.

Passing across the distortion years…

The chart above jumps from 2006 to 2023, which takes the market beyond the crisis period and the ZIRP years and COVID. Both the post-credit crisis period and later COVID crisis prompted the Fed to deliver a wave of market liquidity support and confidence building programs that helped save the capital markets, reopened the credit markets, reduced refinancing risk anxiety, and reduced the contingent liquidity risk profile of the banks.

The credit crisis period from late 2008 to COVID in 2020 brought plenty of QE and normalization distortions to the yield curve shape. The Fed’s dual mandate made that possible. The market could soon face new legislative threats to the Fed in 2026 that seek to reel in the dual mandate. In addition, the new “Fed head” in 2026 is likely to do whatever Trump demands. That topic of sweeping regulatory change at the Fed is based on commentary from Bessent and mirrors plans discussed in Project 2025 (See Chapter 24). That will be a topic to tackle as we get closer to those ideas coming into play.

Recent Trends:

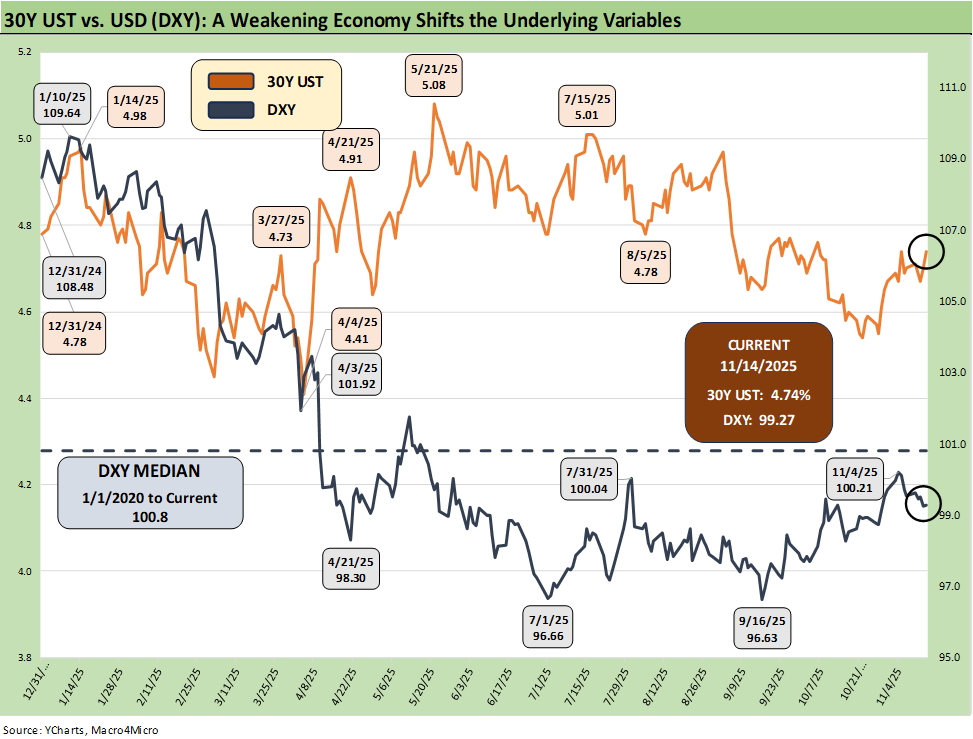

The above chart plots the recent trends in the 30Y UST vs. the dollar index (DXY) as the US dollar weakness throws another risk variable into the picture and poses a major risk factor for non-US buyers of UST.

This past week saw the dollar weaken to 99.27 from 99.56. Lower rates have been a contributing factor to weakening in 2025 as was the continued government shutdown. Recent dollar action and commentary are not signaling a hyper easing move yet – at least until Trump gets “his guy” in the seat in the spring of 2026 and more like-minded people in leadership positions.

Inflation trends and a more visible hawkish element in the FOMC are also diluting Trump’s aggression against Powell. The market is also pushing back on the idea that inflation or stagflation does not remain a very real threat. The revised SEP and dot plot should be interesting with the Dec 9-10 meeting.

