Durable Goods Aug 2025: Core Demand Stays Steady

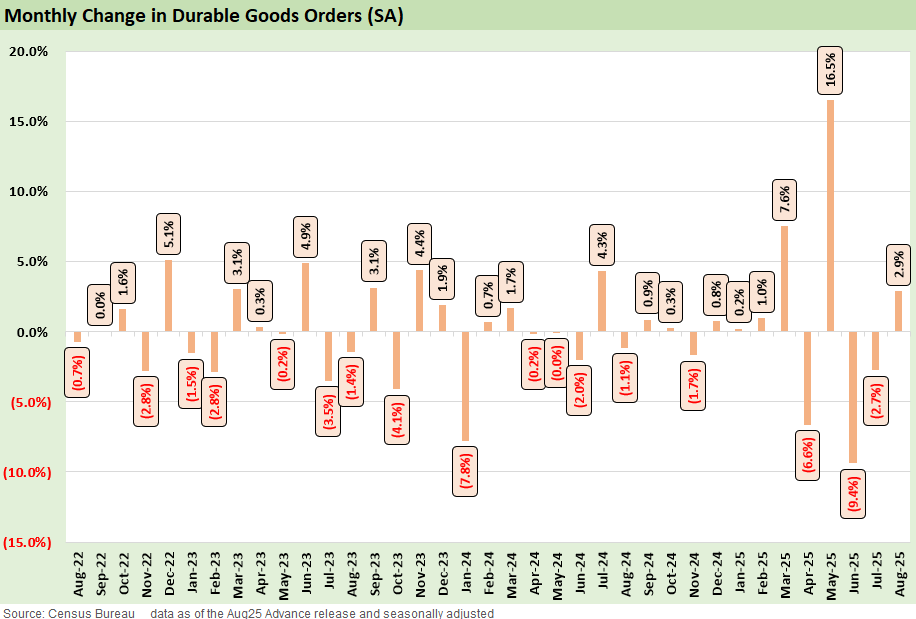

Durable goods orders rebounded in August after two months of decline, though the recovery was largely aircraft-driven while core signals stayed modest.

Headline durable goods orders recovered +2.9% in August as normalization in aircraft-related sectors led the swing back higher.

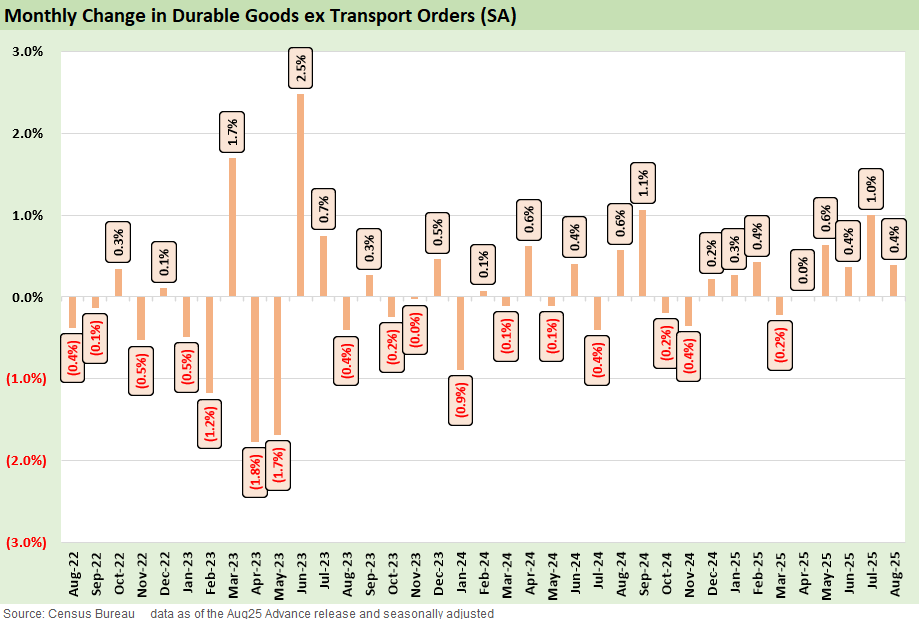

The ex-Transport measure gained +0.4% for a fourth consecutive growth month and a constructive signal for core business investment demand. Solid gains in Fabricated Metals (+1.3%) and Machinery (+0.7%) underpinned the core performance as other areas were largely flat.

