Industrial Production Aug 2025: Capacity Utilization

Crosscurrents in Industrial Production and Capacity Utilization remind us to sort out plant activity from hiring and margins (prices, expenses).

August industrial production numbers held in well with a slight tick higher by +0.1% after a soft July. Motor vehicles posted steady and solid numbers across 2025 including a stronger August that was also in evidence in the Retail Sales lines today. The auto trade rags have been reporting favorable performance in volumes in 2025 but have been very guarded on future tariff effects and EV investment damage. FOMC easing would help affordability.

Some of the brand name economists (Zandi et al.) have been delivering useful research on what income tiers are driving the consumption numbers with the latest PCE income and outlays stats holding up well enough (see PCE July 2025: Prices, Income and Outlays 8-29-25). The lower income brackets are feeling the pain more as one would expect with the higher tiers carrying the ball in consumption.

The rising breakeven rate for manufacturing on the other side of tariff expenses from materials to components will need higher volumes and where possible higher pricing to offset the tariff expense damage. It is just math – and accounting – but the policy leaders keep denying reality. The alternative is less payroll (layoffs) or slower hiring to generate growth and once again substitute tech for bodies.

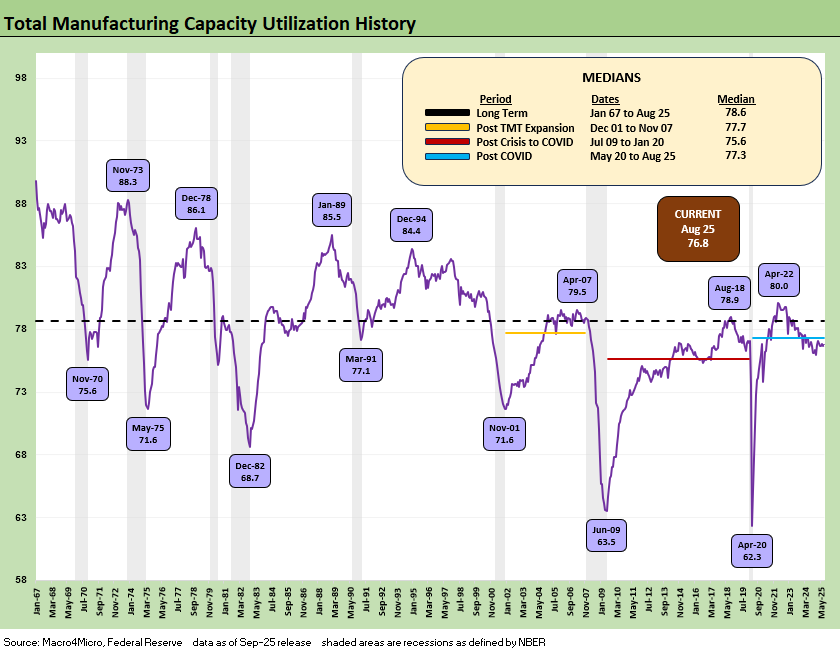

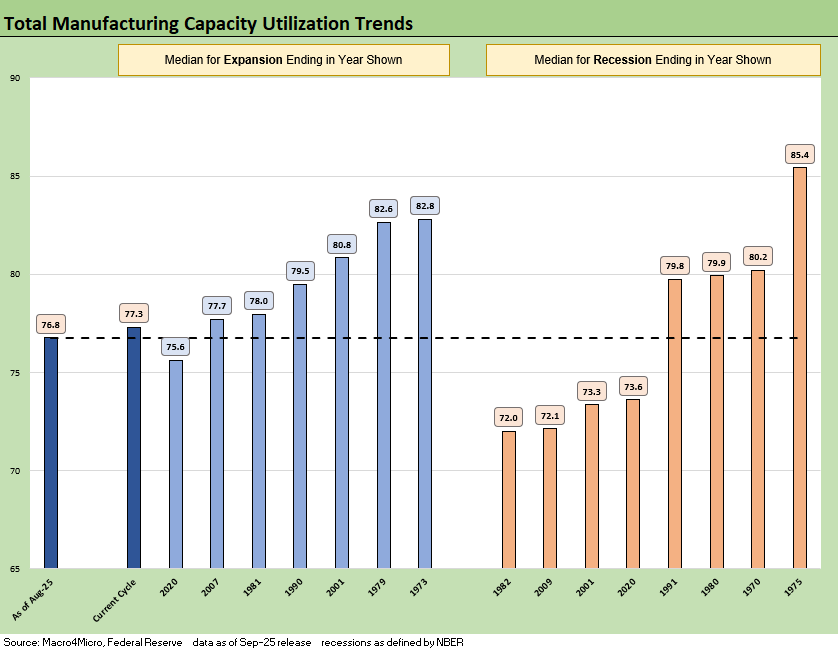

The above chart updates the time series for total manufacturing capacity utilization. We see total manufacturing tick slightly higher sequentially from 76.7% to 76.8%. The 76.8% rate is slightly above the 2Q25 run rate (76.7%), the 1Q25 run rate (76.6%) and above the 4Q24 numbers (76.2%). The peak utilization after COVID was seen in April 2022 at 80.0% ahead of the tightening cycle impact.