The UST price action out to 30Y from last week posted a relatively mild move of only +4 bps vs. +3 bps for the 10Y and +7 bps for the 5Y UST as highlighted in other charts below. The reality is that a UST steepener remains a threat with inflation not easing and UST supply pressures remaining higher across the longer horizon despite the tariff revenue.

This weekend, Secretary Bessent clarified that Trump’s $2,000 tariff rebate for “not rich” people would require new legislation by Congress. That $2,000 check needs a total at some point based on the planned criteria, but it will be measured in hundreds of billions. Estimated total cost of the tariff rebate is all over the map. We see as high as $600 billion (source: Committee for a Responsible Federal Budget). We have seen others at $100-$300 billion.

The IEEPA case awaits a decision from SCOTUS in coming weeks. A setback on IEEPA would not help the technical supply-demand picture but would ease some inflation fears. Tariff “refunds” in theory would be a windfall recovery to those who paid those tariff fees to customs. The approach the ruling will take is anything but clear.

On the other side of the risk checklist, trade partners might be more emboldened (or less cowed) if SCOTUS removed Trump’s ability to drop triple-digit tariff threats with every mood swing. In a twist, that might increase the risk of retaliation. Trump still has Section 301 tariffs and Section 232 in his arsenal if he loses the SCOTUS case.

Historical Context:

Team Trump loves to speak of record tariff revenue as if the word “record” makes it a good thing when it comes out of US consumer and corporate pockets. If you want to create a recipe for stagflation, that would be the easiest recipe book to pull from. Just add record deficits and a weaker dollar from the spice rack that makes the tariff even higher at the border. We continue to see very negative color on tariffs from small business trade sources.

Tariffs hit prices or profitability – there is no hiding from the tariff expense paid to customs by the buyer/importer. Resulting expense offsets could create layoffs or slow hiring and potentially reduce expansion by companies who get hit on the cost line. “Tariff cost mitigation” actions are a new part of many earnings calls.

The currency challenge…

The dollar has gone through its worst pounding in 2025 since the 1970s during the dark days of stagflation and multiple deep recessions. Lower rates could be a catalyst for more dollar weakness while political risk factors and governance quality should now be factors in the US sovereign credit quality assessment. The flip side is that rates and inflation metrics may not cooperate with baseline scenarios. In a world where everyone is a borrower, someone has to be the lender.

Record forward-looking deficits and the optics of political instability adds a negative element to the sovereign risk profile of the US that no rating agency would have the courage to flag. The latest assault on free speech and Trump’s threat to arrest people who accuse him of being against free speech is not without its humor and twisted irony (“Call me a fascist and I will arrest you”?!?). Tossing around the Insurrection Act is anything but reassuring to political stability and broader economic confidence. Demanding Federal monitors of select Blue state elections handpicked by Trump is not a Founding Fathers moment. States run election rules – not the White House.

The latest shutdown handily beat Trump’s 2019 record, and the headlines around Epstein files adds to the dysfunction of Washington functionality. The political goal could be to inspire more “Hatfields vs. McCoys” division and “team loyalty” and head off the move to force the production of the Epstein files.

Unlike in the Senate, the House leader Mike Johnson had refuses to swear in the deciding vote (a special election Democrat) or bring the House back into session until the shutdown is over. That vote could be teed up this week. The intent in Washington is clear. Make the clash uglier and hopefully peel off some support to block the Epstein files evidence demands.

The recent shutdown has been one more case of “politics = policy = economics” as services and payrolls can be decimated. It also blurs performance attribution in framing and evaluating Trump macro policy (notably tariffs). Construction projects get delayed, investments stall, and both federal and private sector payrolls can get hit. To add to the problems, this latest shutdown came at a time when economic data was critical.

With health care costs soaring (notably ACA premiums) and SNAP recipients essentially thrown under the bus during the shutdown with more of them in the “criteria crosshairs” the lower income consumer and subprime quality could be in for a very ugly period ahead.