The uncertainty around the longer-term tariff environment still brings plenty of complicated variables in the investment decision-making process in looking across prices, expenses, margins, and potential distortions in supply and demand.

At least for now, some clarity around the Fed path and tax bill tailwinds supports the core focus on cyclical resilience. There is massive demand data infrastructure, but there are still a lot of questions around capex in other areas that face replacement vs. growth tradeoffs.

The above chart looks at the monthly swings in headline Durable Goods orders with a swing back to +2.9% this month for another large move that reflects the volatility inherent in this measure. That volatility is once again driven by aircraft moves with the recovery this month tied to the +22% nondefense aircraft and +50% defense aircraft that skew the headline number.

We strip out the most volatile piece of the release in the above chart to the ex-Transport numbers, which better reflects core investment signals. This morning’s release extends the run of modest core gains, consistent with subdued but steady business equipment demand. Momentum remains bifurcated, however, as we see incremental growth in traditional machinery/metals versus higher structural demand for data and power infrastructure to support AI build-out.

For now, the recent months support the view that capex has been sustained despite where tariff noise has made for a challenging planning environment. Even as the cooling labor market has provided cover for a Fed cut, the GDP revisions this morning reported better 2Q25 PCE – even if at unimpressive levels in the context of recent history.

The GDP numbers are backwards looking at this point, but the combination of a still healthy consumer and elevated inflation concerns limits the amount of curve relief that we are likely to see. Fear of a UST steepener remains and stagflation is not off the table. The damage from tariffs is slowly being unveiled. Whether it is a one-time price increase or a more prolonged distortion of product pricing, supply-demand, and wage expectations remains to be seen.

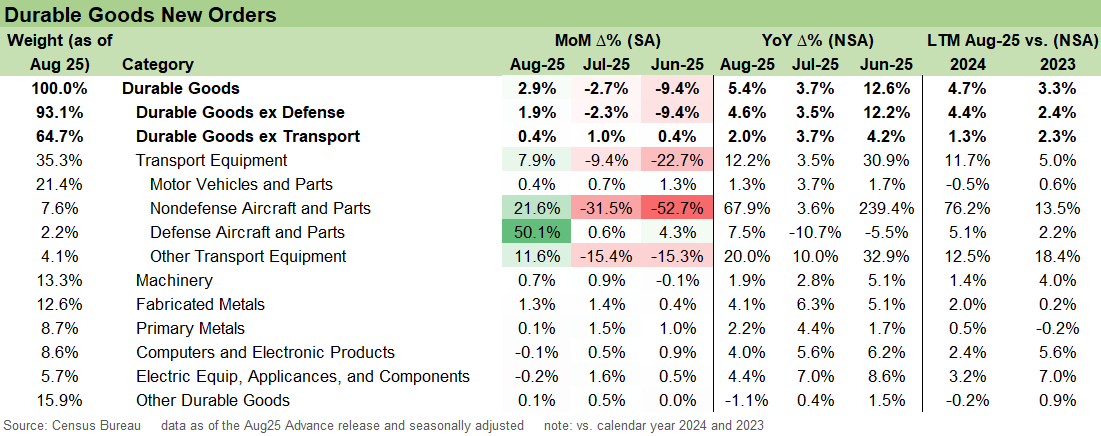

The above chart covers the underlying details and the ‘ex-defense’ and ‘ex-transport’ lines. The transport swing stands out with +7.9% growth this month on the back of two larger down months given the lumpiness of aircraft ordering patterns. Motor vehicles and parts at +0.4% continued adding on to a growth streak, though remaining below where it was last year. The autos have been a primary focus given their exposure to tariffs but at least the massive margin hit has not yet crippled capex programs, even if they haven’t accelerated.