The takeaway from the vantage point of “trend” during 2025 is that capacity utilization has hung in well through the midpoint of the 3Q25 period. A manufacturing fade is not evident yet in these numbers. As we cover below, the Durables line has held in with August flat to July and above the 2Q25 and 1Q25 averages.

As tariffs get debated, the reality for a manufacturer is they can eat some costs and keep the plants rolling to manage unit costs in high fixed cost industries and sacrifice some margin to support volumes. That will slow the process of tariffs flowing into goods pricing but there is a chain reaction that comes alongside it that plays out over months and quarters and supplier chain contract cycles.

Tariff cost-mitigation strategies will run the gamut from “working with suppliers” (sharing or shifting some of the pain) to headcount actions (payroll fallout) to plant closures and product mix shifts that generate better numbers. Share buybacks are also on the menu on the other side of the tariff adjustments if equity markets do in fact weaken.

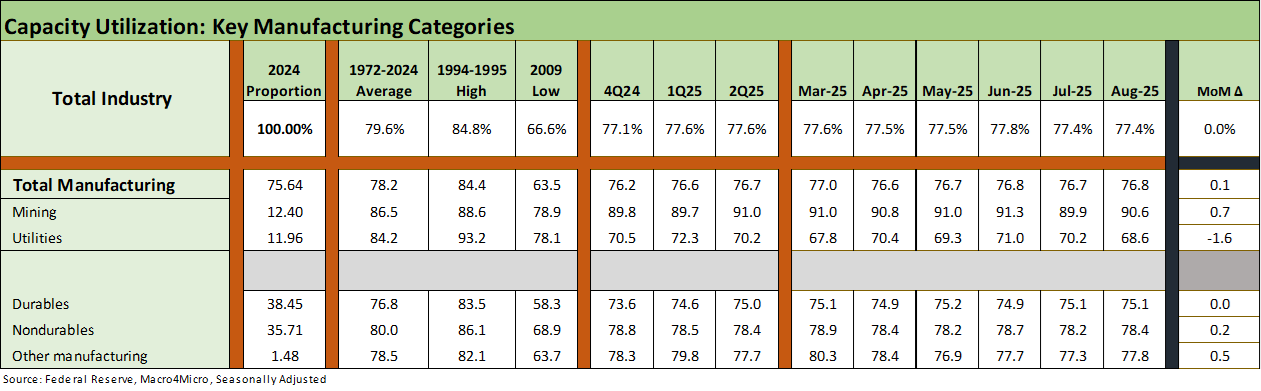

The above table breaks out the high-level buckets with the deltas in the right column. We see total industry posting a flat number vs. July. Manufacturing ticked slightly higher and remains in a tight band across 2025 at the rolled-up level. Durables were flat while Mining ticked up and Utilities moved lower. The decline in manufacturing payroll is a rational response to rising tariff costs and preparing for cyclical weakness.

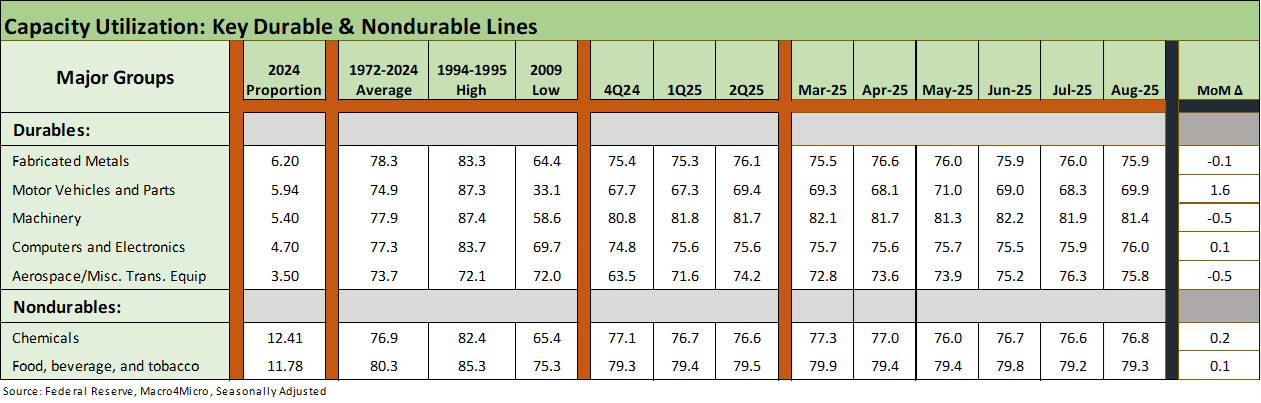

The above table details the top 5 durable and top 2 nondurable industry groups with 2 up and 3 down in durables and both higher in nondurables. The deltas are in the column on the right. Motor Vehicles had a strong showing, but we see modest weakness in Machinery and Aerospace this month.

