Housing Starts Jan 2025: Getting Eerie Out There

After a rough month for starts, we provide the cost mix for a median home (NAHB). It is very topical with the tariff binge.

Housing starts are showing some sequential nerves as the NAHB worries out loud about the materials chain and how tariffs will flow through into the cost of building a home. Total housing starts posted a -9.8% decline sequentially (-0.7% YoY). In the critical South region, we see -19.2% sequentially for single family (-10% YoY) and -23.3% MoM for total starts.

The 25% tariffs on aluminum and steel and the potential for another spike in lumber and gypsum and a wide range of materials are on builder’s anxiety lists as Trump’s decisions are getting closer on the blanket 25% on Canada and Mexico.

For January permits, the numbers were more a stall with very favorable demographics and a solid economy ahead of the spring selling season. A lot of things can happen as the season unfolds. Confidence across the builders has faded lately on the cumulative effects of mortgages and forward-looking concerns on materials and labor.

If the goal is more affordable pricing, jacking up the costs to builders - as rigorously confirmed by the homebuilders – might not be the best plan. We highlight that the major builders are headquartered in red states and the South region (includes Texas and Florida) where almost 60% of the single family home starts are generated.

The good news is that credit quality across the major homebuilders is rock solid, and homebuilder bonds are broadly underrated as BBB and BB tier names even if just on the low financial risks. The equity valuations are justifiably under scrutiny after such a heady run in 2024 through the 3Q24 period.

The costs of building a home…

Before we get into the starts and permits details, we thought it was worth revisiting the cost of building a home in this month’s housing starts update. The statistics in the chart below are provided by the National Association of Home Builders (NAHB). We also include some links in the bullets above to some important recent commentary. The articles are worth a read.

The management teams of the homebuilders are typically housed in red state headquarters with a heavy Texas and Florida flavor. Homebuilder C-Suites are typically not found in healing circles with AOC and Jasmine Crockett. In other words, their views on tariffs are not partisan. It is their business.

The tone of worry is climbing sharply, and it seems from our vantage point the level of warnings from the NAHB have picked up a lot as the attack on material costs by tariff policies are increasing. Below we cut and paste the raw details. Labor is allocated into the lines also. Subcontractors need to price their services that include labor and the supply chain.

The desire to “win the point” and “support the leader” is causing many otherwise relatively smart people on Team Trump to abandon facts and concepts and ignore what the industry is telling them plainly and clearly. We would say this is Washington’s version of “the things you do for love,” but that would be understating the better parallel of the red light district version of the appetites for power.

Reality and facts usually converge in business even if not in politics. The fact that Trump claims the “seller pays” the tariff is a flat out lie (giving him some credit on that one), but his advisers know better either way. The material costs, labor (loss of immigrant labor underway), and subcontractor terms mean higher costs for the subcontractor, which will mean higher costs to the homebuilders and also higher prices for the “same house” purchase. You can buy less house, be less flexible on design options, get less square feet, or choose the less desirable location. One way or another, the price on an apples-for-apples basis will go higher.

For the UST curve, if the UST supply explodes (likely) then there is the question of the monthly payment fallout via 30Y mortgages. The only way those rates go down is if inflation plunges for some reason (oil price crash?) and pull the curve lower. Another path to lower mortgage rates is an economic slowdown or contraction, but that is not great for payrolls and homebuyer confidence.

The pushback from the tariff allies is that we did not hit material inflation in Trump 1.0, but then they proceed to lie about what happened in Trump 1.0. As we have covered, the year 2018 saw a horrible set of results in asset returns for the year, and the year 2019 saw weaker corporate investment and soft exports that in turn led the FOMC to ease multiple times. The bailout of the agricultural sector over several years was much more costly than the auto bailout. Will that be built into the budget reconciliation assumptions this time?

In the end, if costs go up, the profits go down or the prices go up. Anyone who does not see that would have (should have) changed majors from accounting/ finance/ economics to creative writing or poetry.

January 2025 starts information….