Core manufacturing categories were more mixed than previous months as the best performers of 2025 in Computers and Electronics and Electrical Equipment both saw minor contractions in orders this month. Instead, the gains were concentrated on the Machinery and Fabricated Metals line that reflects minor growth in the year. The split highlights incremental gains in traditional manufacturing versus ongoing strength in digital/data-related categories earlier in the year.

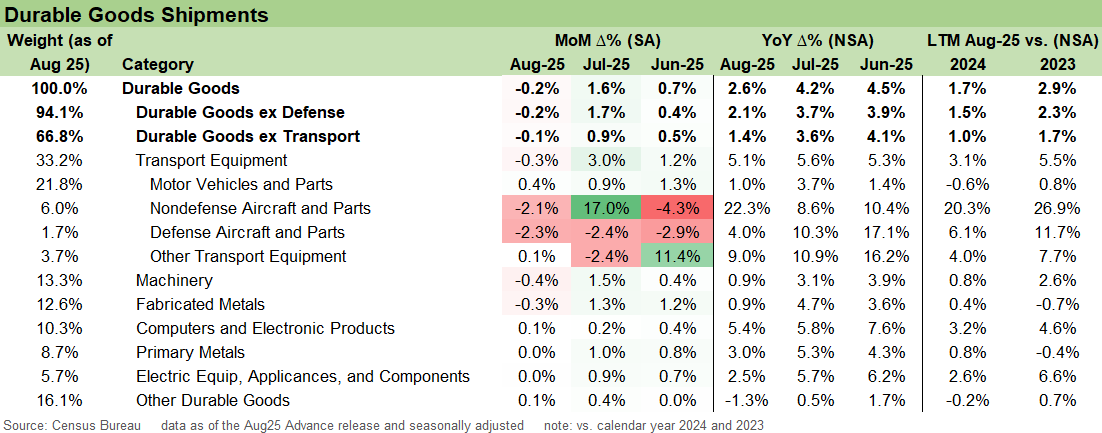

The last chart here shows shipments activity down -0.2% but overall, the trailing 3M shows a modest contribution for 3Q GDP.

See also:

2Q25 GDP Final Estimate: Big Upward Revision 9-25-25

New Homes Sales Aug 2025: Surprise Bounce, Revisions Ahead? 9-25-25

Credit Markets: IG Spreads Back in the Clinton Zone 9-22-25

The Curve: FOMC Takes the Slow Road 9-21-25

Market Commentary: Asset Returns 9-21-25

Mini Market Lookback: Easy Street 9-20-25

FOMC: Curve Scenarios Take Wing, Steepen for Now 9-17-25

Industrial Production Aug 2025: Capacity Utilization 9-16-25

Retail Sales Aug 2025: Resilience with Fraying Edges 9-16-25

Credit Markets: Quality Spread Compression Continues 9-14-25

The Curve: FOMC Balancing Act 9-14-25

Footnotes & Flashbacks: Asset Returns 9-14-25

Mini Market Lookback: Ugly Week in America, Mild in Markets 9-13-25

CPI August 2025: Slow Burn or Fleeting Adjustment? 9-11-25

PPI Aug 2025: For my next trick… 9-10-25

Mini Market Lookback: Job Trends Worst Since COVID 9-6-25

Payrolls Aug 2025: Into the Weeds 9-5-25

Employment August 2025: Payroll Flight 9-5-25

JOLTS July 2025: Job Market Softening, Not Retrenching 9-3-25

Hertz Update: Viable Balance Sheet a Long Way Off 9-3-25

Mini Market Lookback: Tariffs Back on Front Burner 8-30-25