Recent Trends:

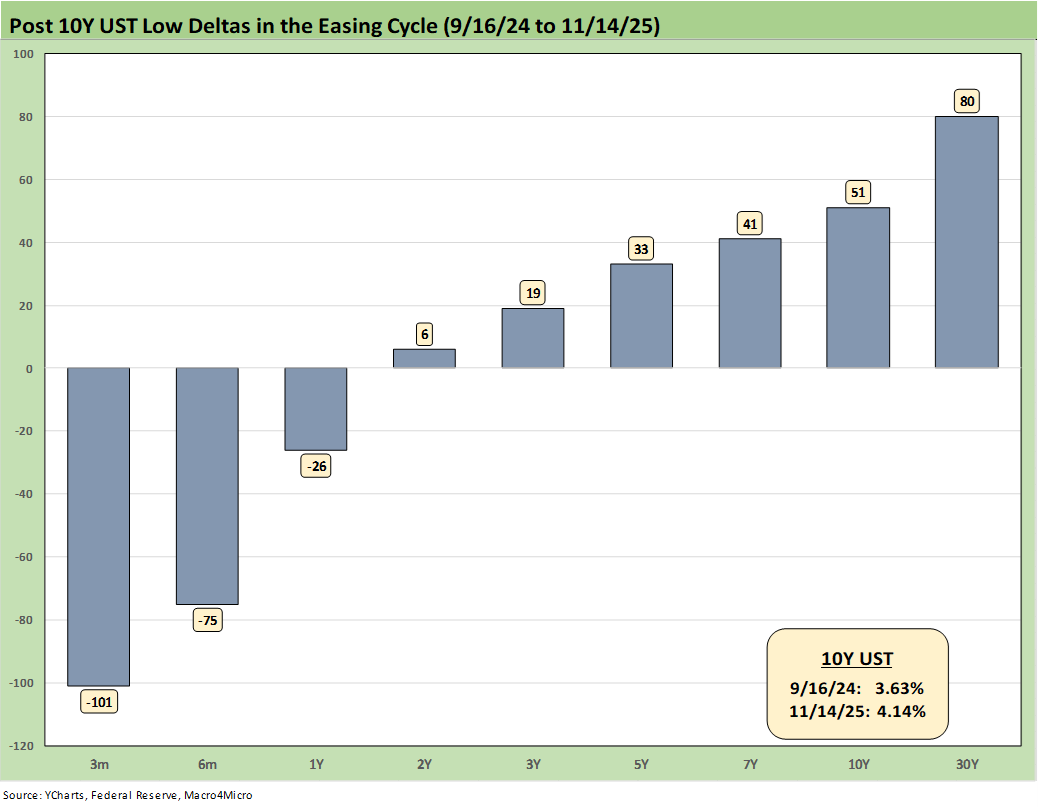

The above chart updates the post-easing shift and gives some context to the last major easing in Sept 2024. The current curve has not yet followed the Sept 2024 shift into a bull flattener with the lower fed funds, but we saw some intermittent signs of a rally in the 10Y UST to below the 4.0% line (well above the 3.6% lows of Sept 2024) before the10Y moved higher again. On Friday, the 10Y closed at 4.14% or +3 bps on the week. The rally after Sept 2024 was brief and soon gave way to a bear steepener. We are at a critical juncture for this latest 4Q25 easing sequence.

We saw the entire curve move slightly higher this week as hopes for another cut diminish. The 30Y has held up and declined less across the bull steepening of 2025. The long bond (30Y) chaos in various countries has kept global investors on edge since the supply-demand concerns for UST funding are not going away.

Historical Context:

The above chart frames today’s rates amid the wild ride from the Oct 2023 peak (10Y UST) down across the bull flattener into year-end 2023 and then into the easing actions and rally of Sept 2024. Then came the ensuing bear steepener that is evident in the journey to November 2025. We break out some numerical UST deltas in the box.

