Retail Sales Aug 2025: Resilience with Fraying Edges

We delve into the details of a strong retail sales print that signals a still steady consumer with a few cautionary signals.

Headline retail sales rose +0.6% in August with Core up +0.7% for a good ending to the summer for consumers as the Fed is all but set to lower rates amidst a weakening labor market. For now, the absence of sharply higher unemployment or runaway inflation at least keeps consumer demand positive. Any lagging effects of labor market weakness would erode from a starting point of a relatively stable consumer sector at this point.

E-commerce channels led core retail sales strength as the surge in Nonstore retailer spending (+2.0%) accounted for the bulk of the increase, outpacing the next largest category by two-fold. Though the shift to more online sales has been an overarching theme in retail, the outsized strength this month likely points to where more value-oriented shopping, especially as other nondiscretionary spending categories look more tied to inflation.

Inflation remains the main caveat in framing the headline number this morning given that retail sales are not inflation adjusted (i.e. in current dollars). The +0.4% MoM CPI headline suggests a sizeable portion of the +0.6% this morning is due to elevated price levels. Recent trends in CPI and PPI still suggest the tariff pass-through is beginning and is beginning to factor into some line items in the categories below.

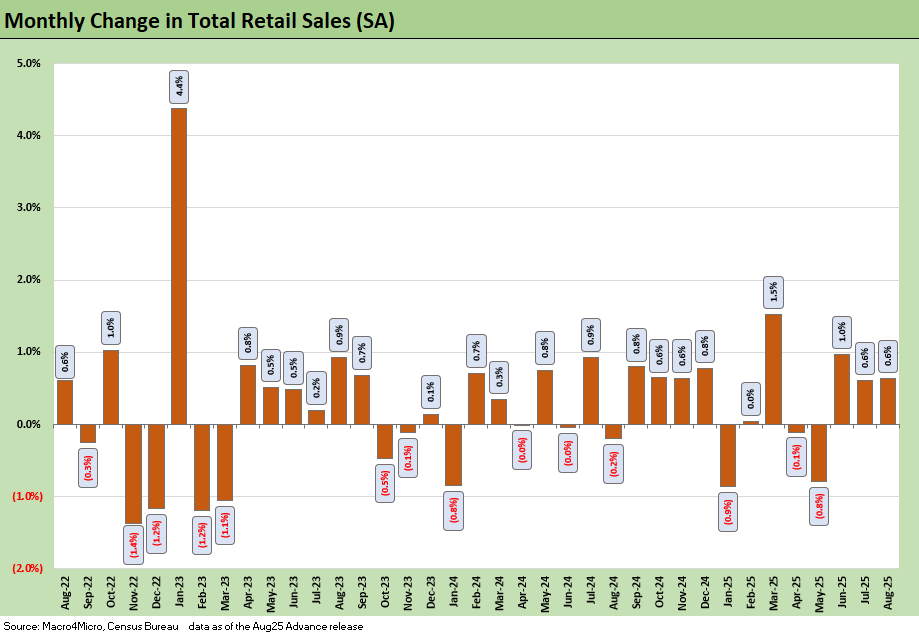

The above shows the recent history of monthly headline retail sales changes with August marking a 3rd consecutive month of growth. Even as the last 3-months improve, the extent of tariff effects continues to loom over the market, raising concern that part of the strength reflects pull-forward behavior rather than sustainable demand.

Consumer sentiment remains low driven by still elevated inflation expectations and that in turn raises concerns of behavioral change. Acute changes are more apparent looking back at the March to May period, but as tariff costs still roll into pricing there are risks of further shifts. There are a lot more Section 232 tariff ahead with IEEPA still being collected ahead of the SCOTUS decision (likely November).

For now, the major change seen at sea level is a shift towards value and, for retailers, use of promotional pricing to get consumer dollars. Value oriented retailers are seeing more traffic and the outsized nonstore retailer results for this month point to where behaviors shift towards evaluating a wider range of retailers for better pricing. We also see this in the weaker spending for other discretionary areas like Food & Beverage stores (+0.3%), General Merchandise (-0.1%), and Health & Personal Care (-0.1%) where some of the spending shifted from.

This print is consistent with a still healthy consumer with some fringing at the edges. Delinquencies and net-charge offs were stable with slight improvements across major issuers this quarter and little to suggest near-term erosion of those metrics. However, there are outstanding questions around the lower end, especially as inflation remains elevated and the labor market has seen hiring freeze. Even as the Fed moves to provide some relief, the combination is unlikely to see an easy solution if tariffs remain the major factor. We still see this as early innings here in gauging the full tariff impact (even beyond the IEEPA uncertainty).