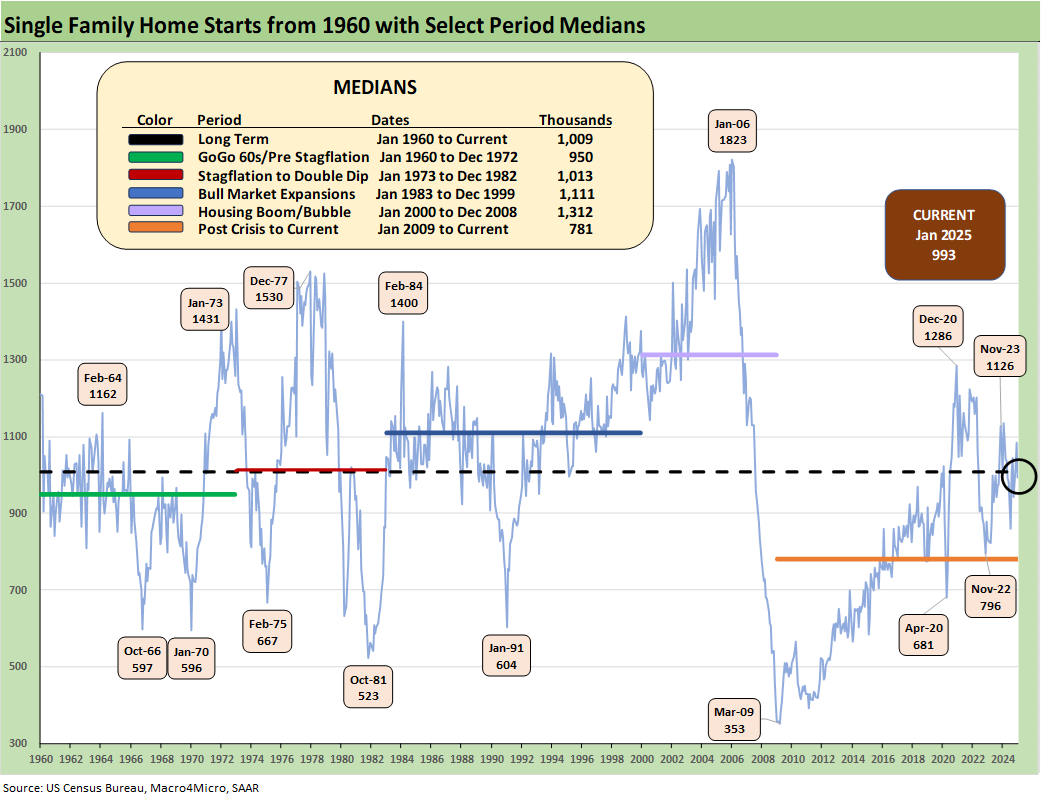

The above chart updates the single family home starts across the decades. The current 993K is a solid enough number in long-term context and only modestly below the long-term median. It is also above the post-crisis median of 781K since Jan 2009 that included the protracted hangover from the housing crisis.

The swing factor for homebuilders is the use of incentives to lower monthly payments through mortgage buydowns and fees. Builders have been signaling of late that those are not as effective as they have been in recent peak seasons, so the ability of the starts level to stay high is going to be tied to the ability to move current inventories.

Builders are much more disciplined in inventory management and starts cadence than the “bad old days,” and lower sales this spring would mean more inventory drawdown and fewer starts. With a fresh round of very aggressive tariffs now being threatened by Trump for visibility by April on sectors such as Pharma, Autos, and Semis, the macro outlook is something “Only a MAGA could love.” That is, until it starts hitting their households and local economies. Pharma tariffs would flow into health care costs for households just at a time auto costs would rise. Those are two big line items for household finance.

The Not Seasonally Adjusted (NSA) Starts and Permits are posted above for Total and also for Single Family only. We see both Total Starts and Single Family Starts down in January. In contrast, Permits are essentially flat for Total and up for Single Family. The builders know there is plenty of excess demand in the market, and they know better at this point than to try and predict mortgage rates that have swung in a 200 bps range since fall 2023. So permits have held in.

The homebuilders also are not ruling out the idea that Trump is posturing on all these tariff ideas that just keep on rolling off his tongue and phone more than out of any due diligence and published analysis. The Trump team has to be measured in its published work on the process since someone might make the mistake of writing “buyer pays” on tariffs, meaning Trump never “collected billions and billions from China” as he claims. Anyone who publishes that would lose access to his email quickly and get “doged” (a new action verb in DC?).

The above chart updates Single Family Starts by region on a Not Seasonally Adjusted (NSA) basis. The dominant South region is down along with the Midwest and small Northeast market with the West higher. The West will be one to watch in coming months for obvious reasons as the rebuilding plans develop.

The above chart updates running Multifamily starts. At +355K, Jan 2025 is down -11% sequentially but +2.3% YoY. The 355K is above the long-term median of 338K and above the median from Jan 2009 but well above the median from 2000 to 2008.

The above chart updates Multifamily permits. The 427K is down slightly by -1.4% from Dec 2024 and essentially flat YoY at +0.2%.

See also:

UST Yields: Sept 2024 UST in Historical Context 2-17-25

Footnotes & Flashbacks: State of Yields 2-16-25

New Home Sales Dec 2024: Decent Finish, Strange Year 1-28-25

Existing Home Sales Dec 2024: Another “Worst Since” Milestone 1-24-25

Housing Starts Dec 2024: Good Numbers, Multifamily Ricochet 1-17-25

Homebuilders:

Credit Crib Note: Lennar Corp (LEN) 1-30-25

D.R. Horton: #1 Homebuilder as a Sector Proxy 1-28-25

KB Home 4Q24: Strong Finish Despite Mortgage Rates 1-14-25

Toll Brothers: Rich Get Richer 12-12-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

KB Home: Steady Growth, Slower Motion 9-26-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

Homebuilders: Updating Equity Performance and Size Rankings 7-11-24

Credit Crib Note: KB Home 7-9-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24

Toll Brothers: A Rising Tide Lifts Big Boats 5-23-24

Credit Crib Note: Taylor Morrison 5-20-24

PulteGroup: Strong Volumes, Stable Pricing 4-24-24

D.R. Horton: Ramping Up in 2024 Despite Mortgages 4-19-24

D.R. Horton: Credit Profile 4-4-23