The UST experience in the period after Sept 2024 and the -50 bps in cuts (followed by another two cuts in 4Q24) will loom large in memory banks. This chart reminds us that the “ease and flatten” shapeshifting pattern is hard to rely on in a market where the supply-demand of UST is tenuous, and tariff impacts are hard to predict.

Fed easing and the flattener vs. steepener debate…

There was a lot of bear steepener action from the end of 2023 into the summer of 2024 and fresh bouts of the same after the big rally in the fall of 2024. The Sept 2024 easing gyrations will make it hard to take much for granted this time after Sept 2025 with much higher, sweeping tariff policies and an ongoing debate over a cyclical slowing in the mix of variables. Payroll weakness and slower consumption and demand would help the short end, but the 10Y UST move is more complicated. We still expect 2026 to bring a 3M to 10Y steepener with a lower short end and a stubborn long end.

Historical Context:

The above chart just updates where the current UST curve stands relative to the Dec 2020 UST curve on the low end and the 10-19-23 highs after the tightening cycle went into effect in March 2022.

Recent Trends:

The above chart updates the 1-week UST deltas, and we see the UST curve flatten slightly from 2Y to 30Y. We look at 2Y to 30Y slope history further below.

Only time will tell how the lack of macro data and decidedly cautious FOMC will move in the Dec meeting. As discussed above, the plunge in the odds of a Dec 2025 cut at FedWatch to 45.8% highlights the state of confusion right now.

We will be curious to hear how the FOMC considered the relative lack of data with the upcoming meeting. We’ll keep our ears open for comments by Fed members, especially those already cautioning against further easing in the face of tariff uncertainty. The “hawks” are getting noisier, and they of course need to ponder the recession risk vs. the goods affordability challenge.

One big line item – health care insurance – is all over the headlines at this point as the market considers the multiplier effects beyond the big tax bill (Medicaid cuts) and the pending ACA premium spikes. Week-to-week paycheck subsistence and household budgets can get roiled quickly.

Recent Trends:

The above chart updates the YTD UST deltas. We see how the bull steepener has paid off for bond returns in YTD 2025 with the 7 bond ETFs we track all in positive return range YTD (see Market Commentary: Asset Returns 11-16-25).

Recent Trends:

The above chart updates the running UST deltas from the recent low point in the post-tightening cycle reached in Sept 2024 (9-16-24) when the 10Y UST (10-19-23) dipped to 3.6% around the first -50 bps easing. At the very least, the 3.6% on 10Y UST (after the Sept 2024 easing) offers some hope to the UST flattening bulls. Of course, that flattening did not last.

The 4.14% from the Friday close underscores the stubbornness of the long end as the FedWatch expectation for 1 more cut in 2025 has plummeted. The expectation of weaker payrolls is still in place with the on-off color from ADP. 3Q25 earnings did not rattle the fundamental economic story in the large cap corporate sector. The small business sector remains a wildcard in the age of high tariffs, and that requires more data from the BLS.

Historical context:

The biggest difference between the current backdrop and Sept 2024 is the radically different tariff policies and the slowing GDP growth. There is no question the economy has been posting weaker growth in 2025 than 2024. The PCE line in GDP is weaker while the investment line under GPDI should recover based on the proposed investment “promises.” Those are not in the GDP numbers yet even if investment in IP remains very strong (see 2Q25 GDP Final Estimate: Big Upward Revision 9-25-25). Some 3Q25 data would be helpful at this point.

Lead times on projects vary materially, and a promise from a trade partner is not a contract with the crews ready to break ground. We assume the loosely defined investment promises are subject to market conditions and to final, inked trade deals. As of now, new ironclad and rigorously documented trade deals are lacking with the EU, Mexico, Canada, and China. That is, deals are lacking for the majority of US trade, which is dominated by those four. There are a lot of “frameworks” with the White House. We already saw some hostile commentary this week on the status of the EU framework implementation.

GDP Jedi Mind Tricks…

The sudden shift by Team Trump (notably Bessent, Hassett) to emphasize the 2Q25 headline GDP of 3.8% after instructing their audience to ignore the revised 1Q25 headline number of -0.6% as distorted is almost funny.