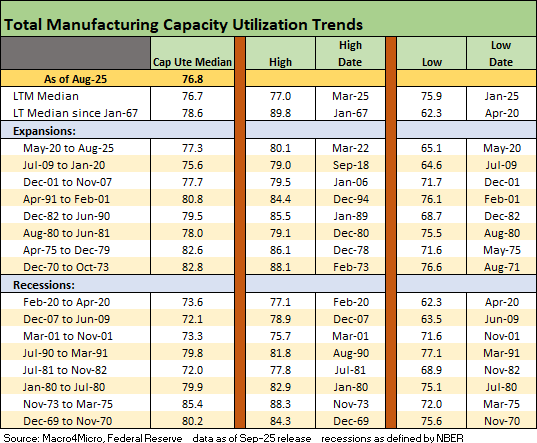

The above table updates the capacity utilization history for expansions and recessions. As noted earlier, the ability of more companies to generate solid profits at lower capacity utilization in today’s markets vs. past cycles is tied in part to automation and in part to the development of low-cost supplier chains. Low-cost supplier chains are now fatally threatened by tariffs.

The current utilization level of 76.8% is below the long-term median from 1967 of 78.6%. That is below half the recession averages from earlier recession periods as noted in the chart. The pressure will be high on manufacturers as we move into 4Q25 and then into 2026.

Those low-cost supply chains were risk-mitigating structural advantages of global sourcing that are going to eventually unravel under Trump tariffs. The new tariff policies are based on a highly speculative concept of how tariffs will translate into mass investment in the US to reshore and expand as producers scrap their offshore asset base and pour money into US operations or supplier chains. That end result is more a matter of faith and speculation for many (notably MAGA) fed in part by partisan misinformation.

The truth (something rare in Washington) is that this will take quarters to play out on pricing impacts and margin pressure. The ability to replace supply chains domestically will take years. The Section 232 tariffs will just keep on coming while the IEEPA tariffs (“reciprocal” is a misnomer) face a key test in front of SCOTUS (likely November).

The above chart details expansion and recession averages and lines them up by height as a frame of reference. We see the current level on the left. What has been striking after the credit crisis and protracted recession that followed was that US manufacturing could be so profitable at capacity utilization rates that were below numerous prior recessions.

Low-cost global sourcing was the rage in some industries (notably autos) in the US as well as in Europe. That process had been ongoing for years (component and finished goods assembly in tech from laptops to semis and integrated tech systems in the pan-Asia chain). That “lower breakeven” plan is now “toast” with the tariffs. The oft-stated theory is that supplier chains will rapidly return to the US or some of the US for the first time. That is a long-term hope.

The theories on reshoring or onshoring combines a level of optimism with a disdain for the concept of “time lags” and willingness of companies to make substantial multiyear capital outlays when the tariffs could be one election away from material revisions. The problem with emergency declarations to enact so many tariffs is that the “next guy” can simply say – in whole or in part – that “the emergency is over.” Legislation would be a bigger barrier, but these tariffs are all about one decision-maker.

One way to ease the threat of loss of tariffs in the future is to make the federal budget dependent on tariff revenue. In other words, undoing tariffs will lead headlong into a tax legislation battle.

See also:

Credit Markets: Quality Spread Compression Continues 9-14-25

The Curve: FOMC Balancing Act 9-14-25

Footnotes & Flashbacks: Asset Returns 9-14-25

Mini Market Lookback: Ugly Week in America, Mild in Markets 9-13-25

CPI August 2025: Slow Burn or Fleeting Adjustment? 9-11-25

PPI Aug 2025: For my next trick… 9-10-25

Mini Market Lookback: Job Trends Worst Since COVID 9-6-25

Payrolls Aug 2025: Into the Weeds 9-5-25

Employment August 2025: Payroll Flight 9-5-25

JOLTS July 2025: Job Market Softening, Not Retrenching 9-3-25

Hertz Update: Viable Balance Sheet a Long Way Off 9-3-25

Mini Market Lookback: Tariffs Back on Front Burner 8-30-25

PCE July 2025: Prices, Income and Outlays 8-29-25

2Q25 GDP: Second Estimate, Updated Distortion Lines 8-28-25

Avis Update: Peak Travel Season is Here 8-27-25

Durable Goods July 2025: Signs of Underlying Stability 8-26-25

Toll Brothers Update: The Million Dollar Club Rolls On 8-26-25

New Home Sales July 2025: Next Leg of the Fed Relay? 8-25-25

Mini Market Lookback: The Popeye Powell Effect 8-23-25

Existing Home Sales July 2025: Rays of Hope Brighter on Rates? 8-21-25

Home Starts July 2025: Favorable Growth YoY Driven by South 8-19-25

Herc Holdings Update: Playing Catchup 8-17-25

Mini Market Lookback: Rising Inflation, Steady Low Growth? 8-16-25

Retail Sales Jul25: Cautious Optimism in the Aisles 8-15-25

Iron Mountain Update: Records ‘R’ Us 8-11-25

Mini Market Lookback: Ghosts of Economics Past 8-9-25

Macro Menu: There is More Than “Recession” to Consider 8-5-25

Mini Market Lookback: Welcome To the New World of Data 8-2-25

Happiness is Doing Your Own Report Card 8-1-25