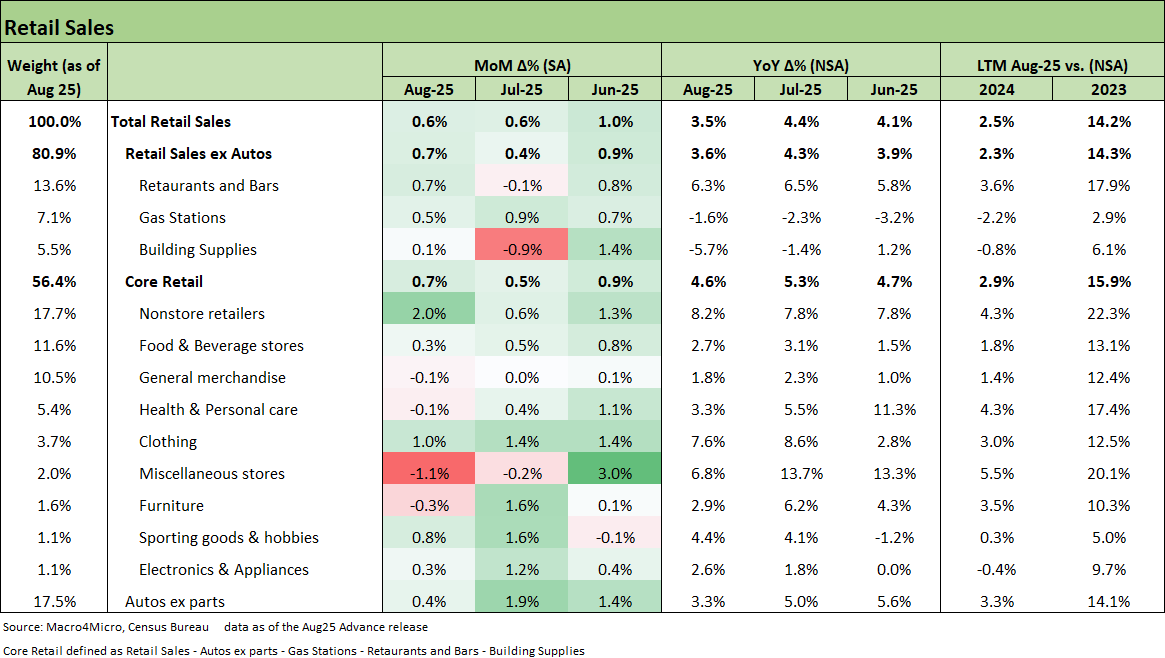

The above table shows the underlying line item details for headline retail sales as well as the ‘ex-Autos’ and Core retail lines. For such a positive headline, the breadth of core retail gains was notably low with 5 positive and 4 negative, and only Nonstore Retailers (+2.0%) of the larger core categories positive.

The other largest winners in the month are Clothing (+1.0%), Sporting Goods (+0.8%), and Restaurants and Bars (+0.7%) show some appetite for discretionary spending. Rate-sensitive purchases such as Building Supplies (+0.1%), Furniture (-0.3%), and Electronics and Appliances (+0.3%) continue to see softer growth. Electronics in particular is flagged as an area where promotional activity is increasingly necessary in generating sales.

Though the main takeaway for this morning is that the consumer is still ticking along, as a good but not great print with limited breadth leaves questions around shifting behavior and fragility as incremental tariff costs continue to accumulate. The mitigation strategies in place have cushioned sharp increases, but the increasing use of value channels speaks to the trend of consumers responding to price increases, raising the possibility of more fragility than the headline suggests. That is especially the case when taken in tandem with the softening labor market.

See also:

Footnotes & Flashbacks: Asset Returns 9-14-25

Mini Market Lookback: Ugly Week in America, Mild in Markets 9-13-25

CPI August 2025: Slow Burn or Fleeting Adjustment? 9-11-25

PPI Aug 2025: For my next trick… 9-10-25

Credit Markets: Spread Risk Lurks, but the World Waits 9-8-25

The Curve: The Road to Easing has been Long. 9-8-25

Footnotes and Flashbacks: Asset Returns 9-6-25

Mini Market Lookback: Job Trends Worst Since COVID 9-6-25

Payrolls Aug 2025: Into the Weeds 9-5-25

Employment August 2025: Payroll Flight 9-5-25

JOLTS July 2025: Job Market Softening, Not Retrenching 9-3-25

Hertz Update: Viable Balance Sheet a Long Way Off 9-3-25

The Curve: Risk Tradeoff - Tariffs vs. UST Supply 9-1-25

Mini Market Lookback: Tariffs Back on Front Burner 8-30-25

PCE July 2025: Prices, Income and Outlays 8-29-25

2Q25 GDP: Second Estimate, Updated Distortion Lines 8-28-25

Avis Update: Peak Travel Season is Here 8-27-25

Durable Goods July 2025: Signs of Underlying Stability 8-26-25

Toll Brothers Update: The Million Dollar Club Rolls On 8-26-25

New Home Sales July 2025: Next Leg of the Fed Relay? 8-25-25

The Curve: Powell’s Relief Pitch 8-24-25

Mini Market Lookback: The Popeye Powell Effect 8-23-25

Existing Home Sales July 2025: Rays of Hope Brighter on Rates? 8-21-25

Home Starts July 2025: Favorable Growth YoY Driven by South 8-19-25

Herc Holdings Update: Playing Catchup 8-17-25

Mini Market Lookback: Rising Inflation, Steady Low Growth? 8-16-25

Mini Market Lookback: Ghosts of Economics Past 8-9-25

Macro Menu: There is More Than “Recession” to Consider 8-5-25

Mini Market Lookback: Welcome To the New World of Data 8-2-25

Happiness is Doing Your Own Report Card 8-1-25