The key here is to understand how the major tariff-related distortions in net exports/imports and “change in inventories” lines impact the headline GDP number. This is not necessarily intuitive.

Headline GDP for both 1Q25 and 2Q25 is materially distorted by the import line. In 1Q25, higher imports, as part of the pre-tariff import spike and inventory build, generated a -4.7% hit to GDP. In 2Q25, dramatically lower imports generated an additional +5.0% to headline GDP. That +5.0% decline in imports gets netted against a -0.2% decline in exports for a net addition to GDP of +4.8% in 2Q25.

Bessent and Hassett want you to adjust for the negative distortions for 1Q25 to make the number higher. Then they want you to ignore the positive distortions from decreased imports in 2Q25. That is a tad self-serving – and intellectually dishonest.

Beyond the net exports/imports line, the “change in private inventories” is also a major distorting variable. In 1Q25, change in private inventories adds +2.6% to GDP while in 2Q25, it deducts -3.4%. In other words, imports in 2Q25 “artificially” boosted GDP and you can net that +5.0% against -3.4% from inventory.

On a darker note, the huge decline in imports can also be construed as a sharp decline in companies’ low-cost sourcing capabilities and in turn higher expenses. That gets back to the debate of how companies can sustain profit margins via price or alternative cost cutting. Or companies simply can accept lower margins. Nothing comes for free under the laws of economics or double-entry accounting.

If you want to make the case that declining imports, declining exports and lower investment in inventories is a good thing in 2Q25, just don’t bring it up in macroeconomics class or ahead of your bonus review.

Headline GDP numbers are part of the exercise, but the value-added focus should always be first and foremost on the PCE lines and various Fixed Investment lines. That is where the cyclical stories can be found.

Recent Trends:

The above chart updates the running UST deltas from 10-19-23 through Friday. At the very least, it offers a reminder of what could go wrong if we get adverse inflation outcomes from tariffs. The politics of inflation have always been a death knell for reasonable discussion based on facts (e.g., “seller pays” vs. “buyer pays,” etc.). This week Trump signed Executive Orders to eliminate tariffs on a range of products to help lower inflation, effectively admitting that the “buyer pays” and that they’ve been lying (“politically enhancing reality”?) to the American people all along on tariff economic effects.

As we’ve been discussing this past week, the belated Sept CPI numbers underscore stubborn inflation in Services and rising inflation in Goods. The Fed’s 2% target for inflation is almost a full point below where both CPI and PCE had been hovering. If jobs stay weak and inflation numbers get uglier, there is every reason to expect intervention by the White House in the BLS and BEA process (see Happiness is Doing Your Own Report Card 8-1-25).

Historical Context:

We now live in a world where votes and economic data get rejected, and the lemmings fall right into line and join the disinformation chorus. The data sets do struggle in payroll, and the need to use better model assumptions and improve survey utility have been picked over ad nauseum. When Trump piled on the “get rid of quarterly reports” bandwagon (in the age of AI and streamlined data delivery), the “intent” to mask any negative trends in the economy started to get more transparent in terms of motives.

The explicit Project 2025 ambition (Chapter 21, 24) is to consolidate data and information and unify control – not to assure better and more comprehensive data. That has been evident in an array of actions that we have covered in other notes. Ambitions for better data require more investment, more tech, and more public-private alliances. That dilutes control – and closer control is the point for the White House.

Recent Trends:

The above chart plots the 2Y to 30Y slope from 1984 for a read on the current shapeshifting potential ahead. For the 2Y to 30Y, the current +112 bps is just below the long-term median of +122 bps as the 30Y has lagged the 2Y move during 2025 as detailed in earlier charts. That relationship shows room for steepening from current levels with FOMC easing more likely and subject to the ability of the 30Y to move higher.

A more sustained rally in the 30Y might end up as more of a “wish list” item than a likely reality given the noise around 30Y bonds on a global scale. The UST shifts with FOMC actions, but UST rallies have struggled with the 10Y also.

Historical context:

Bear steepening moves have been common in the 2024-2025 timeline, and the next move could be more of the bull steepener from the front end as the FOMC moves down. That may await a new Fed Chair more included to do whatever Trump says and regardless of the merit of any such move. The days of Fed independence are numbered. The tariff topic is one more force that keeps the “good vs. bad steepener” debate on the front burner. Reality is setting in.

The economy has been slowing in 2025 with PCE inflation still inside the 3.0% line as of the last read in August (see PCE August 2025: Very Slow Fuse 9-26-25). We are seeing plenty of inflation pressures across select product lines and numerous major lines are running higher in Sept 2025 than in Dec 2024. All you have to do is turn off the sound on the TV and look at the numbers (see CPI September 2025: Headline Up, Core Down 10-24-25).This past week Trump how much lower energy inflation was now. Actually total Energy has risen in 2025 (see Simplifying the Affordability Question 11-11-25).

We include a box within the chart above that details the other UST curve segment slopes that we watch along with the long-term medians. The front-end inversion from 3M is still the most anomalous part of the curve when you consider the fact we have been in an economic expansion since spring 2020 after a very brief 2-month COVID recession per NBER.

See also:

Market Commentary: Asset Returns 11-16-25

Mini Market Lookback: Tariff Policy Shift Tells an Obvious Story 11-15-25

Retail Gasoline Prices: Biblical Power to Control Global Commodities 11-13-25

Credit Markets: Budget Armistice or GOP Victory Day? 11-12-25

Simplifying the Affordability Question 11-11-25

The Curve: Back to the Future 11-9-25

Market Commetary: Asset Returns 11-9-25

Mini Market Lookback: All that Glitters… 11-8-25

Credit Markets: Little Shop of Worries 11-3-25

Mini Market Lookback: Not Quite Magnificent Week 11-1-25

Synchrony: Credit Card Bellwether 10-30-25

Credit Markets: Call Me After Trouble Arrives 10-27-25

Market Commentary: Asset Returns 10-26-25

Existing Home Sales Sept 2025: Staying in a Tight Range 10-26-25

Mini Market Lookback: Absence of Bad News Reigns 10-25-25

CPI September 2025: Headline Up, Core Down 10-24-25

General Motors Update: Same Ride, Smooth Enough 10-23-25

Credit Markets: The Conan the Barbarian Rule 10-20-25

Mini Market Lookback: Healthy Banks, Mixed Economy, Poor Governance 10-18-25

Mini Market Lookback: Event Risk Revisited 10-11-25

Credit Profile: General Motors and GM Financial 10-9-25

Mini Market Lookback: Chess? Checkers? Set the game table on fire? 10-4-25

JOLTS Aug 2025: Tough math when “total unemployed > job openings” 9-30-25

Mini Market Lookback: Market Compartmentalization, Political Chaos 9-27-25

PCE August 2025: Very Slow Fuse 9-26-25

Durable Goods Aug 2025: Core Demand Stays Steady 9-25-25

2Q25 GDP Final Estimate: Big Upward Revision 9-25-25

New Homes Sales Aug 2025: Surprise Bounce, Revisions Ahead? 9-25-25

Mini Market Lookback: Easy Street 9-20-25

Home Starts August 2025: Bad News for Starts 9-17-25

Industrial Production Aug 2025: Capacity Utilization 9-16-25

Retail Sales Aug 2025: Resilience with Fraying Edges 9-16-25

Mini Market Lookback: Ugly Week in America, Mild in Markets 9-13-25

CPI August 2025: Slow Burn or Fleeting Adjustment? 9-11-25

PPI Aug 2025: For my next trick… 9-10-25

Mini Market Lookback: Job Trends Worst Since COVID 9-6-25

Couldn't agree more; your consistent dissection of how real-world pressures might influence the supposed objectivity of data, building on your previuos work, makes me wonder if even an AI would shrug at the current state of these forecasts.